My BAT share price forecast includes a 360-degree examination to determine whether investors should consider this global tobacco giant as a long-term investment.

This stock analysis report goes into detail on British American Tobacco’s financial position, competitive strengths, industry outlook, valuation metrics, and analysts’ predictions to uncover whether BAT shares actually present a golden long-term opportunity.

Read On: To find the BAT share price forecast and my price target.

- BAT Share Price (LON:BATS)

- BAT Background

- BAT Business Model

- BAT Earnings Breakdown

- BAT Financials

- BAT Competitive Advantage

- BAT Shortcomings

- What is the Dividend Forecast for BAT Shares?

- Are BAT Shares Cheap?

- What is the Profit Forecast for BAT Shares?

- What is the BAT Share Price Forecast?

- What is the Price Target for BAT Shares?

- Are BAT Shares a Buy, Sell, or Hold?

BAT Background

British American Tobacco is one of the world’s largest tobacco companies. The group manufactures and sells cigarettes, tobacco, and alternative nicotine products. It operates in around 180 markets worldwide and has factories in more than 40 countries.

The company owns multiple cigarette brands in its trade mark portfolio, including Dunhill, Pall Mall, and Lucky Strike. Its most prominent brand in the e-cigarette market is Vuse, under which it sells a variety of vapour products.

British American Tobacco shares trade on the London Stock Exchange and are constituents of the FTSE 100.

Find Out: How easy it is to buy British American Tobacco shares in 6 simple steps.

BAT Business Model

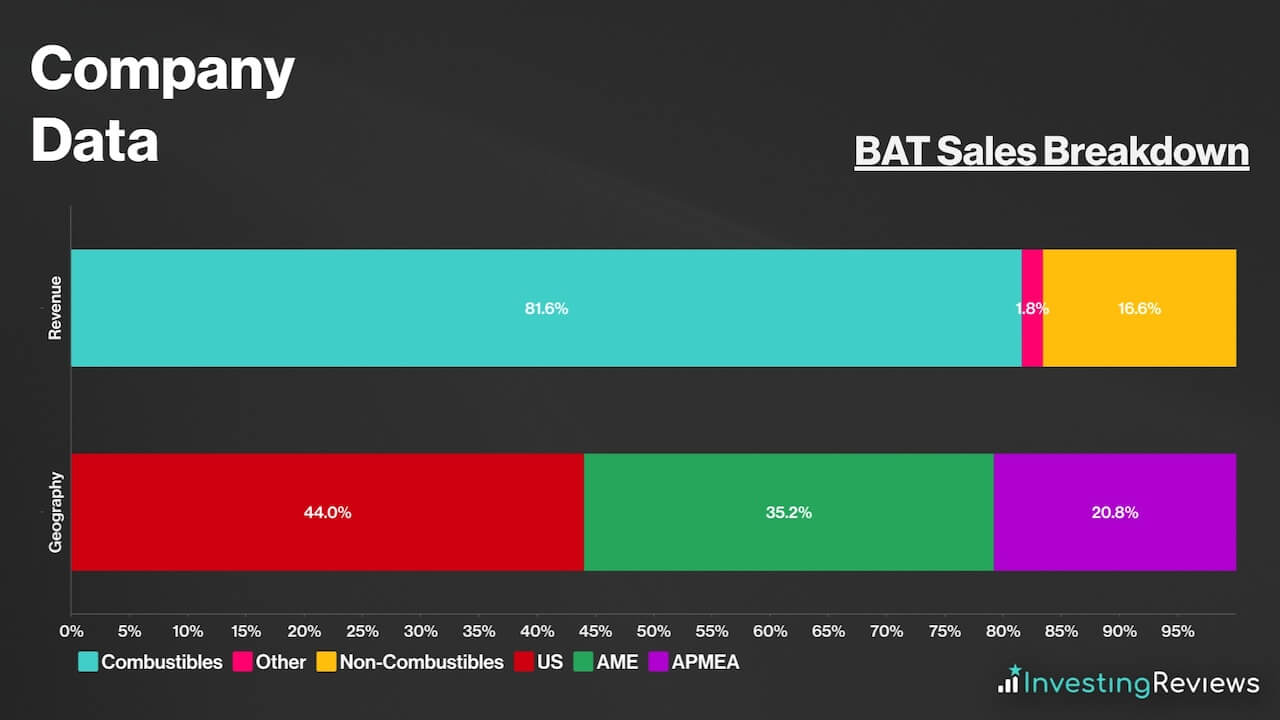

As a conglomerate, British American Tobacco makes its money through a variety of revenue streams. The vast majority of its sales are generated by its traditional tobacco business, with over 83% of the firm’s total revenue coming from combustible tobacco products. On top of that, it also generates over 16% of its revenue from ‘New Category’ products, which spans vapour, heated tobacco, and oral nicotine pouches.

On the geographical front, the corporation operates all around the world, but receives more of its revenue from the US, which accounts for a little under half its sales. British American Tobacco’s next three largest markets are Europe, Asia-Pacific, and the Middle East, followed by the Americas and Sub-Saharan Africa.

BAT Earnings Breakdown

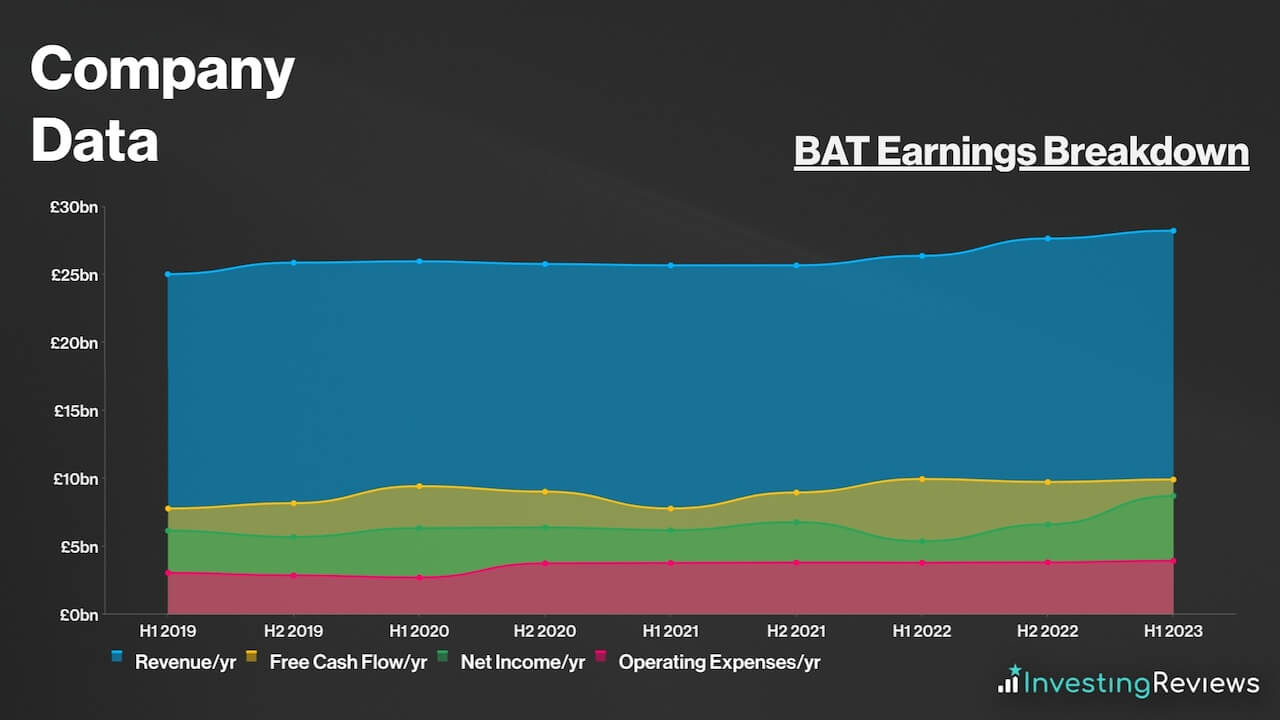

British American Tobacco operates a tobacco sourcing, production, and distribution business model for the most part, and earns its profits from the sale of cigarettes and combustible tobacco. Increasingly, alternative nicotine products are an important source of revenue for the cigarette giant.

Because most of BAT’s profits stem from its traditional tobacco business, profit margins and cash flow are considered to be relatively high relative to other industries. That’s because cigarettes are relatively cheap to make and addictive in nature. Accordingly, consumer demand for these products is fairly stable and non-cyclical, despite regular price increases due to tax.

BAT Financials

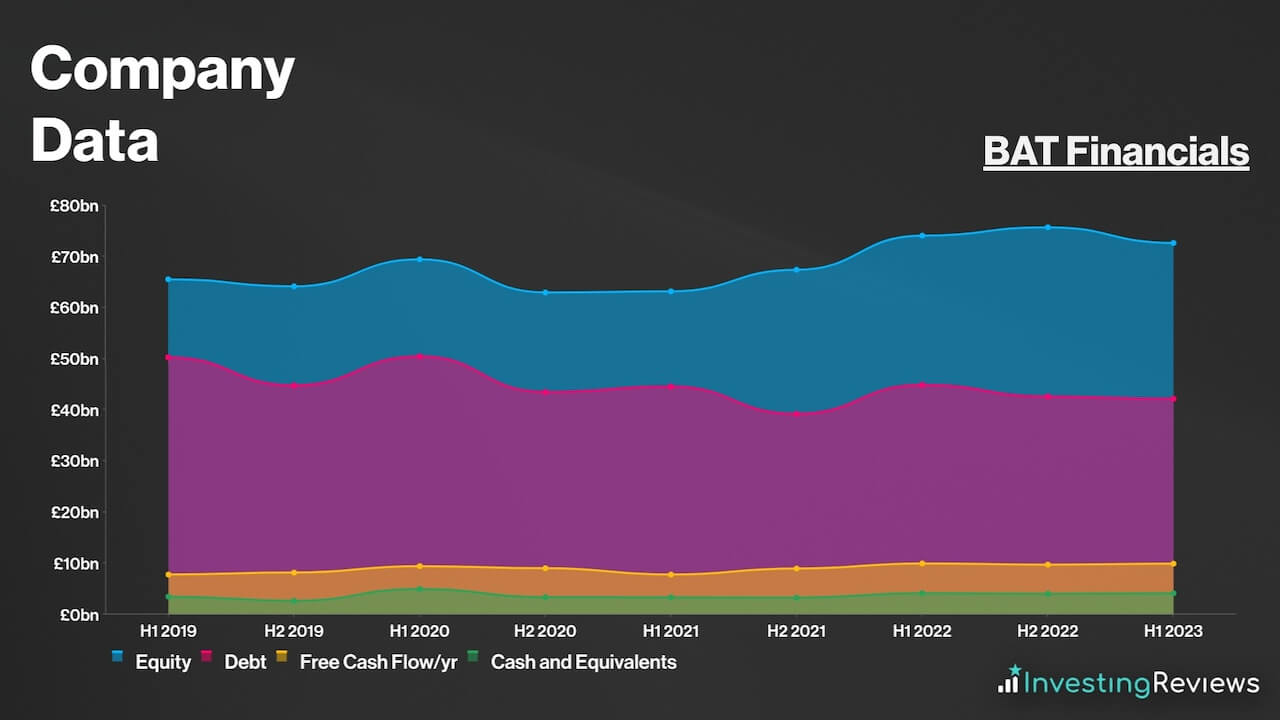

On the face of it, BAT’s balance sheet may be off-putting to some as its current liabilities trump its current assets by £1.1bn. Nonetheless, this is considered to be a norm in the tobacco industry, especially for giant manufacturers. Still, debt reduction is a growing priority for British American Tobacco. Indeed, the suspension of the share buyback programme is testament to management’s concerns about BAT’s debt pile.

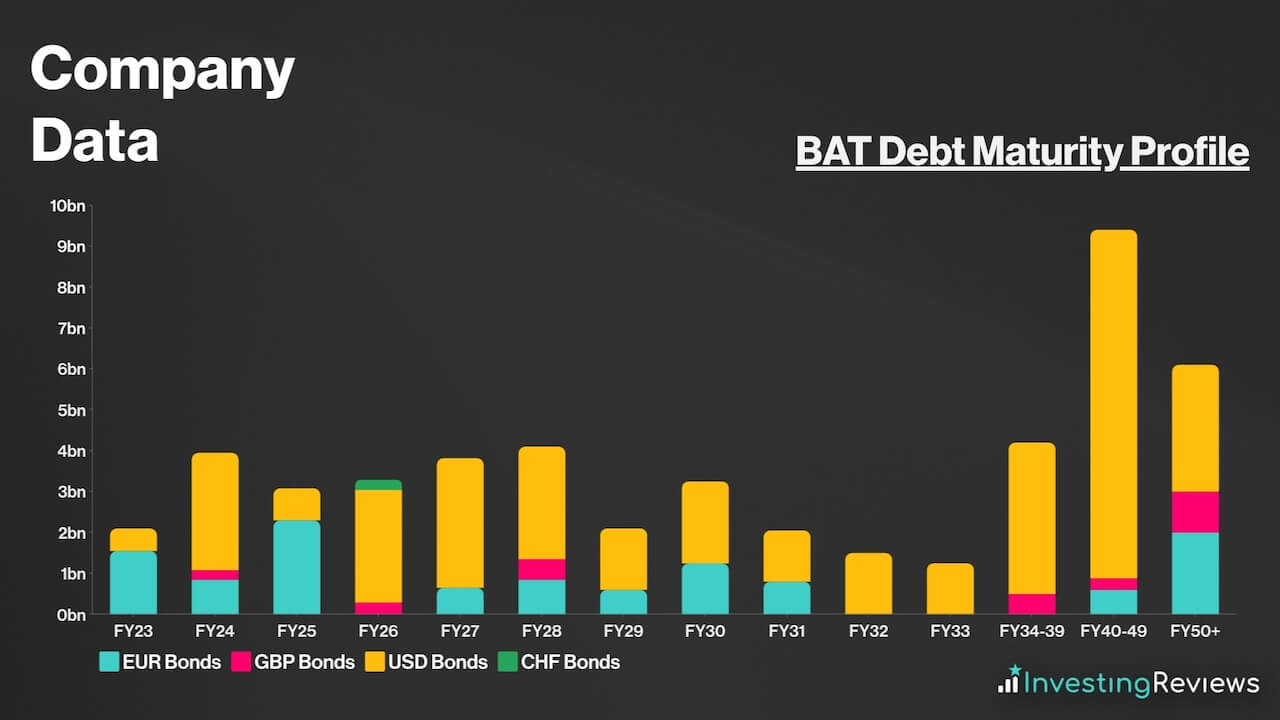

Either way, its debt maturity profile isn’t alarming, with repayments spread out rather evenly over the course of the next few decades. The FTSE 100 stalwart’s average centrally managed debt maturity was 9.9 years at the end of FY22 and it maintained a fixed debt profile of around 95%. This buys the consortium some time to get the £36.26bn net debt figure under control, and ultimately bring it close to its target 2-3x adjusted EBITDA range.

With less than £4bn due per year, over the next decade, BAT should have sufficient liquidity to pay off its debt in the coming years, as long as it continues to generate cash at these levels. It’s also worth noting that British American Tobacco has £5.7bn worth of revolving credit facilities and £2.1bn in undrawn bilateral facilities. This means that it has the option to inject more liquidity into the business if it needs to.

Overall, BAT currently has a net debt to adjusted EBITDA ratio of 2.9x, which is lower than the standard ratio of 3.0x for companies. Plus, its fixed charge cover sits at a strong 6.8x. For those reasons, it’s safe to say that its debt pile is manageable, as the board continues to efficiently utilise capital and generate further value for shareholders.

BAT Competitive Advantage

Having an economic moat (competitive advantage) over competitors is crucial in industries such as tobacco, where profit margins are at risk of shrinking from higher taxes and regulation.

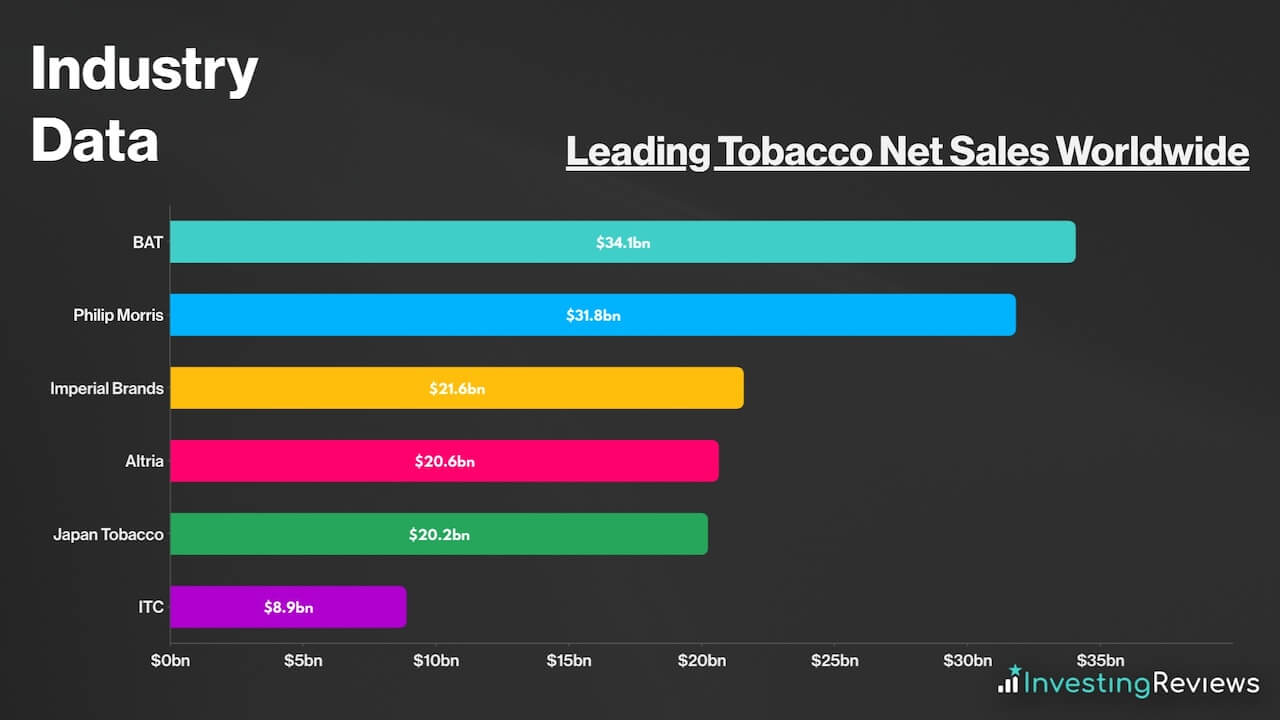

As such, BAT’s main competitive advantage is its dominant market share. It currently competes with Philip Morris for the top position as the world’s largest tobacco company. In an industry where consumers are loyal to cigarette brands, this is a crucial asset. Indeed, BAT’s brand portfolio is expansive and overarches the 600bn cigarettes it sold in FY22.

Another vital string to British American Tobacco’s bow is its New Category products division. The FTSE 100 constituent has invested more heavily in its alternative nicotine products range than competitors such as Imperial Brands. The fruits of these efforts are beginning to show with the business serving 24m non-combustible consumers today.

Vuse is its hero product range in this arena. The brand occupies a leading position in the global vapour value market, with a full year value share of 35.9% in 2022. If the combustible tobacco market’s future is as gloomy as some analysts expect, claiming market share in alternative nicotine products will be critical for firms in the sector to generate growth.

British American Tobacco has recognised the importance of this for some time with 2023 marking the 10-year anniversary of its journey in building a multi-category portfolio. Keen to preserve its competitive advantage, the tobacco giant increased its R&D expenditure to £323m in FY23, centred on its New Category division.

BAT Shortcomings

Despite being such a giant in the tobacco space, British American Tobacco also has its fair share of weaknesses. This could put investors off when buying BAT shares.

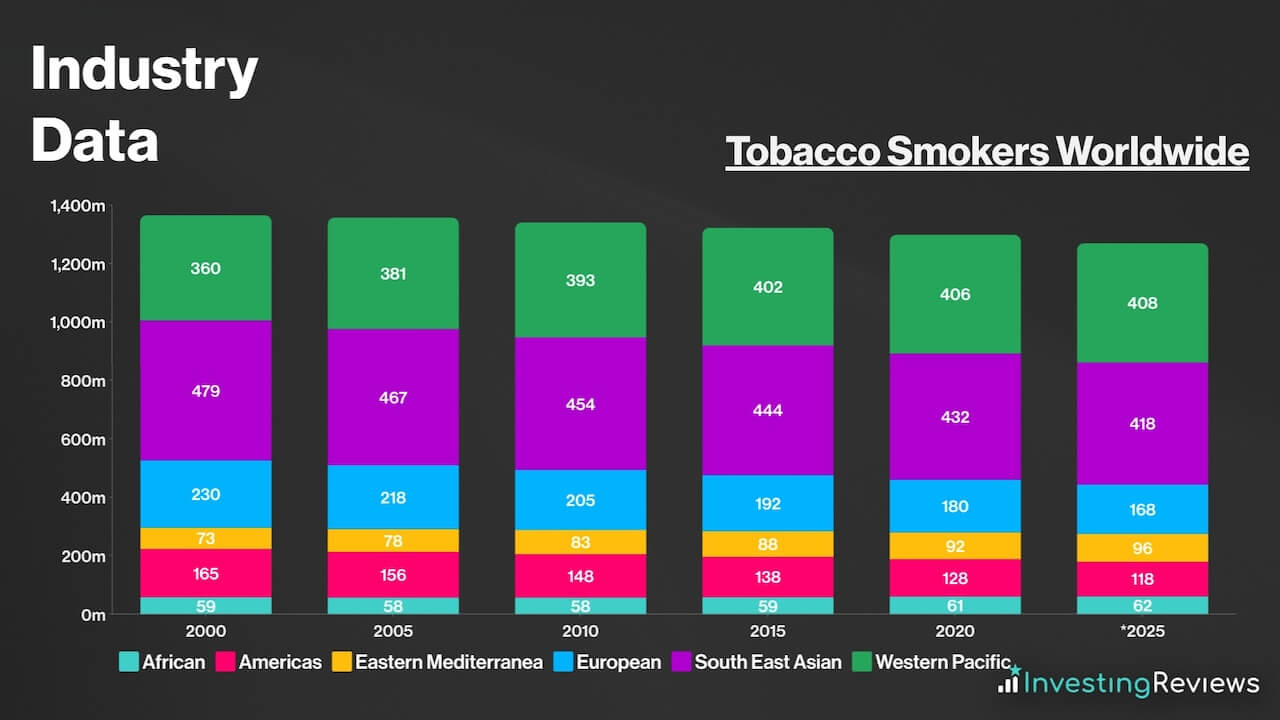

For one, it can be argued that big tobacco is a sunset industry. With government plans to ban smoking for future generations being set into motion in New Zealand and the UK, coupled with falling tobacco consumption across many countries, the industry’s future customer base appears to be shrinking. This is a concern considering traditional cigarette sales still make up the lion’s share of BAT’s revenue.

Second, some investors may have moral concerns about investing in a so-called ‘sin’ stock like British American Tobacco. The cigarette manufacturer generates revenue from selling addictive tobacco and nicotine products. Accordingly, this may mean the stock is an unsuitable investment for those who have ethical concerns about the sector. Indeed, many institutional investors avoid tobacco stocks, which depresses their valuations.

Third, the performance of BAT’s ‘New Category’ products division is likely to be critical for its future if the combustible tobacco market continues to shrink. Nevertheless, despite maintaining a solid growth trajectory in recent years, this unit is still loss-making and not expected to turn a profit until 2024.

Finally, BAT has used a fair amount of leverage in recent years. Debt reduction is now a key priority for the board and the £2bn share buyback has been paused as a result. By contrast, rival firm Imperial Brands continues to implement its share buyback programme.

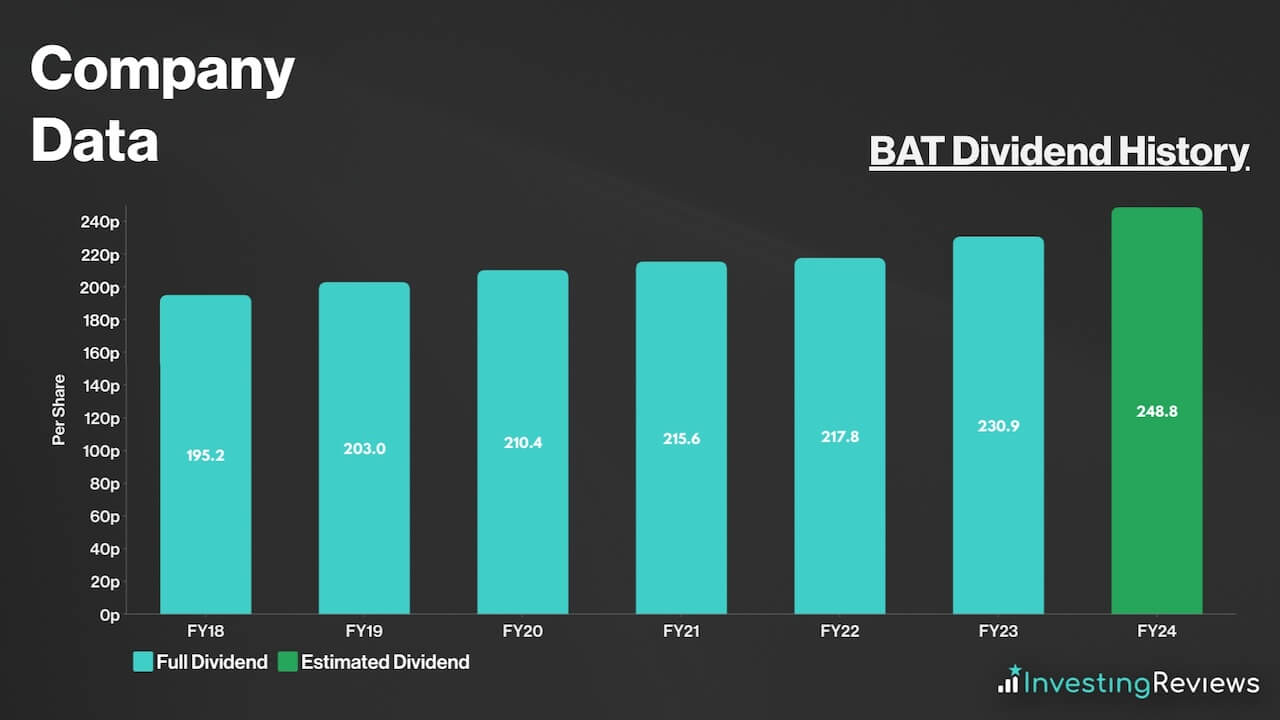

BAT pays a dividend and has been paying dividends for more than two decades; even through financial crises. This makes BAT a dividend aristocrat given its impressive track record of shareholder payments.

For that reason, BAT shares are known for their ‘safety’, and are a favourite among dividend investors seeking passive income. The stock has become even more popular amongst investors over the years due to the organisation’s commitment to having a progressive dividend while maintaining a 65% target payout ratio. In addition to that, its dividends are well covered at 1.7x.

BAT is expecting to continue paying a dividend for the foreseeable future. Currently, analysts are forecasting dividends to rise over the next two years.

British American Tobacco shares are currently trading at a discount when compared to their industry competitors, and are in line on an adjusted basis. Their adjusted P/E ratio is well below the index average too. What’s more their P/B ratio is trading well below 1 which could indicate a bargain.

Among the 17 qualified analysts covering BAT shares, the consensus is for British American Tobacco to grow its top and bottom lines over the next two years, as sales improve and its new category products division continues to expand.

| Metrics | FY22 (Reported) | FY23 | FY24 |

|---|---|---|---|

| Revenue | £27.66bn | £27.99bn | £28.48bn |

| Adjusted Diluted EPS | 371.4p | 378.8p | 392.0p |

Data source: BAT, Financial Times

BAT shares currently have an average Buy rating from several brokers. But with an average price target of 3460p, brokers seem to agree that there’s upside potential for BAT shares over the next 12 months.

| Date | Brokerage | Rating | Price Target |

|---|---|---|---|

| 13/10/2023 | Jefferies | Buy | 4000p |

| 13/10/2023 | UBS | Buy | 3800p |

| 5/10/2023 | JPMorgan | Hold | 2800p |

| 26/9/2023 | Citi | Buy | N/A |

| 1/9/2023 | Argus | Hold | N/A |

| 28/7/2023 | Barclays | Buy | 3300p |

| 28/7/2023 | Goldman Sachs | Hold | 2950p |

| 26/7/2023 | RBC | Hold | 3500p |

| 20/7/2023 | Credit Suisse | Buy | 3900p |

| 11/1/2023 | Morgan Stanley | Buy | 3900p |

Data source: Market Screener

My price target for BAT shares was last updated on 24th October 2023.

| Metrics | Adjusted FY23 (Projected) | Comments | |

|---|---|---|---|

| Combustibles | £23.51bn | c.2% growth — accounting for the impact of one-off charges related to the disposal of the Russian business. | |

| Non-Combustibles | £4.51bn | c.10% growth — strong momentum in expanding volumes across various product ranges. | |

| Revenue | £28.02bn | ||

| Raw Materials and Consumables | £4.80bn | Broadly flat, in line with H1. | |

| Changes in Inventories of Finished Goods | £0.10bn | ||

| Employee Benefit Costs | £3.22bn | c.11.5% of revenue — higher than recent average due to wage costs. | |

| Depreciation, Amortisation, and Impairments | £0.98bn | c.35% reduction — in line with H1. | |

| Other Operating Income | £0.72bn | ||

| Other Operating Expenses | £7.26bn | ||

| Operating Profit | £12.58bn | ||

| JV Income | £0.58bn | ||

| Finance Income | £0.17bn | Higher interest receivables from higher interest rates. | |

| Finance Costs | £2.03bn | Higher than FY22 due to rising rates of bonds and commercial papers. | |

| Profit Before Tax | £11.30bn | ||

| Taxation | £2.83bn | Underlying effective Tax Rate of c.25%, in line with guidance. | |

| Profit for FY23 | £8.47bn | ||

| Shares in Issue | 22.36bn | Share buyback programme suspended. | |

| Adjusted Diluted EPS | 378.8p | ||

| Price Target | 3030p (BUY) | ||

British American Tobacco faces many existential threats to its business from increasingly stringent government regulation. However, it may take a while before cigarettes become true legacy products and traditional tobacco sales should continue to act as a robust source of primary revenue for the business in the near term. After all, many people continue to smoke and the firm has strong pricing power over its addictive tobacco products.

The group is further ahead of several competitors in terms of investment and innovation in alternative nicotine products. Delivering further growth for the New Category division will be essential for the stock’s future prospects in light of the potential regulatory challenges facing its combustible products range. In addition, it’s encouraging to see some diversification via investments in medical cannabis companies and CBD research.

High debt levels and a suspended share buyback programme weigh on the investment outlook. Plus, the scale of the challenge presented by making fundamental changes to a 120-year old business model shouldn’t be underestimated. That said, the valuation looks attractive at today’s level and a mighty dividend yield should help to compensate for the risks facing investors while providing steady passive income.

Charlie Carman, Equity Research Analyst

Please note: Charlie Carman has positions in British American Tobacco. These stock analysis reports are not personal recommendations or advice and should never be treated as such.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

- Learn how to invest in the FTSE100

- Have you considered transferring your pension?

- Find the best trading platforms