Since March 2020, interest rates have sat at a historic low of only 0.1%, which has had wide-reaching financial consequences.

With the risk of rising inflation, many people are wondering whether rates will increase again in 2022 and 2023. Read on to find out more.

- Bank of England interest rate historical data 2022/23

- Who sets the level of interest rates?

- What is the Monetary Policy Committee?

- Why did UK interest rates fall in 2020?

- What was the benefit of lowering UK interest rates?

- Why was there talk of negative interest rates?

- Why is inflation rising?

- Why can inflation be a problem?

- Why would an interest rate rise reduce inflation?

- Is an interest rate rise likely in 2022?

- What would an interest rate rise mean for savers?

- How would an interest rates rise impact mortgage rates?

- Should I fix my mortgage rate?

- How would an interest rate rise affect investments?

- Working with an advisor

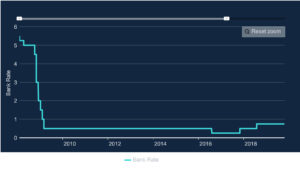

Bank of England interest rate historical data 2022/23

| Date Changed | Rate |

|---|---|

| 03 Aug 23 | 5.25 |

| 11 May 23 | 4.50 |

| 23 Mar 23 | 4.25 |

| 02 Feb 23 | 4.00 |

| 15 Dec 22 | 3.50 |

| 03 Nov 22 | 3.00 |

| 22 Sep 22 | 2.25 |

| 04 Aug 22 | 1.75 |

| 16 Jun 22 | 1.25 |

| 05 May 22 | 1.00 |

| 17 Mar 22 | 0.75 |

| 03 Feb 22 | 0.50 |

Source: Bank of England

Who sets the level of interest rates?

The Bank of England sets the base rate for the UK, which is the amount of interest that other financial institutions have to pay when they borrow from the central bank. In turn, this affects interest rates as banks pass these costs on to their customers.

For example, if the Bank of England reduced their base rate, other banks which borrow from them could cut interest rates in turn.

Since changes to the base rate can have a significant impact on the UK economy, any changes to the base rate are decided by a group called the Monetary Policy Committee.

What is the Monetary Policy Committee?

The Monetary Policy Committee is made up of nine people. Of these, five are senior members of the Bank of England, while four more external members are appointed by the chancellor.

This committee decides whether the base rate should rise or fall, depending on the needs of the UK economy. For example, in the aftermath of the 2008 financial crisis, they decided to reduce the base rate so banks would cut interest rates in turn.

Why did UK interest rates fall in 2020?

2020 was a difficult year for the UK, partly due to the economic fallout of Britain’s decision to leave the European Union. Even though four years have passed since the Brexit vote, many businesses were unprepared for the transition.

However, arguably the more significant disruption was the outbreak of the coronavirus pandemic. Due to the lockdown measures implemented by the government, many businesses were forced to remain closed for a significant portion of the past year.

In response to the initial financial shock of the pandemic, the then-governor of the Bank of England, Mark Carney, announced two cuts to the base rate in March 2020, initially from 0.75% to 0.25% and then from 0.25% to 0.1%. By doing so, the bank hoped that it would be able to stimulate the economy and support businesses.

Source: Bank of England

What was the benefit of lowering UK interest rates?

The ability to set the base rate can be a powerful tool for influencing the economy. This is because interest rates affect consumers and businesses in main two ways:

Savings

When interest rates are high, people typically save more as their wealth can generate strong returns. Conversely, when rates are low, interest on savings may have their value eroded by inflation, which encourages people to spend.

Borrowing

When rates are high, loans are more expensive. By lowering rates, people and businesses can take out loans more cheaply, which can encourage spending and investment.

Essentially, the bank aimed to support businesses in 2020 by encouraging consumer spending and making it cheaper for companies to take out loans.

Why was there talk of negative interest rates?

Despite the efforts of the British government and Bank of England to mitigate the impact of the virus, the UK economy has not yet fully recovered. According to government figures, the UK GDP in Q1 of 2021 was 8.8% lower than it was prior to the initial national lockdown.

Due to this, many analysts speculated that the Bank of England might implement a negative base rate to stimulate the economy further. If they did, banks might follow suit and offer negative rates to their customers.

One of the main impacts of this would be that banks may charge a fee to keep your money with them. As a result, people would have more incentive to spend it, stimulating the economy.

Even though negative rates would punish savers, it could help to drive economic growth. However, the threat of rising inflation may mean that UK interest rates are now much more likely to rise.

Why is inflation rising?

In recent months, the rate of inflation in the UK has jumped considerably and this is partly due to the reopening of the economy. Thanks to the success of the UK’s vaccination programme, lockdown measures have been slowly phased out.

As more people get out and spend their money, combined with some supply shortages caused by Brexit and the pandemic, prices have started to rise. While some inflation is a good thing (the Bank of England has an annual target of 2%), too much might negatively impact the UK economy.

One of the policies that the Bank of England has been using to keep inflation low is “quantitative easing” (QE), in which they buy bonds from companies and the UK government.

Despite the Bank of England’s QE programme, according to figures from the ONS, the UK rate of inflation reached 2.1% in May and this can pose a serious problem for the country’s economic recovery.

Why can inflation be a problem?

Essentially, inflation erodes the buying power of money. So, if your wages are not rising as fast as the cost of living, you’re worse off in real terms. It is also not good for business confidence as firms cannot be sure of what their costs and prices are likely to be.

A further problem arises when too much spending causes even more inflation, resulting in a feedback loop.

This can cause inflation to spiral out of control if it isn’t carefully managed. One of the key ways that the Bank of England reins it in is by raising interest rates.

Why would an interest rate rise reduce inflation?

As we mentioned earlier, there are two main ways in which UK interest rates affect consumers: saving and borrowing.

When interest rates rise, people tend to spend less and save more. On top of this, it also becomes more expensive to borrow money.

With less money being spent, the demand for goods drops and their price doesn’t rise as quickly.

Is an interest rate rise likely in 2022?

While the risk may mean that the Bank of England needs to raise interest rates, it’s hard to say whether they will do so in the near future.

Part of the problem is that many analysts expect the current rise in inflation to be temporary. According to a report published in the Guardian, the Bank of England believes that while it may peak at around 3% by the end of 2021, it will fall again in the following year.

Experts believe that the Bank of England will consider other measures before an interest rates rise.

Richard Hunter, head of markets at Interactive Investor, says: “The Bank of England stands ready to take additional action if required and is currently in ‘wait and see’ mode. Should further monetary easing become necessary, it seems more likely the Bank will use other parts of its arsenal other than interest rates, such as quantitative easing.”

Laith Khalaf, a financial analyst at stockbroker AJ Bell, says it is likely that rates will stay where they are in the short term, but could rise later.

He adds: “Given that the picture is still unfolding, it makes sense for the Bank of England to wait, particularly as it is running out of monetary policy ammunition. It also doesn’t want to take steps that will stoke inflation if the economy proves more resilient than expected.”

However, if economic circumstances change in the next six months, there may be an interest rate rise in 2022.

One of the reasons that the Bank of England may be reluctant to raise UK interest rates is that the government has borrowed significant sums during the pandemic to fund support packages. An increase in interest rates could see the government having to find billions more to pay the increased interest on this borrowing.

What would an interest rate rise mean for savers?

One of the main groups that would benefit from an interest rate rise would be savers and their interest savings rates in 2022, potentially.

If interest rates were to increase in 2022, and banks and building societies passed on these increased rates, savings held in cash would benefit from higher growth. This can reduce the risk of your wealth’s true value being eroded by inflation.

How would an interest rates rise impact mortgage rates?

An interest rate rise may be bad news for mortgage holders because it might lead to higher monthly repayments, meaning you have less money to spend on other things.

For example, let’s say you had £200,000 left to pay on a tracker-rate repayment mortgage with 20 years left and you were paying 2% interest. According to the HSBC base rate calculator, your monthly repayment would cost you £1,012.

However, if your interest rate rose by just 1%, your monthly repayment would then cost you £1,109. This would be an increase of just under £100 per month (or around 9%).

Should I fix my mortgage rate?

The prospects of rising interest rates would only be a problem if you have a tracker-rate mortgage. If you had a fixed-rate mortgage instead, a rate increase would not affect you until the end of your fixed rate.

This might leave you asking the question “Should I fix my mortgage rate?”

If you have a tracker-rate mortgage and interest rates do rise then your monthly repayments will be higher. If you want to avoid this, you may consider searching the market to find the best deal for you.

How would an interest rate rise affect investments?

Another group that may be negatively affected by a rise in interest rates would be investors. This is due to the fact that higher rates mean it is more expensive to borrow.

Since credit becomes more expensive, many people and businesses reduce the amount that they spend. This can lead to reduced profits for companies, particularly ones that rely on consumption.

When people buy fewer goods, companies typically experience slower economic growth so share prices grow more slowly and this can lower the return on your investment.

If you’re concerned about how a future rise in interest rates will impact your investments, you may benefit from seeking professional advice. Working with a professional can help to alter your portfolio to minimise the impact that the change would have, giving you greater confidence and peace of mind.

Working with an advisor

As we’ve seen, while it may not be likely that interest rates will rise in 2022, we cannot discount the possibility. If they do, it will have a variety of economic impacts.

To ensure that you’re ready for any potential changes, it can be useful to seek professional advice.

Working with a financial advisor can help you to manage your wealth in the most effective way, whether it’s analysing your investment portfolio or assessing whether a fixed-rate mortgage would be right for you.

If you want to speak to a professional, use our search tool to find an advisor near you.

- Learn how to invest in the FTSE100

- Have you considered transferring your pension?

- Find the best trading platforms