The following guide is an easy way to narrow down your list of the best pension providers and get to the answers you need, fast.

I’ve looked through dozens of options from some of the most well-respected, FCA regulated personal pension providers in the market. Investigations included downloading apps, testing platforms and trialling services. I’ve compared costs, features, and investment options for a range of customer needs and objectives – helping you skip straight to the information that’s most relevant to you.

Best for small pension pots

Capital at risk. T&Cs apply.

Cheapest for small portfolios

- Excellent research

- Good choice of funds

- Easy to use platform

Best for SIPP

Capital at risk. T&Cs apply.

Large pension pots

- Award-winning platform

- Extensive investment choice

- Competitively priced

Best for quick and easy setup

Capital at risk. T&Cs apply.

Easy to use platform

- Excellent customer service

- Good choice of pension funds

- Low cost fees

My best rated pension providers in the UK, September 2025

- AJ Bell – Small pension pots

- interactive investor – Large pension pots

- PensionBee – Quick and easy set up

- Penfold – Self-employed pensions

- Moneybox – Pensions for beginners

- BestInvest – Choice of pensions

- Hargreaves Lansdown – Premium service

- Moneyfarm – Ethical investments

- Netwealth – High-net-worth individuals

- iSIPP – Range of funds

- Vanguard – Low cost pension providers

- Wealthify – Fully managed pensions

- Aviva – Well-known pension provider

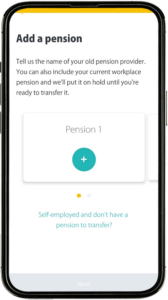

PensionBee is a specialised pension service providing a quick and easy way to streamline old pensions or start a new personal pension. Launched in 2014, more than 1 million people, to date, have taken advantage of their streamlined service and innovative, easy-to-use app.

Key features

Key features

- Combine existing pensions for easy management.

- Initiate pension transfers in minutes.

- Set up a new personal pension in minutes.

- No minimum contributions, and customisable savings.

- Choice of 8 pension plans

- Personal account manager

- Funds managed by renowned managers like State Street Global Advisors, BlackRock, Legal & General, and HSBC.

- Low, transparent investment costs

Who should use PensionBee?

PensionBee is tailor-made for people who have limited time and experience and would rather have the entire process handled for them. Opening and managing your account can be done in minutes, which is about as convenient as you will find anywhere.

Final thoughts

Simplicity is the key to PensionBee’s success. It’s a great option for those who want to simplify their pension arrangements. The platform’s clean and intuitive user interface makes pension management effortless.

Pros:

- Easy to use

- Excellent levels of customer service

- Clean and intuitive user interface

- Pension transfers achieved in minutes

- Choice of pension plans managed by leading money managers

- Straightforward, low-cost annual management fees

Cons:

- Limited investment options: Less flexibility than some other investment platforms and self-invested personal pensions (SIPPs)

Service Fees:

- One simple annual management fee of between 0.50% and 0.95%. Fees are halved for any amount above £100,000 as a way of rewarding saving.

- No entry or exit fees.

Investment Types:

A variety of bonds, equities, property, and gilts depending on the plan selected.

Best for:

Those looking for a quick and simple way to consolidate multiple pensions and manage their pension pot.

Capital at risk.

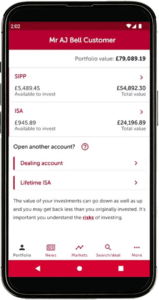

AJ Bell is one of the UK’s largest and best regarded investment platforms, serving more than 480,000 customers, from DIY investors to professional advisers. It’s an excellent option if you have a fairly meagre pension pot and are looking for a cost-effective solution while you grow your pension.

Key features

Key features

- AJ Bell introduced the first online SIPP, providing a broader range of investment choices than traditional pensions.

- Low cost

- AJ Bell analysts excel in research.

- Dedicated customer support

- Well-established: A FTSE 250 company

- Vast fund choice

Who Should Use AJ Bell?

If you have a modest pension fund and want a cost-effective way to manage it while it grows, AJ Bell is a great fit for you. Their fees start at just 0.25% of your invested cash, making it challenging to find a more economical option elsewhere.

Final Thoughts:

For those of us with smaller pension pots, AJ Bell is a cost-effective and versatile choice. Its low fees and diverse investment options make it an attractive option for growing your pension. However, if you plan to actively trade shares, do keep an eye on the dealing fees, as they can add up. Overall, AJ Bell is a top pick for individuals looking to make the most of their small pension pots.

Pros:

- Extensive choice of funds

- Exceptional quality and scope of research

- High level of customer support

- User-friendly trading platform which is clear on phone, iPad and laptop

- One of the cheapest options for small and medium portfolios

- No account set up fees, inactivity fees, holding fees, or withdrawal fees.

Cons:

- A fixed fee works out cheaper for large pension pots

- Cheaper dealing fees are available

Service Fees:

AJ Bell boasts some of the market’s lowest service charges, with a maximum fee of 0.25%. For accounts exceeding £250,000, platform management fees are even lower. Frequent trading incurs dealing fees ranging from £4.95 to £9.95 per transaction, but they provide a cost-effective regular investing service, reducing charges to £1.50.

Investment Types:

Choose from 2,000+ funds, shares across UK and international markets, hundreds of ETFs, investment trusts, bonds and gilts.

Alongside SIPPs, you can also invest in a stocks and shares ISA, Lifetime ISA, or dealing account.

Capital at risk.

Penfold is a private pension provider aimed specifically at self-employed people. Everything at Penfold is designed for those who are short of time and looking for a simple solution to retirement saving which still allows them some options.

Key features

Key features

- Provides SIPPs

- Quick setup: Start a Penfold pension in 5 minutes.

- User-friendly app

- Flexibility: Easily adjust contributions.

- No minimum investment

- Pension locating and consolidation

- Lifestyle profiling for goal planning

- Transparent pricing with all costs in one annual fee

- Four pension plans: Standard, Sustainable, Sharia, and Sustainable Lifetime

- Funds backed by BlackRock and HSBC

Who Should Use Penfold?

Penfold is the go-to option for self-employed individuals seeking a hassle-free and efficient way to save for retirement. It’s designed to simplify the process and accommodate changes in your income, making it an excellent fit for freelancers, entrepreneurs, and anyone without access to traditional employer-sponsored pensions.

Final Thoughts

Penfold is designed with the user in mind, focusing on simplicity, flexibility, and expert support. While the fees are a consideration, the convenience and personalised guidance make Penfold my top pick for self-employed retirement savers. It’s a hassle-free way to secure your financial future as you pursue your entrepreneurial endeavors.

Pros:

- As simple and quick to set up a pension as is possible

- Regular monthly contributions can be as little as £1 (Penfold takes the view that any investment into a pension, however small, is worth doing)

- Competitively-priced

- Intuitive and user-friendly app

Cons:

- Passively managed funds only. Experienced investors may prefer to have more choice.

- A small, limited range of plans

- No in-house advisory service

- Sparse on research and tools

- The ability to pause may lead to a lack of retirement savings

Service Fees:

Penfold charges 0.75% (or 0.88% for the Sharia plan) of your total pot value each year. If your pension pot size is larger than £100,000, the fee is reduced to 0.4% (0.53% for the Sharia plan).

Investment Types:

All Penfold pensions are passively managed. They are invested across a range of low-cost Exchange-Traded Funds (ETFs) which hold a basket of assets, which could include stocks, bonds and other securities.

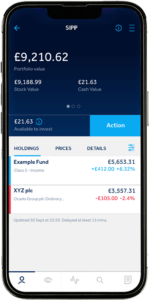

interactive investor (also known as ii.co.uk) is a low-cost, award-winning, online investment platform.

Key features

- Low flat fee: Ideal for high-value portfolios, potentially saving up to £85,000 over 30 years compared to percentage fees

- Wide range of investments

- Plan options

- Ready-made funds

- Extensive research and informative advice for decision-making.

Who Should Use Interactive Investor?

interactive investor is tailor-made for individuals who have amassed substantial pension savings and want a cost-efficient platform to manage them. It’s especially suited for experienced investors who are comfortable selecting and managing their investments, whether for diversification or specific investment strategies.

Final Thoughts:

interactive investor is a well known legacy pension provider which has an excellent reputation among investors. The decision in 2019 to move to a flat fee has also made this one of the most cost effective platforms for those with a substantial pension pot. It comes highly recommended.

Pros:

- Low flat fees

- Plenty of investment choice to satisfy experienced investors

- Contribute as little as £25 per month

- Good range of ready-made options

- Low trading fees for stocks

- Exceptionally low fees for actively managed, ready-made funds

- Excellent, informative website

Cons:

- Fixed platform fees are expensive if you have a small portfolio

- Trades of (non-US) international shares are relatively high at £9.99

Service Fees:

- Flat fees for ii SIPPs

- A subscription fee of £12.99 a month, which includes one free trade per month under the Investor Plan and two free monthly trades under the Super Investor Plan

- For ‘Quick-start Funds’ (the ready-made options), charges are based on a percentage of value, and are all exceptionally low, ranging from 0.22% to 0.35%.

- Standard fees for trading stocks are low, starting from £3.99 per trade for UK and US trades

Investment Types:

Choose individual investments for customisable portfolios or opt for ‘Quick-start Funds,’ which offer pre-made portfolios blending equities and fixed income for varying risk levels. Six available funds include a mix of active and passive management, each containing 6,000 to 20,000 shares and bonds across sectors like technology, media, and energy.

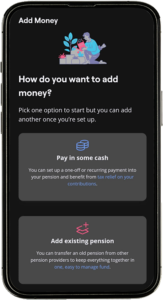

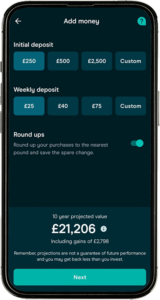

Moneybox is a mobile-first money-saving app that is designed to make setting up a savings or investment account quick and easy. It brings together investment options and pension consolidation with a ‘rounding-up’ feature which encourages customers to squirrel-away the extra pennies on purchases into savings.

Key features

Key features

- Offers personal pensions for hands-off saving.

- Rounding-up feature: Automatically adds spare change to your pension.

- Easy and flexible: Regular or one-time deposits, adjustable contributions.

- Pension tracking and consolidation service.

- Simple fund selection: Four starting funds for straightforward investing.

Who should use Moneybox?

Those wanting to get started with saving and investing who are short of time and want much of the responsibility for investment strategies taken by someone else. Moneybox might suit your needs if your focus is on saving for a house deposit, for example.

Final thoughts:

Moneybox really is a quick and simple solution that requires little to no skill or knowledge to set up and manage. The savings feature would suit those who do not have a set amount of pension savings each month but would still like to put an affordable amount aside for their pension pot.

Pros:

- Convenient way to save and invest

- Little effort or prior knowledge is required

- A flexible option as it’s easy to adjust contributions

Cons:

- Fees are among the highest on my list

- Little choice on how your money is invested

- The ability to pause may lead to a lack of retirement savings

Service Fees:

Moneybox has complex and relatively high fees. Their pension includes fund fees ranging from 0.13% to 0.63%, along with a 0.45% platform fee for balances under £100,000 and 0.15% for higher balances.

Additionally, there’s a monthly £1 subscription fee (waived for the first three months). For instance, choosing the mid-priced Old Mutual MSCI World ESG Index Fund at 0.27% annually adds up to total fees of 0.82% annually when factoring in the subscription fee, making it comparatively expensive.

Investment Types:

Most Moneybox contributions are invested into funds. Some of the funds consist entirely of shares (equities); others invest in a variety of asset types, for example equities and bonds.

Lifestyle funds invest in a mix of asset types, with the proportion of each asset type changing the closer you get to retirement, to ensure more of your funds are invested in less risky fixed income securities.

Bestinvest is a UK-based platform offering an award-winning SIPP and 3,700 investment options, including funds, shares, ETFs, and investment trusts. Bestinvest is owned by wealth management firm Evelyn Partners (previously Tilney Smith & Williamson).

Key features

- Offers SIPPs for retirement savings control.

- Wide investment selection: Thousands of funds, ETFs, trusts, and UK shares.

- Investment search tool for easy fund selection.

- Ready-made options available for simplicity.

- Free financial planner advice.

- Expert insights through factsheets and articles.

- £500 towards exit fees for pension transfers.

Who Should Use Bestinvest?

Bestinvest is suitable for individuals looking for a comprehensive and flexible pension provider in the UK. Whether you’re a hands-on investor or prefer a ready-made approach, Bestinvest can accommodate your preferences. Their free financial planner service is a unique offering that can benefit anyone seeking expert guidance.

Final Thoughts:

Bestinvest is a versatile and robust choice for individuals seeking a pension provider in the UK. Their extensive investment options, ready-made portfolios, and free access to financial planners make it a compelling option. However, it’s essential to consider the fees associated with your chosen investments. Bestinvest’s potential reimbursement of exit fees for pension transfers adds to its appeal for those looking to consolidate their pensions on their platform.

Pros:

- Wide choice of investments for those wanting flexibility

- A range of ready-made portfolios for those looking for more guidance

- Tiered fees for SIPPs, benefits holders of large pensions

- Low trading fees

- Free tailored financial advice and individual coaching available

- Great free resources

- High level of customer support

Cons:

- Only offers UK and US shares

- Relatively high percentage-based platform fees for SIPPs for a large provider. However, this may be balanced by low share trading fees and charges, no trading fee, and a low platform fee on US shares.

Service Fees:

- Bestinvest operates a tiered fee structure. For ready-made portfolios and US shares, annual fees range start at 0.2% on pots up to £250,000, and slide down to 0% on pots worth more than £1m.

- For other investments, annual fees range start at 0.4% on pots up to £250,000, and slide down to 0% on pots worth more than £1m.

- Trading fees are £4.95 for ETFs and non-US shares, and free for everything else. These fees apply if trades are conducted online. There is a £30 fee for dealing over the phone.

- A foreign exchange fee of 0.95% applies on non-sterling trades.

Investment Types:

For SIPPS, more than 3,700 investment opportunities are available, including UK and US shares, funds, exchange-traded funds (ETFs) and investment trusts.

If you choose a ready-made portfolio option, your money will be invested in a mix of assets and investments, depending on the risk level you select. Higher-risk ‘Expert’ funds are actively managed, whereas cost-efficient ‘Smart’ funds are passively invested in ETFs.

With the third option – ‘Direct’ – your investment is put into individual shares and bonds rather than funds. The make-up of these securities are then chosen based on the level of risk you are comfortable with.

Hargreaves Lansdown (HL) is a FTSE 100 company and leading UK investment platform. Their self-invested personal pension (SIPP) offers access to more than 2,500 funds, shares, investment trusts, and more.

Key features

Key features

- Wide SIPP investment selection: Over 2,500 funds, shares, trusts, and more.

- Pension consolidation: Combine old pensions into one online account.

- Ready-made portfolios for beginners.

- Paid financial advice available.

- Access to additional investment options: ISA, lifetime ISA, and junior ISA.

Who Should Use Hargreaves Lansdown?

Hargreaves Lansdown is an excellent choice for individuals in the UK seeking a comprehensive pension provider with an excellent reputation. Whether you’re new to investing or prefer to craft your own portfolio, Hargreaves Lansdown’s offerings are designed to accommodate a range of needs. Additionally, their financial advice service is available for those who require expert guidance.

Final Thoughts:

Hargreaves Lansdown, a leading investment platform in the UK, offers a versatile solution for pension planning through its SIPP. With a wide selection of investments, including ready-made portfolios, it caters to a broad spectrum of investors. Additionally, their financial advice service provides expert guidance for those who require it. Whether you’re new to investing or an experienced saver, Hargreaves Lansdown offers a robust platform for managing your retirement savings.

Pros:

- A financially secure FTSE 100 company with more than 40 years’ experience

- Excellent customer service levels

- Excellent mobile app

- Extensive research expertise

- No trading fee for funds

- Capped platform fee for shares

Cons:

- Trading fees for shares are at the higher end of the market

- Platform fees of 0.45% (under £250,000) are at the higher end of the market

Service Fees:

- The HL SIPP is free to set up.

- Annual charge for holding investments is never more than 0.45% (0.25% for pensions £250,000 – £1m, 0.1% on pensions valued at £1m – £2m and no charge on figures above £2m) and is capped at £200 per year.

- Some investments incur additional annual charges such as fund manager fees.

- Free to buy and sell funds.

- Other dealing charges depend on how often you trade. For 0-9 deals per month, deals are charged at £11.95. Charges are £8.95 for 10-19 deals and £5.95 for 20+ deals per month.

Investment Types:

SIPP investors can choose from more than 2,500 funds, UK and overseas shares and investment trusts.

Moneyfarm is a pan-European robo-advisor providing investment plans based on investors’ personal approaches to risk and ethical preferences. Established in 2011, this digital wealth management platform is all about simplicity and affordability.

Key features

Key features

- Moneyfarm, a top robo-advisor, offers low-cost services.

- Access to digital consultants for human touch.

- Offers SIPPs for self-directed investors.

- Personalized portfolios based on goals and risk.

- Free pension transfers in 3-4 weeks.

- 7 risk-aligned portfolio choices, including ESG options.

Who Should Use Moneyfarm?

Moneyfarm is an ideal choice for individuals in the UK looking for a hassle-free and personalized pension provider. If you prefer a hands-off approach to investment management and appreciate guidance from experienced professionals, Moneyfarm is a strong contender. It’s also suitable for those looking to transfer existing pensions seamlessly.

Final Thoughts:

Moneyfarm is a user-friendly and personalised solution for pension planning in the UK. With diversified portfolios, including ethical options, and a commitment to adjusting your investments based on your risk tolerance and retirement goals, it offers a seamless experience. The access to free guidance and easy pension transfers add to its appeal. While account management fees apply, they are competitive and decrease for larger pots. Moneyfarm’s flexibility and ease of use make it a compelling choice for those seeking a tailored approach to pension planning.

Pros:

- An impressive user-friendly app

- A dedicated consultant bringing the human element to the robo-advisor experience

- More convenient and cost-effective than a traditional advisory firm

- The ability to invest in more than one portfolio within the same account

- Risk matching helps ensure you’re not taking on more risk than you are comfortable with

Cons:

- Minimum investment of £500 could be a barrier to entry for some

- The website is light on education resources but advice and guidance can be sought from the personal consultant

Service Fees:

- There are essentially two charges you’ll need to pay as a Moneyfarm customer: the management fee and the fund charge.

- Moneyfarm operates a sliding scale fee structure for management fees. The more you have invested, the lower the percentage of value you’ll need to pay.

- Fees for actively managed accounts range from 0.35% for assets over £500,000, to 0.75% for anything under £10,000.

- Fees for passively managed accounts range from 0.25% for assets over £500,000, to 0.45% for anything under £100,000.

- The fees for funds are less clear, however. They are not included in the annual management fee. The average fund charge is 0.2% per annum at Moneyfarm. Charges can be as much as 1% with mutual funds though, sometimes more.

Investment Types:

Moneyfarm uses low-cost Exchange-Traded Funds (ETFs). Your funds will be spread across: cash, bonds, equities, commodities and real estate.

Choosing the best private pension provider:

Experience level:

- Beginners: Platforms like PensionBee, Penfold, and Moneybox are user-friendly and require minimal intervention.

- Experienced Investors: Platforms like interactive investor, Hargreaves Lansdown, and iSIPP offer extensive investment options.

Contribution flexibility:

Depending on your financial situation, choose providers like Penfold or Aviva for irregular incomes. Ensure the provider aligns with your payment preferences.

Fees: While cost matters, don’t just opt for the cheapest. Understand all fees, including account, fund, transfer, and withdrawal charges.

Consolidation:

If consolidating old pensions, ensure the provider offers this service. Check for exit fees from your current provider; some new providers might cover part of this cost.

Types of UK pensions:

State Pensions:

Available to those with 10+ years of National Insurance Contributions. The payout is based on these contributions, with a current maximum of £179.60 weekly. It’s often supplemented with other pensions. The pension age is 66, rising to 67 by 2027.

Workplace Pensions:

Mandatory for employees aged 22-66 earning over £10,000 annually. Employers contribute and can either save or invest these funds. It’s received alongside the state pension.

Do you have a workplace pension? Since 2018, qualifying employees are auto-enrolled into workplace pensions unless they opt out. If you’re unsure, use the government’s pension finder or check with pension providers offering this service.

Private Pensions

Private pension schemes are set up and managed by the private pension holder and allow you to pay a sum of money, as determined by you, into a pot, which is then invested towards your retirement savings.

Private pensions attract a healthy tax relief of 20% for basic rate taxpayers; therefore, for a £100 deposit, you would only be required to pay £80, with the government paying in a further £20. However, how you are taxed will always depend on your personal circumstances, and pension and tax rules can change depending on how you pay income tax.

You are solely responsible for the money invested in your private pension; however, you are unable to access your private pension before the age of 55.

There are three main types of private pensions:

1. A personal pension plan

A personal pension plan is solely managed by the company you appoint on your behalf. The company will choose your investments or, alternatively, give you a limited choice of investments, which are then maintained by your chosen provider.

Pros of a personal pension plan

- Tax benefits, as all private pension contributions attract relief on both income tax and capital gains tax.

- Anyone can contribute including self employed people, employers, family members etc.

- Flexible and unaffected by changes to your employment status

- 25% withdrawal as a tax free lump sum upon reaching retirement age guaranteed

Cons of a personal pension plan

- Pension funds are locked away until you reach retirement age

- The value of your investments can go down as well as up

- Can be complicated and subject to regulations

2. SIPP (self-invested personal pension)

This is the pension scheme that gives you the most control over how your pension is invested. With a SIPP (self-invested personal pension), you can usually choose from a wide range of pension funds, shares, and other assets.

Pros of a SIPP

- Complete control over how your money is invested

- Greater choice of investment assets

- Same tax benefits as a personal pension

- Good for consolidating existing pensions

Cons of a SIPP

- Can suffer poor gains as a result of lack of investment knowledge

- Can attract additional costs and charges

- The value of your investments can go down as well as up

For more information refer to the pros and cons of investing in SIPPs

Can I have a workplace pension and a personal pension?

Yes, you are free to save into more than one type of pension; however, your contribution limits, in order to receive the government top-up, remain the same across all your pensions:

- 100% of your annual earnings

- £40,000 a year cap

- £1,073,000 lifetime allowance

Get a FREE Pension Review

Get a free no obligation pension review today from a qualified financial adviser.

Our partner Unbiased will connect you with one of over 27,000 FCA-regulated advisers.