How to start saving money

No matter what you want to achieve with your money, the first step is almost always to start saving.

In this step by step guide, I’ll show you exactly how to start saving money so that you’re able to reach your financial targets.

I’ll take you through the importance of setting financial goals, before showing you some of the best strategies and different financial products like money saving apps, you could consider to help you save money.

The 5 steps to saving money

- Work out what you want to achieve – The first step in any savings strategy will be to set your financial goals. That way, your savings have a clear focus, motivating you to stick to your plan.

- Create a budget – Once you know what your goals are, you need to start thinking about how much money you’ll actually have available. To do this, create a budget of your income and expenditures so that you can see exactly how much you have to do this.

- Research strategies and products that can help you – Using this savings figure, you can start looking at the strategies, products, and apps available to you that can allow you to give your savings a boost.

- Start saving – Finally, you can put these into action and start saving towards your goals.

- Paying off interest early – To save money on interest, you might want to consolidate or pay off early any poor credit loans, or bad credit car finance for example.

Setting your savings goals

Having a savings goal is a key part of saving money and is the first step you should take when you want to start saving. After all, if you don’t know what you’re saving for, then it can be much harder to do it.

Setting goals like this can narrow your focus, further motivating you to stick to your habits and strategies.

In general, your goals can be divided into three categories: short-, medium-, and long-term goals.

Short-term goals

A short-term saving goal is anything that will take less than a year to complete.

It could be something such as clearing credit card debt or building up an emergency fund.

Medium-term goals

Your medium-term goals will typically take between one and five years to complete.

These could include building enough savings so that you can apply for a mortgage or even put a down payment on a house.

It could also include other moderately expensive targets, such as buying a car or saving for a dream holiday.

Long-term goals

Finally, your long-term goals include anything that will take five years or more.

For example, a common long-term savings goal for many people is retirement.

It may seem premature for you to be thinking about long-term goals such as retirement, especially if you’re still in the middle of your working life.

But actually, the earlier you work out what you want to achieve and how much you’ll need to do it, the sooner you can start putting plans in place to get there.

Have you considered savings apps and websites?

Outside of using strategies and products to reign in your spending, you could also look at the various apps and websites that have been specifically designed to help you save money.

MoneySavingExpert

MoneySavingExpert (MSE) is one of the best websites for saving money in the UK, combining tips, deals, and practical ways for you to make the most of your money.

For example, MSE has information on the best bank accounts, including the most favourable interest rates for a current or checking account.

Similarly, the site contains plenty of information on how to get a better deal on everything from mortgages to energy, water, or internet services.

You can also passively read MSE’s simple tips by signing up for their email newsletter. This newsletter is packed full of tips and the latest deals that, when combined, could see you save hundreds of pounds.

Cleo

Cleo is an innovative app that connects directly to your main current account and then provides analysis and insights into your spending habits.

One of Cleo’s best features is that it allows you to create budgets. This can be useful in combination with a strategy such as the 50/30/20 saving strategy.

Emma

Emma is an entirely free money-saving service, helping you with a full analysis of your finances when you link it up to your bank account.

From identifying areas where you’re overspending to finding old subscriptions that take your money without you using them, you can use the data Emma provides to clean up your budget and improve your savings.

Moneybox

Moneybox has become a popular investment service, boasting over 700,000 customers, but it can also be great for saving.

When using Moneybox, you can use its “round-up” feature which rounds up your purchases to the nearest pound. While this may be pennies to begin with, these amounts can quickly add up.

This can help to turn a bit of your spending into savings. You can then invest or save this money in a variety of accounts.

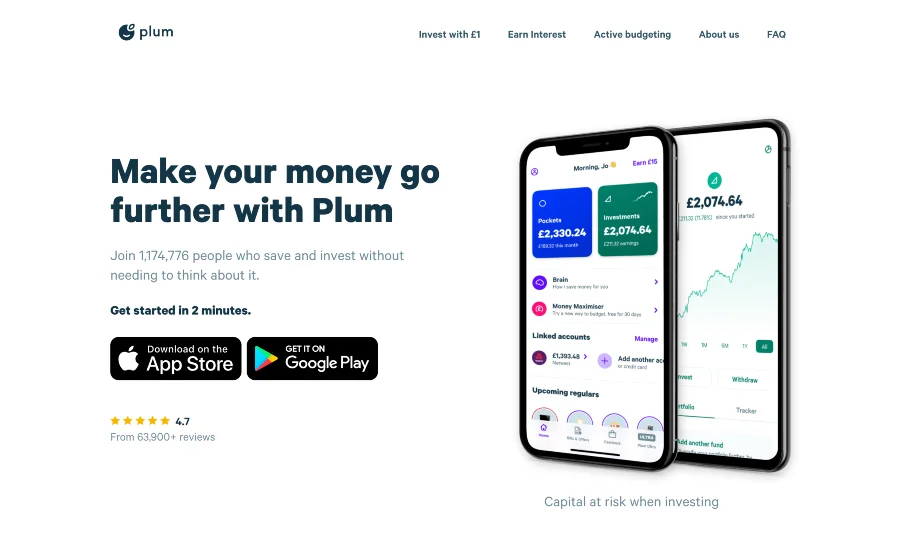

Plum

By connecting Plum to your bank account, the intuitive app calculates what you can afford to save based on your past habits and then does it for you.

Much like Moneybox, Plum also allows you to save or invest your money in a variety of accounts, including investment accounts and pensions.

How can I quickly save £1,000?

If you want to quickly save £1,000, the answer will likely be in a combination of the strategies above.

Start with your budget and then work from there, cutting out spending as you go. Then in the meantime, consider adding strategies and products that help you to reach your targets.

The key is not to get disheartened at the first few hurdles of saving. Give your strategies at least six months, potentially even up to a year, so that you can really see the impact of changing your behaviours.

From there, you can assess how successful they’ve been and then start making changes to improve your situation even further.

Taking financial advice

If you’re still unsure of the most appropriate strategies and products to use to help you save money in your personal circumstances, or you want to save money quickly but you’re not sure how to do so, you could consider working with a financial advisor.

A financial advisor can help you to work out your financial goals and then find the right strategies and products to help you achieve them.

Please note

The information in this article does not constitute financial advice.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.