So how do you start to take control of your finances? It can reap many rewards, not least getting rid of debt and growing your wealth. So what stops us from taking that step and organising our finances in a way that makes our money work harder for us? Mostly it comes down to choice.

Questions such as “How much to save” and “How to start investing as a beginner” can leave us paralysed into doing nothing.

The more choice we are offered, the less likely we are to take action. It’s a fact.

But this needn’t deter you from financial success. In fact, we are here to guide you through the process, and help you find the best solutions for you, cutting out the noise, and just focusing on practical solutions that can, and will affect your bottom line.

A comprehensive list of free debt resources can be found here.

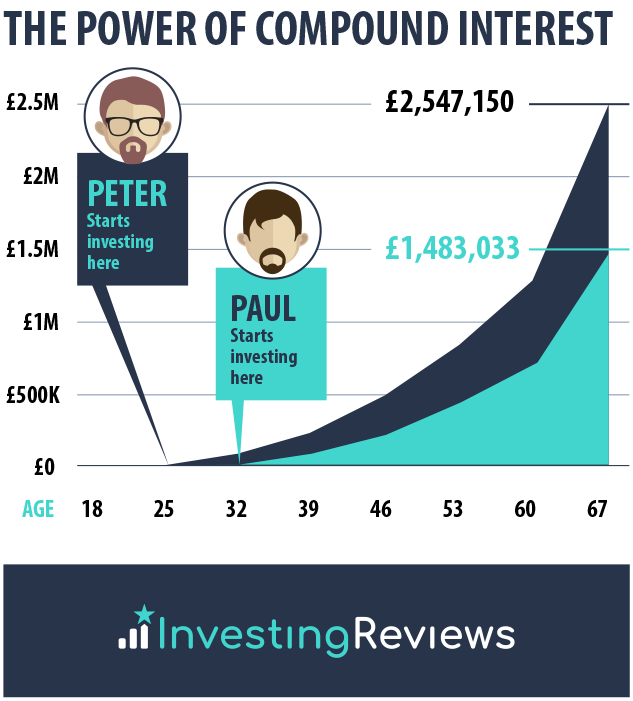

The Earlier You Start, The Better Your Returns

You may have already figured out that some quick action now can make a difference to your bottom line down the track, but you may not realise how much difference it can make. Financial planning isn’t the domain of older people who have accumulated a decent pot of money. In fact, just because you don’t currently have surplus income, doesn’t mean that you shouldn’t start planning your finances now. There are ways of putting money aside without even being aware of it, and small amounts can quickly accumulate into something more substantial, thanks in part to something called compounding. Little tweaks you make now, can mean buying a home sooner, or retiring early.

What is Compounding?

Simply put, compounding is the process by which your original investment increasingly grows in value due to the interest earned on the original amount and on the interest earned on that amount. Compounding is also true of liabilities or debt, and over time can also increase the amount owed on a loan as interest accumulates.

Here’s an illustration of how compounding works. Let’s say you put £1,000 in an account that pays 5% annual interest. After a year, that amount has grown to £1,050. However, in year two, your 5% interest is paid on the original amount of £1,000 plus the interest made on the previous year, resulting in your original investment growing to £1,102.50. So leave this amount for 10 years and your original £1,000 has grown in value to £1,628.86. Of course this figure can grow even quicker should you be invested in an account with more than one compounding period per year.

So what does this mean for you? It means that even a small investment, that you forget about, can start to work towards your future building more and more each year to give you substantial returns. It’s the reason you don’t need a massive bankroll to get you started.

The Impact of Saving on Tax

Any income you make on savings is taxable income as soon as you earn over £1,000. While the rate of tax can vary depending on what other income you have, it can be up to 45% which is a significant amount of your savings income. In case you are wondering exactly what qualifies as taxable savings income, it includes:

Any money you receive in the form of interest earned from entities such as your bank or building society, savings and investment products, bonds, gilts, interest bearing shares, and unit trusts.

Dividend income from company shares, investment trusts and unit trusts.

Also consider: Will interest and savings rates rise in 2022?

Life insurance income

Thankfully there are tax free wrappers available that allow you to earn income on your savings without paying tax. Utilising these can literally save you thousands and pave the way for greater returns on your savings income.

| Type of taxpayer | Income Tax on Savings | Income Tax on ISAs |

|---|---|---|

| Basic Rate | 20%* | 0% |

| Higher Rate | 40%* | 0% |

| Additional Rate | 45% | 0% |

Cash ISA

A cash ISA (Individual Savings Account) is probably the most obvious way to swerve tax on your savings income and anyone over the age of 16 can open one as long as they are living in the UK. Keeping your savings in a cash ISA means that the interest you earn on the money in your ISA account is completely free of any tax. What’s the catch? Well, firstly you can only deposit up to £20,000 in any tax year, anything over that will have to go in your regular account. Secondly, many ISA accounts come with a small fee.

Stocks and Shares ISA

A stocks and shares ISA (investment ISA) comes with the same deposit limits of £20,000 per year and you have to be over the age of 18 to open one. The difference between this account and the cash ISA is that a stocks and shares ISA allows you to invest the money you hold in your account, potentially generating higher returns than should you be simply earning interest, and without any tax due on the income your investments generate. Of course, as with any investments, this is a riskier option and you are not guaranteed that you will get back the money you originally invested.

Also consider reading: How to Start an ISA

Junior ISA

A junior ISA is a great way to put a bit of money to one side for the kids. Again, this comes in the form of a cash ISA and the stocks and shares ISA. A junior ISA allows your child to access their money in full when they turn 18, however, the maximum deposit for a Junior ISA is currently £9,000.

You might also like: Guide on How to Start a Junior ISA

Lifetime ISAs

This is the ideal account for anyone under the age of 40 looking to save for their retirement or to buy a new home as these are the only two ways to access the funds within a Lifetime ISA without incurring a penalty. Within this account you can save up to £4,000 a year and the government will top up your savings with a 25% bonus helping you to grow your pot faster. Within the lifetime ISA you have the option to either earn interest on your savings, or to invest your savings.

Self-Invested Personal Pensions – SIPPs

Like the ISA the SIPP account allows you to invest your savings completely free from income and capital gains tax. Another great advantage of the SIPP account is that any money you invest will be topped up a further 20% by the taxman.

ISA v SIPP

If you’ve decided that you want to take advantage of the tax reliefs offered by the ISA and SIPP accounts but are unsure which option is most suitable for you then the following information may help you make an educated decision.

The first major difference to be aware of are the tax reliefs when paying money into a SIPP. A SIPP allows you to make payments before income tax, potentially saving you 20% if you are in the lower tax bracket or 40% to 45% for higher earners. This makes the SIPP account by far the best vehicle for growing your wealth.

However, when it comes to spending the wealth you have accumulated, the SIPP account will only allow you to withdraw 25% of your fund tax free and anything beyond that will incur a tax charge at your normal rate. Conversely, an ISA account allows you to withdraw your funds completely free of charge.

The key element to consider when you are choosing between an ISA and a SIPP account is that the SIPP account is designed to be utilised as a retirement fund, therefore it is only in extremely limited circumstances that you would be able to access these funds before the age of 55.

On the other hand, the funds you hold in an ISA account can be accessed at any time and are far more suitable for buying a house or saving for school fees offering a greater scope of flexibility. Therefore it’s important to ascertain your requirements before committing to a decision. If it’s a nest egg you are after then the SIPP account can help you avoid temptation and save towards your retirement. However, for short term savings the ISA account offers all the flexibility you require. There are also the limits on paying into an ISA and SIPP account (£40,000 for the SIPP in order to gain the tax benefit and £20,000 for the ISA) and therefore you may want to consider a combination of the two accounts for your needs.

It’s Never Too Late

You are never too old to start saving whether it be for your first home or for your retirement. Many people worry that they have left it too late to save a decent pension pot, however, thanks to compounding, you can make up for lost time and still enjoy a comfortable retirement. Of course one way to start making up for lost time is to increase the amount you save.

You can read our complete guide to personal pensions to get the most up-to-date information on the types of pensions available as a saver in the UK.

There are ways of reducing household overheads and with a bit of time and research you could free up a considerable amount of money towards your pension pot.

Another way to grow your pot fast is to invest your savings in a high return portfolio, although this is not without risk and you would need enough time to ride out any short term volatility that may occur.

Should You Consider Investing?

If you have managed to pay off any debt (outside of your mortgage) then it may be time to consider investing. This may mean transferring as little as £10 a month into a retirement account, however, ensuring you have an affordable amount automatically set to transfer into an investment account will ensure you can start taking advantage of compounding on your interest.

The main difference between investing and saving is that funds you deposit in a saving account are guaranteed and you will always get back what you put in. However, with savings accounts, the interest earnt often struggles to keep up with inflation, and therefore you are unlikely to really grow your wealth. Despite the fact that banks will typically pay out more interest when inflation is high, this does not necessarily mean that your savings will grow fast enough to counteract funds lost as a result of inflation.

However, when investing, the idea is to secure a greater rate of return in order to grow your original fund quickly. This is not without risk and you could get back less than you originally put in.

When making a decision about whether you should consider investing or saving, you should firstly take into account whether you are saving for a long or short term goal. A short term goal such as buying a car or saving for a wedding is best achieved with the use of a high interest saving account where your original pot is guaranteed. However, if you are saving for a long term goal such as retirement, and you still have some time to go, then investing your funds may be the best way forward.

Investing can be a daunting prospect for someone with little to no knowledge or experience. However, there are hundreds of tools available to help you make a success of it and if you lack the discipline or interest to trade the markets yourself, then modern platforms can literally take it all out of your hands with premade portfolios that look after your investments for you.

You might also like: Guide on Investing for Beginners

The Power of Automation

Saving isn’t always easy, indeed the very thought of budget planning, setting goals, and working out how much you can afford to save is enough to deter most people from taking any action. As a species who have come from a past of communal living, we are not even hard wired to save, and since we only lived into our 40’s as little as 100 years ago, it’s no wonder we don’t have an appetite for saving.

However, if you are a person to whom saving does not come naturally, there is some good news. Artificial intelligence and clever algorithms have teamed up to do it all for you. Not only this, there are a host of great little apps that are all competing to make your savings aspirations a reality, so all you really have to do is pick the best one for you.

But how does this all work? These clever little apps link to your main bank account and assess your income and expenditure to ascertain an exact figure that you can afford to save. They will then send this amount to your new savings account, without you even realising it. This happens several times a month, in amounts that make no difference to your lifestyle, so you can start saving, what you can afford, without really noticing. Because technology is doing all the hard work for you, you can literally forget about it, removing the temptation to spend your savings. Research has shown that only around 40% of employees will opt in to a company pension scheme whereas 100% will take advantage if they are automatically enrolled in the scheme and asked to opt out.

Further Reading: Robo Advisors – The Complete Guide

Only around 14% to 17% of the population are natural savers, the rest of us need to harness this technology in order to ensure our savings’ success. Another way to harness the power of automation is to set yourself up with a round up feature. This way each time you use your card to purchase items, your spend is rounded up to the nearest pound and this amount is then stashed away in your savings account. The more you spend, the more you save which makes an effective saving strategy. People who enrol in automatic saving programs, on average save 240% more than those who are not.

There is no better time than now for you to take control of your finances and start planning for a secure financial future.

Overwhelmed with how to invest?

Connect with a Financial Adviser near you for FREE.