How to start saving money

No matter what you want to achieve with your money, the first step is almost always to start saving.

In this step by step guide, I’ll show you exactly how to start saving money so that you’re able to reach your financial targets.

I’ll take you through the importance of setting financial goals, before showing you some of the best strategies and different financial products like money saving apps, you could consider to help you save money.

The 5 steps to saving money

- Work out what you want to achieve – The first step in any savings strategy will be to set your financial goals. That way, your savings have a clear focus, motivating you to stick to your plan.

- Create a budget – Once you know what your goals are, you need to start thinking about how much money you’ll actually have available. To do this, create a budget of your income and expenditures so that you can see exactly how much you have to do this.

- Research strategies and products that can help you – Using this savings figure, you can start looking at the strategies, products, and apps available to you that can allow you to give your savings a boost.

- Start saving – Finally, you can put these into action and start saving towards your goals.

- Paying off interest early – To save money on interest, you might want to consolidate or pay off early any poor credit loans, or bad credit car finance for example.

Setting your savings goals

Having a savings goal is a key part of saving money and is the first step you should take when you want to start saving. After all, if you don’t know what you’re saving for, then it can be much harder to do it.

Setting goals like this can narrow your focus, further motivating you to stick to your habits and strategies.

In general, your goals can be divided into three categories: short-, medium-, and long-term goals.

Short-term goals

A short-term saving goal is anything that will take less than a year to complete.

It could be something such as clearing credit card debt or building up an emergency fund.

Medium-term goals

Your medium-term goals will typically take between one and five years to complete.

These could include building enough savings so that you can apply for a mortgage or even put a down payment on a house.

It could also include other moderately expensive targets, such as buying a car or saving for a dream holiday.

Long-term goals

Finally, your long-term goals include anything that will take five years or more.

For example, a common long-term savings goal for many people is retirement.

It may seem premature for you to be thinking about long-term goals such as retirement, especially if you’re still in the middle of your working life.

But actually, the earlier you work out what you want to achieve and how much you’ll need to do it, the sooner you can start putting plans in place to get there.

Creating a budget

Once you know what you want to achieve, the next thing you need to do if you want to start saving money is to create a budget.

A budget can give you a visual tool that shows you exactly how much comes into your household each month and, crucially, where it goes.

List your income

First, make a list of all your income. Add together your monthly salary – including a rough average of any bonuses you receive each month – to any interest received on savings and any investment returns you generate.

Combined, this figure is how much you’ll typically have to work with each month.

Calculate and subtract your expenses

Next, you need to work out how much you spend on a monthly basis. This needs to include living expenses and monthly bills, including utility bills and student loans, as well as a rough estimate of your monthly credit card debt.

You should also include any other monthly expenses that you have, such as streaming services or a gym membership.

Take this figure and subtract it from your total income. This should give you the amount that you have left over for saving at the end of the month.

Divide your expenses into “needs” and “wants”

At this stage, it can be useful to divide your expenses into “needs” and “wants”.

For example, you need to pay your electric bill, but you also want a Netflix subscription. If you can’t afford both, you should be prioritising the need.

Doing this can also help you to see where you have expenses that you don’t really need. For example, you may have a gym membership that you simply don’t make the most of each month.

Cutting these expenses could give you even more to set aside and save.

Having an emergency fund

As part of your budget, you should remember to build an emergency fund for those unexpected costs or events that can change your financial situation.

For example, if your car broke down and you needed to fix it, or you suddenly lost your job and your income dropped, you could rely on this fund to tie you over in the short term.

Estimates vary for how much you need to have in your emergency fund, but a good benchmark is often three to six months’ worth of expenses. That way, you’ll be covered for a fairly significant period of time in case of an emergency.

This money should be held in an easy-access savings account so that you can get to it quickly if you ever need to.

3 easy ways to save money

Once you’ve got your budget in place and you know how much you have to hand, you can start looking at your available ways to save money.

Saving strategies can be an effective and easy way to do this, especially if you manage to create a routine and stick to your saving habits.

Here are three saving strategies that you could try.

1. The 50/30/20 rule

Popularised in senior US senator Elizabeth Warren’s book, All Your Worth: The Ultimate Lifetime Money Plan, the 50/30/20 rule can help you to save by changing your financial behaviour.

What is the 50/30/20 rule?

The key to the 50/30/20 rule is in the name. It simply refers to dividing your income by percentages and then spending and saving it accordingly.

Specifically, this division means you do the following:

- Spend 50% of your income on your “needs”, including household bills and other essentials.

- Spend 30% of your income on your “wants”, including expenses such as online shopping or going to the cinema.

- Save 20% of your income directly into your bank account each month.

How can it help me?

The 50/30/20 strategy is useful because it ensures your essentials are paid and creates a regular savings habit, while still giving you a fun budget so that saving doesn’t feel like a chore.

Crucially, this fun budget has a spending limit. This hard stop point can help to scratch the itch of wanting to buy and do things, while simultaneously preventing you from going overboard.

A fixed saving habit like this can be especially useful if you have a tendency to compulsively spend your money.

2. The “penny-per-day” system

The “penny-per-day” system became popular a few years ago when it went viral on social media.

If you often find yourself with extra cash or loose change lying around, then this could be a good strategy for you.

How does the “penny-per-day” system work?

The penny-per-day system is remarkably simple. All it involves is saving pennies each day with an equivalent value to the day of the year.

So, on 1 January, you’ll put one penny in a jar; on 2 January, you’ll put two pence in; on 3 January you’ll put three pence in, and so on.

This may not sound like much, but on the 100th day of the year, you’ll be saving £1, with £3.65 going in on 31 December.

How can it help me?

You’d be surprised how much you can save just by using this strategy.

In a year, using this strategy would see you actively save £667.95 into your pot. While this isn’t a life-changing sum, it’s still a fairly healthy amount saved without much effort.

Of course, if you used this strategy over many years, it could provide you with significant savings by the end.

3. The 30-day rule

The 30-day rule is less of a savings strategy and more of an “anti-spending” strategy.

What is the 30-day rule?

The 30-day rule comes into effect whenever you want to buy something.

If you’re considering buying something or you’ve spotted an ad online that’s piqued your interest, take 30 days before you make your purchase.

By doing this, you’ll give yourself the space to decide whether you really want to buy what you’ve been considering. If after those 30 days you’re still sure you want the product, then go ahead and buy it.

But, if after those 30 days you realise you don’t really need it or you wouldn’t get that much use out of it, then simply don’t go back.

This space between purchases can be invaluable in helping you to decide what you think you want, and what you actually want.

How can it help me?

When it’s working at its best, the 30-day rule can help you to entirely eliminate all your unnecessary shopping and spending. This can make a huge difference to your financial situation, particularly if you manage to do this over a long period of time.

The best thing about the 30-day rule compared to other saving strategies is that there’s theoretically no limit to how much money doing this can save you.

Even if it leads to you reevaluating just half of your purchases, this would be an enormous victory for your pocket.

What financial products could you consider?

Alongside these saving strategies, you could also consider the range of financial products on the market that can help you make the most of your money.

High-yield savings accounts

While it’s good to use easy-access savings accounts for your everyday expenses, a high-yield savings account can make a good option for building up a savings pot.

High-yield accounts often boast better interest rates than other savings accounts, meaning you receive more for your money than on other accounts.

The downside to this is that you may have to lock your money away for a certain period. This means it’s important to not put any money you need for living your daily life into this account.

Depending on the financial institution you save with, you may also be able to find other benefits that come with the account, such as a cashback scheme.

Whether you decide to go with a bank, building society, or even an online bank, it can often be sensible to search across the market to find an account with the right details for you.

ISAs

ISAs are a popular savings product in the UK, allowing you to hold money tax-efficiently.

ISAs have a limit for how much you can put into them each tax year. For the 2021/22 tax year, this limit is £20,000. You can use the entire allowance in one ISA or spread it across various products.

Crucially, money held in an ISA is entirely free from Income Tax or Capital Gains Tax (CGT).

There are various different types of ISA, but the main ones that you might use are:

Cash ISA

A Cash ISA means holding your savings in cash within the ISA wrapper. You won’t have to pay tax on any interest that your savings generate.

Stocks and Shares ISA

A Stocks and Shares ISA allows you to invest money in the stock market within the ISA wrapper. Any returns generated are then free from Income Tax and CGT.

You can read more about investing below.

Junior ISA

A Junior ISA (JISA) is an ISA specifically for children. You can save into both a Cash JISA or invest via a Stocks and Shares JISA.

JISAs have a separate allowance each tax year, which for 2021/22 is £9,000. You can use the entire allowance in one type of JISA or spread it across both types.

As a JISA is held in the name of a child, you can use the whole of your own £20,000 allowance and also save or invest for your child on top of this using the JISA allowance.

Lifetime ISA

A Lifetime ISA (LISA) is a type of ISA specifically for 18 to 39-year-olds who are either saving for a first home or towards their retirement.

Whenever you make a contribution to a LISA, you’ll receive a 25% government bonus. That means for every £4 you put in, you’ll receive an extra £1.

While money in LISAs does count towards your £20,000 ISA allowance, they have a separate maximum allowance of £4,000 each tax year. So, if you made full use of this limit, you could receive an additional £1,000 in government bonus each tax year.

Putting money in a LISA can be one of the best ways for younger people to save money for the future without having to pay tax.

One downside to a LISA is that you’ll face a 25% withdrawal charge if you withdraw money for any reason other than buying a home or retiring. This charge removes any government bonus plus a little bit extra.

Investing

If you have an emergency budget all sorted and you want to try and turn your savings into more money, then you could consider investing in the stock market.

By buying and selling investments, you can potentially see your money rise in value, giving your savings a boost.

You can also invest via a Stocks and Shares ISA, allowing you to invest without having to worry about Income Tax or CGT.

If you want to find out how to start investing, my guide to investing for beginners may be of help to you.

The key thing to remember with investing is that there’s a possibility that you’ll lose money, as well as make gains. This means your money is at risk.

Never invest money that you need for living your daily life or paying essential bills, and only invest money that you can afford to lose entirely.

Have you considered savings apps and websites?

Outside of using strategies and products to reign in your spending, you could also look at the various apps and websites that have been specifically designed to help you save money.

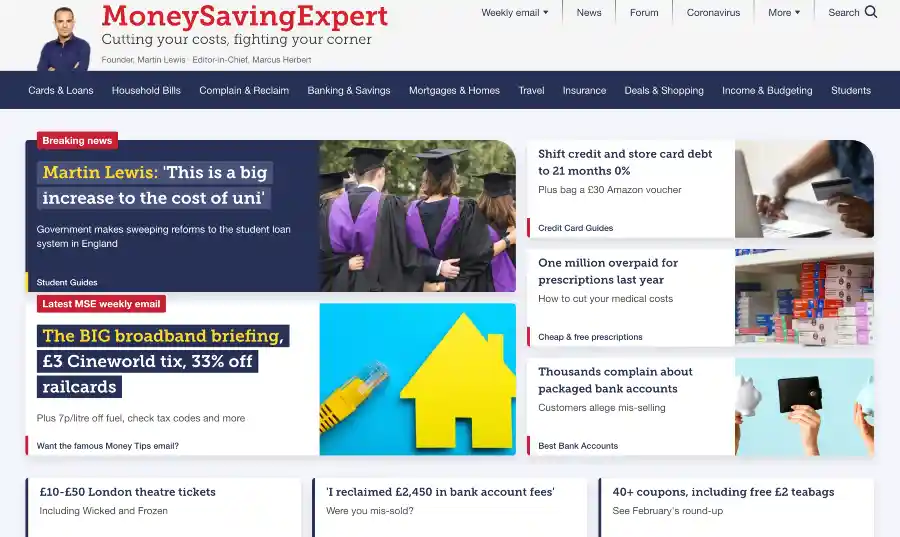

MoneySavingExpert

MoneySavingExpert (MSE) is one of the best websites for saving money in the UK, combining tips, deals, and practical ways for you to make the most of your money.

For example, MSE has information on the best bank accounts, including the most favourable interest rates for a current or checking account.

Similarly, the site contains plenty of information on how to get a better deal on everything from mortgages to energy, water, or internet services.

You can also passively read MSE’s simple tips by signing up for their email newsletter. This newsletter is packed full of tips and the latest deals that, when combined, could see you save hundreds of pounds.

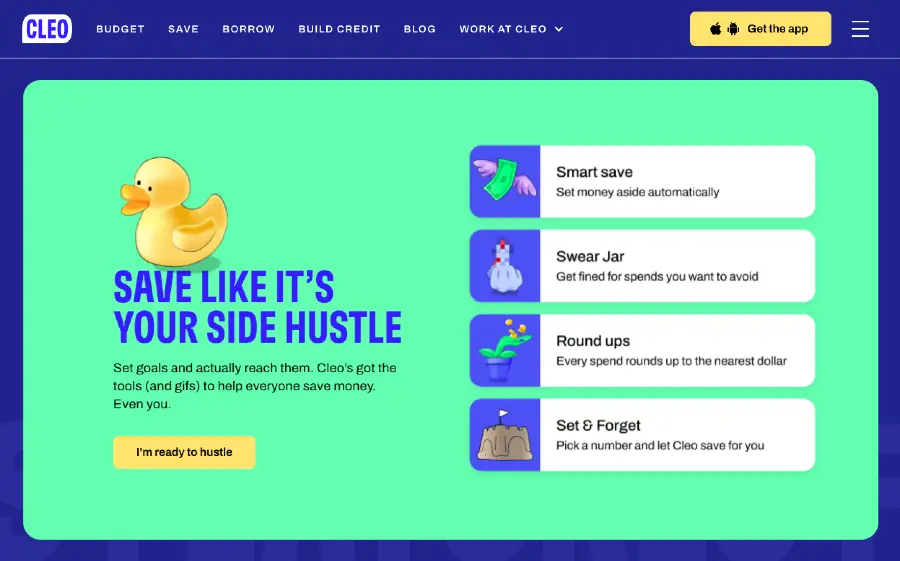

Cleo

Cleo is an innovative app that connects directly to your main current account and then provides analysis and insights into your spending habits.

One of Cleo’s best features is that it allows you to create budgets. This can be useful in combination with a strategy such as the 50/30/20 saving strategy.

Emma

Emma is an entirely free money-saving service, helping you with a full analysis of your finances when you link it up to your bank account.

From identifying areas where you’re overspending to finding old subscriptions that take your money without you using them, you can use the data Emma provides to clean up your budget and improve your savings.

Moneybox

Moneybox has become a popular investment service, boasting over 700,000 customers, but it can also be great for saving.

When using Moneybox, you can use its “round-up” feature which rounds up your purchases to the nearest pound. While this may be pennies to begin with, these amounts can quickly add up.

This can help to turn a bit of your spending into savings. You can then invest or save this money in a variety of accounts.

Plum

By connecting Plum to your bank account, the intuitive app calculates what you can afford to save based on your past habits and then does it for you.

Much like Moneybox, Plum also allows you to save or invest your money in a variety of accounts, including investment accounts and pensions.

How can I quickly save £1,000?

If you want to quickly save £1,000, the answer will likely be in a combination of the strategies above.

Start with your budget and then work from there, cutting out spending as you go. Then in the meantime, consider adding strategies and products that help you to reach your targets.

The key is not to get disheartened at the first few hurdles of saving. Give your strategies at least six months, potentially even up to a year, so that you can really see the impact of changing your behaviours.

From there, you can assess how successful they’ve been and then start making changes to improve your situation even further.

Taking financial advice

If you’re still unsure of the most appropriate strategies and products to use to help you save money in your personal circumstances, or you want to save money quickly but you’re not sure how to do so, you could consider working with a financial advisor.

A financial advisor can help you to work out your financial goals and then find the right strategies and products to help you achieve them.

Please note

The information in this article does not constitute financial advice.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.