My easyJet share price forecast includes a 360-degree examination to determine whether investors should consider this renowned aviation engine maker for the long haul.

This stock analysis report goes into detail on easyJet’s financial position, competitive strengths, industry outlook, valuation metrics, and analysts’ predictions to uncover whether easyJet shares actually present a golden long-term opportunity.

Read On: To find the easyJet share price forecast and my price target.

- easyJet Share Price (LON:EZJ)

- easyJet Background

- easyJet Business Model

- easyJet Earnings Breakdown

- easyJet Financials

- easyJet Competitive Advantage

- easyJet Shortcomings

- What is the Dividend Forecast for easyJet Shares?

- Are easyJet Shares Cheap?

- What is the Profit Forecast for easyJet Shares?

- What is the easyJet Share Price Forecast?

- What is the Price Target for easyJet Shares?

- Are easyJet Shares a Buy, Sell, or Hold?

easyJet Background

easyJet is a British low-cost airline operating out of the UK. It’s the second-largest budget airline behind Ryanair in Europe by number of passengers carried. It operates almost 1,000 short-to-medium-haul routes in and around the continent.

Altogether, easyJet sells a variety of products and services. These include flight bookings, holiday packages, and other ancillaries such as food, flight add-ons, and duty-free products.

easyJet shares trade on the London Stock Exchange and are constituents of the FTSE 250.

Find Out: How easy it is to buy easyJet shares in 6 simple steps.

easyJet Business Model

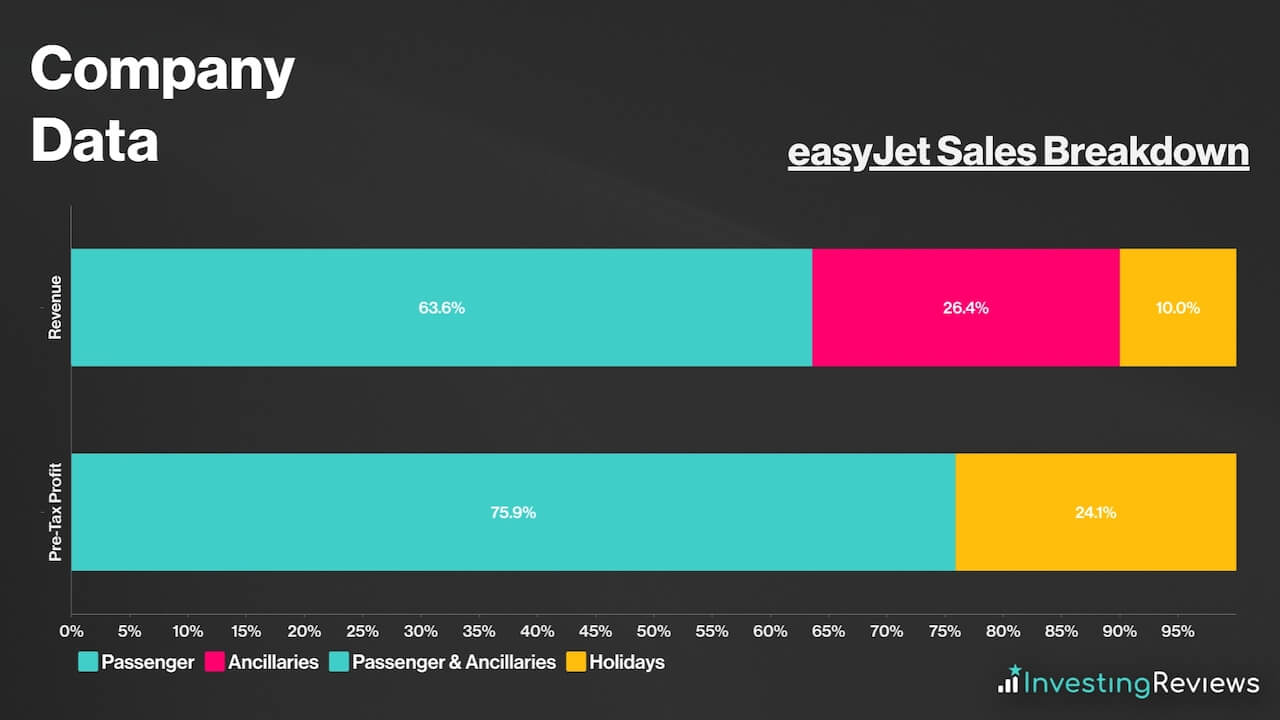

As a conglomerate, easyJet makes its money through a variety of revenue streams. The bulk of its sales stems from passengers where it sells flight tickets. On top of that, easyJet also generates revenue from other add-ons like seat selection, extra baggage allowance, food, etc.

On the geographical front, the firm predominantly operates out of the UK from its base in London’s Luton Airport. However, easyJet also has other operating bases in key airports with lots of traffic. These include Belfast, Bristol, Edinburgh, Glasgow, Liverpool, Gatwick, and Manchester.

Nonetheless, the budget airline also earns revenue through other streams. For instance, more than a quarter of its revenue comes from ancillaries such as car hires, accommodation, and travel insurance. What’s more, easyJet has its growing Holidays segment, where the company sells all-inclusive flight and hotel packages.

Gross margins from flight tickets are minuscule due to the budget market easyJet operates in. For that reason, the business model thrives on economies of scale, as more passengers per flight result in higher profits.

easyJet Earnings Breakdown

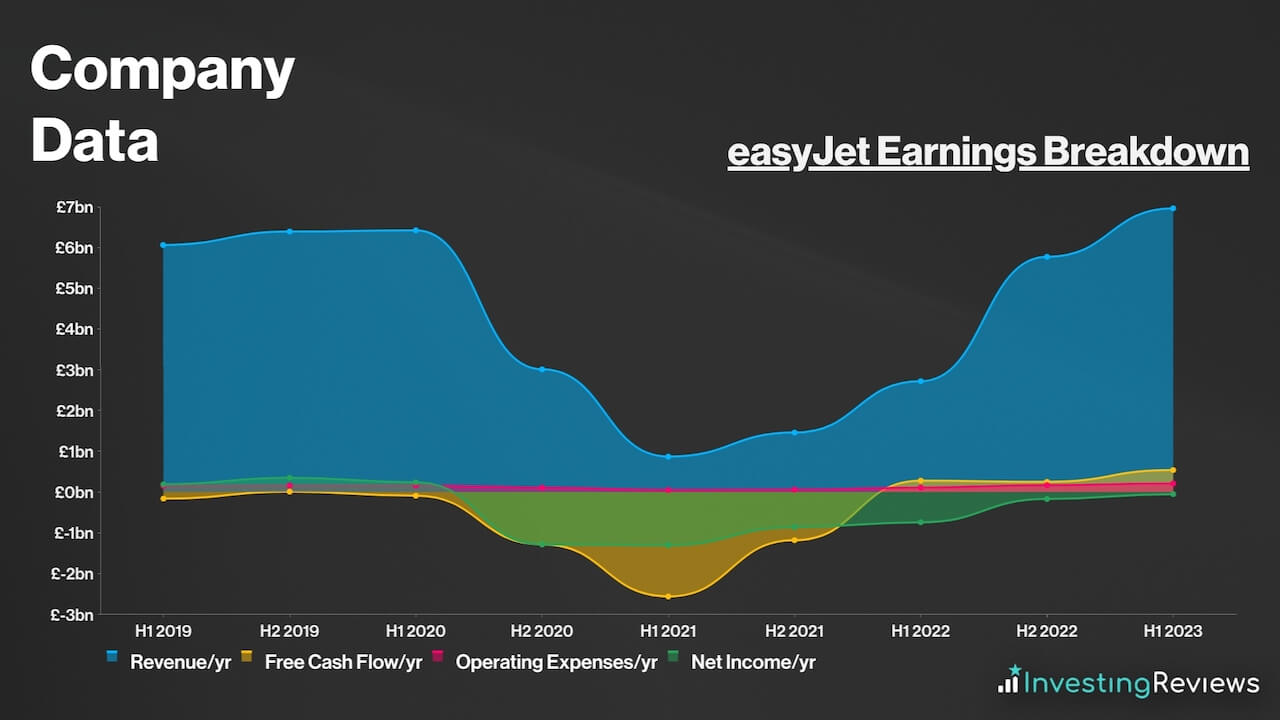

While easyJet was a profitable business prior to the pandemic, it hasn’t been profitable on an annualised basis since. Most of its income stems from selling flight tickets and the add-ons associated with them. Although revenues have picked up, profits continue to lag behind as a result of elevated fuel and labour costs.

Because most of easyJet’s profits thrive on economies of scale, profit margins are considered to be relatively low. That’s because the business operates on a high-volume basis to earn profits.

At times, such as during the winter, the airline barely breaks even on its flights. Therefore, it relies on passengers purchasing other ancillary items to prop up its profit margins. As such, investors will be hoping that its new and upcoming Holidays segment will boost profit margins in the months and years to come.

easyJet Financials

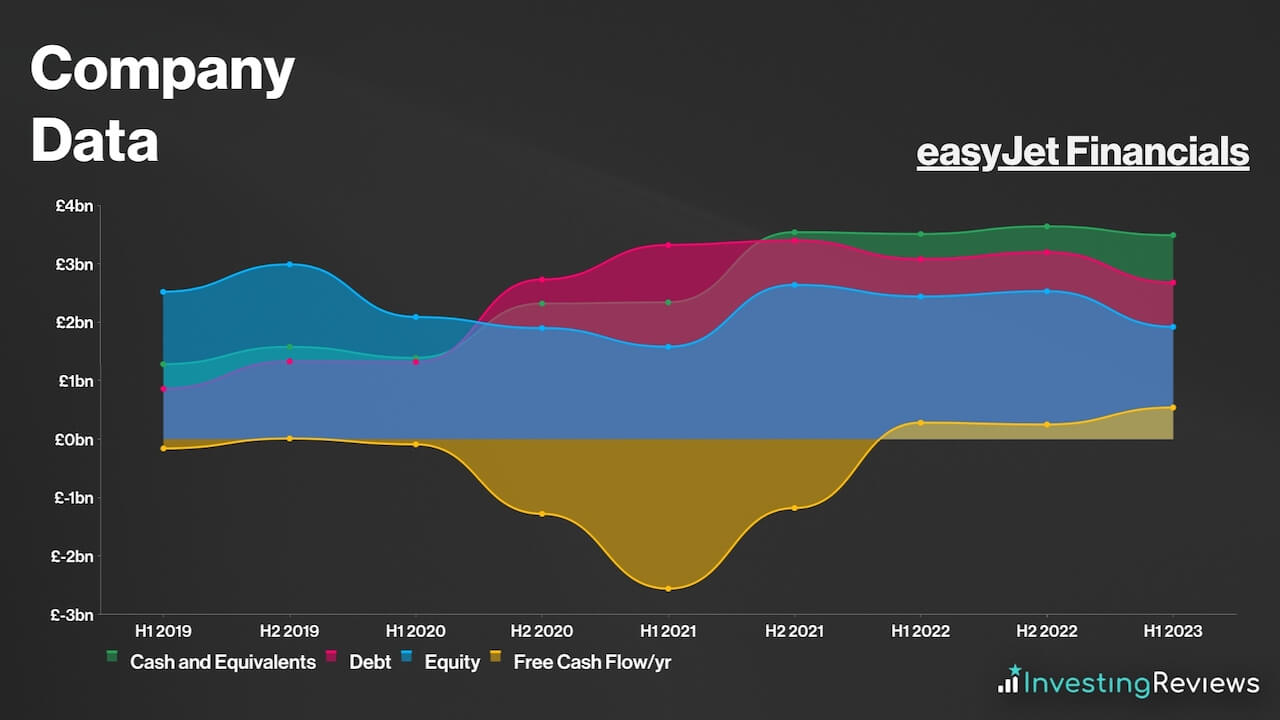

On the face of it, easyJet’s balance sheet may be off-putting to some as its current liabilities trump its current assets by £260m. Nonetheless, when contextualised, easyJet’s financials are actually among the best in the industry.

| Airlines | Net Debt | Cash and Equivalents |

|---|---|---|

| easyJet | -£0.04bn | £2.90bn |

| IAG | €7.61bn | €10.73bn |

| Lufthansa | €6.72bn | €1.43bn |

| Air France-KLM | €4.90bn | €6.17bn |

| Ryanair | -€0.98bn | €2.95bn |

| Wizz Air | €3.89bn | €1.79bn |

Data source: easyJet, IAG, Lufthansa, Air France-KLM, Ryanair, Wizz Air

Like many of its peers, airlines took on massive amounts of debt during the pandemic in order to continue running its operations. Hence, it’s no surprise to see easyJet’s debt levels rise monumentally in 2020. Nevertheless, the operator has kept its liabilities at a sustainable level.

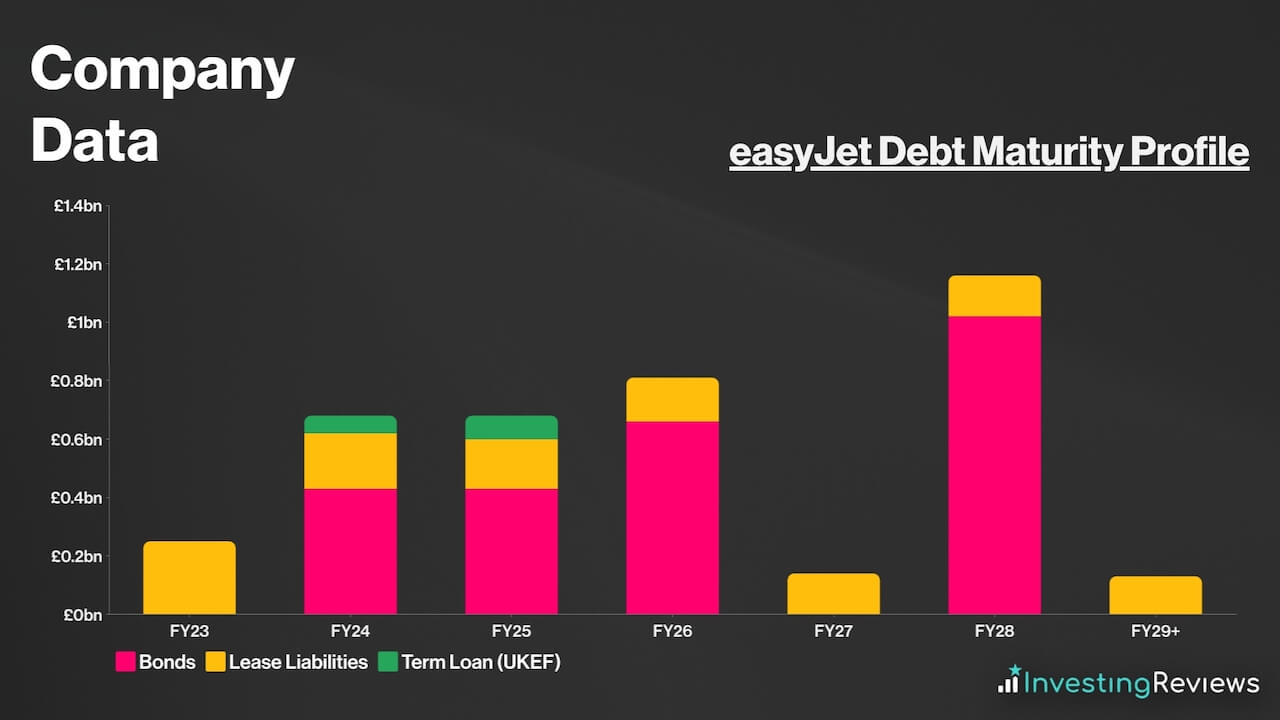

The board has managed their debt maturity profile very well by spreading out the repayment periods so that easyJet wouldn’t have to refinance loans at a higher rate. This allows easyJet to pay off its debt in a steady manner through its ever-improving free cash flow and large pile of cash and equivalents. Given that CEO Johan Lundgren is guiding the group to beat profit estimates this year, easyJet shouldn’t have much trouble paying off its creditors.

With less than £1.2bn due per year, over the next decade, easyJet should have sufficient liquidity to pay off its debt in the coming years, as long as it continues to generate cash at these levels.

easyJet Competitive Advantage

Having an economic moat (competitive advantage) over competitors is crucial in saturated industries such as budget civil aviation, where profit margins aren’t the highest, with medium barriers to entry.

Thankfully, easyJet has a couple of competitive advantages. The first is its size — it is the UK’s second-largest budget airline. This means that it has the capacity to operate a large number of routes. In fact, it’s only second to Ryanair, and comfortably above Wizz Air in the UK budget market.

More crucially, where it loses out in routes to Ryanair, it gains in customer satisfaction. The FTSE 250 stalwart only lags behind IAG‘s British Airways in terms of customer satisfaction in the UK, and is miles ahead of its budget competitors.

Aside from that, it's also worth noting that easyJet only operates with a single aircraft type, the Airbus A320 family. This allows the FTSE 250 constituent to operate more cost-effectively, as crew training programmes, aircraft parts, and other functions are all streamlined.

Perhaps more excitingly, is its Holidays division. Launched in 2019, the arm's objective is to offer holiday packages and encourage the 84% of its customers travelling for leisure to spend more with easyJet, rather than book accommodation elsewhere. Thus far, this has proven to be a success as the sleek interface and mouthwatering offerings have seen grown revenues exponentially, and should lift overall profit margins over time.

easyJet Shortcomings

Despite being such a giant in the budget airline space, easyJet also has its fair share of weaknesses. This could put investors off when buying easyJet shares.

Most notably, although it’s working its way back to profitability, easyJet is still unprofitable on an annualised basis. And even when it was profitable, margins were rather slim, ranging from 3% to 5% before the pandemic. This means that a black swan event like a pandemic can badly affect its business.

Moreover, while its dependence on the A320 family has been advantageous, it’s worth stating that any hiccup in production, parts, and/or reliability could severely impact easyJet’s operations. After all, Boeing’s turmoil with its 787 and 737-MAX planes only goes to show how risky it can be to put all the eggs in one basket.

In addition to this, jet fuel prices continue to remain stubbornly elevated as well. As a consequence, it’s been finding it difficult to turn a profit due to the high costs of the black gold.

On the other hand, the cost-of-living crisis remains at the forefront of issues, as household affordability and real wages continue to decline every month. If this lasts for a prolonged period, the travel industry could start stalling out, which could inadvertently affect the strong performance easyJet shares have seen this year.

Furthermore, possible strikes and disruptions from ground staff at easyJet’s airports may impact operations too. Last summer’s disruptions serve as a reminder of what ramifications could follow when industrial action takes place. And given that easyJet operates on quick turnaround schedules, one minor hiccup could result in severe delays for the rest of the day.

Prior to the pandemic, easyJet paid dividends, although this has since been halted as the outfit remains unprofitable with debt to pay off. Still, prior to the stoppage, owners of easyJet shares were enjoying hefty payouts, with dividend yields of up to 6% at that time.

Due to its unprofitable status, analysts aren’t forecasting easyJet to pay a dividend this financial year. Having said that, provided the carrier achieves profitability by 2024, a resumption of shareholder returns may occur.

easyJet shares are currently trading at a discount when compared to their industry competitors. Their P/E ratio and forward P/E are very much below the FTSE 100‘s average too. What’s more, their P/S ratio sits comfortably below 1, which could indicate tremendous growth potential from its sales.

Among the 20 qualified analysts covering easyJet shares, the consensus is for easyJet to grow its top and bottom lines over the next two years as travel demand shows no signs of cooling.

| Metrics | FY22 (Reported) | FY23 | FY24 |

|---|---|---|---|

| Revenue | £5.77bn | £8.20bn | £9.31bn |

| Basic Headline EPS | 19.60p | 47.72p | 55.45p |

Data source: easyJet, Financial Times

easyJet shares currently have an average Buy rating from several brokers. With an average price target of 600p, analysts seem to agree that there’s upside potential for easyJet shares in the next 12 months.

| Date | Brokerage | Rating | Price Target |

|---|---|---|---|

| 19/10/2023 | Barclays | Hold | 415p |

| 13/10/2023 | RBC | Hold | 550p |

| 13/10/2023 | Deutsche | Buy | 585p |

| 13/10/2023 | UBS | Buy | 750p |

| 13/10/2023 | Oddo BHF | Hold | 510p |

| 3/10/2023 | Bernstein | Hold | 500p |

| 2/10/2023 | JPMorgan | Hold | 540p |

| 21/7/2023 | Stifel | Buy | 650p |

| 21/7/2023 | Goldman Sachs | Hold | 600p |

| 22/5/2023 | Liberum | Buy | 690p |

| 12/4/2023 | Bank of America | Sell | 400p |

Data source: Market Screener

My price target for easyJet shares was last updated on 13th October 2023.

| Metrics | Headline FY24 (Projected) | Comments | |

|---|---|---|---|

| Passenger Revenue | £5.85bn | c.12% growth — Lower growth vs FY22 due to tougher comps and travel demand returning to pre-pandemic levels. | |

| Ancillary Revenue | £2.52bn | c.43% of passenger revenue — improved ancillary offerings. | |

| Holidays Revenue | £0.88bn | c.15% of passenger revenue. | |

| Revenue | £9.25bn | ||

| Fuel Costs | £2.34bn | c.40% of passenger revenue — slightly higher than guidance of £0.27bn increase, but hedging contracts to provide some cushion from higher prices in H1. | |

| Airports and Ground Handling | £2.34bn | c.40% of passenger revenue — Higher costs from bigger concentration at constrained airports. | |

| Crew | £1.17bn | c.20% of passenger revenue — lower portion vs last year with productivity gains. | |

| Navigation | £0.47bn | c.8% of passenger revenue — in line with recent average. | |

| Maintenance | £0.47bn | c.8% of passenger revenue — higher input costs. | |

| Holidays Operating Costs | £0.31bn | c.35% of Holidays revenue. | |

| Selling and Marketing | £0.37bn | c.4% of total revenue — slightly higher than recent average due to Holidays marketing spend. | |

| Other Costs | £0.50bn | Lower vs FY23 but still higher than long-term average due to expected ATC disruptions. | |

| Other Income | £0.01bn | In line with recent average. | |

| Gross Profit/EBITDAR | £1.29bn | ||

| Aircraft Dry Leasing | £5m | ||

| Depreciation and Amortisation | £700m | Higher than long-term average due to bigger fleet size with new Airbus NEO aircarft. | |

| Operating Profit | £585m | ||

| Finance Income | £140m | Higher interest receivables from higher interest rates. | |

| Finance Costs | £150m | Lower financing costs from lower debt. | |

| Foreign Exchange Gain | £10m | ||

| Profit Before Tax | £585m | ||

| Taxation | £152m | Effective Tax Rate of c.26%, in line with guidance. | |

| Profit for FY23 | £433m | ||

| Shares in Issue | 753m | ||

| Headline Diluted EPS | 57.50p | ||

| Target Price | 575p (BUY) | ||

| Metrics | Headline FY23 (Projected) | Comments | |

|---|---|---|---|

| Passenger Revenue | £5.34bn | c.40% growth — Higher demand in H2 to offset lower demand in H1. | |

| Ancillary Revenue | £2.19bn | c.41% of passenger revenue — improved ancillary offerings. | |

| Holidays Revenue | £0.74bn | c.9% of total revenue — in line with FY23 trends. | |

| Revenue | £8.27bn | c.43% growth — in line with Q4 RPS guidance with a slightly higher than guided capacity due to Wizz Air grounding issues. | |

| Fuel Costs | £2.14bn | c.40% of passenger revenue — lower jet fuel prices overall to lower cost pressures vs last year, while hedging contracts to provide some cushion with higher prices in H2. | |

| Airports and Ground Handling | £2.03bn | c.38% of passenger revenue — Better economies of scale in H2 should slightly offset higher costs in H1. | |

| Crew | £1.12bn | c.21% of passenger revenue — higher than recent average due to wage costs. | |

| Navigation | £0.43bn | c.8% of passenger revenue — in line with recent average. | |

| Maintenance | £0.37bn | c.7% of passenger revenue — lower input costs in H2 to offset higher costs in H1. | |

| Holidays Operating Costs | £0.26bn | In line with H1 trend. | |

| Selling and Marketing | £0.25bn | c.3% of total revenue — slightly higher than recent average due to Holidays promotions. | |

| Other Costs | £0.55bn | Slightly lower than FY22 but still higher than long-term average due to compensation payments as a result of airport disruptions. | |

| Other Income | £0.01bn | In line with recent average. | |

| Gross Profit/EBITDAR | £1.13bn | ||

| Aircraft Dry Leasing | £5m | ||

| Depreciation and Amortisation | £630m | Higher than long-term average due to bigger fleet size. | |

| Operating Profit | £470m | ||

| Finance Income | £130m | Higher interest receivables from higher interest rates. | |

| Finance Costs | £160m | €500m Eurobond repaid in H1, lowering financing costs in H2. | |

| Foreign Exchange Gain | £10m | Hedging losses in H2 due to depreciating GBP. | |

| Profit Before Tax | £450m | ||

| Taxation | £117m | Effective Tax Rate of c.26%, in line with H1. | |

| Profit for FY23 | £333m | ||

| Shares in Issue | 758m | ||

| Headline Diluted EPS | 43.93p | ||

Having peaked in May, easyJet shares have been on a downward slide since. Their performance in September wasn’t better either, with the shares now approaching their 2023 bottom. However, I see this more as an opportunity than a sign of weakness.

Like its other competitors, easyJet shares are also suffering from negative sentiment of NATS’ incompetence and higher fuel prices. But the budget operator has more than half of its fuel hedged for the rest of the year.

This should insulate the airline from higher costs to some extent, and still put it on a flight path to further recovery in FY24. More importantly, its fast-growing Holidays business and improving ancillary offerings remain a key catalysts in providing higher profits and margins over the medium to long term. As such, I reiterate my Buy rating.

John Choong, Senior Equity Research Analyst

Please note: John Choong has positions in easyJet. These stock analysis reports are not personal recommendations or advice and should never be treated as such.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

- Learn how to invest in the FTSE100

- Have you considered transferring your pension?

- Find the best trading platforms