What is Trading?

Trading involves buying and selling assets to make a profit. It’s often riskier than investing but can turn a profit quicker. To make a decent return, traders tend to make a high frequency of transactions with higher or lower margins depending on their strategy and tactics.

You can also think of trading as a short-term strategy and investing as a longer-term strategy which involves holding assets for months or years.

- What is Trading?

- Key takeaways

- What accounts can be used for trading?

- Related trading articles

- What are the differences between trading and investing?

- How do I start trading?

- What strategies are used for trading?

- How are trades placed?

- What is CFD trading?

- What are the best markets for day trading?

- What are the fees associated with trading?

- Final thoughts

- Related articles

Key takeaways

- Trading is the act of buying and selling financial assets, including stocks forex, options, and commodities

- Traders seek to use short-term price fluctuations in order to make a profit

- Traders will make quick decisions based on market analysis and trends

- Trading can be done using an online trading platform

What accounts can be used for trading?

Most platforms will provide a trading account; however, a handful of platforms will also provide a tax wrapper in the form of an ISA. An ISA allows you to profit from your trades without being subject to capital gains tax or income tax.

Interactive Brokers is one of the best trading platforms that I have identified that also offers an ISA.

Trusted partner

80% of retail CFD accounts lose money

2000+ CFDs

- User friendly mobile app

- unlimited CFD demo account

- Trading academy

Trusted partner

71% of traders lose money trading with IG.

Commission-free trading

- Free demo account

- Advanced charting tools

- Extensive educational content

What are the differences between trading and investing?

While the terms trading and investing are often used interchangeably, there are some important differences between these two investment strategies.

Time

The key difference between trading and investing is the length of time that you hold your assets for.

While investors will often seek to hold assets for months or, most often, years, traders will look to hold assets for a much shorter time—in some cases, only minutes.

Risk

As mentioned previously, trading is often riskier than investing. This is because trading can be seen as more complex, requiring a good understanding of the markets and time to analyse the various factors that can make the markets move up or down.

Contrary to this, proper diversification can make investing very low risk, although it is important to note that with both trading and investing, there is always a risk of losing your money

Research

Trading relies on taking advantage of fluctuations in the marketplace to buy when prices are low and sell when prices have increased. It is therefore important for traders to understand the factors that cause surges and sags, including inflation, trade policies, tax breaks, economic optimism, global events, geopolitical events, and recessions, to name a few.

Styles

Both trading and investing have different styles, including active investing, passive investing, position trading, swing trading, day trading, and scalping. More on this will follow further down in this article.

How do I start trading?

If you are serious about trying your hand at trading, then it is absolutely vital that you learn the necessary skills to tip the odds in your favour.

Open a trading account

This might sound obvious but it’s important that you find the right platform to meet your individual needs. I have conducted detailed reviews of all the platforms available and summarised my top 10 trading platforms. This should help you make an informed decision quickly.

If you are reading this article, it’s safe to assume that you are a beginner. Therefore, you should find a platform that offers the tools and resources you need as well as excellent educational facilities.

If you are interested in starting off by copying the trades of more experienced traders, then eToro is one of the best platforms for copy trading.

Learn about the stock market

Trading requires you to dedicate time to studying the stock markets in order to anticipate price movements and identify trading opportunities. There is a plethora of information available, often for free.

Study the various international markets, paying particular attention to rising and falling prices, which will help you decipher whether you’ll buy (go long) if you think there is a chance that the asset’s price will go up, or whether you will sell (go short) if you think it’s likely that the asset’s price will fall.

Understand how to manage risk

As mentioned, trading is often considered inherently risky when compared to investing. However, that being said, there are tools and strategies that can help you reduce your exposure to risk.

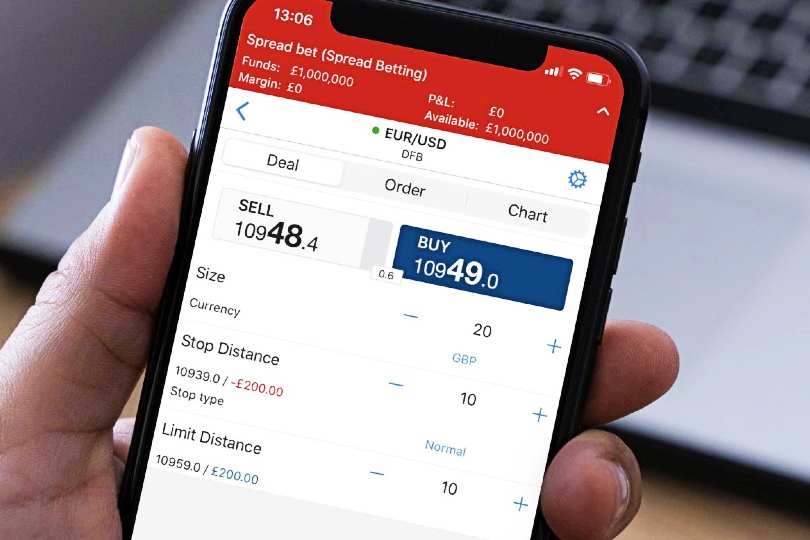

A good platform will provide a number of risk management tools that you can use to bring your trading in line with your risk appetite. These include::

- Stop-Loss Orders to automatically close your position in the event the market starts to move against you

- Guaranteed Stops to close your position at a predetermined price as set by you

- Price alerts, often sent straight to your phone to keep you up to date on market movements

- Negative Balance Protection to prevent your balance from going into negative – this feature is a requirement of any FCA regulated financial platform

Hedging your positions can also help mitigate your exposure to risk. Make sure you are familiar with hedging strategies.

Practise using a demo account

An excellent place to start schooling yourself in the art of trading is with a demo account. This allows you to practise your trades in real market conditions without risking any of your personal funds.

Most trading platforms will offer a demo account, which mimics exactly the financial markets and which you can utilise before opening a live trading account.

What strategies are used for trading?

There are many strategies available for trading, but in the interest of brevity, I will provide you with details of the most commonly used strategies.

Day trading: Day trading uses small price movements to buy and sell assets within a single day. This requires careful monitoring by day traders in order to make a profit from short-term price fluctuations.

Swing trading: Swing trading can be less labour intensive as it requires the trader to hold their position for several days or even weeks. Swing trading aims to profit from short to medium term price trends by utilising technical analysis to identify potential entry and exit opportunities.

Scalping: Scalping is possibly the most labour-intensive of all the strategies, as traders aim to make a significant number of small trades throughout the day in order to profit from tiny price movements. Positions are often held for very short periods of time, mostly seconds or minutes.

Position trading: Position trading resembles investing the most. It is a strategy with which traders take a relatively long-term position in the financial markets. This can extend from weeks to months and even years. There is still a requirement to analyse fundamental factors, macroeconomic trends, and long-term price patterns when using this strategy.

How are trades placed?

Once you have chosen the best trading platform for your needs and have taken time to familiarise yourself with the market, it will be time to place your first trade.

Open an account – this is a relatively simple procedure that can be done in mere moments. You will need to provide some personal information, including your National Insurance number.

Fund your account – the amount of funds you place in your account will determine your buying power when it comes to placing your first trade.

Research and analysis – use fundamental analysis, including financial data and news, as well as technical analysis, including price charts and patterns, in order to make informed decisions. Always remember that past performance is not an indicator of future results.

Select an asset and market – most commonly traded financial instruments include stocks, bonds, commodities, currencies, and derivatives such as options and futures.

Decide whether you will be using leverage – leverage allows you to take a much larger position than you would otherwise be able to access with the funds that you have. Make sure you understand leverage, as while it can significantly increase your profits, it can also increase your losses.

Set your risk management tools – including order types, Stop Loss, and Take Profit.

Place your trade – specifying the number of units or contracts you wish to trade.

Monitor your trade – depending on your trading strategy.

Close the trade – either manually or by placing a closing order.

Review and analyse – Trading is a constant learning curve and by reviewing the outcome and analysing the results, you can learn from your experiences.

What is CFD trading?

CFD (Contracts for Difference) trading is a popular form of trading in financial markets that involves speculating on the price movements of various underlying assets without owning the actual asset. However, before I go into any more detail, it is important to note that trading CFDs is a form of financial derivative trading that is extremely risky, with a high chance of losing all your funds.

That being said, there are several advantages to CFD trading, including:

- A wide range of underlying assets, including stocks, indices, commodities, currency or forex, bonds, and more

- Leverage, which allows traders to control a larger position size with a relatively small amount of capital.

- The ability to profit from rising and falling markets means traders can take advantage of market volatility

- Markets are available 24/5 with traders being able to enter and exit positions relatively quickly

Please bear in mind that more people will lose money trading CFDs than those who will make a profit. Trading CFDs requires a lot of knowledge and experience.

Consider: Read our guide to trading CFDs if you are unsure where to start.

What are the best markets for day trading?

Day trading involves opening and closing your positions within the same trading day. By doing this, you are seeking to profit from short-term price movements.

One of the most popular markets for day traders, including beginners, is the forex market. The forex market involves the exchange of one currency for another, usually traded in pairs. This is popular among day traders for its low barrier to entry as well as its deep liquidity.

What are the fees associated with trading?

Fees can vary from platform to platform so it is a good idea to ensure that the fees offered are in line with your trading style.

Some of the fees you can expect to encounter include:

- Currency conversion fees – often applicable when buying non-UK shares and usually represented as a percentage of the value of the transaction

- Spreads – most often charged by zero commission platforms and vary depending on the asset

- Deposit and withdrawal fees

- Platform fees

- Inactivity fees

Final thoughts

It’s important to remember that being successful in trading requires a significant amount of research and time. You are unlikely to make a profit through sheer luck. The tools and analysis used to decipher the best entry and exit points are often complex for beginners. Patience and preparation are the keys.