eToro is my top best trading platforms in the UK.

With its extensive menu of assets including 6000+ instruments, unlimited demo account use, low fees and 5-star social trading credentials, it’s a great option if you’re new to the trading world and would like the option to mirror the moves of high-performing traders.

{etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees

- eToro Ratings

- Our eToro review in 60 seconds

- Quick facts about eToro

- Who is eToro suitable for and Why?

- eToro Product Range Overview

- How eToro’s Investment Options Compares to Other Brokers

- eToro CopyTrader Review

- eToro CopyPortfolio Review

- eToro Accounts vs Interactive Investor and Hargreaves Lansdown

- eToro ISA Review

- eToro SIPP Review

- eToro Demo Account

- eToro WebTrader

- eToro Platform Review

- eToro Research Service and Tools Review

- eToro Fees and Charges Review

- Guide to opening an eToro account

- eToro Deposit and Withdrawal Review

- eToro Customer Service Review

- Is eToro safe?

- Is eToro good for beginners?

- Alternatives to eToro

- eToro Pros and Cons in more detail

- Useful Information

- eToro FAQs

- eToro Customer reviews

This review is based on my own first-hand experience and research. When conducting reviews, the main points I look for (and which you should also be on the lookout for) are:

- Assets available

- Product offerings

- Fees

- Account options

- Education and tools

- Ease of use

- Customer service

Our eToro review in 60 seconds

Quick facts about eToro

- eToro offers access to a wide variety of assets, including over 5,500 stocks, 680 ETFs, 55 currencies, 35 commodities, 18 indices and over 100 cryptocurrencies.

- You can use their CopyTrader service, which allows you to copy the trades of its top investors.

- The eToro platform is easy to use and well-suited to beginners, with both a web and mobile application.

- The demo account is free and ideal for testing your trading strategies before risking actual funds.

- They do offer Stocks and Shares ISA and it is powered by Moneyfarm. You can read their review here

- Since March 2024, they also offer a new ready-made portfolio through BlackRock.

- eToro is cost-effective, with 0% commissions on real stocks and ETF trading.

- You can save on deposits fees by using eToro Money.

- eToro is a safe option and is regulated by world’s major authorities including the Financial Conduct Authority in the UK, ASIC (Australia), CySec (Cyprus), GFSC (Gibraltar), FinCen and FINRA (United States).

Who is eToro suitable for and Why?

Their platform is designed for everyone. Beginners can ease their way into a live investment portfolio with the help of an unlimited demo account to practice trading and even try their hand at copy trading from there before risking any real funds. I like their CopyTrade, it is a quick way to kick-start newcomers’ investment journey. Investors can build an investment portfolio from over 5,500 stocks and shares, or choose a ready-made option based on personal priorities and risk appetite.

More experienced traders are going to find the excellent range of assets enticing as well as the low trading fees. There are also rewards on offer for traders who are successful enough to appeal to traders looking for someone to copy.

eToro Product Range Overview

eToro offers:

- CFDs

- Forex

- Real stocks

- ETFs

- Cryptocurrencies

- Commodities

- Indices

Alongside commodity, cryptocurrency and ETF trading, eToro offers a wide selection of stocks to enable investors to further diversify their portfolio. The large asset choice gets 5 stars from me.

It’s a comprehensive offering; but let’s compare it with two of the largest platforms in the United Kingdom, Interactive Investor and Hargreaves Lansdown, so you can get a direct comparison.

Related: Guide to ETFs for UK Investors

How eToro’s Investment Options Compares to Other Brokers

| Investment Option | eToro | Interactive Investor | Hargreaves Lansdown |

|---|---|---|---|

| Stocks | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes |

| Funds | No | Yes | Yes |

| Forex | Yes | No | No |

| Bonds | No | Yes | Yes |

| Options | No | No | No |

| Futures | No | No | No |

| CFDs | Yes | No | Yes |

| Crypto | Yes | No | No |

| Commodities | Yes | Yes | Yes |

| Indices | Yes | No | No |

One of the standout differences between eToro and its competitors is that it offers cryptocurrency trading.

eToro has launched their own cryptocurrency wallet, which allows users to buy, sell, convert, trade, and pay for services using a wide range of cryptos, including:

(Please note: eToro users under UK FCA regulation cannot open CFD crypto positions, only real assets are available.)

- Bitcoin

- Bitcoin Cash

- Ethereum

- Ethereum Classic

- Ripple

- Litecoin

- Cardano

- IOTA

- TRON

- ZCASH

- Binance coin

- BNB

- Dash

- Stellar

- EOS

- NEO

- Tezos

- XRP

The eToro crypto wallet app incorporates military level encryption and can be used to store over 120 cryptocurrencies, reflecting the surge in popularity for cryptocurrency trading in recent years.

eToro also offers Smart Portfolios which allow users to invest in a preselected collection of assets and provides an easy way to diversify their holdings.

On a negative note, with eToro, you will be sacrificing the ability to trade in options, investment trusts, and funds.

What really sets eToro apart is the innovative features that change the way you trade, which I will look at in more detail next.

eToro CopyTrader Review

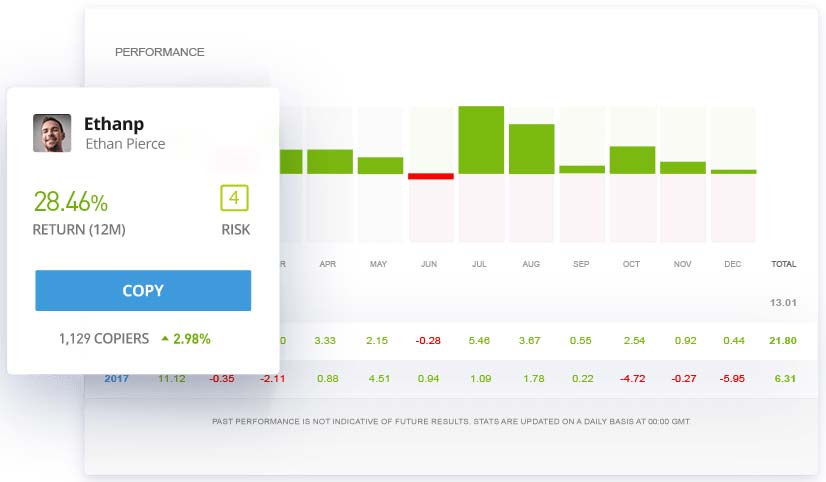

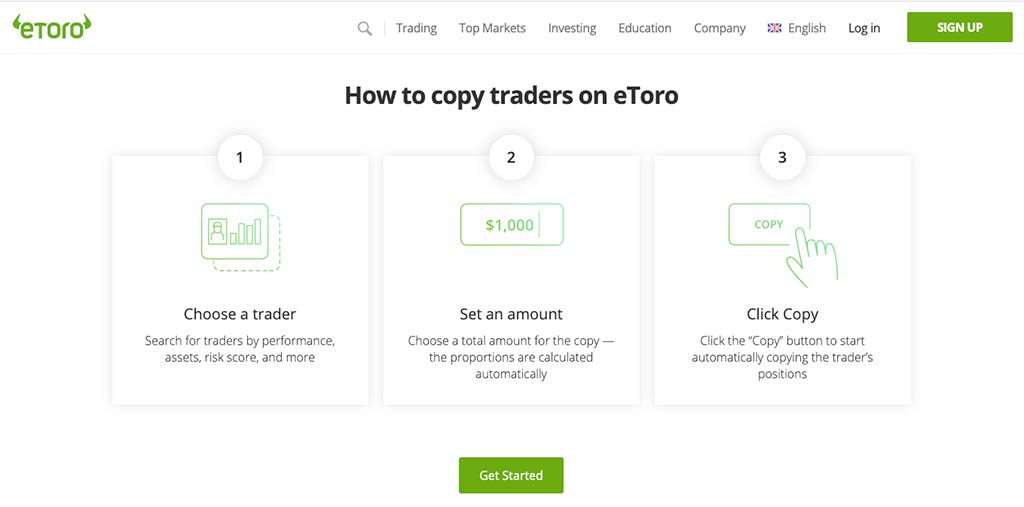

Just as the name suggests, CopyTrader allows you to copy the investment portfolio of more experienced or successful eToro users by browsing through profiles and selecting traders based on their previous performance, both on an annual and monthly level.

Past performance is not an indication of future results.

eToro gives you the ability to copy up to 100 eToro users at the same time.

To help make your selections a bit easier, eToro assigns each trader a ‘risk score’, as well as providing information on the number of trades per week, average holding time, charted performance, and news feed comments. This is enough information to give you real insight.

I found one of the great advantages of CopyTrader is that you can start copying other traders with no extra charge as there are no management fees. However, the minimum amount you can start trading with at eToro is $100.

eToro CopyPortfolio Review

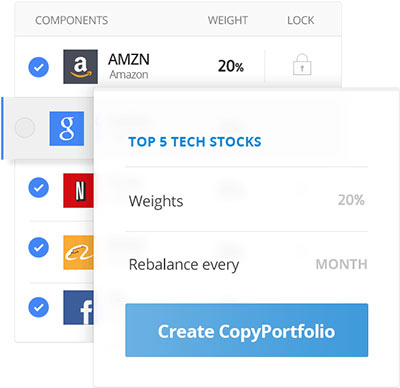

CopyPortfolio allows you to invest in two main types of investment portfolio: Top Trader Portfolios, which, simply put, allow you to invest in a portfolio consisting of the eToro users who are achieving the best returns, and Market Portfolios, which allow you to pick a market or theme of CFD stocks, commodities, or EFTs.

Bearing in mind that trading on CFDs comes with a high risk of losing your money, it’s good news that eToro makes it easy to spot the proportion of CFDs in any specific portfolio. In addition to this, asset distribution, performance, and investment strategies are all readily available to help you make the best possible decisions, and I particularly like that eToro makes sure you understand the complexity and high risk of CFDs at the outset.

Bearing in mind that trading on CFDs comes with a high risk of losing your money, it’s good news that eToro makes it easy to spot the proportion of CFDs in any specific portfolio. In addition to this, asset distribution, performance, and investment strategies are all readily available to help you make the best possible decisions, and I particularly like that eToro makes sure you understand the complexity and high risk of CFDs at the outset.

eToro Accounts vs Interactive Investor and Hargreaves Lansdown

| Account Type | eToro | Interactive Investor | Hargreaves Lansdown |

|---|---|---|---|

| Trading Account | Yes | Yes | Yes |

| SIPP | No | Yes | Yes |

| Stocks and Shares ISA | No | Yes | Yes |

| Cash ISA | No | No | No |

| Lifetime ISA | No | No | Yes |

| Junior SIPP | No | No | Yes |

| Junior Stocks and Shares ISA | No | Yes | Yes |

| Demo Account | Yes | No | Yes |

eToro ISA Review

Ok, so eToro was a little late to the party with their ISA, but better late than never, and this recent addition really puts the platform a giant step ahead of the competition.

It’s not all good news, however, as this is a fairly limited account when compared to the main eToro trading account.

You won’t be able to access the plethora of tradable assets from your eToro ISA; it’s definitely geared towards beginners and those happy to relinquish some level of control over their investments.

The eToro ISA is provided by Moneyfarm. Clients will be able to see the value of their ISA from their eToro investment portfolio, and the value of their ISA will count towards eToro’s Club programme, but clients can only invest in the Moneyfarm discretionary portfolios, which are very limited.

That being said, eToro is already hinting about further developments here, so it’s definitely worth watching this space.

eToro SIPP Review

The lack of a SIPP account at eToro seems like a big void in their online offering. Giving investors the option to transfer in and invest their pension pots using eToro’s great range of investment options would certainly be a welcome addition.

The account offering at eToro is fairly basic at this point. However, with constant innovations, I wouldn’t be surprised if this improves soon.

eToro Demo Account

The eToro demo account gives investors the opportunity to trade with $100,000 of demo money before risking any of their own funds on the main trading account. Given the general lack of education on the platform, this is a handy tool to help get to grips with all the products and features of the platform.

eToro WebTrader

eToro’s WebTrader platform is now in version 2.0 and allows users to directly manage stock market trades and forex trading from the central platform using the investment portfolio section.

Users can trade personally by entering orders directly, manage and monitor their personal positions in the market, and manage and monitor other traders’ transactions by using the Copy Trading function.

eToro Platform Review

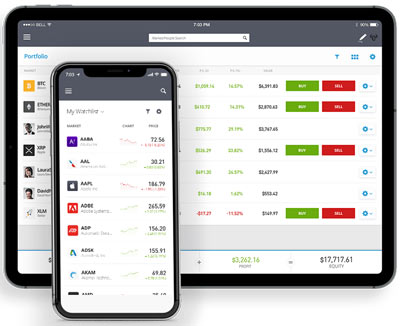

eToro has designed a really clean, modern-looking innovative trading platform that is easy to navigate and highly functional. This is available both on the web and on mobile, although they have yet to offer a desktop version to the market.

The eToro mobile app is most certainly an impressive offering to the market. Clean, easy to use, modern, and with a wealth of functionality, I enjoyed using it, and it makes for a seamless trading experience while on the move. That being said, eToro only scores 3.8 out of 5 on the app store, with a lot of the negative reviews complaining about mobile app crashes, some issues with the formatting of the charts, and the spreads, which users report they are often unaware of prior to trading.

In terms of security, eToro has installed optional two-factor authentication (2FA). This means that they verify your identity not only via your password, but also via a second authentication method. Two-factor authentication (2FA) is available on the eToro app, the eToro Money app, and the Delta investment app.

Searching, placing orders, and alerts and notifications features are all straightforward and easy to use at eToro and provide investors with a great level of functionality. On the eToro mobile version, you can even set up a push notification when an asset reaches a certain price point or when your order has been fulfilled.

eToro offers decent charting options on the eToro trading platform, giving investors the option to change chart types, chart intervals, and overlays and the ability to compare six different charts at once with their eToro ProCharts functionality. You also have easy access to your eToro account balance.

eToro Research Service and Tools Review

For investors looking for a decent level of technical analysis, eToro won’t disappoint. Unfortunately, they only offer recommendations on a limited number of stocks; however, for the ones that do have recommendations, there is a wealth of information available, such as average price targets and analyst reports.

While the research offered at eToro was good, it didn’t quite match up to providers like Interactive Investor or Hargreaves Lansdown, mostly due to the limited fundamental data on offer and insufficient research reports. In addition, eToro has failed to provide investors with financial market news or stock screeners, unlike most of their competition, which feels like a bit of an oversight.

However, eToro makes up for a lot of this with its social trading network. This works like a social feed, where other investors will offer their thoughts on stocks, often with supporting data to help you with your decisions. This social aspect of trading is not widely available and is a great little feature – earning 5 stars from me.

In terms of education, eToro has missed the mark. Their only offering is some hour-long videos in their trading academy, and while these do provide useful information regarding trading, financial markets, placing trades, and managing goals, they make it difficult for investors to find answers to specific questions without sitting through hours of webinars.

eToro Fees and Charges Review

While eToro is quick to promote their zero commission stock trading fees, there are currency conversion fees, withdrawal fees, CFD fees, and inactivity fees that investors need to be aware of.

When I compared eToro to similar trading and investing platforms, I found their CFD fees to be roughly in the same range, so nothing out of the ordinary there. However, it is worth noting that when trading eToro forex, the fees are high compared to their main competitors, which is worth taking into consideration if you plan to trade on forex.

As eToro only trades in USD, conversion fees will be applied when you deposit or withdraw money in any other currency. These vary according to the currency and how your money is deposited, but range between 50 pips and 250 pips per conversion.

For withdrawals, eToro charges a flat fee of $5 with a minimum withdrawal amount of $30. There is also an inactivity fee of $10 per month once your account has been dormant for 12 months. As a comparison, Plus500 doesn’t charge for withdrawals, and while they do have an inactivity fee, this is not on a monthly basis.

Fees

| Minimum DepositThe minimum amount required to open an account | $100 |

|---|---|

| Minimum TradeThe minimum amount to trade or buy shares | $1 |

| ETFs FeeFee per ETF trade | 0% |

| Investment Trusts FeeFee per investment trust trade | NA |

| Junior S&S ISA FeeSubscription fee per month and the platform fee | NA |

| Non Trading FeeFee for not trading in a period | $10 pcm after 1 year inactivity |

| Stocks & Shares ISA FeeSubscription fee per month and the platform fee | NA |

| Telephone Dealing FeeFee for trading over the telephone | NA |

| Withdrawal FeeFee for withdrawing funds from your account | $5 |

Guide to opening an eToro account

I have nothing bad to say about opening an account with eToro. If you are looking for a seamless, fully digital experience that takes moments, then you will find it at eToro.

There are three main types of accounts on offer: their eToro Live Account, where you can start trading; the stocks and shares ISA; and their eToro Virtual Account, which gives you the option of experiencing the eToro trading platform with play money.

To open your eToro account, you simply need to register your email address or Facebook or Google+ account, and you will have immediate access to the eToro trading platform. There is a minimum deposit of $100 to start trading, and the minimum amount for a bank transfer is £500.

Of course, in order to fund your eToro account, you will need to verify your identity, which is not unusual and can be done quickly by uploading a couple of supporting documents.

eToro Deposit and Withdrawal Review

eToro has certainly supplied customers with masses of options when it comes to depositing money, including:

- Visa Credit Card

- MasterCard

- PayPal

- Skrill

- Neteller

- Wire transfer

It is important that UK investors understand that eToro only operates in USD, which means any deposits will be converted and charged the relevant conversion fee. This fee will also be applicable upon withdrawal back to GBP.

Bank transfers tend to take 4–7 business days to appear in your eToro account.

When it comes to withdrawals, eToro does levy a $5 withdrawal fee, which is fairly substantial when compared to other brokers. However, by bank transfer, the whole process only takes around 2 business days and is very easy to complete on the website.

eToro Customer Service Review

While not outstanding, I did find the customer service offering at eToro to be satisfactory, with several channels of communication, including a live chat function and a web-based ticketing system. The eToro customer service reps are polite and knowledgeable, and during my eToro review, my queries were answered in a timely fashion. However, unlike some platforms, there is no customer service available outside of normal office hours.

If you’re a Platinum Plus member, you have 24/7 access to a personal account manager who can assist with buying, selling, and analysing investment opportunities by phone or video call, if you wish. You’ll automatically become a Platinum Plus member if you have $50,000+ invested.

Is eToro safe?

eToro is safe for UK customers to use. The trading and investment platform is authorised and regulated by the Financial Conduct Authority (FCA), as well as being covered by the Financial Services Compensation Scheme meaning eToro customers are entitled to up to £85,000 should eToro become insolvent.

eToro is a start-up and not yet listed on any stock exchange meaning there are no financial statements available from which to check its financial health. eToro (Europe) Ltd. is authorised and regulated by the Cyprus Securities Exchange Commission (CySEC).

Is eToro good for beginners?

I feel that eToro would be a suitable choice for those with limited trading experience for a number of reasons. Firstly, the web platform is easy to use and very clear and quick to navigate, and the same can be said for the mobile platform. In terms of fees, it is highly competitive, although you do need to be aware of some of the non-trading fees, which can be a little steep.

The account opening process is very quick, and beginners can get started with a low minimum deposit.

The other aspect that makes this an appealing platform for beginners is the demo account. With $100,000 of virtual funds to practise with over an unlimited period of time, inexperienced traders have an opportunity to hone their skills without risking any real money.

Alternatives to eToro

eToro vs Freetrade

Both of these investment platforms are highly rated and good options for beginners. However, eToro dominates the asset market with access to stocks, ETFs, cryptocurrencies, commodities, indices, and forex. Conversely, Freetrade has a limited selection of stocks and ETFs.

Another key difference is social trading, with eToro being the largest social trading platform online and Freetrade yet to offer any social trading capabilities.

In terms of fees, Freetrade is a lower-cost option with commission-free trading, whereas eToro charges spreads on trades.

Freetrade’s user interface is a little bit simpler to use, but at the sacrifice of all the tools and capabilities that eToro offers.

eToro vs Trading 212

Trading 212 is a commission-free platform. You can expect to encounter a spread on trades at eToro as well as fees for holding positions overnight. At Trading 212, there are no spreads. They do charge currency conversion fees, but they are a staggeringly low 0.15%. In addition, Trading 212 allows you to hold and trade in multiple currencies, meaning it is possible to avoid FX fees altogether. This is a key difference between Trading 212 and eToro since eToro only allows trading in USD.

Another factor you might want to consider is that if you do not log into your eToro account for over one year, a monthly inactivity fee of $10 USD will be charged from any remaining available balance. Trading 212, on the other hand, does not charge inactivity fees.

Both Trading 212 and eToro offer fractional shares, and both offer a demo account (it’s known as ‘Practice Mode’ on Trading 212), although eToro provides $100,000 of virtual funding, while Trading 212 only offers $50,000.

Trading 212 offers trading on a choice of over 12,000 stocks and ETFs. In contrast, eToro offers a choice of around 3,600 stocks and ETFs.

eToro cannot be beaten when it comes to social trading. There is no social or copy trading offered by Trading 212 at all. The platform has, instead, focused its efforts on providing an easy-to-use interface alongside a wide range of educational resources, making Trading 212 a good option for beginners and those with smaller trading balances, but not the right choice for those wanting to copy trade.

interactive investor vs eToro

eToro and interactive investor are two established trading and investment platforms with a large client base. However, eToro is well known for its social trading and copy trading facilities.

Both of these platforms offer a wide range of assets for trading, although eToro is better for crypto trading.

In terms of fees, eToro would undoubtedly offer a lower-cost proposition.

interactive investor is a traditional trading platform with access to some excellent research and analysis tools and a comprehensive education centre. In addition, investors looking for a tax wrapper from which to trade a wide range of assets would be better off at interactive investor.

Hargreaves Lansdown vs eToro

Hargreaves Lansdown is one of the most well-established and well-known investment platforms, having been on the scene since 1981.

eToro is certainly a lower-cost option than Hargreaves Lansdown, particularly for frequent traders who could find the cost per trade at Hargreaves Lansdown prohibitive.

The other consideration is the robust social and copy trading capabilities at eToro, which makes it an excellent platform for beginners as well as those with more trading experience.

However, Hargreaves Lansdown offers an extensive range of funds and is definitely a better option for those saving for their retirement.

InvestEngine vs eToro

InvestEngine is one of the most popular low-cost investment platforms for ETFs.

One of the main differences between eToro and InvestEngine is that InvestEngine offers just fully managed portfolios, or a range of ETFs for DIY portfolios – no competition for the extensive range of assets available at eToro.

eToro is the clear winner for anyone looking to engage in copy trading. However, if you are looking for a low-cost, hands-off option, InvestEngine is hard to beat.

eToro vs Avatrade

There isn’t much to differentiate between these two investment platforms; however, I did find eToro slightly better than Avatrade due to the zero commission trading on real stocks and their thriving social and copy trading facilities.

Where AvaTrade is hard to beat is their exceptional educational resources and extensive range of trading platforms, including MetaTrader 4. Given that eToro does not have a desktop version of its platform, this may sway a few traders in the direction of AvaTrade.

eToro vs Robinhood

The first thing of note is that Robinhood is not currently available to UK residents although they are planning to change this by the end of 2023. You might, therefore, be keeping an eye on Robinhood as an upcoming option. As things stand, eToro offers greater transparency on the fees it charges, a greater number of research and advanced trading tools, and a greater number of instruments on offer.

eToro vs Coinbase

Of course, this comparison is only relevant if you are looking to trade cryptocurrencies, as while eToro is a multi asset platform, Coinbase is specifically for trading, holding, and storing crypto.

Only at eToro will you be able to trade cryptos by automatically following the investments of more successful traders using their copy trading facilities, so if this is appealing to you as a trader, then eToro stands out as the clear option.

eToro would also be a lower-cost option for buying and selling crypto; however, I would recommend Coinbase to complete novice traders as their platform is extremely easy to use.

Comparison table

| Platform | Fees | Asset range | User interface | Customer support | Tools and research |

|---|---|---|---|---|---|

| eToro | 4.5 | 4 | 4.5 | 3.5 | 3.5 |

| Freetrade | 5 | 2 | 1.5 | 3.5 | 0.5 |

| Trading 212 | 4.5 | 3.5 | 4.5 | 3.5 | 3 |

| interactive investor | 4 | 3.5 | 4.5 | 4.5 | 3.5 |

| Hargreaves Lansdown | 3 | 4 | 4 | 4.5 | 4 |

| InvestEngine | 4.5 | 4 | 4 | 5 | 4 |

| AvaTrade | 4.5 | 4 | 4.5 | 4 | 4 |

| Robinhood | 4.5 | 2.5 | 4.5 | 1.5 | 3 |

| Coinbase | 3.5 | 3 | 4 | 3 | 4 |

eToro Pros and Cons in more detail

For a quick overview of where I feel eToro really shines and where it may fall a little short, here are my pros and cons in more detail:

Pros

-

Free trading on stocks

There are a number of platforms that offer zero-commission trading on stocks. It is important to note that all transactions on eToro are conducted in USD, and therefore you will encounter currency conversion fees. However, for investors looking to trade stocks, this is still a competitive platform.

-

Quick and easy account opening

You will only need to put aside around 5 to 10 minutes to open an account with eToro and start trading. You’ll need to go through the usual identity verification so have your supporting documents on hand. Be aware that should you decide to fund your account via bank transfer, this will require a minimum of £500.

When logging in after you’ve registered, eToro uses two factor authentication.

-

Well designed trading platform

Available on the web and mobile, the trading platform at eToro is easy to navigate, even for those with limited to no experience. You won’t miss any of the functionality when using the mobile app, and the design of both versions makes trading and copy trading remarkably accessible.

Cons

-

Very limited education

Whilst there is some educational material in the eToro academy, this could have been organised a little better and the inclusion of financial goals would have been a bonus. Particularly since eToro’s mission is to be one of the leading trading and investment platforms when it comes to empowering investors to grow their knowledge alongside their wealth.

eToro does trail some of the leading platforms for education, however, it would be wrong not to mention the demo account, as well as the social trading facilities that can be an education in themselves.

-

Conversion and withdrawal fees

All trading at eToro is conducted in USD, which means that you can expect to encounter currency conversion fees when trading. There are of course ways to mitigate this by using a currency conversion platform offering good rates. However, there is no way to avoid the withdrawal fee.

-

High forex fees for a low cost broker

Forex fees at eToro are found in the spread which represents the difference between the bid (sell) price and ask (buy) price. This is how most brokers make their money from forex traders. At eToro you can expect to pay a spread of 1.0 pips on the EUR/USD, while the raw spread, as determined by the market, is between 0.00 pips and 0.01 pips. This places eToro at around average when compared to other brokers, some of which will charge as low as 0.4 pips on the spread.

Sadly this cost increases significantly for those trading commodities, CFDs. and cryptocurrencies.

Useful Information

Here, I have outlined some useful information to make your experience at eToro as seamless as possible.

How do I contact eToro?

eToro customer support can be contacted via their online ticketing system, available on their webpages, or via live chat and email.

However, existing customers can make use of the eToro customer support web chat facility that can be found on your account.

How do I withdraw my money from eToro?

Withdrawing your money from eToro is quick and easy. Simply select ‘Withdraw Funds’ from the tab in the left-hand menu and enter the amount you wish to withdraw. You will then be asked to complete an electronic withdrawal request form.

How do I close my account at eToro?

Closing your account with eToro is fairly painless and can be done by clicking the ‘Withdraw Funds’ tab in the left-hand menu of your Account Settings page.

eToro FAQs

Is eToro any good?

Can I use eToro in the UK?

Does eToro have an ISA?

Please note:

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

eToro Customer reviews

Account opening straight forward but clunky. Better alternatives available for general investment accounts like Trading 212 and Invest Engine

- Deposit and withdrawal

- Customer service

etoro is an excellent platform for beginners or for people like me who cannot trade for themselves, etoro’s copytrading is second to none and I cannot recommend it enough, this is a no brainer.

- Fees

- Account opening

- Deposit and withdrawal

- Customer service

Great stuff but I could hardly get a hold of the customer service, but I was surprised how quickly I saw my money on the account and could start trading, that really helped me!

- Fees

- Account opening

- Deposit and withdrawal

- Customer service

Click here to learn how we review.

- Learn how to invest in the FTSE100

- Have you considered transferring your pension?

- Find the best trading platforms