Savvy investors don’t just trade; they invest for their and their family’s financial future. They do not disclose the tools they use but at Investing Reviews, we have checked out over 140 platforms to bring you the best trading platforms that suit your needs in the UK so you can focus on watching your money grow.

For each of these platforms, we have tested parameters such as fees, tools, education, product range, and customer service to ensure you get off to the best possible start.

Best Trading Platform

Capital at risk. T&Cs apply.

Over 2,000 CFDs

- Easy to use platform

- CFD demo account

- Publicly listed company

Best for Trading

Capital at risk. T&Cs apply.

13,500+ Markets

- Good for traders of all levels

- Great trading platforms

- Low-cost trading platform

Featured trading platform

Capital at risk. T&Cs apply.

13,000+ instruments

- Low cost Trading

- MetaTrader 4

- 24/7 customer support

- My best rated trading platforms in the UK, July 2025

- What’s my methodology?

- View best trading platforms in 60 seconds

- How to choose the best trading platform for you

- What’s the difference between a trading platform and an online broker?

- How I’ve chosen this list of best trading platforms in the UK

- Some common trading platform terminology explained

- Tax and Trading in the UK

- Which type of trading is best?

- Most asked questions about best UK trading platforms

- Best UK Trading Platforms FAQs

My best rated trading platforms in the UK, July 2025

- Plus500 – One of the best for trading

- City Index – Best for trading

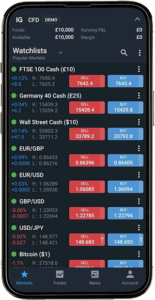

- IG – Best overall trading platform

- Admiral Markets – Best for choice

- XTB – Zero-commission trading

- eToro – Best for copy trading

- Forex.com – Best for low-cost trading

- Pepperstone – Best for low-cost trading

- Interactive Brokers – Best for professionals and research

- Saxo Markets – Best for tools and products

- Interactive investor – Best for DIY investors

- AJ Bell – Best for ease of use

- Hargreaves Lansdown – Best for premium service

Trusted partner

80% of retail CFD accounts lose money

2000+ CFDs

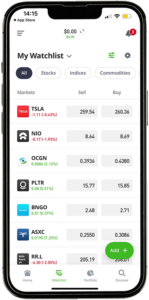

- User friendly mobile app

- unlimited CFD demo account

- Trading academy

Plus500 is a multi-asset broker offering a range of financial products, including CFDs, shares, and futures.

Key features:

Key features:

- Proprietary online trading platform for mobile and web

- Offers over 2800 CFD contracts

- no commissions, spreads and other fees apply with a free lifetime demo account

- Heavily regulated and listed on a stock exchange

- Provides trading tools like negative balance protection and guaranteed stop-loss orders

- Recently launched “Insights,” a real-time data trading tool

Who should use Plus500?

This platform is best for CFD traders seeking powerful trading tools to boost their performance, but this is not ideal for those who frequently enter and exit the financial markets.

Final thoughts:

Plus500 stands out as a leading CFD broker in the UK, especially for active traders. Its no commissions, spreads and other fees apply, combined with a well-designed interface, makes it a popular choice. The platform is secure and transparent, being listed on the stock exchange and disclosing all financial information. However, potential users should be aware of the risks associated with CFD trading. Advanced traders might find the platform lacking in some sophisticated functionalities.

Pros:

- no commissions, spreads and other fees apply

- User-friendly platform with tight spreads

- Guaranteed stop-loss orders

- Exclusive Insights advanced trading tools

Cons:

- Only offers CFD trading

- Charges inactivity fees

Fees:

- No commissions; earnings through spreads

- No deposit or withdrawal fees

- Inactivity fee of $10/month after 3 months of no login

- Currency conversion fee of 0.7%

Products:

- Extensive range of CFDs, including forex, stock indices, shares, commodities, ETFs, and options

- Plus500 Invest, a new share trading platform, is launching soon in the UK

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

City Index is a low-cost, well-established CFD and spread betting platform that provides access to more than 40 options markets, with daily, monthly, and quarterly contracts on offer. City Index is part of the NASDAQ-listed StoneX group.

Key features:

Key features:

- Access 13,500+ markets and 40+ options in indices, FX, metals, and commodities

- Quality news feeds from Reuters and in-house research

- Economic calendar and social media presence for retail investors

- Choice of trading platforms, including Metatrader 4 (MT4)

- Beginner-friendly educational resources

- Powerful research tools for market understanding

- Comprehensive trading tools and market news from Reuters

Pros:

- Low-cost trading platform

- Great choice of assets

- Excellent education and research tools

- Great customer support

Cons:

- No MetaTrader 5

- Inactivity fee applied

Service Fees:

- Buy/Sell Spreads: Rather than charging commission, City Index’s charges are incorporated into the spread. You’ll need to open an account (or demo account) to see spreads on their 1,000s of markets but, depending on the market, both fixed and variable spreads are offered. These start at margins from 5% and fixed spreads from 0.4pts.

- Commission: There is no commission on spread betting markets. With CFDs, you’ll only pay commission when trading shares. Commission for these trades is typically 0.08%.

- Overnight funding: Overnight financing fees on both long and short positions are 2.5% +/- the benchmark regional interest rate.

- Guaranteed Stop Order: A charge is made for use of this feature. For full details, check the website.

- Deposit / Withdrawal fees: No charges.

- Inactivity fee: A monthly inactivity fee of £12 will be applied for accounts that are inactive for 12 months or more.

- Currency conversion: Spread betting accounts are not affected because all trades take place in one base currency, usually sterling. Fees apply on CFDs. Check the website for full details.

- Borrowing costs for shorting CFDs: Borrowing costs are incurred when you short a shares CFD position. Very few markets will incur a borrowing charge – check the relevant market information sheet for details.

Products:

-

-

- Indices

- Shares

- Forex (FX)

- Commodities

-

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

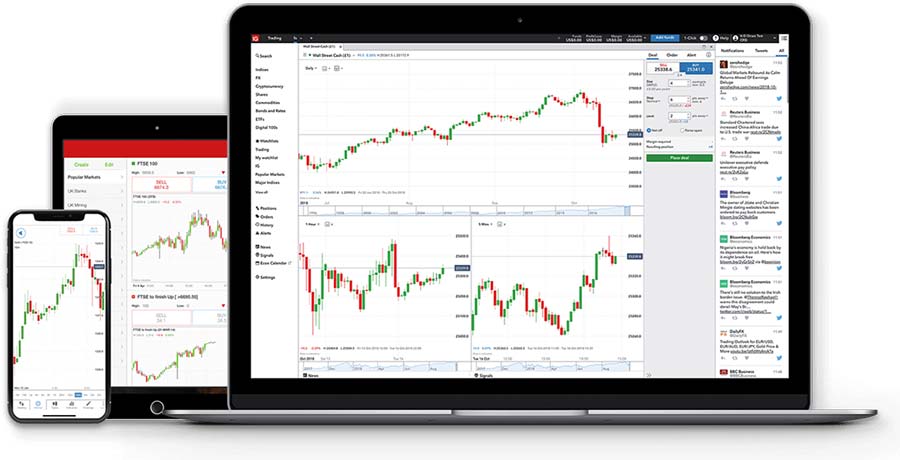

IG is the biggest spread betting and CFD provider in the UK, offering access to 17,000 markets across the globe. With low rates and excellent tools and market research, this easy-to-use online trading platform easily swooped into my top spot.

Key Features:

- Comprehensive online trading platform suitable for both beginners and professionals

- MT4, L2 dealer, and ProRealTime platforms offering advanced charting tools, alerts, and risk management tools

- Over 17,000+ markets available for trading

- Offers both Share Dealing ISA and IG Smart Portfolio

- Established for over 50 years with 313,000+ clients worldwide

- Free trading platform demo account

- Excellent educational resources, including the IG academy

Who Should Use IG?

IG is suitable for moderately experienced traders and professionals. New investors can benefit from the Smart Portfolio and IG Academy; however, I would say this is not ideal for complete novices in spread betting. This is an excellent low-cost option for retail investors who are likely to make more than three trades per quarter.

Final Thoughts:

IG Investments stands out as a versatile platform catering to a wide range of investors. Their extensive market offerings, combined with competitive fees and a robust educational academy, make them a top choice for those looking to delve into the world of trading. However, beginners should exercise caution, especially when exploring leveraged products.

Pros:

- Multiple funding and withdrawal options

- Intuitive desktop trading platform and mobile trading app

- Extensive research tools and educational content through IG Academy

- No transfer fees for electronic shares

Cons:

- No copy trading or backtesting integration

- Not ideal for very infrequent trader

- Some advanced research tools require additional fees

Fees:

-

-

- IG Smart Portfolio: 0.72% on the first £50,000; 0.22% on amounts over £50,000

- Share Dealing ISA: £8 for 0–2 trades, £3 for three trades and over (up to £25,000)

- Custody fee of £24 per quarter (can be waived under certain conditions)

-

Products:

-

-

- Non-Leveraged: ETFs, Shares, Bonds, and Commodities

- Leveraged: Spread betting, Forex, Options, CFDs, Cryptocurrencies

-

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Admiral Markets, regulated by the UK FCA, is a solid option for those seeking a platform that bridges trading and long-term investing. It offers over 8,000 tradable instruments, including stocks, ETFs, forex, and CFDs, alongside advanced tools like MetaTrader 4/5. The standout features are low FX fees (0.3%), no annual account fees, fractional share trading, and exceptional customer service.

Key Features:

Admiral Markets provides a powerful trading platform tailored for traders across all levels. Here are the standout features:

- Platform Options:

- Access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5), enhanced with Admirals’ Supreme Edition add-on, which includes advanced charting, sentiment analysis, real-time news, and trading simulators.

- Web-based trading and mobile apps for flexible trading on the go.

- Wide Range of Instruments:

- Over 8,000 tradable instruments, including forex, CFDs on stocks, indices, commodities, ETFs, cryptocurrencies, and bonds.

- Fractional share trading, allowing smaller-scale investments.

- Low-Cost Trading:

- Competitive spreads starting at 0.1 pips for forex and low commissions for stock CFDs (from $0.02 per share).

- Currency conversion fees are only 0.3%, making it cost-effective for multi-currency trades.

- Strong Regulation and Security:

- Regulated by top-tier authorities like the UK FCA, ASIC, and CySEC, ensuring a secure and trustworthy trading environment.

- Educational Resources:

- Extensive support for traders with webinars, tutorials, market analysis, and trading calculators.

- A free demo account with virtual funds for practice.

- Additional Tools:

- Virtual private servers (VPS) for uninterrupted trading.

- Leverage of up to 1:30 for retail traders and higher for professionals.

Who Should Use Admiral Markets?

- Forex and CFD Traders:

- With competitive spreads, fast execution times, and access to MT4/MT5, Admirals is ideal for active forex and CFD traders looking for advanced tools.

- DIY Traders and Investors:

- Perfect for those who want to actively manage their portfolios without relying on pre-made strategies, thanks to the wide range of instruments and customizable trading tools.

- Advanced Traders:

- Admirals’ Supreme Edition add-on and professional-grade tools make it a strong choice for traders who rely on technical analysis and algorithmic trading.

- Cost-Conscious Traders:

- Low commissions, competitive spreads, and minimal FX fees make it an excellent option for traders who prioritize affordability.

- Educated Beginners:

- While it may seem overwhelming initially, the educational resources and demo accounts help new traders build their confidence.

Final Thoughts:

Admirals delivers a versatile and feature-rich trading platform, combining advanced tools, diverse tradable instruments, and competitive pricing. It stands out with its MT4 and MT5 integration, enhanced by the Supreme Edition, catering to both advanced traders and those willing to learn. While it may not be ideal for passive investors or those seeking ready-made portfolios, Admirals is a standout choice for active traders who value customization, affordability, and reliability. For anyone looking to dive into forex, CFD trading, or even stocks and ETFs, Admirals provides a secure and dynamic environment to grow.

Pros:

- Wide Range of Instruments

- Advanced Trading Tools

- Low-Cost Trading

- Fractional Shares

Cons:

- Learning Curve for Beginners

- Inactivity Fee

- Limited Support for Passive Investors

Fees:

-

-

- Tight spreads starting from 0.1 pips for forex and competitive stock CFD commissions (e.g., $0.02 per share)

- Low currency conversion fees of 0.3%

- low commissions starting at €1/$1

-

Products:

-

-

- Non-Leveraged: ETFs, Shares, Bonds, and Commodities

- Leveraged: Forex, Options, CFDs

-

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

XTB is a top-tier CFD broker known for its low trading fees, diverse tradable instruments, and superior educational resources.

Key Features:

- Proprietary trading platform with excellent usability

- Over 2100 instruments are available for trading

- Comprehensive educational materials, including one-on-one mentoring

- Award-winning platform with accolades like “Best Forex Broker for Beginners” in 2022

Who should use XTB?

XTB is ideal for traders of all levels, especially those aiming to cut down on trading costs.

Final Thoughts:

XTB stands out for its low costs, vast product range, and exceptional educational offerings. While it lacks MetaTrader 4 support, its proprietary platform is robust and user-friendly. It’s a solid choice for both novices and seasoned traders. If you’re looking to minimise trading expenses and access a wide range of assets, XTB might be the best trading platform for you.

Pros:

- Competitive forex spread cost

- 24/7 support

- Extensive asset range

Cons:

- No MetaTrader 4 support

- Fees for withdrawals under certain amounts

- Inactivity charges

Fees:

-

-

- Low forex trading costs

- Inactivity fee after one year of no trading

- £12 fee for withdrawals under £60

-

Products:

-

-

- Forex: 48 currency pairs

- Indices: 20+ global indices

- Commodities: Including gold, silver, and oil

- Stock CFDs: Over 1,850 from global exchanges

- ETF CFDs: Over 100 globally

-

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

eToro is a multi-asset, low-cost platform offering 0% commission on real stocks. It is also the world’s leading social trading platform.

Key Features:

- CopyTrader allows you to replicate successful traders’ portfolios in real-time

- Offers a wide range of assets: over 5,000 stocks, 671 ETFs, 55 currencies, 35 commodities, 21 indices and over 100 cryptocurrencies

- User-friendly web and mobile applications

- Virtual portfolio with $100,000 available for practise

- Regulated by the Financial Conduct Authority

Who Should Use eToro?

This is a good option for most traders. Beginners in the UK can benefit from the demo account and copy trading, while experienced traders can explore a wide range of assets with low trading fees.

Final Thoughts:

eToro stands out for its social trading capabilities and a wide range of assets. The platform is user-friendly, making it a suitable trading platform for beginners; however, while it offers competitive fees for stock trading, users should be aware of other associated fees such as withdrawal fees and FX fees. Overall, eToro is a robust platform for those interested in social trading and a diverse range of assets.

Pros:

- Free stock trading

- Quick and easy trading account setup

- Well-designed online trading platform with social trading features

Cons:

- Does not offer funds (OEICs)

- Accounts in USD

- Foreign exchange and withdrawal fee

- High forex fees compared to competitors

Fees:

- 0% commissions on real stocks

- Conversion fees for non-USD transactions

- $5 withdrawal fee

- Inactivity fee of $10/month after 12 months of dormancy

Products:

- Offers CFDs, forex, real stocks, ETFs, cryptocurrencies, commodities, and indices

- ISA product provided by Moneyfarm

- Unique features like CopyTrader and CopyPortfolio enhance trading experiences

{etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees

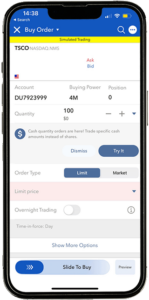

Forex.com have designed an app that is a joy to navigate even for beginners. They offer two mobile platforms, the ever-popular MT4 and their own proprietary platform. Excellent search functions make finding your currencies a breeze and functions such as place market, limit, stop, stop trailing, and OCO orders all add to the experience.

Forex.com really shine when it comes to charting with a plethora of charting tools and comprehensive research and news sources providing complete analysis to complement your trading activities.

On the negative side, recent reviews have suggested that Forex.com are having some issues with the app slowing down or even freezing from time to time however, I hope this is something Forex.com will rectify and it’s certainly not worth writing off just yet.

Pros

- Over 80 currency pairs

- Excellent range of features

- Demo account available

Cons

- App has been known to freeze

- No fundamental data

- Inactivity fee

Forex.com Fees

- Standard spread 1 pip

- Zero commissions

Forex.com Account Features

- Range of platform options

- Advanced charting tools

- Demo account

- Real-time view of pricing

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Pepperstone is a renowned online CFD trading platform that offers a wide range of trading services. Pepperstone, with its headquarters in the UK, provides traders with a comprehensive trading experience tailored to their needs.

Key Features:

- Pepperstone offers access to multiple trading platforms, including TradingView, MetaTrader 4, MetaTrader 5, and cTrader

- Traders can access a variety of financial instruments, including forex, commodities, indices, and equity

- Pepperstone provides professional forex trading market analysis, insights, and education

Who Should Use Pepperstone?

Ideal for forex and CFD traders of all levels. Not suitable for those looking to trade real stocks in the UK and Exchange Traded Funds (ETFs).

Final Thoughts

Pepperstone offers a comprehensive trading experience with a variety of platforms and trading tools. Their focus on customer service and competitive fees makes them a top choice for CFD and forex traders. However, those interested in real stocks or ETFs might need to look elsewhere.

Pros:

- Traders have the flexibility to choose from multiple platforms based on their trading preferences

- Especially beneficial for high-volume traders

- The platform offers a wide range of educational materials, including articles, videos, and webinars

Cons:

- Only forex and CFDs are available

- Demo account available for only 30 days

Fees:

-

-

- Competitive spreads with no inactivity or trading account fees. Commissions vary by platform and trading account type

- Standard (zero commissions with a spread) and Razor (raw spread with a commission)

-

Products:

-

-

- Forex

- Index CFDs

- Commodity CFDs

- Cryptocurrency CFDs (professional traders only)

- ETFs

- Currency index CFDs

- Social trading

- Spread betting

-

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Interactive Brokers is an excellent all-round platform offering stocks and shares ISA, a Self Invested Personal Pension (SIPP), up to 4.83% interest on instantly available USD cash balances, and a wide range of platforms from which to trade on more than 150 markets. They have almost 3m client accounts and are listed on Nasdaq (IBKR).

Key features:

Key features:

- Offers stocks and shares ISA and a Self Invested Personal Pension

- Up to 4.83% interest on USD cash balances

- Trade on more than 135 markets in 33 countries and 23 currencies

- Mobile and desktop platforms are available

- Extensive range of products, including stocks, ETFs, forex, mutual funds, bonds, options, futures, CFDs, commodities, cryptocurrencies and more

- Socially responsible investing with Impact Dashboard

- Automated trading with robo-advisor arm

Who should use Interactive Brokers?

Interactive Brokers is best suited for advanced traders and active traders, although beginners can use the web platform and Global Trader for a simpler experience.

Final Thoughts:

Interactive Brokers offers a comprehensive trading platform with a vast range of tools and products. Their low fees and extensive product range make them a top choice for both advanced and beginner traders. The platform’s security measures and long-standing reputation in the industry add to its credibility. However, the complexity of some of its tools may be overwhelming for beginners.

Pros:

- Low fees: among the lowest in the industry

- A vast selection of international investments

- Up to 4.83% interest on cash balances

Cons:

- Trading platform can be complex for beginners

Fees:

-

-

- £3 / €3 per trade for Western European Stocks

- No added spreads, trading account minimums, or platform fees

- Tiered and fixed pricing structures available

- Overall a low fees platform. If you are price-sensitive, this will be perfect for you

-

Products:

-

-

- Stocks, ETFs, forex, mutual funds, bonds, options, futures, CFDs, crypto, and more

- Stocks and shares ISA and SIPP available

- Fractional shares for European stocks and ETFs

-

Investing in financial products involves taking risk.Your investments may increase or decrease in value, and losses my exceed the value of your original investment.

Key Features:

- Over 1,200,000 users globally

- Facilitates over 260,000 trades daily

- £70+ Bn client assets

- Access to 71,000+ instruments

- 23,500+ stocks from 50+ markets

- Offers both non-leveraged and leveraged products

- Managed portfolios in partnership with BlackRock and Morningstar

Who should use Saxo?

Saxo is best suited for advanced traders due to its comprehensive tools and extensive product range. While it offers a professional edge, it might not be the best choice for beginners.

Final Thoughts:

Saxo Markets offers a robust platform for seasoned traders. Its extensive tools and products, combined with its professional sheen, make it stand out in the UK market. However, its complexity and fee structure might deter beginners or those looking for a simple trading experience. The other thing to consider is that Saxo have a high minimum deposit. At $2,000, the minimum deposit may serve to deter investors looking for an entry level platform.

Pros:

- User-friendly stock trading platform

- Extensive product portfolio

- Top-notch research facilities

Cons:

- High fees for certain products like bonds, options, and futures

- No 24/7 support

- Account verification can be slow

- High minimum deposit

Products:

-

-

- Non-Leveraged: Stocks, Bonds, Commodities, Managed portfolios

- Leveraged: Forex, CFDs, Futures, Commodities, Forex options, Listed options, Trading strategies

-

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs, or any of our other products work, and whether you can afford to take the high risk of losing your money. The value of your investments can go down as well as up. Losses can exceed deposits on some margin products. Professional clients can lose more than they deposit. All trading carries risk.

interactive investor is a comprehensive investment service with a full suite of products, including ISAs, SIPPs, share dealing, fund investing, CFDs, and IPOs. Here’s why interactive investor is one of my top choices for managing my own portfolio:

Key Features:

- ISAs, managed ISA, SIPPs, Share Dealing, Fund Investing, Cash Savings, CFDs, Bonds and Gilts, Investment trusts and IPOs

- Flat fee structure introduced in 2019, with a certain number of free trades within the monthly fee

- Mobile trading app available for both Android and iOS

- 24-hour Monday-to-Friday customer support

- With assets under administration (AUA) over £50 billion and over 40,000 customers

- Multiple awards won, including “Which? Recommended SIPP Provider 2024” and Boring Money Best For Low-cost Pension > 50k 2024

Who should use interactive investor?

Interactive Investor is best suited for DIY investors with significant portfolios (over £50k). The platform’s fixed fee structure is cost-effective, especially for those with larger portfolios. The wide range of share-dealing investment options complements various investment strategies. However, always remember that investments can fluctuate in value.

Final Thoughts:

For anyone looking for a comprehensive stock trading platform in the UK, Interactive Investor is a top contender. With its user-friendly interface, diverse product range, and competitive platform fee structure, it’s ideal for both novice and experienced investors.

Pros:

- User-friendly web and mobile trading platforms

- Wide range of investment options

- Economical for larger portfolios

- Now part of Aberdeen

Cons:

- More affordable investment options are available for portfolios under £1,000

- Basic charting tools

Fees:

-

-

- Investor Essentials Plan: £4.99/month for investments up to £30,000

- Investor Plan: £11.99/month

- Super Investor Plan: £19.99/month

-

Products:

-

-

- Stocks & Shares, ETFs, Investment Trusts, Bonds and Gilts, ISAs, SIPPs, US and International investing and more

- Quick Start Funds provide new investors with passively managed funds from Vanguard and actively managed funds from BMO

-

November Offers

SIPP, ISA and Trading/GIA

Pay no account fee for 6 months when you open an account. Offer ends 30 November. Capital at risk. Terms & trading fees apply. New customers only

Capital at risk.

AJ Bell is a top-tier stock trading platform, especially for those prioritising ease of use. It’s an ideal solution for individuals with small to medium portfolios seeking a cost-effective, user-friendly platform.

Key Features:

- Established in 1995, pioneering the first online SIPP in 2000

- Manages assets worth over £80.3 billion with nearly 503,000 customers

- They are listed in the FTSE 250 (LON: AJB)

- Multiple awards, including Which Recommended Provider for Investment Platforms for six years running 2019–2024,

- Offer a range of products, including Ready-made pension, SIPP, Junior SIPP, Stocks and Shares ISA, Junior Stocks and Shares ISA, Lifetime ISA, cash savings and Share Dealing account

Who Should Use AJ Bell?

If you’re someone who wants to save on costs for a modest portfolio and isn’t a finance professional or keen on extensive share trading, AJ Bell is for you. Their focus on ready-made portfolios combined with low fees makes it an attractive option. However, if you have a larger portfolio, you might want to consider alternatives like Interactive Investor for a more favourable fee structure.

Final Thoughts:

AJ Bell offers a robust platform for those new to investing or those who prefer a more hands-off approach. Their competitive fees and user-friendly interface make them a top choice for many. AJ Bell stands out for its simplicity; however, those with larger portfolios might find better value elsewhere.

Pros:

- User-friendly across devices (iOS, Android and desktop)

- Among the most affordable for small and medium portfolios

- No fees for account setup, inactivity, holding, or withdrawals

Cons:

- Percentage platform fee structure may not be ideal for larger portfolios

- Cheaper platform fees can be found elsewhere

Fees:

-

-

- No account set up, inactivity, holding, or withdrawal fees

- Regular investment services at £1.50 per deal

- £5 per share deal for the first 0-9 trades each month

- £25 fee for phone deals

-

Products:

-

-

- Offers a variety of products, with the SIPP personal pension being the star

- Unique offerings like Junior SIPP accounts and Junior ISAs

- AJ Bell Passive Funds available for those preferring hands-off investing

-

Capital at risk.

Hargreaves Lansdown, often referred to as the “Rolls Royce” of investment platforms, offers a premium service with an extensive range of assets and products. However, this comes at a price, especially with their high trading and management fees. But considering they hold the largest market share in the UK, it’s evident that many find the cost justifiable.

Key Features:

- Stocks and Shares ISA, Junior ISA, SIPP, Fund and Share Account, Active Savings Account, and more

- Founded in 1981 by Peter Hargreaves and Stephen Lansdown

- Over 1.8m clients and manages more than £130 billion

- Phone consultations, in-person consultations with financial advisors, and award-winning customer service

- Voted “Best For Customer Services 2024” by Boring Money

Who should use Hargreaves Lansdown?

Hargreaves Lansdown is ideal for those who prioritise excellent customer service, a wide range of investment choices, and a user-friendly investment platform. The ability to consult with financial advisors is a significant advantage, especially for newcomers to the investment world. However, the platform might be pricier for those with larger portfolios due to its tiered fee structure. In my opinion, if you’re looking for a comprehensive platform with a proven track record in the UK, Hargreaves Lansdown is worth considering.

Final Thoughts:

While the fees might be on the higher side, the peace of mind and extensive services offered by the UK’s largest platform might just make it worth the investment.

Pros:

- Extensive selection of investment products

- User-friendly trading platforms

- High-quality educational tools

Cons:

- High fees for stocks and ETFs

- Only GBP as a base currency

- No digital registration for clients outside the UK

Fees:

-

-

- Trading fees are the primary cost

- £11.95 per deal for 0-9 deals a month

- Funds: 0.45% annual charges on the first £250,000

- Tiered management fees based on portfolio size

- Share-dealing charges vary based on trading frequency

-

Products:

-

-

- Over 3,500 funds available

- Access to shares listed on multiple stock exchanges, bonds, ETFs, and more

-

Capital at risk.

What’s my methodology?

When putting together this list, I first made sure that I used every trading platform. This not only gives me a feel for the platform in question but also how they compare to each other. I also go through a predetermined checklist of attributes that include:

- How does the pricing structure work and is it competitive?

- How quick and easy is it to open an account?

- What are the lead times for depositing and withdrawing money?

- What is the minimum deposit?

- What trading platforms are on offer and what are the tools and features like?

- What markets and products are available?

- What research is available to aid your decision-making?

- How responsive and knowledgeable is customer service?

- How robust is the educational offering?

- And lastly, I always check that the platform in question is fully regulated and meets minimum standards of safety.

This is a basic summary of my method. For a more detailed version of how I review the platforms, please refer to this page.

View best trading platforms in 60 seconds

How to choose the best trading platform for you

There are some key considerations when deciding which trading platform is best for your investment objectives, educational needs, and preferred access to markets.

One main consideration is to make sure they are Financial Conduct Authority (FCA) regulated.

You will need to decide exactly what you need from the trading platform in question, taking into account your level of experience, whether you are an active or passive investor, the level of resources you require, the securities offered, whether you require fully managed funds or wish to pick and choose your own investments, what you are saving for, and therefore the type of trading account you require.

The first step to finding which trading platform is best for you is to know what tools and resources you require. This will depend on a number of factors, but most crucially, you should consider what investment experience you currently have.

Beginner traders

Complete beginners looking to build their experience would benefit from good educational resources, glossaries, how-to videos, and access to highly responsive support staff. A beginner may also benefit from a live paper trading account where they can practise their trades before risking any of their personal funds.

Platform comparison table for beginners

The following table will provide you with an insight into how the platforms scored out of 5 when I tested each one. This should help you decide which trading platform is best for you at a glance.

| Platform | Overall score | Demo account | Support | Minimum deposit | Social trading | Education | Assets offered |

|---|---|---|---|---|---|---|---|

| Plus500 | 3 | 5 | 4.5 | £100 | 4 | 3 | 3 |

| eToro | 4 | 5 | 4 | $10 | 5 | 2.5 | 5 |

| AvaTrade | 4.5 | 5 | 4 | $100 | 5 | 5 | 4 |

| Pepperstone | 4 | 3 | 4.5 | £0 | 5 | 4 | 3 |

| Interactive Brokers | 4 | 5 | 3.5 | £0 | 5 | 4.5 | 5 |

| Interactive Investor | 3 | 0 | 4.5 | £0 | 0 | 4.5 | 4.5 |

| AJ Bell | 4 | 0 | 5 | £0 | 0 | 5 | 4.5 |

| Hargreaves Lansdown | 3.5 | 0 | 4.5 | £0 | 0 | 4.5 | 4 |

| IG | 4 | 5 | 4 | £0 | 0 | 5 | 4 |

| Saxo Markets | 3.5 | 3 | 3 | $2,000 | 0 | 4.5 | 5 |

What’s the difference between a trading platform and an online broker?

An online broker provides access to stock markets, and a trading platform is the trading software that you use to execute trades with that broker. The two are often used together: you may open an account with a broker and then use the broker’s trading platform to place trades, or you may open an account with a broker and then use a different trading platform from that same or a different vendor.

So, if you’ve had your eye on AstraZeneca stock or would like to buy Tesla shares, then an online trading platform could be just the ticket. It’s surprisingly easy to start buying and selling stock online in the UK, less so to actually turn a profit doing it.

Some of the stock trading platforms in the UK have a wealth of tools and features at your disposal to help you with your investment journey. And to make sense of it, with fees that are a far cry from what a traditional broker would charge, more and more people, from beginners to seasoned traders, are turning to online trading platforms for their investment journey.

Also consider: My guide to the Best Stock Trading Apps UK

How I’ve chosen this list of best trading platforms in the UK

I have conducted hours of vigorous research in order to identify the top platforms in the UK that I believe will best meet your needs as an investor. To clarify how I have gone about this process, here are some of the factors that I have taken into consideration:

Fees and Charges

Custody fee: This is the fee that you pay to the platform for taking care of and managing your investments. This fee is a major consideration, as small costs can really start to erode your investment gains.

Cost per trade: This is the fee you will pay every time you buy or sell stocks and shares. Some platforms have zero trading fees, which is great; however, you need to weigh up whether they are providing you with all the other features you require from a trading platform.

Frequent trader: some platforms in the UK will reward you for trading more frequently with a reduced fee. This is only relevant if you feel you will be trading more than a certain number of times each month. Otherwise, you will need to pay the per-trade fee.

Investment trusts fee: Investment trusts allow you to pool your money together with other investors into a ‘trust’. The trust manager will then use these pooled assets to invest in shares and financial assets on your behalf. The charge for an investment trust is usually based on a percentage of the amount of money you put into the trust.

Ease of Use

Trading can be a complex endeavour, and the design and usability of the platform you choose can have an impact on how efficient you are at managing your portfolio. I have therefore assessed each UK trading platform to identify which ones will allow you to make quick, accurate trades in an online environment that can help instil a sense of confidence.

Market Research and Education

This section is especially important for beginners who require high levels of research and education in order to learn trading and make profitable decisions regarding their investments. Webinars, blogs, videos, seminars and tracking options are all important educational tools to help beginners get up to speed.

Investment Choice

This will be especially important for experienced traders who are creating a highly diversified portfolio. Having a broad spectrum of global investment options, including stocks, ETFs, index funds, investment trusts, etc., from various stock markets is what seasoned investors have come to expect. Of course, this can be overwhelming for novice investors who may prefer to invest in a pre-made portfolio or engage in copy trading.

Accounts on Offer

This is an important consideration in order to ensure you are being as efficient as possible with your investing. If you are between the ages of 18 and 40 and saving for your first home, then the most efficient account would be the Lifetime ISA, as this attracts a government bonus of 20%. Remember that outside of the personal allowance, all income and returns from your investments are subject to tax at your usual rate. Therefore, you may want to consider a tax wrapper, such as an ISA. However, if you are already at the annual allowance for your ISA, then a General Investment Account might be more attractive.

Safety

Here at Investing Reviews, we always ensure that the trading platforms we recommend meet minimum safety standards. This includes being authorised and regulated by the Financial Conduct Authority (FCA), as well as adequate security and protection of data within the site or app. Some stock trading apps also utilise biometric identification and many of the providers listed above are covered by the Financial Services Compensation Scheme, which means your account balance is protected up to the sum of £85,000 should the provider go out of business.

Demo Account

If you would like to practise trading before you risk any of your money, then it may be best to select a trading platform that provides its users with a demo account.

A demo account will give you a certain amount of ‘virtual money’ with which to trade on the stock market. These are useful trading tools to help you get to grips with the setup of the trading platform and to familiarise yourself with the various assets on offer.

Some common trading platform terminology explained

What is online stock trading?

Online stock trading is when you buy shares using an online trading platform in the hope that you will then sell them at a higher price, thus turning a profit. Online stock trading has replaced more traditional stock brokers in the UK as a way to trade stocks in the UK and around the globe and often presents a more accessible and affordable way to trade stocks.

What are ETFs (Exchange Traded Funds)?

An EFT is a collection of investments that can include stocks, commodities, bonds, and other investment assets, all of which are then traded on exchanges just like stocks.

Exchange Traded Funds (ETFs) provide a passive investment strategy that is often low in cost and can help diversify your portfolio.

What is a diversified portfolio?

A diversified portfolio contains a mix of stocks and bonds from around the globe, in companies of various sizes and sectors. This is to ensure that if one sector or country were to experience a sudden fall in value for any reason at all, the remainder of your portfolio would be robust enough to prevent you from experiencing a complete loss.

What is a stockbroker?

A stockbroker is a professional body that buys and sells shares on behalf of a client. In this case, the trading platform is the stock broker and you are the client. It is impossible for anyone to buy or sell stock without first becoming a member of an exchange or belonging to a firm that is a member.

Tax and Trading in the UK

It’s important to understand how different financial assets are taxed in the UK. These can depend on your personal circumstances but you may have to pay extra tax on money you make from investments, depending on which tax bracket you fall into.

Tax on spread betting and CFDs in the UK

Spread bets are tax-free for the majority of UK residents. This includes stamp duty and capital gains tax. While no stamp duty is due for CFDs, there is a capital gains tax on your profits, which may be applicable to your circumstances.

Tax on stock trading

Profits made from trading stocks are subject to income tax. The amount you pay will depend on your personal allowance, which includes the money you earn through interest, wages, pensions, and other incomes. Your personal allowance is tax-free up to an annual limit of £12,500.

When it comes to UK capital gains tax (CGT), this will be charged on any profits from the sale of your stocks and shares that exceed £12,300. Again, the amount you pay will depend on your tax bracket, with higher or additional rate payers being subject to 20% CGT on their gains and basic rate taxpayers being subject to 10% CGT on their gains.

The exception to this occurs when the investments are being held within a stocks and shares ISA and remain within the ISA limits.

Stamp duty is also a consideration when purchasing stocks and shares using a stock transfer form or paper share transfer. This includes online purchases using an electronic paperless share transaction. This is charged at a rate of 0.5% when you purchase more than £1,000 worth of stocks and shares. The actual amount charged is rounded up to the nearest £5.

Which type of trading is best?

The type of trading that is best for you will depend on several factors, including your trading experience, how frequently you plan to trade, whether you are trading to fulfil shorter-term plans or long-term objectives, and what your appetite for risk is. Below, I have detailed some active trading strategies.

Scalping

Scalping involves utilising small movements in the price of a security in order to generate a profit. This method can generate quick gains; however, there are a number of factors to consider.

- This involves a high frequency of trading so you will need to commit time.

- Generally, positions are held for a few seconds to a few minutes.

- The frequency of trading can generate high commissions and spreads.

- It requires focus and discipline.

- Scalpers are required to manage multiple positions and limit their exposure to risk.

Day trading

Again, day trading is a short-term trading strategy, with securities being bought and sold within the same day. Typically, day traders will close all open positions at the end of each trading day. While there is the potential to generate decent returns with day trading, there are also some considerations to take into account.

- This is a high-risk strategy with the potential for day traders to lose significant amounts of money.

- A good understanding of market trends and risk management techniques is required for day trading.

- Day traders have the potential to generate high trading costs.

- Day trading is a fast-paced strategy that requires focus.

Swing trading

Swing trading seeks to gain from short-term price movements in the market by buying when prices are low and selling when prices are high. This usually involves holding securities from a few days to a few months. While this strategy can help reduce transaction costs, there are some factors to consider.

-

-

- Unexpected market events can lead to significant losses.

- Swing traders are required to commit time to monitoring positions and analysing market trends and news.

- Discipline is required to manage risk and avoid emotional trading decisions.

-

Most asked questions about best UK trading platforms

How do you choose a share dealing platform in the UK?

Choosing the best share dealing platform for you is a very personal journey that will depend largely on your financial goals and aspirations. Are you saving for retirement? Then you will require a SIPP account. Perhaps you just want a tax-efficient way to grow your wealth, in which case a Stocks and Shares ISA will be required.

You will then need to ascertain whether the share-dealing platform in question has a suitable range of investment options and compare the fees charged between the providers you are considering. You should also consider the trading software and whether it effectively caters to your trading requirements.

What trading platforms can I use in the UK?

There are a number of platforms available in the UK; however, identifying the best online trading platform for you should be aligned with your unique needs.

Here at Investing Reviews, all our recommended platforms cater to UK customers and are regulated by the Financial Conduct Authority (FCA); therefore, it is simply a matter of selecting a platform that meets your needs from our list on this page.

How much starting capital do you need to start investing?

You can start investing with as little as £1, depending on the online trading platform you select and their minimum investment amounts. However, we would caution you to be aware of the fees associated with the platform, as these can soon eat away at your investment capital should you be starting with a small amount.

If you are new to investing and would like to try your hand without risking too much of your money, then we would recommend selecting online trading platforms with free paper accounts like eToro, where you can use virtual money risk-free.

What should a beginner invest in?

Choosing your investments is a lengthy process that requires a lot of painstaking research. There are certain metrics that can help you identify great businesses that should be long-term performers, including the price-to-earnings ratio, the price-to-earnings growth ratio and the payout ratio.

However, if you are looking for a quick way to get started and want to ensure that you are fully diversified in order to mitigate your exposure to risk, then you may be better off investing in a fund.

A fund is where lots of investors pool their money together in order to invest in plenty of different shares.

Fully managed funds are managed by professionals who will regularly make strategic adjustments in order to maximise returns. These are slightly more expensive than fixed allocation funds, which are designed to perform with minimum human intervention.

Usually the best investment websites in the UK will have the historical returns of their funds listed on their website, and this is certainly worth checking before you select a fund with the correct level of risk for your circumstances.

See also: My guide on where to invest money to get monthly income UK

Who has the cheapest online trading?

Trading 212, eToro and Freetrade all have the edge when it comes to cost-effective share dealing. eToro is the best online trading platform for copy trading while Trading212 is the best online trading platform for range of shares. Freetrade does have some limitations in terms of assets and research tools so this would be my pick for best online trading platform for beginners looking for low costs.

Freetrade has the same zero-commission trading and also offers free stock when you open a new account and deposit for the first time. The value of your free stock can be anywhere from £3 to £200 and this could possibly give them the edge when it comes to finding the cheapest online trading platform.

What do I need to open an account with an online trading platform in the UK?

Different stock trading apps in the UK will require different documents in order for you to open an account and start trading.

Most trading platforms in the UK will require the following:

-

-

- Full name

- Valid ID

- Email address

- Phone number

- National Insurance number

- Bank account details

-

Best UK Trading Platforms FAQs

Below are some of the most frequently asked questions about the best UK trading platforms.

What is the best platform for day trading UK?

The best platform for day trading is eToro, with over 2,000 global shares, over 40 forex pairs and 15 cryptocurrencies. eToro also offers ETFs, bond trading, and social / copy trading.

In addition to eToro and the other best UK trading platforms mentioned in this guide, others are recommended for day trading purposes. Find out more with my day trading guide.

Do I pay UK tax on share dealing?

Trusted partner

80% of retail CFD accounts lose money

2000+ CFDs

- User friendly mobile app

- unlimited CFD demo account

- Trading academy