If you’re approaching retirement, you may have been thinking about your pension options. One potential choice is to buy an annuity, which will give you an income for life. If you’re considering doing this, there can be several important things that you need to think about.

Also consider: Best Pension Providers

Who offers the best pension annuity rates in the UK in 2025?

Check the best annuity rates from the UK’s leading annuity providers from these sources below.

Pension Promotion

AJ Bell

- Pensions Options: DIY & Ready-made

- Annual Fee: 0% – 0.25%

- Min. Investment: £1,000 lump-sum. No minimum for regular pension contributions

Remember that investments go up and down in value, and you could lose money as well as make it. How you’re taxed will depend on your circumstances, and the rules can change.

Wealthify

- Bring your old pensions together into one pot or start a new pension

- Ethical pension available

- Low fees

As with all investing, your money is at risk. The value of your portfolio can go down as well as up and you could get back less than you put in. The tax treatment of your investment will depend on your individual circumstances and may change in the future. You should seek financial advice if you are unsure about investing.

Penfold

- Best for Self-employed

- Annual Fee: 0.4% – 0.88%

- Min. Investment: £0

Bestinvest

- Readymade portfolios available

- Invest in 3,000+ funds, shares and ETFs

- Open a new SIPP or transfer your pension

Pensionbee

- Ready-made portfolios

- Annual Fee: 0.28% – 0.95%

- Min. Investment: £0

Interactive Investor

- Open a SIPP today and pay no fee for your first 6 months

- Free to join and free to leave

- Trading costs: £7.99 for UK shares and ETFs, funds, investment trusts and US shares

Hargreaves Lansdown

- Investment Options: DIY & Ready-made

- Annual Fee: 0.1% – 0.45%

- Min. Investment: £100 lump-sum or £25 a month

Moneyfarm

- Investment Options: Ready-made

- Annual Fee: 0.35% – 0.75%

- Min. Investment: £500

Netwealth

- Free consultation with qualified adviser – to maximise your retirement potential

- Consolidate your pensions into a cost-effective, fully managed and flexible personal pension

- Get the best of tech + an expert team to get the retirement you deserve

Profile Pensions

- Investment options: A recommended personalised pension plan, tailored to you using funds from the whole of the market

- Annual fee: All-inclusive (platform, funds & ongoing management including pension advice) 0.83-0.87%

- Min. Investment: £0

What is an annuity?

To put it simply, annuities are insurance products for retirement, which allow you to trade all or part of your pension fund for a guaranteed income for life. The regular income that you’ll receive is known as an “annuity rate” and this is determined by several factors and often varies between providers.

Historically, purchasing an annuity used to be your only option if you had a defined contribution pension. This changed, however, when the government implemented Pension Freedoms in 2015, which gave people more control over their retirements.

What are the benefits of buying an annuity?

One of the main benefits of an annuity is that it can give you a sense of security, which can be invaluable once you’ve retired.

When you opt for a pension drawdown, even if you manage your money well, there is always the possibility that you may one day run out of money.

If there is a downturn in the economy, the stock market may suffer and the value of your pension could fall. When you buy an annuity, however, you will receive a guaranteed income each year.

One of the benefits of buying an annuity is its flexibility, as you can choose a variety of extra features to suit your needs.

Get a FREE Pension Review

Get a free no obligation pension review today from a qualified financial adviser.

Our partner Unbiased will connect you with one of over 27,000 FCA-regulated advisers.

What are my options with an annuity?

One important thing to bear in mind when it comes to annuities is that you don’t have to spend your entire pension pot on buying an annuity.

From the age of 55, or 57 from 2028, you can access your pension and take up to 25% of it as a tax-free lump sum.

You could choose to take this tax-free cash from your pension and then purchase an annuity with the remaining 75%, or spend the full amount to receive a larger income.

Of course, it’s worth noting that if you do spend more of your pension fund on an annuity, you may get a more lucrative or guaranteed annuity rate.

Furthermore, there are several different types of annuities to choose from, so it’s important to think carefully about which one would be right for you. Some of the most popular choices are:

- Lifetime annuities

- Fixed-term annuities

- Enhanced annuities

What is a lifetime annuity?

As the name would suggest, a lifetime annuity will pay you a guaranteed income for the rest of your life. This can be particularly useful if you’re risk-averse and want to avoid the potential for a market downturn to affect your pension.

It’s important to note that you don’t have to spend all of your pension savings to buy an annuity. Instead, you can choose to only spend a portion of it.

With this option, your annuity income could give you a regular income which is enough to cover your essential household spending, such as grocery and utility bills.

You may then want to keep the rest of your pension invested, to benefit from the growth potential that offers.

If you’re concerned about the impact of inflation on your pension income, you can get an annuity that increases the amount it pays every year. This could either be by a fixed percentage amount, or by an index (such as the Consumer Price Index including Housing).

What is a fixed-term annuity?

When you buy a fixed-term annuity, you will receive a guaranteed income for a period of time. This can be up to 40 years, although between 5 and 10 years tends to be more usual.

Essentially your annuity provider will invest the money that you pay them and promise to pay you a “maturity amount” at the end of the term.

Once you reach the end of the term, you’ll receive it as a lump sum. Its value will be equal to the money you paid, plus the investment growth but minus the income you have received.

This means that you could choose to have a higher annuity rate, but with a smaller final lump sum.

What is an enhanced annuity?

If you are in poor health then you may be able to buy an enhanced annuity. The benefit of doing so is that it can offer you a higher regular income.

The reason for this is that if you are in poor health or have any medical conditions (such as diabetes or high blood pressure) then you may have a lower life expectancy. This is why they are sometimes called “impaired life” annuities.

You may also be able to get an enhanced annuity if you have worked in certain professions before you retired, such as ones involving manual labour. Since the risks of some jobs mean you’re more likely to develop a health condition in later life, you may be able to get a higher income.

How is annuity income calculated?

If you choose to trade some of your pension for a single-life annuity, you could expect a guaranteed income until you pass away. But how is this income calculated?

There are typically four main factors that influence annuity rates.

Your life expectancy

Since a lifetime annuity would provide you with a guaranteed income until you pass away, your life expectancy is one of the main factors which will influence your rates. If you’re likely to live longer, then you’ll receive a smaller amount each year, and vice versa.

Your health

In the same vein, your health is also taken into consideration as it may have an impact on your life expectancy.

If you have a medical condition or unhealthy lifestyle habits (such as smoking) then your annuity provider may expect you to live for a shorter time and so give you a higher income as they anticipate paying the income for a shorter period.

Interest rates

Typically, annuity providers buy government bonds (known as “gilts”) in order to generate returns. When interest rates are low, it tends to lower the return on these bonds. This means that, indirectly, lower interest rates can affect annuity rates.

Your annuity options

Annuity options can also impact the rates that you are offered as, if you have more add-ons (such as a guaranteed spouse’s income) then you may expect rates to decrease.

For example, if you want your guaranteed income for life to rise annually with inflation, then you may get a lower amount each year.

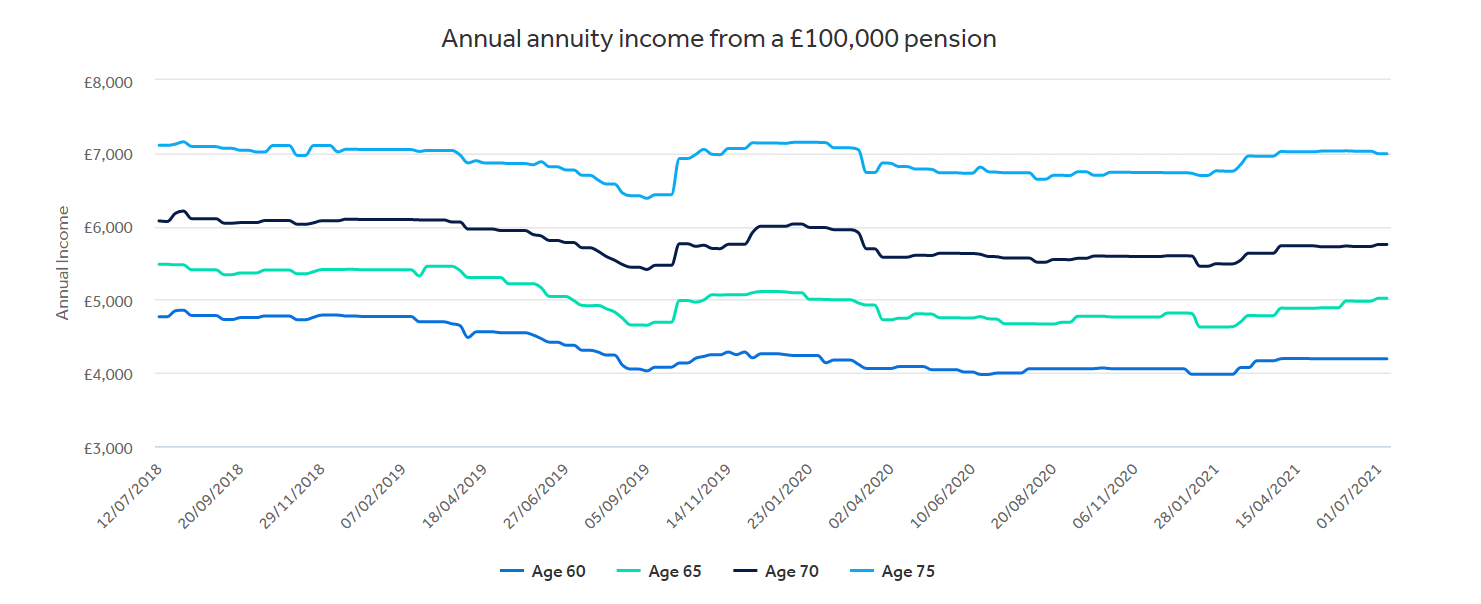

How have annuity rates performed?

In recent years, annuity rates have been impacted by a variety of factors. They have remained relatively low since the 2008 financial crash, and then after the Bank of England cut the base rate to 0.25% and then to 0.1% in 2020.

Ross Leckridge, associate director at Johnston Carmichael Wealth, was quoted in the FT Adviser as saying that “The combination of low interest rates, low gilt yields and increasing life expectancy has been the perfect storm for annuities over the past 10 years or so.

“If interest rates and gilt yields rise, you’d expect annuity rates to follow. But given where we are right now, with economies taking a severe knock from coronavirus-related national lockdowns, that could take some time.”

Source: Hargreaves Lansdown

Despite the recent low annuity rates, it is possible that, as the UK economy improves over time, interest rates could return to higher levels.

As I mentioned in my previous blog about interest rates rising in 2022, the return of inflation has prompted many analysts to ask whether interest rates may rise in the near future to combat it.

If interest rates do rise, then gilt yields would also increase, which could lead to annuity rates increasing.

Despite this, at least in the short and medium term, it seems unlikely that annuity rates will change any time soon.

How did Pension Freedoms impact annuities?

Another event that impacted the annuities market was the introduction of Pension Freedoms in 2015. As I mentioned earlier, this gave people more control over their retirement.

Traditionally, annuities and their guaranteed income were the main option for your retirement income, but Pension Freedoms changed this.

Since their implementation, you can now choose to use the funds in your pension pot in a variety of different ways, such as:

- Taking some tax-free cash

- Purchasing a traditional annuity

- Getting an adjustable income with flexi-access drawdown

- Taking the money from your pension pot in uncrystallised lump sums

According to FT Adviser, prior to the reforms around 90% of pension pots were traded for a guaranteed income from an annuity during the decumulation phase.

However, in recent years, pension providers have seen a fall in the number of people seeking annuities. Data from the Financial Conduct Authority shows that annuity sales are on a downward trend, falling by 6% since the 2019/20 tax year.

One issue with this is that many retirees are now more financially vulnerable, as downturns in the stock market can have a significant impact on people’s retirement income. If the value of your pension pot falls due to an economic shock, you may have to reassess your retirement plans.

While annuities may have declined in popularity in recent years, that doesn’t mean that you shouldn’t consider them in your retirement options. Having a guaranteed pension income can give you invaluable peace of mind once you’ve retired and shouldn’t be overlooked.

Should I look for the highest annuity rates?

If you search the market to find the highest annuity rates, you may notice that they can typically only be found for the most basic types of annuity. This is why you shouldn’t necessarily always look for the one with the highest rate, as it may not be right for you.

Typically, the more useful features you add to an annuity, such as ensuring your payments rise with inflation, the lower your annuity rates are likely to be.

For example, if you bought a single-life level annuity with a guaranteed annuity rate then it would pay you the same income each year until you pass away.

This product wouldn’t take into account the impact of inflation on your buying power and annuity payments would stop at your death. However, because of this, you may get a higher rate as your provider knows they would only have to pay a set amount for your lifetime.

However, if you chose to add a guarantee that your annuity will continue to pay out to your partner for five years after you pass away, you may expect to get a lower income each year. This is because your provider now has to pay out for longer.

Furthermore, if you chose to link your annuity rate to inflation then your regular payments are likely to be significantly smaller, at least in your first year.

This is because your annuity provider will have to increase your payments every year for the rest of your life.

What happens to my guaranteed income when I die?

While an annuity may provide an income for life, the payments will often stop once you pass away.

If you’re concerned about how this may affect your partner’s retirement income, then you may want to consider a joint-life annuity. This means that your regular payments will continue to be paid to your partner after you have died.

You can typically choose how much of your income you would like them to receive, although this will have an impact on your annuity rates.

For example, your rates are likely to be lower if you want your partner to receive the full amount after you’ve passed away, rather than half.

Please bear in mind, however, that joint annuity rates are typically much lower than a single-life annuity since your provider will have to pay out for longer. Your annuity rates may also be affected by your partner’s health and whether they have any medical conditions.

Even though it means that you get lower rates, having a joint-life annuity can give you invaluable peace of mind. With it, you can rest easy knowing that your partner won’t have to change their retirement plans due to lower pension income after you have died.

Can I change my mind?

Even with a useful financial product like an annuity, it can be easy to get buyer’s remorse when making a large purchase.

That’s why many annuity providers offer a grace period in which you can change your mind. Typically, the length of such a period will be confirmed in your key features document.

Your provider should give this to you during the application process but you can also request it sooner.

However, once the grace period has passed, you typically cannot cancel it or switch to different annuity providers for a potentially better deal.

For this reason, it’s important to consider your options carefully. If you are uncertain which extra features you may want, or you aren’t sure which annuity providers are right for you, you could benefit from seeking financial advice.

How do I know if an annuity is right for me?

Making sure that you have enough pension income to support your desired lifestyle in retirement is an important issue. That’s why you should make sure that you’re making the right decision.

If you’re unsure about whether an annuity is right for you, you may want to visit Pension Wise. This government service offers free and impartial guidance, which can help you to understand your options more clearly.

Retirement is an important time in your life and is traditionally seen as a time to enjoy your lifetime of hard work. That’s why it’s important to ensure that you have an annuity that provides you with the income you need.

Speaking to Pension Wise can help you to make an informed decision as to whether trading your pension pot for an annuity is right for you.

You can click here to book an appointment, in which they can explain your choices to you in a free and impartial way.

How can financial advice benefit me when choosing an annuity?

If you’ve weighed up your options, such as by speaking to Pension Wise, and have decided that an annuity is the right choice for you, then it’s time to start searching for one.

When you’re comparing annuity providers, there can be a lot of things to think about. That’s why you might benefit from seeking financial advice first.

An advisor can use their superior knowledge of the financial services sector to scour the market on your behalf, helping you to find the best annuity rates from the UK’s leading annuity providers.

They can check the UK’s leading annuity providers and compare the annuities on offer so you can be sure that you’re getting the best deal.

Can a financial advisor help me to find the best deal?

When you work with an advisor, they can help you in a variety of ways. As we discussed earlier, seeking the product with the highest annuity rate isn’t necessarily always the better deal, as there are other considerations to bear in mind.

One of the ways that an adviser can help you is by tailoring your annuity to suit your individual needs.

For example, you may opt to link your annuity to the rate of inflation or to ensure it continues to pay your partner after you have passed away.

This can help to give you peace of mind, knowing that you can enjoy your retirement without any worries.

If you think you would benefit from speaking to a financial adviser, use our search tool to find one near you.

Overwhelmed with how to invest?

Connect with a Financial Adviser near you for FREE.