Not cut out for DIY investing? (Or just not ready for it yet?)

But not willing to pay traditional wealth management fees?

It’s time to get acquainted with robo advice.

Nutmeg is a leader in the robo advice field, offering an automated investing platform to help you access a tailored, managed portfolio without the high costs – and with the added bonus of wealth management advice from human advisers should you want a bit more reassurance and guidance.

Approved by Nutmeg 11/12/24

As with all investing, your capital is at risk. Tax treatments depend on your individual circumstances and may change in the future. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest.

Nutmeg Alternative

Click here to visit Invest Engine

Nutmeg was the first, and is now the largest digital wealth manager, in the UK. In a market where many robo advisors shutter after a few years in business, it has remained a constant.

And for good reason.

Nutmeg is a great option for beginners who want the reassurance of knowing their funds are looked after by a team with a high level of expertise that invests in great research.

The variety of portfolios on offer means you can still choose the general structure of your investment strategy. In the case of the new Thematic Investing portfolios, you can even choose to invest in the trends you believe will shape the future. Or you can leave it all to the experts at Nutmeg.

Nutmeg’s fees are a little higher than some stockbrokers but their pricing structure is blissfully transparent and easy to understand. Plus, with Nutmeg you get free access to their experts should you need a bit of human help, which you might think is worth its weight in gold.

Nutmeg is a great choice if you don’t have the funds to go with a traditional wealth manager, and just want to start putting some cash away for your future.

Nutmeg Ratings

Overall

Pros

- Leading UK Robo Advisor with expertly designed portfolios to choose from

- No set-up fees, trading fees, transaction fees or exit fees

- Full transparency on fees and performance backed by excellent customer service

Cons

- Fees higher than other investment platforms

- No relief for accounts over £1 million

- Minimum investment contributions for each account

When investing with Nutmeg, their fees are a little higher than some stockbrokers but their pricing structure is simple and easy to understand. Investing with Nutmeg may also not be the best option if you like to be in full control of where your investments are held. Nevertheless, it is the perfect choice for people who don’t have hours upon hours to spend researching tracker funds and instead just want to start putting some cash away for their future.

They have a wealth of blog posts and tutorials to familiarise users with all the lingo when it comes to investments and provide useful tools for calculating how much your money could be worth in the next decade.

Investing with Nutmeg is available on both iOS and Android and you can get signed up in just a few minutes.

Who is Nutmeg?

Nutmeg is one of the most established online discretionary investment management companies – meaning it caters to customers who prefer to have their investment decisions made for them. Nutmeg invests in Exchange-Traded Funds (ETFs), which provide exposure to certain investment classes.

Who owns Nutmeg?

Founded by Nick Hungerford in 2011, Nutmeg was an independent company owned by its shareholders.

On 21st June 2021, Nutmeg was acquired by J.P. Morgan Chase (NYSE: JPM) as part of their ongoing expansion into digital wealth management.

Product Range

Nutmeg offers investors simplified products that include UK tax efficient investments and a general investment account (GIA)

When you create an account with Nutmeg, you can invest in a:

- Stocks and Shares ISA

- Lifetime ISA

- Junior ISA

- Personal Pension

- GIA

If you have a keen interest in investing and a fair amount of money left over at the end of each month to stick in the market, platforms that offer both tax-wrapper accounts and general investment accounts are an excellent choice. You can max out your annual tax-free contributions in your Stocks and Shares ISA and Personal Pension and then use your GIA once you meet your limit. Because they’re offered by the same provider, you only need to learn and use one platform, which saves you time and even costly mistakes.

Also consider: Will ISA rates go up?

Nutmeg fills its investment portfolios with the assets and securities it deems to be most in line with its investment strategy, without ties to a service provider. This differs from providers like Vanguard. (Vanguard can only sell Vanguard ETFs, which limits your investment choice.)

Nutmeg offers a range of portfolios, designed to align with your chosen risk level and investment style:

- Fully managed

- Smart Alpha portfolios powered by J.P. Morgan Asset Management

- Socially responsible investing

- Fixed allocation

- Thematic Portfolios

All five Nutmeg investment styles are built by experts and use exchange traded funds to diversify across stocks, bonds, industries, even countries.

The socially responsible investing (SRI) portfolio is proactively managed.

What does ‘socially responsible’ mean to Nutmeg? Nutmeg offers 10 SRI options aligned to 10 different risk levels. Each portfolio is built by Nutmeg using thousands of data points on issues related to environmental, social, and governance (ESG) principles. You can learn more about the specific make-up of each portfolio on the Nutmeg website. All SRI portfolios, however, invest in ETFs, so they are diverse and regularly rebalanced for performance, and avoid companies engaged in controversial activities, while focusing on those that lead their peers on ESG.

See also: Best Ethical Investment Funds

The fully managed account offers the same benefits as the socially responsible account, but there’s no social responsibility focus.

The fixed allocation portfolio offers diversity and the same access to ETFs but it doesn’t benefit from proactive management.

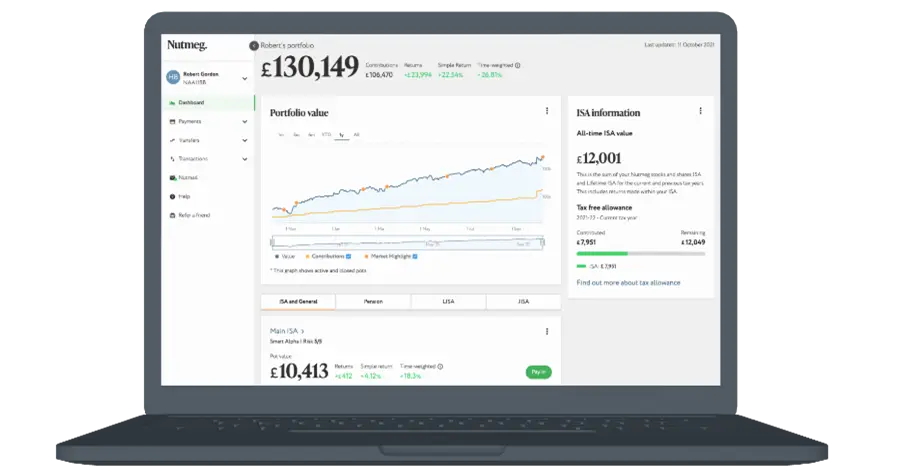

Nutmeg has collaborated with J.P. Morgan Asset Management to create a set of Smart Alpha investment portfolios that bring the power of J.P. Morgan Asset Management’s market insights and deep research expertise while maintaining the same level of transparency and control seen across all Nutmeg investment styles. The Smart Alpha portfolios are now available for personal pensions and can also be accessed via the ISA and General Investment Account types.

The thematic portfolios style is the newest addition to the range. Thematic portfolios is a long-term strategy that focuses on growing trends shaping the future, such as artificial intelligence (AI) adoption, energy generation and the ageing population. This approach invests in the companies that are likely to benefit from the growth of these areas.

Nutmeg’s thematic portfolios style gives you a globally diversified, risk adjusted portfolio with a tilt (up to 20% of equity exposure) towards your chosen theme. The majority of the portfolio is actively managed by the Nutmeg investment team, while the ’tilted’ part of the portfolio is made up of the ETFs that the investment team believe will deliver the best returns from the growth of the trend – something that is reviewed annually. It should be noted that this is only available to those investors who place in Risk Level 5 or above, but is a good option if you’re looking for more choice than with other investing styles and you want exposure to particular markets that you see as a smart choice.

While you won’t get to choose your own ETFs within a Nutmeg Stocks and Shares ISA or Personal Pension, you can be more confident that your portfolio options will contain a mix of investments that serve you rather than the provider. That’s because there are hundreds of thousands of ETFs available across all markets, allowing the Nutmeg experts to choose the funds they believe represent the best in class for each asset class, industry, or region.

Research Services & Tools

People know Nutmeg for its simplified approach to investing. It goes without saying that the charts and tools it provides are also going to be simple. After all, you don’t have much of an option to make use of complicated tools, particularly if you stick to the ISA or Personal Pension accounts when investing with Nutmeg.

Instead of charts and graphs, Nutmeg provides more general tools for financial planning and gives you the option to sort through the tools based on your existing knowledge.

Nutmeg’s knowledge centre reflects typical Nutmeg customers’ concerns and questions around basic personal finance and investing topics rather than in-depth market knowledge. Even if you select the “I really know my stuff” option, Nutmeg directs you more towards its philosophies and strategies than to in-depth tools and learning, during the onboarding journey.

One thing that sets investing with Nutmeg apart from other robo advisers is its financial advice offering. All investors have access to free financial guidance with a Nutmeg Wealth Manager. Investors can also choose their paid advice service, investors will get a tailored strategy and financial plan, with Nutmeg’s expert recommendations on the best route for each of their investments and other assets.

Nutmeg offers 3 financial advice tiers to choose from:

- Core

- Enhanced

- Review

Core:

- £900 inc VAT

- Create personalised plan

- Recommending ways you could achieve short and long-term goals.

- A comprehensive analysis of income, outgoings, savings, investment and pensions.

- Recommend products to make the most of available tax allowances

- Review risk level and investment style for your Nutmeg pot.

Enhanced:

- £1,350 inc VAT

- Everything from Core plus

- Model and compare potential outcomes

- Best strategy to help achieve future goals

- Full cashflow modelling to map out different financial scenarios

- Future income and expenditure forecasting

Review:

- £450 inc VAT

- Available to customers with Nutmeg financial advice in the last 5 years

- In-depth review of when your situation has changed

- A review of their existing financial plan

- Where free general guidance is not enough

- Want help to make the right adjustments

- Review and make recommendations on current investment style, financial contribution, or risk level

- Review of tax allowances and changes you could make

Nutmeg Fees & Charges

Fees correct as of November 2023. As fees may be subject to change, however, I suggest visiting the Nutmeg website for the most accurate and up-to-date figures.

Nutmeg charges sliding scale fees based on the five different investment styles you can choose to build your portfolio:

- Fully managed

- Smart Alpha

- Socially responsible investing

- Fixed allocation

- Thematic Portfolios

Fixed allocation portfolios are the cheapest because of the low-touch approach taken, meaning Nutmeg doesn’t need to service them as frequently. The annual fees for fixed allocation portfolios are:

- 0.45% up to £100k

- 0.25% beyond £100k

You will also pay investment fund costs to the fund providers. Fixed allocation portfolio costs are an average of 0.20% per annum. In addition, you can expect to incur a market spread of 0.03%.

A Fully managed, Smart Alpha, Thematic Portfolios and socially responsible portfolio will cost significantly more than the basic portfolio:

- 0.75% up to £100k

- 0.35% beyond £100k

The additional costs paid to fund providers include an average of 0.20% for fully managed portfolios, 0.24% for Thematic Portfolios 0.32% for Smart Alpha and 0.29% (on average) for socially responsible portfolios.

It’s important to note that there’s no relief on any of the portfolios for accounts holding more than £1 million in assets. The standard practice among investment providers is to stop charging management fees bonds once they meet the £1 million threshold. However, Nutmeg doesn’t do this, and it’s not clear whether it chooses not to or whether the typical Nutmeg investor never reaches a point where their account is worth £1 million.

Management fees are a standard charge across any investment platform that isn’t a barebones stockbroker. You won’t find a platform that doesn’t charge them unless you manage your own portfolios entirely. However, Nutmeg did axe other charges still found among some legacy institutions. So, when you invest with Nutmeg, you pay no:

- Set-up fees

- Trading fees

- Transaction fees

- Exit fees

That means you can take your ISA or Personal Pension to another provider without paying a hefty fee to get your money out. Although it’s an outdated practice, there are a few investment providers who still charge exit fees, so they’re always worth looking out for before you sign up. There’s nothing like pulling your money from a poorly performing portfolio only to take out less than what you invested as a result of exit fees. But, that won’t happen when you invest with Nutmeg.

Nutmeg FAQs

How safe is Nutmeg?

Which is better: Wealthify or Nutmeg?

Nutmeg Customer reviews

Professional and courteous human contacts for any queries. Within my Stocks & Shares ISA, I chose socially responsible and am very pleased with their performance over the past chaotic year.

- Fees

- Account opening

- Deposit and withdrawal

- Customer service

Simple App and easy to use format with plenty of guidance. No adverse issues encountered in the last 2 years since opening. Would recommend.

- Fees

- Account opening

- Deposit and withdrawal

- Customer service

2022 and early 2023 have been difficult years for all investors. Just comparing Robo investment companies my Nutmeg Alpha fund has performed substantially better than those of competitors for the last two years now. The online portal is very easy to use and customer services are exemplary. The fees seem a little on the high side.

- Fees

- Account opening

- Deposit and withdrawal

- Customer service