In short: The best stock trading apps for UK investors are interactive investor, eToro, City Index and InvestEngine to name a few. You will find it easy to open an account with these stock trading apps, and they have a good range of stocks and shares to buy.

There are a number of metrics I have used to identify the best stock trading app including cost, number of stocks available, usability, features, and research. This should provide you with all the information you need to identify which is the best stock trading app for your needs.

Trading apps have taken investing mobile, allowing users to buy, sell, and hold stocks as well as check the performance of their portfolios all from a mobile phone or tablet.

Also consider: My guide to Automatic Investing Apps

Browse the top stock trading apps in August 2025

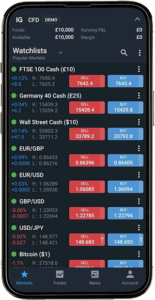

I’ve explored IG Investments to provide you with an in-depth review. IG stands as one of the best trading platforms for UK investors. Let’s dive in:

Key Features:

Key Features:

- Wide range of investment products, including spread betting, and stockbroking

- Extensive product offerings: Forex, Indices, Shares, Commodities, Cryptocurrencies, Bonds, ETFs, Options, and more

- User-friendly web and mobile trading platforms

- 24/7 customer service

Who Should Use IG Investments?

IG caters to a broad audience, including moderately experienced traders and professionals. Here’s a breakdown:

- Moderately experienced traders: IG’s Smart Portfolio offers a straightforward option

- Active traders: Share Dealing account for hands-on investors

- New investors: Smart Portfolio serves as a robo-advisory option

- Forex traders: IG is well-known for forex trading

Final Thoughts:

IG Investments offers a versatile platform suitable for various investor profiles. It provides an array of products and competitive fees, making it a strong choice for those who want flexibility and accessibility in their investments. The platform’s educational resources and customer support further enhance its appeal. However, the fee structure can vary, so it’s essential to assess your investment goals and trading frequency when choosing IG Investments.

Pros:

- Multiple funding and withdrawal options

- Access to IG Academy courses

- Intuitive and customizable trading platforms

- Extensive market coverage

- No withdrawal or inactivity fees for Smart Portfolios

Cons:

- No copy trading or backtesting integration

- Not optimal for infrequent traders

- Higher forex and stock trading fees compared to some competitors

Fees:

IG’s fee structure varies by product:

- Smart Portfolio: Annual fees can be as low as 0.22%

- Share Dealing: Commission fees on US shares depend on trading frequency

- Custody fee: £24 per quarter (can be avoided with trading activity)

Products:

- Smart Portfolios: A fully managed, diversified investment option

- Share Dealing: Ideal for experienced investors creating their portfolios

- Stocks and Shares ISA: Access to both Smart Portfolios and Share Dealing in one ISA

- SIPP: Self-Invested Personal Pension

- Other leveraged products include spread betting and CFDs

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

eToro were the pioneer of copy trading and today they have one of the largest copy trading communities in the world.

The trading app is well-designed and easy to use, making share trading a breeze, even for a complete beginner. There are some comprehensive functions to assist users with their trading including push notifications, flexible search functions, and two-step authentication including biometric ID.

What I like about trading stocks on the eToro app

You can access over 3,000 stocks at eToro which should be ample for most retail investors. Given that the premise of trading is to hold stocks for a much shorter period of time, this can make a massive difference.

eToro also provides stop-loss orders which can be used to automatically close out losing trades at a price level that has been predetermined by the user.

eToro also provides access to fractional shares, allowing investors to access stocks they may not otherwise be able to afford.

Fees: $5 withdrawal fee, $10 inactivity fee, currency conversion fees

Minimum balance: £10

Products available: General Investment account

{etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees

Plus500 provide access to their advanced analytical tool, Insights, via their trading app. This comes free of charge and can arm traders with useful analysis of millions of trades in real-time . This allows you to harness trader sentiment to help with your trading decisions, including the highest-yielding trades.

This can also work out as a really low-cost option with tight spreads and commission free trading.

Fees: Commission free trading and tight spreads, $10 inactivity fee

Minimum balance: £100

Products available: Trading Account

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

City Index is a low-cost, well-established platform that provides access to more than 4,700+ markets. Share trading is available via CFD or Spread Betting (which is exempt from Capital Gains Tax in the UK*). City Index is part of the NASDAQ-listed StoneX group.

Key Features

- Access 4,700+ markets

- Choose how you trade shares via Spread Betting or CFDs

- Quality news feeds from Reuters and in-house research

- Economic calendar and social media presence for retail investors

- Choice of trading platforms, including Metatrader 4 (MT4)

- Beginner-friendly educational resources

- Powerful research tools

Pros:

- Low-cost trading platform

- Great choice of assets

- Excellent education and research tools

- Great customer support

Cons:

- No MetaTrader 5

- Inactivity fee applied

Service Fees:

- Buy/Sell Spreads: Rather than charging commission, City Index’s charges are incorporated into the spread. You’ll need to open an account (or demo account) to see spreads on their 1,000s of markets but, depending on the market, both fixed and variable spreads are offered. These start at margins from 5% and fixed spreads from 0.4pts.

- Commission: There is no commission on spread betting markets. With CFDs, you’ll only pay commission when trading shares. Commission for these trades is typically 0.08%.

- Overnight funding: Overnight financing fees on both long and short positions are 2.5% +/- the benchmark regional interest rate.

- Guaranteed Stop Order: A charge is made for use of this feature. For full details, check the website.

- Deposit / Withdrawal fees: No charges.

- Inactivity fee: A monthly inactivity fee of £12 will be applied for accounts that are inactive for 12 months or more.

- Currency conversion: Spread betting accounts are not affected because all trades take place in one base currency, usually sterling. Fees apply on CFDs. Check the website for full details.

- Borrowing costs for shorting CFDs: Borrowing costs are incurred when you short a shares CFD position. Very few markets will incur a borrowing charge – check the relevant market information sheet for details.

Investment Types:

- Indices

- Shares

- Forex (FX)

- Commodities

Best for:

City Index is a great option for traders of all level seeking an uncomplicated platform from which to access CFDs and spread betting on desktop and mobile

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

When exploring into the world of stock trading apps, I found XTB to stand out notably.

Known as the premier commodity and forex broker, XTB now offers more than just derivatives trading. With zero-commission investing on real stocks and ETFs (up to £100,000 per month) and a flexible stocks and shares ISA, it has broadened its appeal to cost-conscious investors.

The platform’s usability is enhanced by a proprietary trading system, xStation5 platform, enriched with robust tools and features tailored for traders of all levels.

One notable update is XTB’s expanded product range, now offering access to over 6,900 instruments, including 3,000+ stocks and 1,300 ETFs. This breadth ensures traders can access a wide array of markets. However, users should note that MetaTrader 4 is no longer available to UK clients, which may be a downside for those accustomed to this tool. Despite this, XTB’s in-house platform delivers competitive functionality, including fractional shares, an ETF investment plan, and comprehensive research tools like sentiment indicators and stock screeners. The broker further distinguishes itself with an exhaustive educational resource set that caters to all levels of traders, complete with one-on-one mentoring opportunities provided by industry stalwarts through dedicated account managers.

Considering its comprehensive offerings and accolades, including being named “Brokerage of the year” in 2024 by Invest Cuffs, XTB genuinely merits a closer look for anyone seeking a premium trading experience.

Fees: XTB is one of the most competitive brokers, offering zero commission on real stocks and ETFs (up to £100k/month).

Minimum balance: No minimum balance

Products available: Standard Account, Demo Account, and Professional Services Account

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

What could be better on your stock trading journey than to start with a completely free share? That’s exactly what you get at Freetrade when you open and fund an account with at least £50.

The share you get will be valued between £10-£100 and by referring your friends to the app, you can obtain even more free shares.

What I like about trading stocks on the Freetrade app

If you are looking for volume of stocks to trade with then Freetrade won’t disappoint with over 6,000 US, UK, and European stocks to choose from. As with eToro, Freetrade has zero-commission trading, meaning you can buy and sell stocks without incurring any charges.

However, to access the full list of stocks, and invest using the Freetrade ISA, you will need to upgrade to Freetrade’s Standard Subscription Plan which comes in at £4.99 a month.

Freetrade also offers fractional shares which allow users to invest in US stocks for just £2.

Fees: Commission-free trading on all stocks, shares and ETFs

Minimum balance: £0

Products available: General Investing Account, S&S ISA, SIPP, Freetrade Plus

When you invest your capital is at risk, the value of your investments can go down as well as up and you may get back less than what you invest. *Other charges apply. Free share terms and conditions apply. The probability is weighted, so more expensive free shares will be rarer.

InvestEngine also allow you to mitigate your exposure to risk by investing in stocks via an ETF. This is one of the lowest-cost ways to do so with no platform fees, set-up fees, dealing fees, ISA fees, or withdrawal fees.

InvestEngine offer both managed and DIY solutions, bridging the gap between experienced and new traders.

What I like about trading stocks on the InvestEngine app

InvestEngine is a relative newcomer to the investment platform space, and the clean lines and modern feel of their trading app supports this. This is one of the most cost-effective ways of investing into an ISA and if you are nervous about selecting your stocks, or simply lack the time to study the market, then InvestEngine have a range of fully managed portfolios that can be carefully matched to your appetite for risk, financial goals, and starting investment amount.

Fees: 0.25% platform fee for managed portfolios, £0 DIY portfolio

Minimum balance: £100

Products available: S&S ISA, Personal Account, Business Account

With investment, your capital is at risk. This could mean the value of your investments goes down as well as up.

interactive investor are one of the largest trading apps in the UK by market share. Here you can trade stocks from the ii Trading Account, Stocks and Shares ISA, or SIPP.

The trading app is really well-designed and very user-friendly with the ability to manage your portfolio as well as trade shares on the go. It even provides access to the latest news, market performance, and watchlists.

What I like about trading stocks on the interactive investor app

The sheer volume of shares available on the interactive investor trading app (more than 40,000 UK & international investment options) makes this trading platform a dream for DIY investors looking to build a diversified portfolio.

The flat fee works out really well for larger investment pots and includes all the account types. You can also swerve the trading fees at ii by topping up monthly with their regular investing service. This can help to reduce risk by investing little and often, thus averaging out the price you pay for shares over time.

Fees: £5.99 per trade, annual custody fee starting at £4.99, £40 bonds fee

Minimum balance: £0

Products available: S&S ISA, Junior cash ISA, Junior stocks and shares ISA, Self-invested personal pension, company account, cash savings

Capital at risk.

Saxo successfully caters to traders of all levels of experience with their range of dedicated trading platforms including their award-winning proprietary trading platform, SaxoTraderGO which is ideally suited for beginners and allows you to trade on the go with the mobile trading app.

They also cater well to high-volume traders with their tiered fee structure that provides an opportunity to achieve lower transaction fees. However, it is worth pointing out that whilst Saxo will reward high-volume traders, they are not a low-cost broker, but rather a high-end broker that offers an industry-leading amount of assets, research, tools, and platforms.

What I like about trading stocks on the Saxo trading app

There are over 23,500+ stocks available from global markets which is one of the highest numbers I have come across to date. Not only this, but the trading app comes with some pretty impressive trading tools including fundamental analysis tools, news and expert research, technical analysis tools, extensive charting, performance analysis, and returns breakdown to name a few.

You can also utilise curated stock insights for investment inspiration and live market updates. Education includes podcasts, webinars, and more and risk management features can be automated.

Products available: Saxo Account, Joint Account, ISA, SIPP, Trust Account, Corporate Account, Professional Account

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs, or any of our other products work, and whether you can afford to take the high risk of losing your money. The value of your investments can go down as well as up. Losses can exceed deposits on some margin products. Professional clients can lose more than they deposit. All trading carries risk.

Webull is a recent entrant to the UK market, popular for its low costs and commission-free trading of US stocks. However, it’s limited to US stocks, which may not suit those seeking global diversification.

UK investors also face FX fees when trading on this platform.

Final thoughts

Webull offers a cost-effective option for UK investors interested in trading US stocks, but its limited asset range and FX fees may deter those seeking diversified portfolios. It’s a suitable choice for traders focused exclusively on US markets, but other platforms provide broader investment opportunities.

Pros

- Low cost with no platform fees and low commissions.

- Access to fractional shares.

- Fully regulated by the Financial Conduct Authority (FCA).

- Protection under the Financial Services Compensation Scheme (FSCS).

Cons

- Limited to US stocks only.

- FX fees apply for currency conversion.

- No tax-efficient account options like ISAs.

Key Features

- Offers commission-free trading of US stocks.

- No minimum deposit requirement.

- Limited asset class, primarily focused on US stocks.

- Webull’s parent company is Chinese-owned but regulated in the UK.

Fees

- No platform fee.

- Low commission: 2.5 basis points per trade (0.025%).

- FX fees: Currency conversion at the time of execution plus a spread of 0.35%.

Products

- General Investment Account

Your capital is at risk. You may lose money on your investments.

How to decide which stock trading app is the best for you

To decide on the best trading app for you, you should first compare the different features on offer from each stock trading app, then choose one accordingly.

For example, if you’re still new to stock trading and wish to advance your knowledge of investing while you trade, it may be worth finding the best trading app that offers educational materials, or advanced trading tools designed to take some of the complexity out of trading and help you develop your own trading strategies.

Similarly, some stock trading apps offer access to a free demo account that lets you practise making trades with virtual money. This could be a good choice if you aren’t yet confident making your own investment decisions, and are concerned about putting your money in the market.

You should also keep an eye out for trading costs when choosing the best trading apps. Some brokers may charge a percentage-based fee or commission on every trade, while others may charge a fixed fee.

If you’re planning on trading large volumes of shares, it may be wise to choose a stock trading app with commission-free trading or fixed fees so these costs don’t eat into your potential profits.

Also, non-trading costs, such as platform fees or withdrawal fees, will vary between different brokers, so it’s worth taking these into consideration when choosing the best trading apps.

What is stock trading?

Stock trading is the act of purchasing a share in a company, then either waiting until that investment rises in value or relying on the income that it may provide.

A company usually issues stocks in an attempt to raise money to fund any planned projects, or simply to operate the business.

Trading takes place on the stock market, and there are many different markets you can trade on, such as the London Stock Exchange (LSE) or the New York Stock Exchange (NYSE).

Depending on the company, stocks tend to be highly liquid. However, even though they can be bought and sold relatively quickly, they are generally seen as long-term investments . This is because you typically have a greater chance of positive returns the longer you hold your stock – sometimes as long as 10 or 15 years.

The most common way to generate returns through stock trading is speculation. This is when you buy a stock for a certain price, wait for it to appreciate in value, and then sell it again for a profit.

Despite this, there is another way to generate returns from stock trading: dividend payments.

What are dividends?

Dividends are regular payments made by companies to investors as a reward for investing in that company.

A company’s dividend yield will depend on its general performance – if a business is performing well, it might distribute the profits in the form of dividends. That said, performance doesn’t automatically mean a company’s dividend yield will increase – the rate is determined by the company’s board of directors.

Dividend yields are typically expressed as a percentage of a company’s share price. For instance, if you purchased one share in Apple for $200, and its dividend yield was 2.5%, you would receive annual dividend payments of $5.

Dividends are often ideal for income investors. Rather than closely monitoring your investments and waiting for them to appreciate in value, you can instead invest in companies that pay dividends and rely on the payments over a longer period of time.

It’s important to remember that not all companies offer dividend payments; some will instead retain profits and reinvest them into the business.

Investing for growth vs investing for income

The two methods of investing described above are commonly referred to as investing for income, and investing for growth.

If you are targeting a regular income that you can either spend in your day-to-day life, or reinvest, then investing for an income might better suit you. Income stocks tend to be companies that are relatively stable and offer high dividend payments.

It’s worth noting that, while income stocks are typically more stable, they usually have lower growth potential.

As such, you should keep an eye out for companies that have high dividend yields, such as the “Dividend Aristocrats”, which are companies that have increased their dividend yield for at least 25 consecutive years.

Meanwhile, investing for growth involves purchasing stocks in companies that have the potential to increase in value. While they may not offer regular payments in the form of dividends, this growth potential could result in your investment rising in value significantly.

Growth stocks are typically companies that seem to be growing at a faster rate than the general market, and usually use the majority of their revenue to fund further expansion.

They tend to be newer companies with exciting and innovative products that are expected to drive growth in the future. However, since these companies are often less established, they typically come with more risk of losing value on your investment.

How are your investments taxed in the UK?

The levels of tax you will face on your investments depends on the type of income you receive, and where you hold your investments.

If you’ve invested through an ISA, you’ll typically be protected from Income Tax, Capital Gains Tax (CGT), and Dividend Tax. This is because an ISA acts as a “tax wrapper” that shields your investments.

If you aren’t holding your investments in an ISA, you will typically be required to pay CGT if you realise a profit from their sale. As of the 2022/23 tax year, CGT rates are:

- 10% (or 18% on gains from the sale of property that isn’t your main residence) for basic-rate taxpayers

- 20% (or 28% on gains from the sale of property that isn’t your main residence) for higher- and additional-rate taxpayers.

You are entitled to earn gains from the sale of your investments up to a certain value before you’re required to pay CGT. This is called the “annual exempt amount”, and as of the 2022/23 tax year, stands at £12,300.

You should bear in mind that the CGT annual exempt amount will drop to £6,000 in the 2023/24 tax year, then again to £3,000 in 2024/25.

You’ll also pay tax on any dividends you earn through your non-ISA stocks. As of the 2022/23 tax year, Dividend Tax rates stand at:

- 8.75% for basic-rate taxpayers

- 33.75% for higher-rate taxpayers

- 39.35% for additional-rate taxpayers.

Much like the CGT annual exempt amount, you can also earn a certain amount of money from dividends before you’re subject to tax. This is called the Dividend Allowance, and as of the 2022/23 tax year, stands at £2,000.

Following the chancellor’s autumn statement, this allowance will drop to £1,000 in the 2023/24 tax year, then further to £500 in 2024/25.

The different ways you can invest in stocks

There are several different ways you can invest in stocks. Continue reading to discover the different ways you can conduct stock trading.

Direct investments

Direct investing is perhaps the most common way to trade stocks, in which you simply buy stocks directly from one of the many stock exchanges via a broker. You can then either hold onto your investment until it rises in value, or rely on its dividend payments if there are any.

Funds

Funds are a form of pooled investment that reinvest your capital into a selection of financial instruments.

They are typically overseen by fund managers, who tend to be experienced investors. These fund managers will typically aim to diversify the fund’s investments in order to reduce risk by investing in a range of different securities, such as:

- Stocks and shares

- Commodities

- Foreign currency

This means that, by investing in a fund, you’re gaining instant exposure to many stocks from a single investment.

The value of a fund is based on the performance of its constituent investments. If the fund’s investments perform well, the value of the fund – and so your units in it – will rise.

This allows you to purchase a stake in a fund and then sell it for a profit when the fund’s value rises, or hold onto it and rely on regular dividend payments.

There are several different types of fund available, including:

- Exchange-traded funds (ETFs)

- Mutual funds

- Index-linked funds

Funds can either be passive or active. The investments held within active funds are regularly examined and monitored, and managers aim to outperform financial markets.

Meanwhile, passive funds take an “invest and hold” approach, and aim to match pace with an underlying index or benchmark.

Derivatives

You can also trade stocks in the form of derivatives. This is essentially when you “bet” on the performance of a particular security.

One of the most popular ways to trade derivatives is through spread betting. This is when you “stake” a certain amount of money for every point a company’s value rises or falls. You can take a long position, which predicts the value of a company will rise, or a short position, which predicts it will fall.

For example, say you staked £100 for every positive point of movement for Apple’s share price. If Apple’s share price increased by two points, you would earn £200 from your spread bet.

Of course, if Apple’s share price fell by two points in the above example, you would instead lose £200.

Another popular method of derivative trading is with “contracts for difference”, or CFDs. Trading CFDs is similar to spread betting, except that you will instead receive the difference in price from when you first opened your position to the close when you trade CFDs.

It’s vital to remember that trading CFDs and spread betting are both fairly complex. In fact, more than half of retail investor accounts lose money when trading CFDs. Make sure you properly understand the risks involved with trading spread bets and CFDs before you try your hand at it.

The different types of investment accounts

There are different types of investment accounts that determine how much you can invest, and the amount of tax you’re liable to pay. Keep reading to discover the different types of investment accounts.

Stocks and Shares ISA

A Stocks and Shares ISA is a type of investment account that allows you to build a tax-efficient portfolio.

As well as stocks and shares, you can invest in a wide variety of different securities in a S&S ISA. This includes:

- Bonds

- Unit and investment trusts

- Exchange-traded funds (ETFs)

- Index funds

Crucially, your investments in a Stocks and Shares ISA are typically protected from Income Tax, CGT, and Dividend Tax.

It’s important to remember that you are limited to the amount of money you can deposit in your ISA each year. As of the 2022/23 tax year, this ISA Allowance stands at £20,000.

This £20,000 allowance covers all types of ISA, too. For example, you could deposit £10,000 into your Stocks and Shares ISA, £4,000 into your Lifetime ISA, and £6,000 into your Cash ISA, meaning you would have used your entire ISA Allowance.

General Investment Account (GIA)

A General Investment Account (GIA) allows you to build a portfolio of investments with no deposit limit.

However, unlike ISAs, any investments made in a GIA will typically be subject to CGT if you realise profits exceeding the CGT annual exempt amount.

You may also face Dividend Tax if you earn money from dividends above the Dividend Allowance.

A GIA could be a good choice if you’ve used up your entire ISA Allowance and still want to make investments.

Which company is best to invest in?

Technically, there is no “best” company to invest in, as different companies will come with varying benefits and downsides to investing.

For instance, if your investment goals are to generate returns through growth, it may be worth investing in a newer company that reinvests its revenue to target rapid growth.

Meanwhile, if you’d rather invest for an income, you may want to keep an eye out for more stable companies with higher dividend yields.

How to decide which investment would best suit your portfolio

With so many different companies out there for you to invest in, it can sometimes be tricky to decide which would best suit your portfolio.

To find potential companies to invest in, it may be worth staying up to date with industry news. This way, you could be better placed to predict a company’s performance based on its actions.

There are also many stock tips and suggestions available that can give you an idea of some companies that are worth watching, such as our weekly share tip guides.

Best Stock Trading Apps in the UK FAQs

How do I start trading in the UK?

What is the best stock trading app in the UK?

The best stock trading app UK will depend on your individual needs and circumstances. For example, if you’re still new to investing, it may be worth using trading apps that have educational materials on offer.

Or, if you plan on trading in large volumes, you may want to choose a trading app with lower, or fixed, fees.

Please note:

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

CFDs are complex instruments and more than half of retail investor accounts lose money when trading CFDs. Please make sure that you know these risks before you start trading and that you’re aware there’s a high chance of losing money rapidly on your investment.