As of December 2021, Wealthsimple will no longer be offering their investment services to UK residents as they move to shift their focus to their Canadian business.

Existing account holders will be eligible for an automatic transfer to Moneyfarm who currently hold my ‘Best Set it and Leave it Stocks and Shares ISA’ as well as ‘Best Performing Stocks and Shares ISA’.

Important information for Wealthsimple account holders

Do not panic, your money is safe and you now have a number of options as to how you would like to proceed. Here I have attempted to answer any questions you may have:

Why is Wealthsimple transferring client accounts to Moneyfarm?

Moneyfarm is the obvious choice for people who enjoy the services at Wealthsimple. They have a similar offering and are one of the largest and best funded UK robo advisors with seven managed portfolios to choose from and a favourable tiered fee structure. However, there are of course other options and you may wish to check my Best Robo Advisors UK guide before making your final decision.

You can also read my full Moneyfarm review where I have compared Moneyfarm to Nutmeg.

- Important information for Wealthsimple account holders

- Wealthsimple Ratings

- Who owns Wealthsimple?

- Product Range Overview

- Wealthsimple Stocks and Shares ISA

- Wealthsimple Personal Account

- Wealthsimple Junior ISA

- Wealthsimple SIPP

- Wealthsimple Investments

- Socially Responsible Investing

- Wealthsimple Investment Platform Review

- Wealthsimple Mobile App

- Wealthsimple Research Service and Tools Review

- Fees and Charges Review

- FAQS about Wealthsimple

- Wealthsimple Customer reviews

Wealthsimple Ratings

Overall

Pros

- Higher account management fees than other robo-advisors

- Limited tools for personal finance

- No live chat

Cons

- No mobile app

- Limited information on the efficacy of the templates

- No internal community or marketplace for exchanging strategies

Who owns Wealthsimple?

Wealthsimple was founded in 2014 by Michael Katchen, however, today it is primarily owned by the company Power Corporation.

Product Range Overview

In terms of products on offer, Wealthsimple have a generous selection which includes the following account types:

- Stocks and Shares ISA

- Personal Account

- Junior ISA

- SIPP

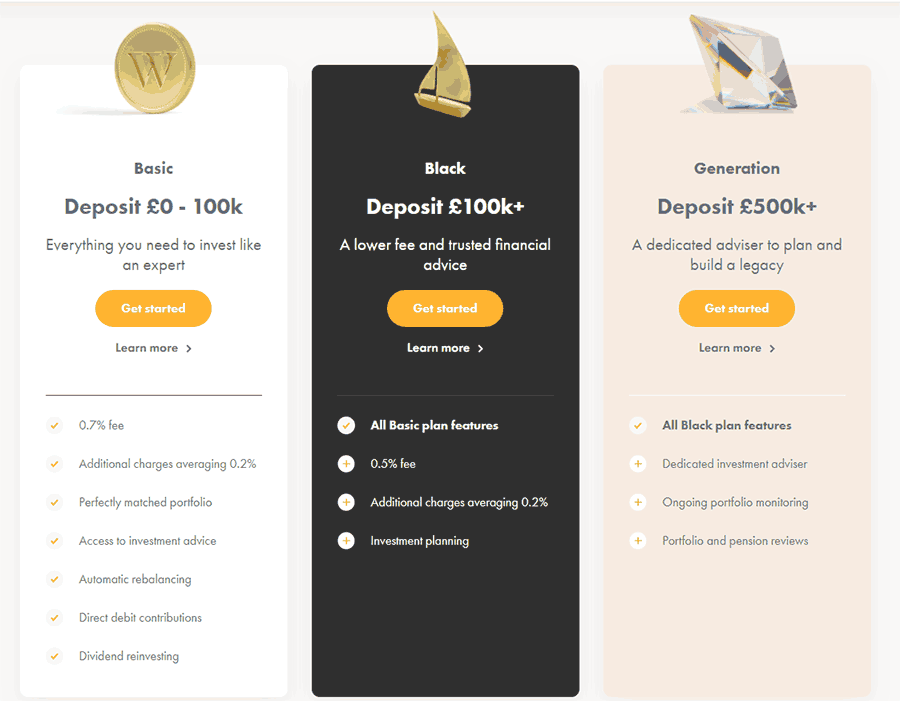

Wealthsimple also have a tiered fee structure to their account which is based on the amount that you have in your account. Each tier carries its own fees and benefits as detailed below:

Wealthsimple Basic Account

- Access to: Investment advice, automatic rebalancing of your portfolio, dividend reinvestment.

- Investment amount: £0-£100,000

- Management fee: 0.7%

- Average fund fee: 0.18%

Wealthsimple Black Account

- Access to: All Basic Account benefits, investment planning, VIP airport lounge access

- Investment amount: £100,000-£500,000

- Management fee: 0.5%

- Average fund fee: 0.18%

Wealthsimple Generation Account

- Access to: All Black and Basic Account benefits, dedicated investment adviser. Customised budgeting and cash flow planning, ongoing portfolio monitoring

- Investment amount: £500,000+

- Management fee: 0.5%

- Average fund fee: 0.18%

The Wealthsimple Stocks and Shares ISA offers all the tax benefits that come under the ISA umbrella and Wealthsimple allows transfers in, free of charge. Not only this, if your current provider charges you for transferring out, Wealthsimple will cover this cost for you. The Wealthsimple Stocks and Shares Individual Savings Account is, of course, subject to all the usual conditions surrounding ISAs and account holders will only be able to deposit the ISA allowance each tax year, which currently stands at £20,000 for the 2020/21 tax year. The Wealthsimple Stocks and Shares ISA provides access to the portfolios on offer and caters to people who want to invest in line with their values and faith.

Wealthsimple Personal Account

The Wealthsimple Personal Account acts in exactly the same way as a General Investment Account (GIA) in that it offers unlimited deposits and the opportunity to invest your cash in Stocks and Shares. However, any income that you earn in the Wealthsimple Personal Account, will be subject to income tax and therefore we would only recommend this account if you had already reached your £20,000 ISA limit for the current tax year. There are no account minimums required and should you choose to empty your account, you will not face any charges.

Wealthsimple Junior ISA

The Wealthsimple Junior ISA is the perfect vehicle for parents who want to start saving and investing for their children early. As with the Stocks and Shares ISA, the Wealthsimple JISA provides access to the Wealthsimple low-cost portfolios and any income earned is tax-free. The Wealthsimple JISA is available for children under the age of 18 who are living in the UK, however, deposits into a JISA must remain within the JISA allowance which currently stands at £9,000 for the 2020/21 tax year.

Wealthsimple SIPP

Wealthsimple are one of a handful of robo-advisers who also offer a SIPP, or pension account. The Wealthsimple SIPP gives account holders the flexibility to choose their investments from a diversified range of portfolios and low-cost funds. This means you can take advantage of the low management fees that come with passive investing through a robo-adviser whilst mirroring the performance of the stock market. What we liked about the Wealthsimple SIPP is that your portfolio is automatically re-balanced and they have human advisors on hand to discuss your investments. This really sets them apart from a lot of the robo-advisors currently available.

These investment accounts represent a decent offering in the market, although we would have liked to have seen a Lifetime ISA added as part of their product offering.

Wealthsimple Investments

Wealthsimple offers five portfolios to you as an investor, consisting of Conservative, Balanced, Growth, SRI and Shariah-Compliant which can be carefully matched to your risk profile. A quick check under the hood will reveal that the standard portfolios use 12 exchange-traded funds, including ETFs from Vanguard, Legal and General, PIMCO, BlackRock and Amundi Asset Management. The SRI portfolios use 6 ETFs and the Shariah-compliant portfolio has 50 individual stocks. This represents a well-diversified mix, although we would have liked to see greater exposure to international bonds.

The obvious place to start with the Wealthsimple investment options is with the socially responsible investing portfolios, designed for the investor who likes to invest in line with their values. There are three portfolios to choose from depending on your appetite for risk, made up from six exchange-traded funds that exclude companies involved in fossil fuels, tobacco and weaponry. Wealthsimple professes to actively look for companies that have a track record of socially responsible values including gender equality. However, whilst conducting this Wealthsimple review we did come across controversy surrounding the actual content of the Socially Responsible portfolio at Wealthsimple and we would have liked to see some more transparency as to which companies Wealthsimple invest in under the SRI umbrella.

The Wealthsimple medium risk SRI portfolio was their top-performing portfolio for the 12 months preceding September 2020. With investment returns of 5.55%, this was sufficient to beat a lot of the competition. As a comparison, the Wealthify confident portfolio experienced a rate of return of just 2.29% over the same time period.

Shariah-Compliant Portfolio

This is a fairly unique offering in the Robo-advisor space and a welcome addition for anyone looking for investment options that are in line with Islamic law. Within this portfolio, investors can access 50 individual stocks that exclude companies that profit from gambling, alcohol, firearms, tobacco or other restricted industries.

Portfolio Performance

When compared with other robo-advisors, Wealthsimple’s portfolios performed very well with a 14.43% growth on their balanced portfolio in the last three years. In comparison, the average managed fund 20-60% equity performance was 5.37%.

Wealthsimple Investment Platform Review

Wealthsimple have presented the information on their investment platform user interface with an attention to detail that is often overlooked. Sharp, modern graphics and the use of subtle animation makes complex chart reading more accessible and easy to use. There is no doubt that Wealthsimple have taken steps to decipher some of the greater complexities surrounding the industry jargon. Their questionnaire was very quick to complete and results in a match with a suitable portfolio that is in line with your risk profile and lists the exact funds they recommend.

We particularly like the projections that are available with each investment portfolio giving you an insight into how your investment might perform over time.

Wealthsimple Mobile App

Wealthsimple have done a great job with the layout and formatting on their mobile app. It’s slick, clean and easy to use with a strong focus on the value of your investments. Topping up your money is quick and easy and you can even open your account straight through the app. The app also provides access to personal finance articles which are great for helping to educate the more novice investors. Customer reviews are generally positive and Wealthsimple have scored a very respectable 4.3 out of 5 on the app store which is testament to the innovative and clean experience they provide.

Wealthsimple Research Service and Tools Review

Being more of a ‘set it and forget it’ type platform, Wealthsimple are fairly sparse when it comes to research services and tools. We couldn’t find any access to calculators or planning tools which is ideal for savers who would rather have everything managed for them but could be a little frustrating for investors who like to take a more active approach. There is access to human advisors vs robo advice if you have queries about your investment or require financial advice but the offering outside of this is a little limited.

However, when it comes to education we found their resources to be quite outstanding for investors to get started, with short videos to educate you on subjects like the stock market, when to pick stocks, and how much you will need to retire. This ‘course’ can be completed in around 45 minutes or done in short, sharp modules. They also have a very informative personal finance section on their website which is accessible to everyone, even non-account holders.

The Wealthsimple Magazine is also a free resource, available to everyone, and provides helpful articles and insights to help you on your investment journey. There is also a comprehensive 101 glossary and investment FAQ’s

Fees and Charges Review

Wealthsimple market themselves as a low-cost provider with management fees of only 0.7% per year. This amount is reduced to £0.5% per year as soon as you invest more than £100,000. In addition to this, you can expect to pay an average fund fee of 0.18%. There are no nasty surprises and Wealthsimple will even cover the cost of transfer fees when you transfer your money across to them.

Fees will soon eat into your investment gains so it’s important to compare Wealthsimple with other robo-advisers.

Vanguard’s LifeStrategy Funds currently come with a management fee of 0.22% which is excellent value when it comes to low fees, however, you won’t get the same slick experience from Vanguard which is more of a hands-on investment approach. Nutmeg on the other hand currently charge 0.45% for their fixed allocation portfolio, however, their fully managed portfolio goes up to 0.75% which is slightly higher than Wealthsimple. Wealthify come in slightly under the Wealthsimple costs with an investment management fee of 0.60% and investment costs of 0.16%.

FAQS about Wealthsimple

Is Wealthsimple in the UK?

How do I contact Wealthsimple?

Wealthsimple Customer reviews

There are no reviews yet. Be the first one to write one.