True Potential Investor (TPI) is one of a number of growing Robo-Adviser Investment Platforms which has headquarters based in Newcastle upon Tyne, UK.

True Potential Investor offer actively managed portfolios with varying risk levels and have shown solid ROIs over the last four and a half years they’ve been in business. Their product range currently includes a Stocks and Shares ISA, General Investment Account and a Personal Pension.

Find top providers for stocks and shares ISAs in our up-to-date guide.

During the course of this True Potential review, I have tested every corner of the platform and assessed its accounts, investment options, resources, financial services provided, and fees, in order to provide you with an unbiased account of whether this would be a suitable platform for your needs.

It has been my finding that True Potential is more suited to some investors than others which I have gone into in more detail below.

True Potential have an informative and helpful customer service team who are available 8 am-8 pm Monday to Friday to answer any general questions; though they do not provide the services of a financial adviser.

Their product is suitable for beginner investors who want to have minimal involvement in where their funds are invested. Those with a solid appetite to risk could see some great returns over longer periods of time.

True Potential Ratings

Overall

Pros

- Clear, jargon-free dashboard

- No charge for withdrawals

- Great customer service with a video chat function

Cons

- Not great for experienced investors

- Long-winded questionnaire when opening your account

- Higher than average investor fees

What is True Potential?

True Potential is a financial services group and investment company that includes True Potential Investor, a regulated investment platform providing retail investors with access to True Potential Wealth Strategy Funds and True Potential Portfolios.

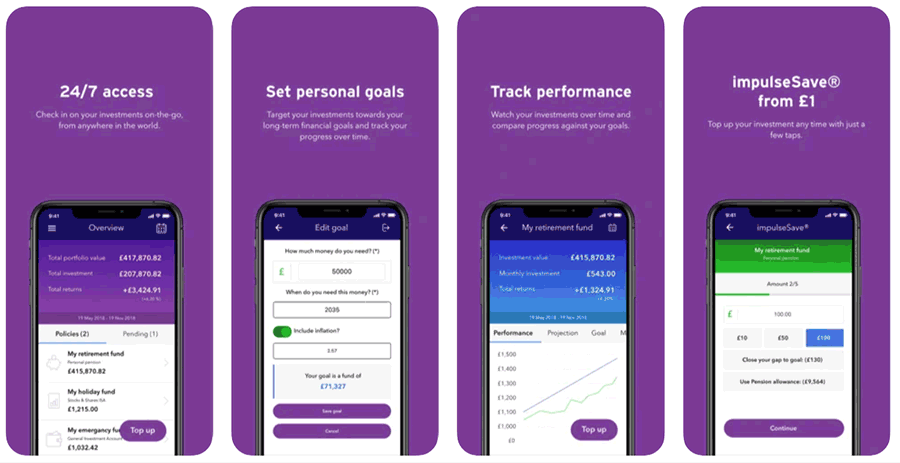

In addition to this, True Potential provides advice distribution, financial services technology and investment management services. The financial services technology at True Potential includes entities such as impulseSave, an innovative top-up technology for investments.

True Potential Wealth Management is a FCA regulated financial advisory service that includes over 440 financial advisors from across the UK. This is a separate part of the business from the investment platform and retail investors should not expect human financial advisers to be included as part of the service.

The final arm to the business is True Potential Advisers Services which provides business support services to over 20% of UK financial advisers using the True Potential Wealth Platform.

Who Owns True Potential?

True Potential Investor is a Limited Liability Partnership (LLP) and owned by the partners. This includes US private equity firm FTV Capital who took a minority stake in 2016. True Potential is largely owned by its Directors including chief executive Daniel Harrison and Chairman David Harrison. In June 2021 True Potential were reported to be considering a potential $2 billion SPAC float on Wall Street following the successful acquisition of Nutmeg by banking giant JP Morgan.

True Potential Investor Product Range

True Potential offers UK investors to put their savings into an ISA, SIPP account, or General Investment Accounts, to help maximise returns compared with your standard Cash ISA.

Though classed as a Robo-advice service their portfolios are actively managed by over 9000 experts based in 200 locations worldwide and there are currently five different portfolios to choose from:

- Defensive

- Cautious

- Balanced

- Growth

- Aggressive

Their asset allocation is as follows:

- UK Equities

- North American Equities

- European (ex UK) Equities

- Japanese Equities

- Emerging Market Equities

- Global Bonds

- Global Inflation-Linked Bonds

- Emerging Market Bonds

- Global High Yield Bonds

- UK Gilts

- UK Corporate Bonds

- Property

- Commodities

- Cash and Cash Equivalents

The percentages of what goes where depends on the type of investment portfolio you pick. You can find your portfolio’s specific asset allocation here. They also run through the strategic allocation and state the exact True Potential fund your cash will be going in, in these key information documents.

Research Services and Tools

Because True Potential is a fully managed Robo-advisor service there isn’t much in the way of research and analysis tools available on their website.

This is because the service is ‘done for you’ and you don’t have the ability to select specific investment funds like you would with a regular self-directed service.

However, they do provide you with enough information about their portfolios so that you can make an informed decision on the portfolio you choose to invest in. The documents section of their website has their key information documents for each portfolio where you can look at the asset allocation, historical performance and find out which True Potential funds they’re specifically in and how they’re spread out.

They also feature a blog section, where they seem to be posting on average two or three times per week; it’s general news kind of stuff but they do post regular investment advice too – for example, on Valentine’s Day themed features on personal savings and investments. The blog is also categorised by topic and they have a most popular featured section on the right which has basic investment-related blog posts to help beginner investors learn the ropes. Things such as achieving your retirement plan and simple steps to saving more.

Finally, they also have a useful investment calculator tool to help you forecast how much your investment could be worth based on initial and monthly contributions. It’s a sliding scale tool and of course, is only a guide, but will give you a great idea of how much you should be locking away each month if you want to achieve your retirement and savings goals.

True Potential Investor Mobile App

The mobile app for True Potential Investor has scored a very respectable 4.3 out of 5 on the App Store. A quick glance through the reviews reveals that negative reviews centre mainly around crashes and bugs that have since been resolved leaving a clear, well functioning, innovative experience. Functionality includes performance tracking, quick deposits, setting personal financial goals and an overview of your net wealth by linking assets and liabilities.

True Potential Investor Fees

True Potential’s fees are slightly higher than others you see on the market, but that is likely due to their portfolios being actively managed.

Technically speaking, with managed funds, you should see better returns, making their fees justifiable but it’s worth noting that it’s not always the case. They try to be as transparent as possible and have a slider at the top of their pricing section to help you calculate exactly how much will be trickling out of your investments per month in fees and charges.

Service Costs

Usually known as the Platform Fee, this is what True Potential charge for running the platform and includes things such as the administration of buying and selling your investments, custodial fees (which some investment platforms charge extra for), running costs of their online platform and mobile app and their live chat/phone support.

True Potential currently charges 0.40%. It’s a flat fee and doesn’t change depending on your investment amount. You can find lower platform fees elsewhere but on small balances, it represents pretty reasonable value for money. Compared to other Robo-advisors I have reviewed this is fairly good for those with balances of less than £100,000. They’re cheaper than Wealthify, Moneybox, and Moneyfarm which helps to offset the slightly higher fund fees from them being actively managed funds.

Product Costs

Also known as the fund fees, these vary but True Potential state that they’re typically around 0.76%. The product costs cover all your transaction fees and the ongoing charges for the funds within your portfolio. If you take a look at the key information document of each portfolio you can see the exact amount each portfolio charges. At the time of writing they’re as follows:

| Defensive | Cautious | Balanced | Growth | Aggressive |

|---|---|---|---|---|

| 0.72% | 0.82% | 0.83% | 0.79% | 0.74% |

Other Fees

True Potential don’t charge any setup fees, transfer fees or discretionary management fees. They also won’t charge to withdraw funds.

True Potential FAQs

How Safe is True Potential Investor?

Is True Potential a good investment?

How much is True Potential worth?

True Potential Customer reviews

Difficult to find fault with True Potential, as their wide-ranging discretionary managed (DM) portfolios, personalised website -allowing access to your investments etc., regular videos and email update’s, and the excellent customer care team, are all 2nd to none. The DM fees are worth it for the huge range funds within and the customer care team are very quick & supportive when required.

- Fees

- Account opening

- Deposit and withdrawal

- Customer service

Very easy and intuitive app and web tools – very helpful call centre – fees are reasonable to low for the content and technology offered

- Fees

- Account opening

- Deposit and withdrawal

- Customer service

The fees are high. I pay platform 0.4%, average fund cost 0.76% PLUS a financial adviser fee 0.5%, total 1.66%. The latter I object to as not needed.

- Fees

- Account opening

- Deposit and withdrawal

- Customer service