Savvy investors don’t just trade; they invest for their and their family’s financial future. They do not disclose the tools they use but at Investing Reviews, we have checked out over 140 platforms to bring you the best trading platforms that suit your needs in the UK so you can focus on watching your money grow.

For each of these platforms, we have tested parameters such as fees, tools, education, product range, and customer service to ensure you get off to the best possible start.

Best Trading Platform

Capital at risk. T&Cs apply.

Over 2,000 CFDs

- Easy to use platform

- CFD demo account

- Publicly listed company

Best for Trading

Capital at risk. T&Cs apply.

13,500+ Markets

- Good for traders of all levels

- Great trading platforms

- Low-cost trading platform

Featured trading platform

Capital at risk. T&Cs apply.

13,000+ instruments

- Low cost Trading

- MetaTrader 4

- 24/7 customer support

- My best rated trading platforms in the UK, September 2025

- What’s my methodology?

- View best trading platforms in 60 seconds

- How to choose the best trading platform for you

- What’s the difference between a trading platform and an online broker?

- How I’ve chosen this list of best trading platforms in the UK

- Best UK Trading Platforms FAQs

My best rated trading platforms in the UK, September 2025

- IG – Best overall trading platform

- eToro – Best for copy trading

- Plus500 – One of the best for trading

- City Index – Best for trading

- Admiral Markets – Best for choice

- XTB – Zero-commission trading

- Forex.com – Best for low-cost trading

- Pepperstone – Best for low-cost trading

IG is the biggest spread betting and CFD provider in the UK, offering access to 17,000 markets across the globe. With low rates and excellent tools and market research, this easy-to-use online trading platform easily swooped into my top spot.

Key Features:

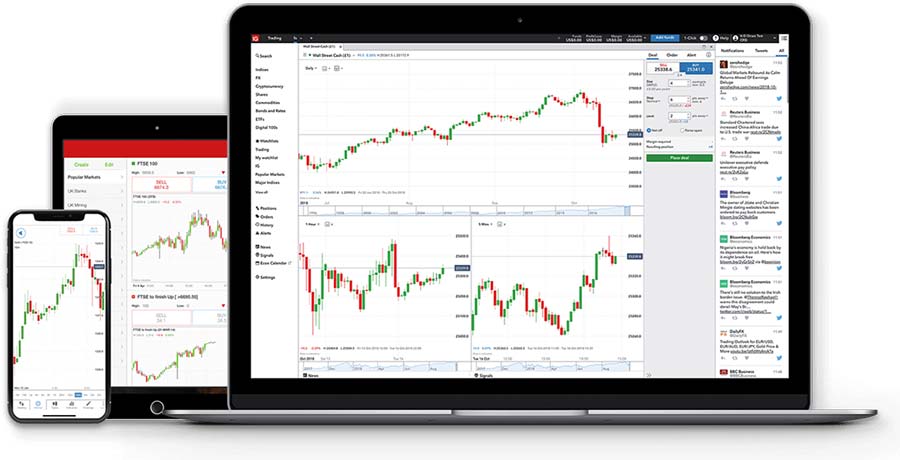

- Comprehensive online trading platform suitable for both beginners and professionals

- MT4, L2 dealer, and ProRealTime platforms offering advanced charting tools, alerts, and risk management tools

- Over 17,000+ markets available for trading

- Offers both Share Dealing ISA and IG Smart Portfolio

- Established for over 50 years with 313,000+ clients worldwide

- Free trading platform demo account

- Excellent educational resources, including the IG academy

Who Should Use IG?

IG is suitable for moderately experienced traders and professionals. New investors can benefit from the Smart Portfolio and IG Academy; however, I would say this is not ideal for complete novices in spread betting. This is an excellent low-cost option for retail investors who are likely to make more than three trades per quarter.

Final Thoughts:

IG Investments stands out as a versatile platform catering to a wide range of investors. Their extensive market offerings, combined with competitive fees and a robust educational academy, make them a top choice for those looking to delve into the world of trading. However, beginners should exercise caution, especially when exploring leveraged products.

Pros:

- Multiple funding and withdrawal options

- Intuitive desktop trading platform and mobile trading app

- Extensive research tools and educational content through IG Academy

- No transfer fees for electronic shares

Cons:

- No copy trading or backtesting integration

- Not ideal for very infrequent trader

- Some advanced research tools require additional fees

Fees:

-

-

- IG Smart Portfolio: 0.72% on the first £50,000; 0.22% on amounts over £50,000

- Share Dealing ISA: £8 for 0–2 trades, £3 for three trades and over (up to £25,000)

- Custody fee of £24 per quarter (can be waived under certain conditions)

-

Products:

-

-

- Non-Leveraged: ETFs, Shares, Bonds, and Commodities

- Leveraged: Spread betting, Forex, Options, CFDs, Cryptocurrencies

-

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

eToro is a multi-asset, low-cost platform offering 0% commission on real stocks. It is also the world’s leading social trading platform.

Key Features:

- CopyTrader allows you to replicate successful traders’ portfolios in real-time

- Offers a wide range of assets: over 5,000 stocks, 671 ETFs, 55 currencies, 35 commodities, 21 indices and over 100 cryptocurrencies

- User-friendly web and mobile applications

- Virtual portfolio with $100,000 available for practise

- Regulated by the Financial Conduct Authority

Who Should Use eToro?

This is a good option for most traders. Beginners in the UK can benefit from the demo account and copy trading, while experienced traders can explore a wide range of assets with low trading fees.

Final Thoughts:

eToro stands out for its social trading capabilities and a wide range of assets. The platform is user-friendly, making it a suitable trading platform for beginners; however, while it offers competitive fees for stock trading, users should be aware of other associated fees such as withdrawal fees and FX fees. Overall, eToro is a robust platform for those interested in social trading and a diverse range of assets.

Pros:

- Free stock trading

- Quick and easy trading account setup

- Well-designed online trading platform with social trading features

Cons:

- Does not offer funds (OEICs)

- Accounts in USD

- Foreign exchange and withdrawal fee

- High forex fees compared to competitors

Fees:

- 0% commissions on real stocks

- Conversion fees for non-USD transactions

- $5 withdrawal fee

- Inactivity fee of $10/month after 12 months of dormancy

Products:

- Offers CFDs, forex, real stocks, ETFs, cryptocurrencies, commodities, and indices

- ISA product provided by Moneyfarm

- Unique features like CopyTrader and CopyPortfolio enhance trading experiences

{etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees

Trusted partner

80% of retail CFD accounts lose money

2000+ CFDs

- User friendly mobile app

- unlimited CFD demo account

- Trading academy

Plus500 is a multi-asset broker offering a range of financial products, including CFDs, shares, and futures.

Key features:

Key features:

- Proprietary online trading platform for mobile and web

- Offers over 2800 CFD contracts

- no commissions, spreads and other fees apply with a free lifetime demo account

- Heavily regulated and listed on a stock exchange

- Provides trading tools like negative balance protection and guaranteed stop-loss orders

- Recently launched “Insights,” a real-time data trading tool

Who should use Plus500?

This platform is best for CFD traders seeking powerful trading tools to boost their performance, but this is not ideal for those who frequently enter and exit the financial markets.

Final thoughts:

Plus500 stands out as a leading CFD broker in the UK, especially for active traders. Its no commissions, spreads and other fees apply, combined with a well-designed interface, makes it a popular choice. The platform is secure and transparent, being listed on the stock exchange and disclosing all financial information. However, potential users should be aware of the risks associated with CFD trading. Advanced traders might find the platform lacking in some sophisticated functionalities.

Pros:

- no commissions, spreads and other fees apply

- User-friendly platform with tight spreads

- Guaranteed stop-loss orders

- Exclusive Insights advanced trading tools

Cons:

- Only offers CFD trading

- Charges inactivity fees

Fees:

- No commissions; earnings through spreads

- No deposit or withdrawal fees

- Inactivity fee of $10/month after 3 months of no login

- Currency conversion fee of 0.7%

Products:

- Extensive range of CFDs, including forex, stock indices, shares, commodities, ETFs, and options

- Plus500 Invest, a new share trading platform, is launching soon in the UK

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

City Index is a low-cost, well-established CFD and spread betting platform that provides access to more than 40 options markets, with daily, monthly, and quarterly contracts on offer. City Index is part of the NASDAQ-listed StoneX group.

Key features:

Key features:

- Access 13,500+ markets and 40+ options in indices, FX, metals, and commodities

- Quality news feeds from Reuters and in-house research

- Economic calendar and social media presence for retail investors

- Choice of trading platforms, including Metatrader 4 (MT4)

- Beginner-friendly educational resources

- Powerful research tools for market understanding

- Comprehensive trading tools and market news from Reuters

Pros:

- Low-cost trading platform

- Great choice of assets

- Excellent education and research tools

- Great customer support

Cons:

- No MetaTrader 5

- Inactivity fee applied

Service Fees:

- Buy/Sell Spreads: Rather than charging commission, City Index’s charges are incorporated into the spread. You’ll need to open an account (or demo account) to see spreads on their 1,000s of markets but, depending on the market, both fixed and variable spreads are offered. These start at margins from 5% and fixed spreads from 0.4pts.

- Commission: There is no commission on spread betting markets. With CFDs, you’ll only pay commission when trading shares. Commission for these trades is typically 0.08%.

- Overnight funding: Overnight financing fees on both long and short positions are 2.5% +/- the benchmark regional interest rate.

- Guaranteed Stop Order: A charge is made for use of this feature. For full details, check the website.

- Deposit / Withdrawal fees: No charges.

- Inactivity fee: A monthly inactivity fee of £12 will be applied for accounts that are inactive for 12 months or more.

- Currency conversion: Spread betting accounts are not affected because all trades take place in one base currency, usually sterling. Fees apply on CFDs. Check the website for full details.

- Borrowing costs for shorting CFDs: Borrowing costs are incurred when you short a shares CFD position. Very few markets will incur a borrowing charge – check the relevant market information sheet for details.

Products:

-

-

- Indices

- Shares

- Forex (FX)

- Commodities

-

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Admiral Markets, regulated by the UK FCA, is a solid option for those seeking a platform that bridges trading and long-term investing. It offers over 8,000 tradable instruments, including stocks, ETFs, forex, and CFDs, alongside advanced tools like MetaTrader 4/5. The standout features are low FX fees (0.3%), no annual account fees, fractional share trading, and exceptional customer service.

Key Features:

Admiral Markets provides a powerful trading platform tailored for traders across all levels. Here are the standout features:

- Platform Options:

- Access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5), enhanced with Admirals’ Supreme Edition add-on, which includes advanced charting, sentiment analysis, real-time news, and trading simulators.

- Web-based trading and mobile apps for flexible trading on the go.

- Wide Range of Instruments:

- Over 8,000 tradable instruments, including forex, CFDs on stocks, indices, commodities, ETFs, cryptocurrencies, and bonds.

- Fractional share trading, allowing smaller-scale investments.

- Low-Cost Trading:

- Competitive spreads starting at 0.1 pips for forex and low commissions for stock CFDs (from $0.02 per share).

- Currency conversion fees are only 0.3%, making it cost-effective for multi-currency trades.

- Strong Regulation and Security:

- Regulated by top-tier authorities like the UK FCA, ASIC, and CySEC, ensuring a secure and trustworthy trading environment.

- Educational Resources:

- Extensive support for traders with webinars, tutorials, market analysis, and trading calculators.

- A free demo account with virtual funds for practice.

- Additional Tools:

- Virtual private servers (VPS) for uninterrupted trading.

- Leverage of up to 1:30 for retail traders and higher for professionals.

Who Should Use Admiral Markets?

- Forex and CFD Traders:

- With competitive spreads, fast execution times, and access to MT4/MT5, Admirals is ideal for active forex and CFD traders looking for advanced tools.

- DIY Traders and Investors:

- Perfect for those who want to actively manage their portfolios without relying on pre-made strategies, thanks to the wide range of instruments and customizable trading tools.

- Advanced Traders:

- Admirals’ Supreme Edition add-on and professional-grade tools make it a strong choice for traders who rely on technical analysis and algorithmic trading.

- Cost-Conscious Traders:

- Low commissions, competitive spreads, and minimal FX fees make it an excellent option for traders who prioritize affordability.

- Educated Beginners:

- While it may seem overwhelming initially, the educational resources and demo accounts help new traders build their confidence.

Final Thoughts:

Admirals delivers a versatile and feature-rich trading platform, combining advanced tools, diverse tradable instruments, and competitive pricing. It stands out with its MT4 and MT5 integration, enhanced by the Supreme Edition, catering to both advanced traders and those willing to learn. While it may not be ideal for passive investors or those seeking ready-made portfolios, Admirals is a standout choice for active traders who value customization, affordability, and reliability. For anyone looking to dive into forex, CFD trading, or even stocks and ETFs, Admirals provides a secure and dynamic environment to grow.

Pros:

- Wide Range of Instruments

- Advanced Trading Tools

- Low-Cost Trading

- Fractional Shares

Cons:

- Learning Curve for Beginners

- Inactivity Fee

- Limited Support for Passive Investors

Fees:

-

-

- Tight spreads starting from 0.1 pips for forex and competitive stock CFD commissions (e.g., $0.02 per share)

- Low currency conversion fees of 0.3%

- low commissions starting at €1/$1

-

Products:

-

-

- Non-Leveraged: ETFs, Shares, Bonds, and Commodities

- Leveraged: Forex, Options, CFDs

-

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

XTB is a top-tier CFD broker known for its low trading fees, diverse tradable instruments, and superior educational resources.

Key Features:

- Proprietary trading platform with excellent usability

- Over 2100 instruments are available for trading

- Comprehensive educational materials, including one-on-one mentoring

- Award-winning platform with accolades like “Best Forex Broker for Beginners” in 2022

Who should use XTB?

XTB is ideal for traders of all levels, especially those aiming to cut down on trading costs.

Final Thoughts:

XTB stands out for its low costs, vast product range, and exceptional educational offerings. While it lacks MetaTrader 4 support, its proprietary platform is robust and user-friendly. It’s a solid choice for both novices and seasoned traders. If you’re looking to minimise trading expenses and access a wide range of assets, XTB might be the best trading platform for you.

Pros:

- Competitive forex spread cost

- 24/7 support

- Extensive asset range

Cons:

- No MetaTrader 4 support

- Fees for withdrawals under certain amounts

- Inactivity charges

Fees:

-

-

- Low forex trading costs

- Inactivity fee after one year of no trading

- £12 fee for withdrawals under £60

-

Products:

-

-

- Forex: 48 currency pairs

- Indices: 20+ global indices

- Commodities: Including gold, silver, and oil

- Stock CFDs: Over 1,850 from global exchanges

- ETF CFDs: Over 100 globally

-

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Forex.com have designed an app that is a joy to navigate even for beginners. They offer two mobile platforms, the ever-popular MT4 and their own proprietary platform. Excellent search functions make finding your currencies a breeze and functions such as place market, limit, stop, stop trailing, and OCO orders all add to the experience.

Forex.com really shine when it comes to charting with a plethora of charting tools and comprehensive research and news sources providing complete analysis to complement your trading activities.

On the negative side, recent reviews have suggested that Forex.com are having some issues with the app slowing down or even freezing from time to time however, I hope this is something Forex.com will rectify and it’s certainly not worth writing off just yet.

Pros

- Over 80 currency pairs

- Excellent range of features

- Demo account available

Cons

- App has been known to freeze

- No fundamental data

- Inactivity fee

Forex.com Fees

- Standard spread 1 pip

- Zero commissions

Forex.com Account Features

- Range of platform options

- Advanced charting tools

- Demo account

- Real-time view of pricing

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Pepperstone is a renowned online CFD trading platform that offers a wide range of trading services. Pepperstone, with its headquarters in the UK, provides traders with a comprehensive trading experience tailored to their needs.

Key Features:

- Pepperstone offers access to multiple trading platforms, including TradingView, MetaTrader 4, MetaTrader 5, and cTrader

- Traders can access a variety of financial instruments, including forex, commodities, indices, and equity

- Pepperstone provides professional forex trading market analysis, insights, and education

Who Should Use Pepperstone?

Ideal for forex and CFD traders of all levels. Not suitable for those looking to trade real stocks in the UK and Exchange Traded Funds (ETFs).

Final Thoughts

Pepperstone offers a comprehensive trading experience with a variety of platforms and trading tools. Their focus on customer service and competitive fees makes them a top choice for CFD and forex traders. However, those interested in real stocks or ETFs might need to look elsewhere.

Pros:

- Traders have the flexibility to choose from multiple platforms based on their trading preferences

- Especially beneficial for high-volume traders

- The platform offers a wide range of educational materials, including articles, videos, and webinars

Cons:

- Only forex and CFDs are available

- Demo account available for only 30 days

Fees:

-

-

- Competitive spreads with no inactivity or trading account fees. Commissions vary by platform and trading account type

- Standard (zero commissions with a spread) and Razor (raw spread with a commission)

-

Products:

-

-

- Forex

- Index CFDs

- Commodity CFDs

- Cryptocurrency CFDs (professional traders only)

- ETFs

- Currency index CFDs

- Social trading

- Spread betting

-

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

What’s my methodology?

When putting together this list, I first made sure that I used every trading platform. This not only gives me a feel for the platform in question but also how they compare to each other. I also go through a predetermined checklist of attributes that include:

- How does the pricing structure work and is it competitive?

- How quick and easy is it to open an account?

- What are the lead times for depositing and withdrawing money?

- What is the minimum deposit?

- What trading platforms are on offer and what are the tools and features like?

- What markets and products are available?

- What research is available to aid your decision-making?

- How responsive and knowledgeable is customer service?

- How robust is the educational offering?

- And lastly, I always check that the platform in question is fully regulated and meets minimum standards of safety.

This is a basic summary of my method. For a more detailed version of how I review the platforms, please refer to this page.

View best trading platforms in 60 seconds

How to choose the best trading platform for you

There are some key considerations when deciding which trading platform is best for your investment objectives, educational needs, and preferred access to markets.

One main consideration is to make sure they are Financial Conduct Authority (FCA) regulated.

You will need to decide exactly what you need from the trading platform in question, taking into account your level of experience, whether you are an active or passive investor, the level of resources you require, the securities offered, whether you require fully managed funds or wish to pick and choose your own investments, what you are saving for, and therefore the type of trading account you require.

The first step to finding which trading platform is best for you is to know what tools and resources you require. This will depend on a number of factors, but most crucially, you should consider what investment experience you currently have.

Beginner traders

Complete beginners looking to build their experience would benefit from good educational resources, glossaries, how-to videos, and access to highly responsive support staff. A beginner may also benefit from a live paper trading account where they can practise their trades before risking any of their personal funds.

Platform comparison table for beginners

The following table will provide you with an insight into how the platforms scored out of 5 when I tested each one. This should help you decide which trading platform is best for you at a glance.

| Platform | Overall score | Demo account | Support | Minimum deposit | Social trading | Education | Assets offered |

|---|---|---|---|---|---|---|---|

| Plus500 | 3 | 5 | 4.5 | £100 | 4 | 3 | 3 |

| eToro | 4 | 5 | 4 | $10 | 5 | 2.5 | 5 |

| AvaTrade | 4.5 | 5 | 4 | $100 | 5 | 5 | 4 |

| Pepperstone | 4 | 3 | 4.5 | £0 | 5 | 4 | 3 |

| Interactive Brokers | 4 | 5 | 3.5 | £0 | 5 | 4.5 | 5 |

| Interactive Investor | 3 | 0 | 4.5 | £0 | 0 | 4.5 | 4.5 |

| AJ Bell | 4 | 0 | 5 | £0 | 0 | 5 | 4.5 |

| Hargreaves Lansdown | 3.5 | 0 | 4.5 | £0 | 0 | 4.5 | 4 |

| IG | 4 | 5 | 4 | £0 | 0 | 5 | 4 |

| Saxo Markets | 3.5 | 3 | 3 | $2,000 | 0 | 4.5 | 5 |

What’s the difference between a trading platform and an online broker?

An online broker provides access to stock markets, and a trading platform is the trading software that you use to execute trades with that broker. The two are often used together: you may open an account with a broker and then use the broker’s trading platform to place trades, or you may open an account with a broker and then use a different trading platform from that same or a different vendor.

So, if you’ve had your eye on AstraZeneca stock or would like to buy Tesla shares, then an online trading platform could be just the ticket. It’s surprisingly easy to start buying and selling stock online in the UK, less so to actually turn a profit doing it.

Some of the stock trading platforms in the UK have a wealth of tools and features at your disposal to help you with your investment journey. And to make sense of it, with fees that are a far cry from what a traditional broker would charge, more and more people, from beginners to seasoned traders, are turning to online trading platforms for their investment journey.

Also consider: My guide to the Best Stock Trading Apps UK

How I’ve chosen this list of best trading platforms in the UK

I have conducted hours of vigorous research in order to identify the top platforms in the UK that I believe will best meet your needs as an investor. To clarify how I have gone about this process, here are some of the factors that I have taken into consideration:

Fees and Charges

Custody fee: This is the fee that you pay to the platform for taking care of and managing your investments. This fee is a major consideration, as small costs can really start to erode your investment gains.

Cost per trade: This is the fee you will pay every time you buy or sell stocks and shares. Some platforms have zero trading fees, which is great; however, you need to weigh up whether they are providing you with all the other features you require from a trading platform.

Frequent trader: some platforms in the UK will reward you for trading more frequently with a reduced fee. This is only relevant if you feel you will be trading more than a certain number of times each month. Otherwise, you will need to pay the per-trade fee.

Investment trusts fee: Investment trusts allow you to pool your money together with other investors into a ‘trust’. The trust manager will then use these pooled assets to invest in shares and financial assets on your behalf. The charge for an investment trust is usually based on a percentage of the amount of money you put into the trust.

Ease of Use

Trading can be a complex endeavour, and the design and usability of the platform you choose can have an impact on how efficient you are at managing your portfolio. I have therefore assessed each UK trading platform to identify which ones will allow you to make quick, accurate trades in an online environment that can help instil a sense of confidence.

Market Research and Education

This section is especially important for beginners who require high levels of research and education in order to learn trading and make profitable decisions regarding their investments. Webinars, blogs, videos, seminars and tracking options are all important educational tools to help beginners get up to speed.

Investment Choice

This will be especially important for experienced traders who are creating a highly diversified portfolio. Having a broad spectrum of global investment options, including stocks, ETFs, index funds, investment trusts, etc., from various stock markets is what seasoned investors have come to expect. Of course, this can be overwhelming for novice investors who may prefer to invest in a pre-made portfolio or engage in copy trading.

Accounts on Offer

This is an important consideration in order to ensure you are being as efficient as possible with your investing. If you are between the ages of 18 and 40 and saving for your first home, then the most efficient account would be the Lifetime ISA, as this attracts a government bonus of 20%. Remember that outside of the personal allowance, all income and returns from your investments are subject to tax at your usual rate. Therefore, you may want to consider a tax wrapper, such as an ISA. However, if you are already at the annual allowance for your ISA, then a General Investment Account might be more attractive.

Safety

Here at Investing Reviews, we always ensure that the trading platforms we recommend meet minimum safety standards. This includes being authorised and regulated by the Financial Conduct Authority (FCA), as well as adequate security and protection of data within the site or app. Some stock trading apps also utilise biometric identification and many of the providers listed above are covered by the Financial Services Compensation Scheme, which means your account balance is protected up to the sum of £85,000 should the provider go out of business.

Demo Account

If you would like to practise trading before you risk any of your money, then it may be best to select a trading platform that provides its users with a demo account.

A demo account will give you a certain amount of ‘virtual money’ with which to trade on the stock market. These are useful trading tools to help you get to grips with the setup of the trading platform and to familiarise yourself with the various assets on offer.

Best UK Trading Platforms FAQs

Below are some of the most frequently asked questions about the best UK trading platforms.

What is the best platform for day trading UK?

The best platform for day trading is eToro, with over 2,000 global shares, over 40 forex pairs and 15 cryptocurrencies. eToro also offers ETFs, bond trading, and social / copy trading.

In addition to eToro and the other best UK trading platforms mentioned in this guide, others are recommended for day trading purposes. Find out more with my day trading guide.

Do I pay UK tax on share dealing?

Trusted partner

80% of retail CFD accounts lose money

2000+ CFDs

- User friendly mobile app

- unlimited CFD demo account

- Trading academy