The best fixed rate cash ISAs can offer savers more interest in exchange for locking their money away for a fixed term. However, with interest rates being historically low across the board and inflation on the rise, is this really the best way to grow your savings or would you be better served with a stocks and shares ISA?

Read my fully updated review to find the best rates currently being offered on a fixed rate cash ISA as well as my top picks for alternatives that could help you grow your savings quicker.

Top ISA alternatives to fixed-rate cash ISAs

Discover my top cash ISA alternatives below, be sure to read about each provider in detail before making a decision.

Top Cash ISA alternatives at a glance

- Top ISA alternatives to fixed-rate cash ISAs

- What is a fixed rate cash ISA?

- Best fixed rate cash ISA interest rates

- Where should I put my savings?

- What is the best interest rate available for savers?

- Which is the best stocks and shares ISA?

- Useful information

- What is the ISA allowance for 2021/22

- Which is best, ISA or bonds?

- Best Fixed Rate Cash ISAs FAQs

- The number one choice for UK Investors

- ISA options available from £25 per month

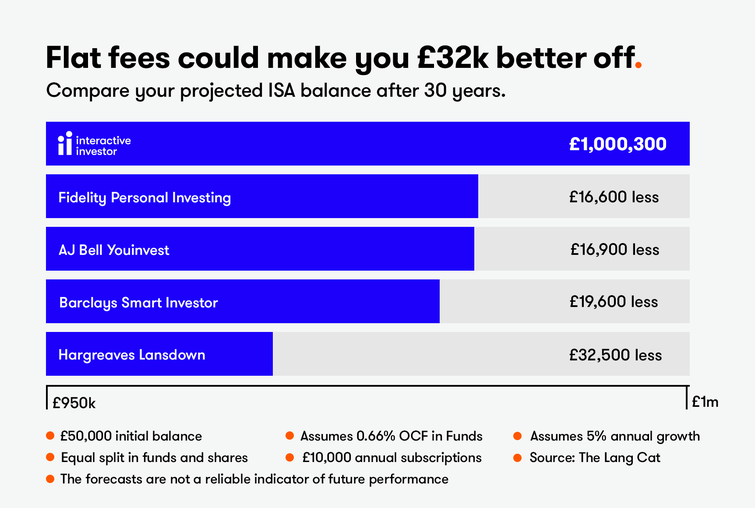

If you are a DIY investor who plans to build a diversified portfolio from a range of individual stocks and funds, then interactive investor is the best platform to meet your needs.

Here, you can access more than 40,000 UK and international investment options, and the trading app provides plenty of functionality for managing your portfolio.

Important information - investment value can go up or down and you could get back less than you invest. If you're in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.

XTB’s stocks and shares ISA offers UK investors a tax-efficient way to grow their wealth while benefiting from the platform’s competitive pricing. With XTB flexible ISA, you can withdraw funds and repay them within the same tax year without impacting your annual allowance, giving you more control over your investments. The account is free to open and includes the same zero-commission investing on real stocks and ETFs as XTB’s general accounts, making it one of the most affordable ISAs on the market. While ISA transfers from other providers aren’t yet available, this feature is expected soon. Whether you’re building a diversified portfolio with 3,000+ stocks and 1,300 ETFs or starting with fractional shares, XTB’s ISA is an excellent choice for investors.

As with any investment the value can go down as well as up. Past performance is no indicator of future performance. The tax treatment of ISAs depends on your individual circumstances and may be subject to change in the future.

- 100% guarantee – Fees refunded if not satisfied.

- Pick your own investments or choose a ready-made portfolio.

With a Hargreaves Lansdown ISA, you have access to 2,500 different funds, shares, and trusts. You can also access shares in Europe, the United States, and Canada. The number of investment options is attractive to hands-on traders, but if you are new to the product or prefer to rely on Hargreaves Lansdown’s advice, you can also take advantage of their Portfolio Management Service with one of six ready-made investment portfolios.

As with any investment the value can go down as well as up. Past performance is no indicator of future performance. The tax treatment of ISAs depends on your individual circumstances and may be subject to change in the future.

If you are looking for a low-cost, simple way to invest, then look no further than InvestEngine. Here, you can invest in a choice of 500+ ETFs for as little as £1.

Exchange Traded Funds (ETFs) are actually a lot simpler than they sound. They are merely a mix of assets, including commodities and shares, that aim to track the performance of a stock market. They make investing a breeze and are diversified, which can help reduce your risk.

With investment, your capital is at risk. This could mean the value of your investments goes down as well as up.

Is a fixed rate cash ISA the best place to grow your savings?

There is little doubt that placing your savings in a fixed rate ISA will attract a better rate of interest than you would gain in an easy access cash ISA. However, since the introduction of the Personal Savings Allowance, unless you are an additional rate taxpayer, there is really very little benefit to having your savings in an ISA at all, as normal savings accounts will often offer better rates of interest.

For those needing access to their savings but still wanting to access the best interest rates available, my recommendation would be to head to Raisin, a marketplace that connects users to the best interest rates from a wide range of banks and winner of Best Savings Provider at the British Bank Awards.

If you are able to lock your money away for at least 5 years, then my recommendation would be that you consider a stocks and shares ISA, as historically investing your money has offered a much better rate of return than any of the cash ISAs available.

What is a fixed rate cash ISA?

Fixed rate cash ISAs are savings accounts that are designed to lock your money away for a set period of time, earning interest, tax free. Locking your money away like this achieves several objectives. Firstly, because of the reduced amount of administration on this kind of account, they often offer higher interest rates than their flexible counterparts allowing you to maximise your returns. They also offer security in the interest rate, as this is fixed for the term of the ISA. Lastly, locking your money away like this removes all spending temptation and acts to secure those funds for your future.

That being said, cash ISAs by law have to give you access to your money at a time of your choosing, therefore, you can withdraw your funds, however, this will usually come with a heavy penalty in the case of a fixed rate cash ISA.

Best fixed rate cash ISA interest rates

Of all the types of cash ISA on offer, the best cash ISA for interest rates is the fixed rate cash ISAs. However, the rate you are offered largely depends on both the provider, and the length of the term. We compare fixed rate providers for each term and identified some of the best rates available in a fixed rate ISA today.

Please note: Rates correct at 25/02/2022. Please check the latest rates with individual providers.

Best 1 year fixed rate cash ISA

| Provider | AER | Min. Opening Balance | Transfer In? |

|---|---|---|---|

| OakNorth Bank | 1.1% | £1 | Yes |

| Shawbrook Bank | 1.06% | £1,000 | Yes |

| Secure Trust Bank | 1.05% | £1,000 | Yes |

Best 2 year fixed rate cash ISA

| Provider | AER | Min. Opening Balance | Transfer In? |

|---|---|---|---|

| Virgin Money | 1.36% | £1 | Yes |

| UBL | 1.36% | £2000 | Yes |

| Secure Trust Bank | 1.3% | £1,000 | Yes |

Best 3 year fixed rate cash ISA

| Provider | AER | Min. Opening Balance | Transfer In? |

|---|---|---|---|

| Leeds Building Society | 1.30% | £100 | Yes |

| Skipton Building Society | 1.30% | £500 | Yes |

| Close Brothers | 1.5% | £10,000 | Yes |

Best 4 Year Fixed Rate Cash ISA

| Provider | AER | Min. Opening Balance | Transfer In? |

|---|---|---|---|

| UBL UK | 1.51% | £2,000 | Yes |

| United Trust Bank | 1.50% | £15,000 | Yes |

| Secure Trust | 1.45% | £1000 | Yes |

Best 5 year fixed rate cash ISA

| Provider | AER | Min. Opening Balance | Transfer In? |

|---|---|---|---|

| Aldermore | 2.10% | £1,000 | Yes |

| Paragon | 1.50% | £500 | Yes |

| Skipton Building Society | 1.45% | £500 | Yes |

Where should I put my savings?

The AERs (Annual Equivalent Rates) listed above are likely to be the best rates you can source on a cash ISA. Therefore, if you don’t need your money for the near future, and are earning over and above the personal allowance, then it makes sense for you to enjoy the tax benefits of a fixed rate ISA.

However, for smaller pots that will generate an income that falls within the personal allowance, it may prove more profitable to find a cash savings account that offers a good interest rate. Virgin Money are currently offering 2.02% AER variable interest on up to £1,000. For anyone with more than £1,000, Raisin offer a way to access the best interest rates available and they also offer a welcome bonus of £50 on deposits of over £10,000. Of course there is nothing to stop savers from enjoying the higher interest rates in a cash savings account and then transferring all their allowance into a fixed rate ISA just before the financial year comes to an end in order to avoid any taxes on income generated from those savings.

Another way to increase your returns on savings is to invest your money in a stocks and shares ISA. Whilst there is a lot more risk involved when investing your cash

What is the best interest rate available for savers?

For the best interest rates currently available I would recommend Raisin, a UK marketplace that connects savers with a range of banks that offer the most competitive rates. They also have a £50 welcome bonus and savers can manage all their savings accounts from one place. For my full Raisin review simply click here.

Also consider: Will ISA rates go up?

The answer to this largely depends on what sort of investor you are and how much money you wish to invest.

For a low cost option you won’t find better value than Vanguard, although with Vanguard you can only invest in their own funds. That being said, Vanguard funds have historically performed well.

For the more experienced investor looking for an extensive range of investments with which to build your own portfolio, we would recommend Interactive Investor. Interactive Investor offers a cost effective service which is ideal for medium to large portfolios. However, the fixed fee means that investors with a small portfolio are likely to pay over the odds at Interactive Investor.

If you are new to investing or feel you lack the time or knowledge to get a handle on your investments, then you may want to consider a completely managed provider.

Useful information

Can I lose money in a stocks and shares ISA?

Definitely, by its very nature the Stock Market is a volatile beast and the value of your investments is likely to go up as well as down. However, with time, it is possible to ride out any volatility in the market and enjoy decent returns on your investments.

This is the reason we recommend you don’t engage in investing unless you are happy to lock your money away for five years minimum and never invest more than you can afford to lose.

Are ISAs worth it in 2022?

The UK government has estimated that 95% of savers are no longer paying any tax on their savings, largely due to the introduction of the Personal Saving Allowance, which has eradicated tax on the first £1,000 earnt from savings, for basic-rate taxpayers. Higher-rate taxpayers can also reap these rewards, however, they are entitled to a smaller tax-free allowance of £500.

This poses the question of whether ISAs still represent good value as a tax free savings vehicle, or whether savers might be better off placing their money in a high interest savings account. Certainly, for any amount below the Personal Saving Allowance, your savings would be best served in a high interest savings account, such as you would find at Raisin, or, in a stocks and shares ISA should you be able to lock your money away for at least 5 years.

However, there is still value to be had in ISAs in some circumstances.

Additional rate taxpayers who don’t receive any Personal Savings Allowance and have no appetite for investing, would almost certainly benefit.

Is a cash ISA better than a savings account?

This very much comes down to the sum of money you plan to save and which tax band you currently sit in. If you are a basic rate taxpayer, then you can earn up to £1,000 income from your savings completely tax free. If you are earning less than this amount in interest per annum then you may be best to keep your savings in a high interest savings account.

However, if you are earning over this amount from your savings, it would certainly represent better value to keep your savings in a cash ISA in order to protect your interest from the taxman. Also it is worth remembering that the tax free element of a cash ISA means that the normal savings rate on a savings account would have to be 82% higher for it to beat a cash ISA.

For savers who are a higher rate taxpayer, a cash ISA is even more likely to represent good value as your personal savings allowance is reduced to £500.

Are fixed rate cash ISAs a good idea for a higher rate taxpayer?

The personal allowance for a higher rate taxpayer is reduced to just £500 which means that for this bracket of savers, an ISA is even more valuable.

Can ISAs go down in value?

A fixed rate cash ISA can not go down in value and you are guaranteed a fixed rate of interest and to get back what you put in plus any interest you earn on your balance for the duration of the term of the fixed rate ISA. However, should you put your money in a stocks and shares ISA it is possible for it to go down in value in response to fluctuations in the marketplace.

Can I deposit money into a fixed rate ISA?

Most providers will give you a set amount of time when you open your fixed rate ISA Account, with which to make your deposits and transfers before locking the account for the duration of the term. This means that once this period is over you won’t be able to make any changes to the account using deposits or withdrawals without incurring a penalty.

How Many ISAs can I pay into?

You can only pay into one of each type of ISA in any one tax year. Each payment into each type of ISA will count towards your ISA allowance of £20,000. This means that you can make payments into one cash ISA, (a fixed rate ISA would count as a cash ISA), one stocks and shares ISA, one Help to Buy ISA, one Innovative Finance ISA and one Lifetime ISA in any one tax year.

What happens if I pay into two ISAs?

This is a common mistake made by savers but thankfully one that can be resolved. Your best course of action would be to contact HMRC on their ISA helpline 0300 200 3300 and explain what has happened and they will advise you as to the correct course of action. You should never try to correct this mistake yourself as you would risk losing your ISA allowance.

What is the ISA allowance for 2021/22

The current ISA allowance for 2021/22 is £20,000.

Which is best, ISA or bonds?

A bond is a type of investment that comes in the form of a loan and can earn money in the form of interest. Like a cash ISA, you are guaranteed to get back what you put in plus any interest earned.

When choosing between a bond and an ISA you will need to answer the following questions:

- How long can you leave your money untouched for?

- What is your appetite for risk?

- Which tax bracket do you currently sit in?

If you are confident that you won’t need access to your money for a set term, then you may want to consider a fixed term bond as these will often offer better rates than a cash ISA. However, if you are looking for the best possible returns and can commit to not touching your cash for five years or more, then you may want to consider an investment ISA as this will offer the best returns of all. Of course placing your money in a stocks and shares ISA comes with a degree of risk, however, they do historically provide better returns over time than either a cash ISA or Bonds.

How to choose the term of a fixed rate ISA

There are several things to consider here. You will notice that the longer the term, the higher the interest on a fixed rate ISA. However, the most important thing is that you are in a position to have your money locked away for the duration of the term as any early access will incur a hefty penalty.

The other thing to consider is whether the interest rate is likely to rise in the near future. Following COVID and Brexit, the interest rate as set by the Bank of England in the UK is at an all time low and locking yourself into a lengthy term on a fixed rate ISA could leave you unable to take advantage of an increase in the interest rate, should it rise. However, there is a chance that interest rates will go down, in which case being locked into a fixed term ISA would be an advantage.

The term you choose on your fixed rate ISA should depend on your circumstances, however, should you be comfortable having your money locked away for five years or more, you may want to consider a stocks and shares ISA instead as these usually offer better returns.

Also consider: Will interest and savings rates rise in 2022?

Should you pay off your mortgage before saving into fixed rate ISAs?

This depends on your unique circumstances, however, we would recommend that you check the interest rates on your mortgage, and if those are higher than what you would be earning within cash ISAs, then you use your money to offset your mortgage first.

How safe are ISAs?

Most providers of ISAs are authorised and regulated by the Financial Conduct Authority, which assures customers that all dealings uphold certain ethical standards. The other entity which ensures the safety of your money is the Financial Services Compensation Scheme which, should your provider go bust, will compensate you up to the value of £85,000 on any money lost. It is best to ensure that the provider you are considering are offering protection by the Financial Services Compensation Scheme.

Making a withdrawal from a fixed rate ISA

You can withdraw your money from Fixed Rate ISAs, however, you will incur a hefty penalty charge which could amount to some, or all, of your interest earnt should you withdraw before the end of the term of the ISA. If you think you will need access to your cash, then you may be better suited to an Easy Access ISA. While the AER may not be as competitive, an easy access cash ISA gives you instant access to your funds without incurring a fee.

Rules surrounding unused ISA allowance

With your ISA allowance it is a case of ‘use it’ or ‘lose it’. Once the financial year has ended, any unused allowance is lost and cannot be recovered. This is the case for all ISAs including a fixed rate ISA.

Can I split my ISA allowance between fixed rate ISAs and easy access ISAs?

Yes, and sometimes this is a very sound strategy that allows you to take advantage of the higher rates often offered in fixed rate cash ISAs and the flexibility that comes from an easy access ISA. However, you should still remain within the ISA allowance across all the ISA accounts you deposit into.