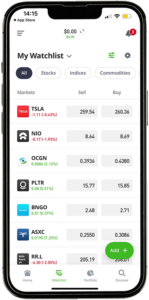

Everyone can now buy and sell stocks and funds using their mobile device. You don’t need experience, but if you are experienced, there are options for you too.

I’ve downloaded more than 140 investment apps and tested each one vigorously, including parameters like fees, assets offered, ease of use, customer service, tools, research, and education, to bring you my list of the top best investment apps in the UK.

Best for trading

Capital at risk. T&Cs apply.

24/7 customer support

- Easy to use platform

- Publicly listed company

- Over 2,000 CFDs

Best for copy trading

Capital at risk. T&Cs apply.

Easy account setup

- Modern and highly responsive app

- Free trading on stocks

- Robust social and copy trading features

Best investment app

Capital at risk. T&Cs apply.

Commission-free investing

- 0% commission investing/trading

- Flexible stocks and shares ISA

- 4.50% interest paid on uninvested cash

My best rated investment apps in the UK, June 2025

- Plus500 – One of the best for trading CFDs

- eToro – Copy trading

- XTB – Commission Free Trading

- IG – Wide range of investment options

- interactive investor – DIY investors

- InvestEngine – Investing in ETFs

- CMC Invest – Low cost

- Freetrade – Free shares

- Trading 212 – Demo account

- AJ Bell – Frequent traders

- Hargreaves Lansdown – Research and range of assets

Trusted partner

80% of retail CFD accounts lose money

2000+ CFDs

- User friendly mobile app

- unlimited CFD demo account

- Trading academy

I found Plus500 to be an excellent investment app, particularly suitable for CFD traders. However, it may not be ideal for those who prefer occasional market participation.

Key Features:

Key Features:

- Proprietary trading platform

- Wide range of financial products, including CFDs, shares, commodities, and options

- Over 2800 CFD contracts available

- no commissions, spreads and other fees apply

- Free lifetime demo account

- Regulated and publicly traded

- Insights trading tool for informed decisions

Who Should Use Plus500?

Plus500 is best suited for active CFD traders who value a user-friendly platform, competitive pricing, and excellent customer support. It may not be the ideal choice for long-term investors seeking more advanced functionality.

Final Thoughts:

Plus500 stands out with its proprietary platform, no commissions, spreads and other fees apply, and the exclusive Insights tool for market analysis. Its strong regulatory standing and customer service make it a secure choice. However, its focus on CFDs and inactivity fees might not appeal to everyone. Before using Plus500, assess your trading objectives and risk tolerance to determine if it aligns with your needs.

Pros:

- User-friendly mobile app

- Tight spreads

- Guaranteed stop-loss orders

- Exclusive Insights trading tool

- Excellent customer service

Cons:

- Limited to CFD trading

- Inactivity fees

- Not suitable for long-term investors

Fees:

- No commissions; profit through spreads

- Guaranteed stop orders may have wider spreads

- Inactivity fee of $10 per month after 3 months

Products:

- CFDs on commodities, cryptocurrency, ETFs, forex, indices, and options

- No real stock or ETF trading for UK customers

- Share trading platform, Plus500 Invest, launching soon

80% of retail CFD accounts lose money

Trusted partner

71% of traders lose money trading with IG.

Commission-free trading

- Free demo account

- Advanced charting tools

- Extensive educational content

eToro remains one of the most popular apps in the UK, and with good reason. The flourishing social trading community to be found here means that you will always have access to copy trading facilities as well as a place to connect, share, and learn from other investors.

Key Features:

Key Features:

- Access to free copy trading

- Diverse range of assets available with zero-commission trading

- User-friendly design with push notifications, flexible search functions, and two-step authentication

Who should use eToro?

eToro is an excellent choice for those interested in copy trading and being part of a vibrant social trading community. The app’s zero-commission trading on stocks and diverse asset options, including cryptocurrencies, make it a compelling platform. While its educational resources are somewhat limited, the user-friendly design, quick account setup, and robust social trading features compensate for that.

Final thoughts:

eToro is an excellent app that empowers users to engage in copy trading with ease. Whether you’re new to investing or an experienced trader, eToro’s user-friendly mobile app and thriving social community provide ample opportunities to grow your portfolio and connect with like-minded investors.

Pros:

- Free trading on stocks

- Quick and easy account setup

- Robust social and copy trading features

- Modern and highly responsive app

- Allows for trading on the go

Cons:

- Limited educational resources

- Charges for conversion and withdrawal

- Inactivity fee of $10

Fees:

- Zero commission trading

- $5 withdrawal fee

- $10 inactivity fee

- Currency conversion fees

- £10 minimum balance

Products:

- General Investment Account

- ISA in conjunction with Moneyfarm

{etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees

XTB is a top-tier CFD broker known for its low trading fees, diverse tradable instruments, and superior educational resources.

Key Features:

- Proprietary trading platform with excellent usability

- Over 2100 instruments are available for trading

- Comprehensive educational materials, including one-on-one mentoring

- Award-winning platform with accolades like “Best Forex Broker for Beginners” in 2022

Who should use XTB?

XTB is ideal for traders of all levels, especially those aiming to cut down on trading costs.

Final Thoughts:

XTB stands out for its low costs, vast product range, and exceptional educational offerings. While it lacks MetaTrader 4 support, its proprietary platform is robust and user-friendly. It’s a solid choice for both novices and seasoned traders. If you’re looking to minimise trading expenses and access a wide range of assets, XTB might be the best trading platform for you.

Pros:

- Competitive forex spread cost

- 24/7 support

- Extensive asset range

Cons:

- No MetaTrader 4 support

- Fees for withdrawals under certain amounts

- Inactivity charges

Fees:

-

-

- Low forex trading costs

- Inactivity fee after one year of no trading

- £12 fee for withdrawals under £60

-

Products:

-

-

- Forex: 48 currency pairs

- Indices: 20+ global indices

- Commodities: Including gold, silver, and oil

- Stock CFDs: Over 1,850 from global exchanges

- ETF CFDs: Over 100 globally

-

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

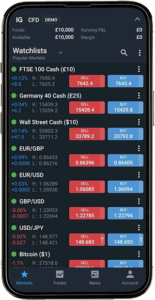

I’ve explored IG Investments to provide you with an in-depth review. IG stands as one of the best trading platforms for UK investors. Let’s dive in:

Key Features:

Key Features:

- Wide range of investment products, including CFDs, spread betting, and stockbroking

- Extensive product offerings: Forex, Indices, Shares, Commodities, Cryptocurrencies, Bonds, ETFs, Options, and more

- User-friendly web and mobile trading platforms

- 24/7 customer service

Who Should Use IG Investments?

IG caters to a broad audience, including moderately experienced traders and professionals. Here’s a breakdown:

- Moderately experienced traders: IG’s Smart Portfolio offers a straightforward option

- Active traders: Share Dealing account for hands-on investors

- New investors: Smart Portfolio serves as a robo-advisory option

- Forex traders: IG is well-known for forex trading

Final Thoughts:

IG Investments offers a versatile platform suitable for various investor profiles. It provides an array of products and competitive fees, making it a strong choice for those who want flexibility and accessibility in their investments. The platform’s educational resources and customer support further enhance its appeal. However, the fee structure can vary, so it’s essential to assess your investment goals and trading frequency when choosing IG Investments.

Pros:

- Multiple funding and withdrawal options

- Access to IG Academy courses

- Intuitive and customizable trading platforms

- Extensive market coverage

- No withdrawal or inactivity fees for Smart Portfolios

Cons:

- No copy trading or backtesting integration

- Not optimal for infrequent traders

- Higher forex and stock CFD trading fees compared to some competitors

Fees:

IG’s fee structure varies by product:

- Smart Portfolio: Annual fees can be as low as 0.22%

- Share Dealing: Commission fees on US shares depend on trading frequency

- Custody fee: £24 per quarter (can be avoided with trading activity)

Products:

- Smart Portfolios: A fully managed, diversified investment option

- Share Dealing: Ideal for experienced investors creating their portfolios

- Stocks and Shares ISA: Access to both Smart Portfolios and Share Dealing in one ISA

- SIPP: Self-Invested Personal Pension

- Other leveraged products include spread betting and CFDs

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

interactive investor is my top choice for self-directed investors seeking an extensive range of investment options and possessing the experience to construct a diversified portfolio. However, even beginners can benefit from it, thanks to its ‘Quick Start Funds,’ which provide fully diversified global investment options. This includes both passively managed funds from Vanguard and actively managed funds from BMO.

Key Features:

- Wide range of investment options

- User-friendly app

- Safety measures

Who Should Use interactive investor?

interactive investor is ideal for investors who want a wide array of investment options and are experienced enough to manage their portfolio. However, even beginners can utilise it, especially through the ‘Quick Start Funds.’ It’s an excellent option for those who prioritise choice over low fees. The platform’s comprehensive features make it suitable for investors of varying experience levels.

Final thoughts

interactive investor stands out with its vast investment options, user-friendly platform, and security features. While it may not be the most cost-effective choice for smaller portfolios, its versatility, especially with Quick Start Funds, makes it a robust platform for investors seeking diversity and convenience in their investment journey.

Pros:

- Award-winning platform: interactive investor boasts an award-winning web and mobile trading platform

- Extensive investment choices

- Cost-efficient for larger portfolios

Cons:

- Availability of cheaper alternatives for those with smaller portfolios

- Basic charting tools

- Trading fees: Fees include a £5.99 per trade charge, an annual custody fee starting at £4.99, and a £40 bonds fee

Fees:

- Trading fee: £5.99 per trade

- Custody fee: Annual fee starting at £4.99

- Bonds fee: £40

- Minimum balance: £0

Products:

- Stocks and shares ISA

- Junior cash ISA

- Junior stocks and shares ISA

- Self-invested personal pension (SIPP)

- Company account

- Cash savings

Important information - investment value can go up or down and you could get back less than you invest. If you're in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.

I found InvestEngine to be an excellent choice of app, especially for ETF enthusiasts. Here’s why I recommend it:

Key Features:

- Offers DIY and fully managed portfolio options

- Economical fee structure

- Focuses exclusively on ETFs

- User-friendly and intuitive app

- Features like smart top-ups, one-click rebalancing, smart orders, and auto-investing

- Responsive customer service

Who should use InvestEngine?

InvestEngine is ideal for those who want to explore DIY investing while still having the option of fully managed portfolios. The app’s cost-effectiveness, user-friendliness, and focus on ETFs make it a standout choice.

Final thoughts:

InvestEngine is a top-notch app, particularly if you’re looking to dip your toes into investing with low fees and a variety of ETF options. Whether you’re a seasoned investor or a newcomer, its user-friendly interface and responsive customer service can help you make the most of your investment journey.

Pros:

- Extremely low fees, only 0.25% for managed portfolios

- Excellent customer service

- Suitable for both experienced investors and newcomers

- User-friendly app with high customer ratings

Cons:

- No Self-Invested Personal Pension (SIPP) option

- Limited to ETF investments

- No ethical investment portfolios available

Fees:

- Managed portfolios: 0.25% platform fee

- DIY portfolios: £0 platform fee

- Minimum balance: £100

Products:

- Stocks and Shares ISA

- Personal Account

- Business Account

With investment, your capital is at risk. This could mean the value of your investments goes down as well as up.

If you’re on the hunt for the best investment app, CMC Invest should definitely be on your radar, especially if you’re looking for low-cost investing options. Here’s why I believe CMC Invest is a standout choice:

Key Features:

- Ideal for both first-time and mid-level investors

- Offers a range of investment options

- General Investment Account with zero commissions and account fees

- ISA available with a £10 per month fee for the Plus Plan, which includes a multi-currency USD Wallet and access to mid-cap UK shares

- Opportunity for users to participate in the development of new features through the CMC Invest community forum

- Also available: Financial analyst recommendations, price targets, and analyst opinions from Morningstar

Who should use CMC Invest?

CMC Invest is an excellent choice for those seeking low-cost investing options. The app is user-friendly, making it accessible to novice investors while also offering features that cater to mid-level investors. The General Investment Account’s absence of commissions and fees is a significant advantage, and the ISA plan, although with a monthly fee, provides additional benefits, including access to mid-cap UK shares.

Final thoughts

CMC Invest is an excellent app that offers cost-effective investing solutions. Whether you’re a beginner looking for an easy entry point or a more experienced investor seeking a budget-friendly platform, CMC Invest has something to offer. Additionally, the app’s commitment to involving users in feature development ensures it stays relevant and user-centric.

Pros:

- User-friendly and easy-to-navigate app

- Hassle-free account setup

- Engaging community forum for user input

- Low-cost General Investment Account with no commissions or fees

- A specialised ISA plan with added benefits for a monthly fee

- Exciting upcoming features for enhanced investing

Cons:

- ISA plan comes with a £10 monthly fee

Fees:

- General Investment Account (GIA): £0

- ISA: £10 per month for the Plus Plan (First 3 months free for new customers, T&Cs apply)

Products:

- General Investment Account

- Flexible Stocks and Shares ISA

Capital at risk.

Trading 212 is a top-tier investing app catering to a wide range of investors. It is especially notable for its zero-commission trading.

Key Features:

- Exceptional investment range

- Low fees

- Multiple account types

- Fractional shares

- User-friendly mobile app

- 24/7 customer support

Who should use Trading 212?

Beginners: The investing app is user-friendly, offers a demo account, and has a low minimum deposit requirement, making it suitable for novices.

Experienced traders: With a wide range of assets and low fees, experienced investors will also find value in Trading 212.

Final thoughts

Trading 212 excels at offering a broad range of investment options, low fees, and an intuitive mobile app. While it lacks copy trading and cryptocurrency support, it caters to both beginners and experienced traders. The platform’s commitment to transparency and low-cost trading makes it an attractive option for those looking to invest in various assets.

Pros:

- Low costs

- Diverse investment choices

- User-friendly mobile app

Cons:

- No copy trading: Trading 212 lacks a copy trading feature

- No cryptocurrencies: The app doesn’t support cryptocurrency trading

- Security: It could enhance security features like two-step login for added protection

Fees:

- Zero-commission: Trading 212 offers commission-free trading on stocks and ETFs

- Low FX fee: There’s a 0.15% FX fee for trades in currencies other than the account base currency

- No deposit or withdrawal fees: There are no account, inactivity, deposit, or withdrawal fees

- Fee-free deposits: Deposits via bank transfer are free, while deposits via cards, Google Pay, Apple Pay, etc., are free up to £2,000

Products:

- Trading 212 CFD: Allows trading across various asset classes, including stocks, forex, and commodities, with measures to protect traders

- Trading 212 Invest: You can start free trading with as little as £1 in over 3,000 stocks, shares, and ETFs, with zero commission fees

- Trading 212 ISA: Offers tax-free trading for UK residents, suitable for experienced investors

- Trading 212 Pro: Designed for experienced traders with specific criteria

- Fractional Shares: Available in both Invest and ISA accounts

As with all investments, your capital is at risk. Investments can fall and rise and you may get back less than you invested.

If you’re on the lookout for best investing apps that offer free shares, Freetrade is the one to consider. Here’s why I believe Freetrade is a standout choice:

Key Features:

- New investment accounts funded with at least £50 instantly receive a free share worth £10-100, with the likelihood of falling on the lower end

- Referring friends to the app can earn you additional free shares, providing a valuable boost to your portfolio

- Diverse range of investments available

- Commission-free trading for cost-effective investing

- Low entry point with a minimum deposit requirement of just £1

- User-friendly interface with biometric authentication options for added security

Who should use Freetrade?

Freetrade is an excellent choice for individuals seeking an investment app that offers free shares. Opening an account with a minimum of £50 instantly rewards you with a free share, making it an attractive option for those starting their investment journey. The ability to earn more free shares by referring friends provides a valuable opportunity to enhance your portfolio further.

Final thoughts

In conclusion, Freetrade’s offer of free shares, coupled with its user-friendly interface and cost-effective trading, makes it an attractive option of investment apps for beginners and budget-conscious investors.

Pros:

- Quick and straightforward account opening process

- Free trading on stocks, shares, and ETFs

- No minimum deposit requirement

- Attractive incentives for referring friends

- User-friendly app interface with biometric authentication

Cons:

- Limited research tools and resources

- Limited options for depositing and withdrawing funds

Fees:

- Commission-free trading on all stocks, shares, and ETFs

- £0 minimum balance

Products:

- General Investing Account

- Stocks and Shares ISA

- Self-Invested Personal Pension (SIPP)

- Freetrade Plus (Paid subscription for additional features)

When you invest your capital is at risk, the value of your investments can go down as well as up and you may get back less than what you invest. *Other charges apply. Free share terms and conditions apply. The probability is weighted, so more expensive free shares will be rarer.

I’ve found that AJ Bell is an excellent choice, particularly for frequent traders. If you’re planning to make more than 10 trades per month and have a relatively modest portfolio, AJ Bell can be very cost-effective. They also offer a range of tax wrappers, including the first online SIPP introduced in the UK back in 2000.

Key Features:

- Cost-effective for frequent traders

- Diverse asset range

- User-friendly trading platform

- Consistent design

Who Should Use AJ Bell?

AJ Bell is an excellent choice for active traders who plan to conduct more than 10 trades per month and have smaller to medium-sized portfolios. It’s particularly advantageous for those who appreciate a user-friendly platform and wish to explore diverse asset options.

Final thoughts

AJ Bell is a strong contender for frequent traders seeking a cost-effective and user-friendly investment platform. Its pricing structure and variety of tax wrappers make it attractive, especially for those with smaller portfolios. If you prefer a simplified, beginner-friendly option, you might explore AJ Bell’s app, Dodl, which offers competitive pricing structures for first-time investors.

Pros:

- User-friendly investment app

- Cost-effective for small to medium portfolios

- No additional fees: AJ Bell doesn’t charge account setup fees, inactivity fees, holding fees, or withdrawal fees

Cons:

- A fixed fee app such as interactive investor, would be better for larger portfolios

- Cheaper investing apps are available

Fees:

- Trading fee: £9.99 per month for the first nine trades each month

- Minimum balance: £0

Products:

- Dealing account

- Stocks and Shares ISA

- SIPP (Self-Invested Personal Pension)

- Junior Stocks and Shares ISA

- Junior dealing account

- Junior SIPP

Capital at risk.

Hargreaves Lansdown stands out as an ideal choice for those seeking premium service and an extensive range of assets. If you’re looking to build a diversified portfolio with access to a vast array of financial instruments, including over 2,500 funds, global shares, ETFs, ETCs, and investment trusts, this platform is a strong contender.

Key Features:

- Diverse asset range

- Access to financial advisors

- Excellent customer service

Who Should Use Hargreaves Lansdown?

Hargreaves Lansdown is an excellent choice for investors who prioritise a broad range of investment options, access to human financial advisors, and exceptional customer service. If you’re willing to pay a premium for these services and primarily deal in GBP, this platform may suit your needs.

Final thoughts

Hargreaves Lansdown offers an extensive array of investment products and access to human advisors, making it a top choice for those who value premium service. However, keep in mind that it comes with relatively high fees, especially when you trade stocks and ETFs. If you’re looking for a platform with a wide range of assets and are willing to pay for premium service, Hargreaves Lansdown is a strong contender.

Pros:

- Extensive investment selection

- User-friendly trading platforms

- High-quality educational tools

Cons:

- High fees when you trade stocks and ETFs

- Limited base currency

Fees:

- Trading fee: £11.95 per trade

- Annual custody fee: 0.45%

- Minimum Balance: £1

Products:

- Stocks and Shares ISA

- Fund and share account

- SIPP (Self-Invested Personal Pension)

- Lifetime ISA

- Active Savings

- Junior Stocks and Shares ISA

- Junior SIPP

- Junior Investment Account

Capital at risk.

Best of the rest

This is a selection of investing apps that narrowly missed being in my top 10 but that I felt still deserved a mention due to the excellent service they offer.

| Investment App | Fees | Minimum deposit | Products | Best for |

|---|---|---|---|---|

| Moneyfarm |

Management Fee: 0.75% – 0.35% Fund Costs: 0.20% Market Spread: Up to 0.09% |

£500 |

ISA Pension Junior ISA General Investment Account |

Ethical investments |

| XTB |

Average Spread on S&P 500 CFD: 0.6 points during peak hours. Average Spread on EUR/USD: 0.9 pips, considered low in the industry. |

£0 |

Standard Account Demo Account Professional Account |

CFDs |

| Nutmeg | 0.25% to 0.75% | £100 – £500 |

General Investing Account Stocks and Shares ISA Lifetime ISA Junior ISA Personal Pension. |

Robo Advisor |

| Moneybox | £1 per month subscription fee, 0.45% platform fee, 0.12%-0.30% fund management fee | £1 | Stocks and Shares ISA, stocks and shares Lifetime ISA, Junior ISA, General Investment Account, Pensions, 32 Day Notice, 45 Day Notice, 95 Day Notice Account, 120 Day Notice, Cash Lifetime ISA | Saving |

| Lightyear | FX fee of 0.35% | £1 | General Investment Account, Business Account | trading in multi-currencies |

| Wombat |

|

£10 | Instant GIA, Standard ISA, Standard GIA | Beginners |

| Webull |

Low commission: 2.5 basis points per trade (0.025%). FX fees: Currency conversion at the time of execution plus a spread of 0.35%. |

£0 | GIA | US stocks and automated investing |

How to choose the best investment app for you

While not exhaustive, the above list should have something for everyone, although there are a few elements that you should consider when deciding which of my recommendations is best for you.

Your investment experience

There are various tools and resources available on most of the apps; however, some will cater more to beginners, while others will have the experienced investor in mind. As an example, Plus500 is an excellent investment app; however, CFDs can be complex, and the sheer volume of choice here makes this app excellent for experienced investors. To the contrary, investing apps such as Nutmeg and Moneyfarm cater excellently to novice investors, with fewer investment options to overwhelm you.

Fees

High fees can eat away at your gains, which is why I have included this detail in each review I have provided. Ensure you understand the fees charged, and always head to the app provider to ensure you are aware of any non trading fees and hidden fees such as inactivity fees and withdrawal fees.

Customer support

The chances are that you will require support at some point during your investment experience. It’s important that you are happy with the level of support on offer. I have personally tested the support on all the investing apps I have recommended, and a detailed review of my findings can be found in the main review.

Account types

Make sure the app caters to your account needs, whether it be a pension product, a tax wrapper, a junior ISA, or simply a general investment account.

Common questions about investing apps

Here I try to answer some of the most common questions people ask me about investment apps.

Which is the best investment app for beginners in the UK?

eToro ranks highly as the best investment app for a beginner, but there are others you can consider, including;

- InvestEngine – Buy shares through themed portfolios

- Freetrade – Commission-free investing

- Wealthify – Start investing from £1

- Nutmeg – A low-cost automatic investing app

See also: My guide on where to invest money to get monthly income

How much money should a beginner invest for the first time?

This depends on your unique financial goals and current situation. As a starting point, it is always a good idea to ensure that you pay off any debt before you invest and acquire an emergency fund of at least three to six months worth of living expenses.

It is also wise to ensure you are in a position to ride out any volatility in the marketplace for at least 5 years, and therefore any money you use for investments should remain untouched for that duration.

However, many of the best investing apps I have recommended will allow you to invest for just a few pounds so there is nothing to stop you from dipping your toe in the water and getting a feel for the market.

How do I choose the right investing app for me?

There are many things to consider when choosing the best investing apps to suit your needs.

As an example, you should ask yourself:

- What am I saving for? Different investment platforms offer different products, which you will need to match your requirements.

- Will I need research tools? If you plan to manage your own investments, then this will be a requirement of the trading app.

- What is the account minimum? This could be relevant for experimental investors who would like to try the platform before committing large sums of money.

Which is the safest investment app for beginners?

The safest investment app for beginners is a difficult question to answer; however, there are some points when wondering ‘are investing apps safe?:

- Is the investing app authorised and regulated by the Financial Conduct Authority?

- Does the company behind the app offer protection for your investment from the The Financial Services Compensation Scheme?

- Does the app offer 2FA? Two factor authentication protects your account by requiring an additional code from a mobile app when you login.

If you’re in doubt, contact customer service on the trading apps or website first and inquire about safety.

What is a ready-made portfolio?

Some investment apps offer ready-made investment portfolios, or themed portfolios like Wombat do, usually in an ETF (exchange traded fund).

A ready made portfolio usually contains a mix of different investments created by fund managers to help beginners choose individual shares or funds.

Ready-made and themed portfolios are a good choice for beginners, and for people who want to create a “set and forget” investment strategy.

See also: My guide to the best stock trading apps

What are mutual funds?

Mutual funds refer to baskets of assets that can include stocks, bonds, and other securities, managed by a professional.

Are investment apps worth it?

Yes, in my experience, investment apps offer a simple to use platform that is significantly cheaper than paying for a financial advisor. They have made investing accessible to all walks of life with low minimum investments.

However, it is up to the individual investor to ensure they remain responsible and invest within their budget.

FAQs about investment apps

Do investment apps really work?

Are investment apps worth it?

Please note:

This article regarding investment apps and trading apps is for informational purposes only and does not constitute investment advice. All contents are based on my understanding of HMRC legislation, which is subject to change.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Trading fees will differ between each of the investing apps featured in this article, and the minimum investment shown is subject to change for each of these apps in the UK.

More on investing

Updated with the latest information.