Capital at risk. This is promotional content.

Shares.io is a social investing app, designed to help investors share ideas and build wealth with the help of a community of peers and experts.

With its focus on friends learning from one another, its low minimum investment (£1), and comparatively low fees (depending on the order value a £1 fee per trade might be considered either very low or big), it will appeal to new traders looking to build confidence and wealth.

It’s not for you, though, if you want to trade non-US shares, funds, derivatives, or crypto, as UK traders are limited to stocks listed on the NASDAQ and NYSE.

Capital at risk.

- Shares.io Ratings

- Who is Shares.io?

- Who owns Shares.io?

- Shares product range overview

- Shares research services and tools

- Shares fees

- Shares opening an account

- Shares platform review

- Shares customer service review

- Shares deposit and withdrawal review

- Shares regulation

- Who is Shares suitable for?

- Alternatives to Shares.io

- Useful Information

- FAQs

- Shares.io Customer reviews

Overall

Pros

- Relatively cheap and simple fees

- Attractive and intuitive app

- Social investing

- Fractional shares available

Cons

- Limited market access – US stocks only

- No ISA or SIPP

- Mobile app only – no desktop

- No demo account

Shares was founded in 2021 by serial entrepreneur and Shares Group CEO, Ben Chemla, Francois Ruty, CTO, and seasoned financial services industry professional, Harjas Singh who is now Chief Product Officer. Originally based in Paris, it launched in London in 2022.

The company achieved one of the largest-ever seed fundraising results by an early-stage startup in Europe, raising $10m in its first, pre-product seed round, and has now raised $90 million in total funding.

Onboard as advisers are André Mohamed, Co-Founder of Freetrade and Former Head of Wealth and Trading at Revolut, Didier Valet, Former Deputy CEO at Société Générale, and Ryan McKillen of the founding team at Uber. It’s an impressive provenance.

Shares is registered in the UK as Shares App Ltd, and is a private limited company.

It is owned by its founders with backing from some big-hitting VCs, including Singular, Red Sea Ventures and Peter Thiel’s Valar Ventures.

Shares offers a very limited product range to UK customers but has committed to adding more investment products in the near future.

Shares currently only offers a general investment account (GIA). They’ve promised an ISA is being worked on, and have made a commitment to providing a SIPP in the future, too, but for now, the investing account is all that is offered.

A Shares GIA provides access to more than 1,500 stocks. At present, it’s only possible to invest in stocks listed on the NASDAQ and NYSE (US stock exchanges). So there are no UK or European stocks, no funds, no options, futures or cryptocurrency to trade. That makes it a very limited offering, which could affect investors’ ability to build a diversified and therefore, less risky, portfolio.

Fractional shares can be bought and sold, however, which is good news for investors with small budgets as it means it’s possible to buy stocks in the most popular and expensive companies, such as Apple, Amazon, and Tesla, from as little as £1 (note a £1 trade fee applicable).

The platform is only available via the mobile app; there is no desktop version.

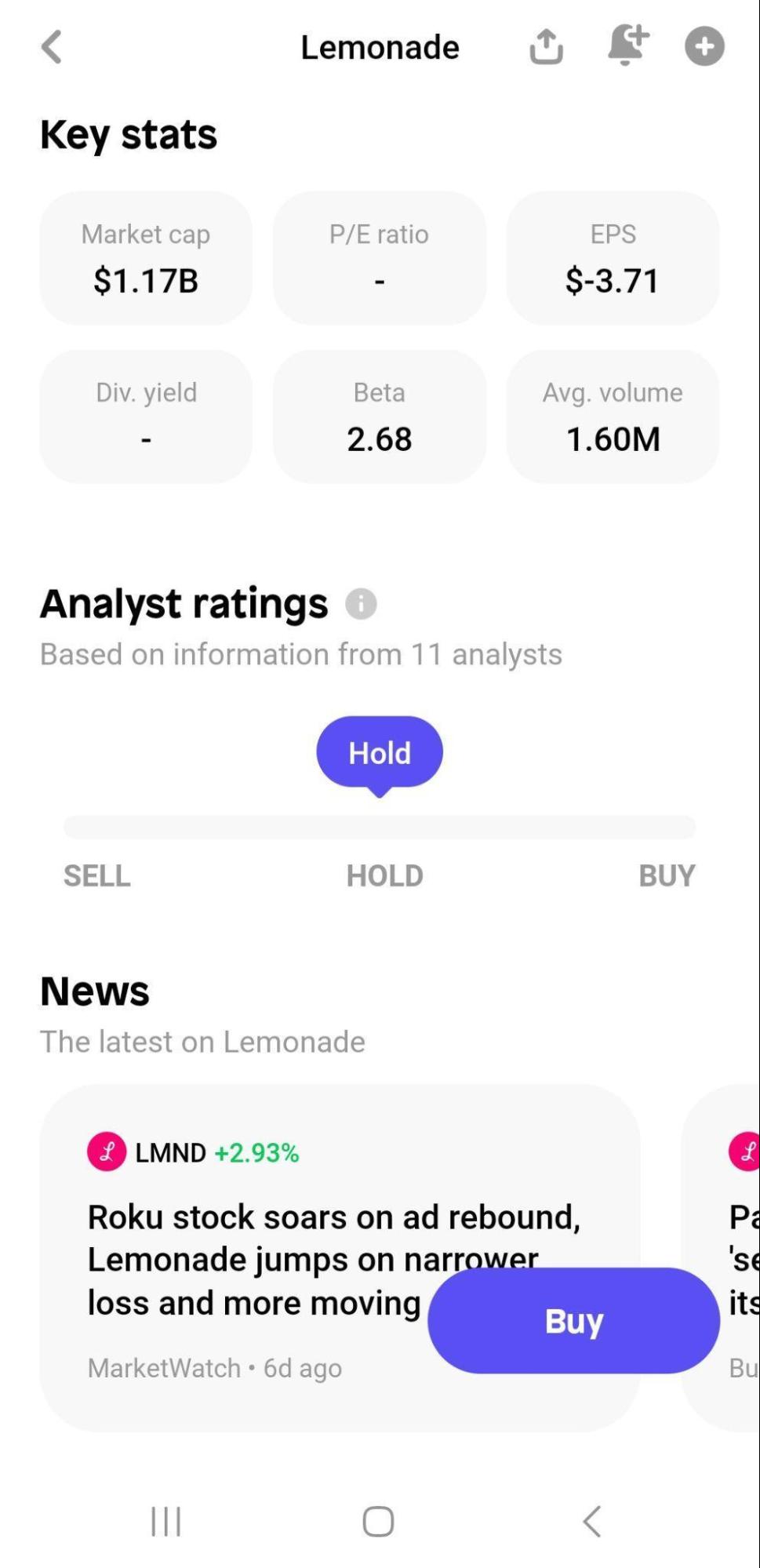

The research and trading tools provided on the app are fairly rudimentary but if you’re a new trader, that could be a plus point. The social investing tools are great if you want to share ideas on the same app but I have questions about how users establish their community.

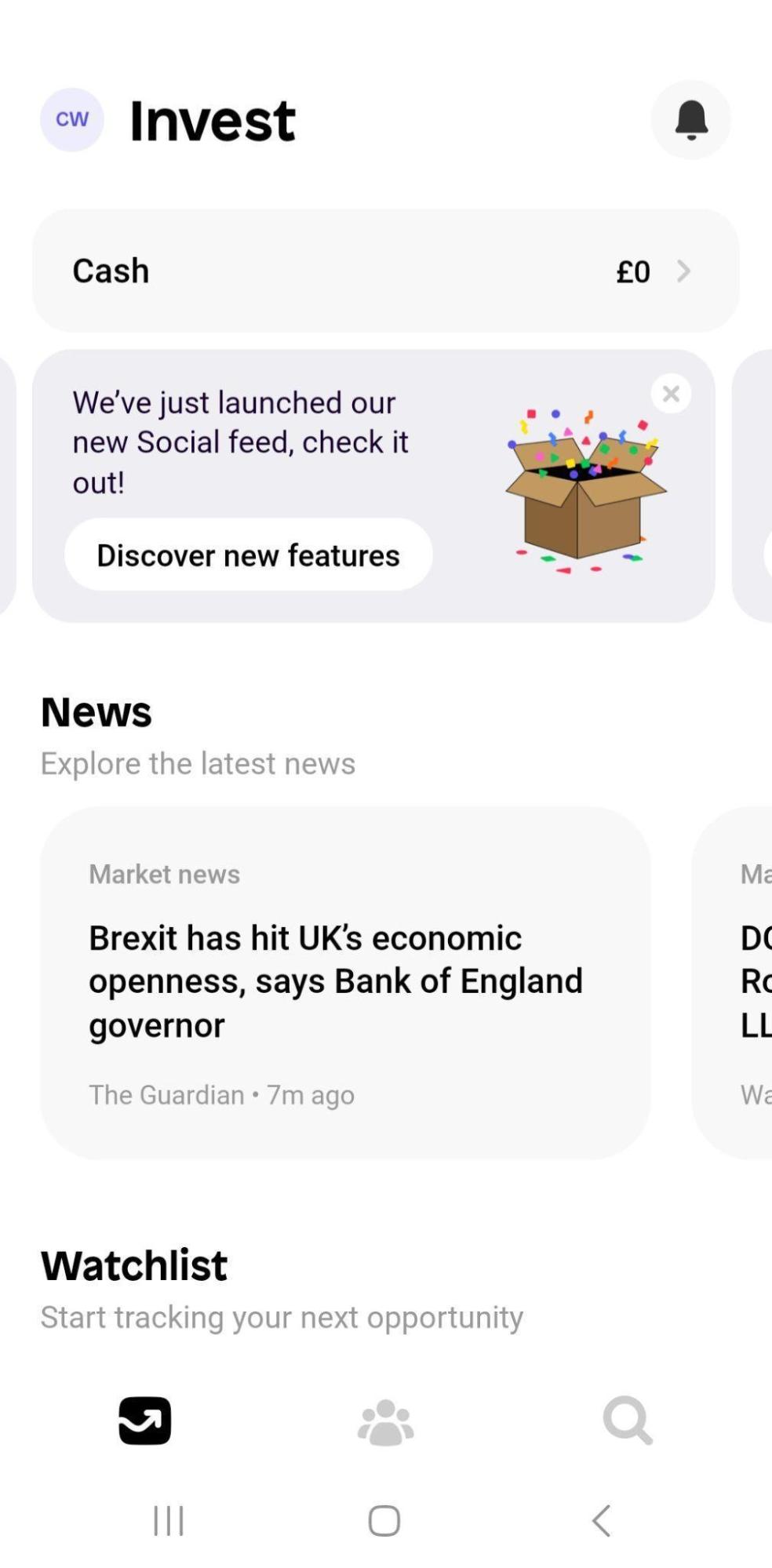

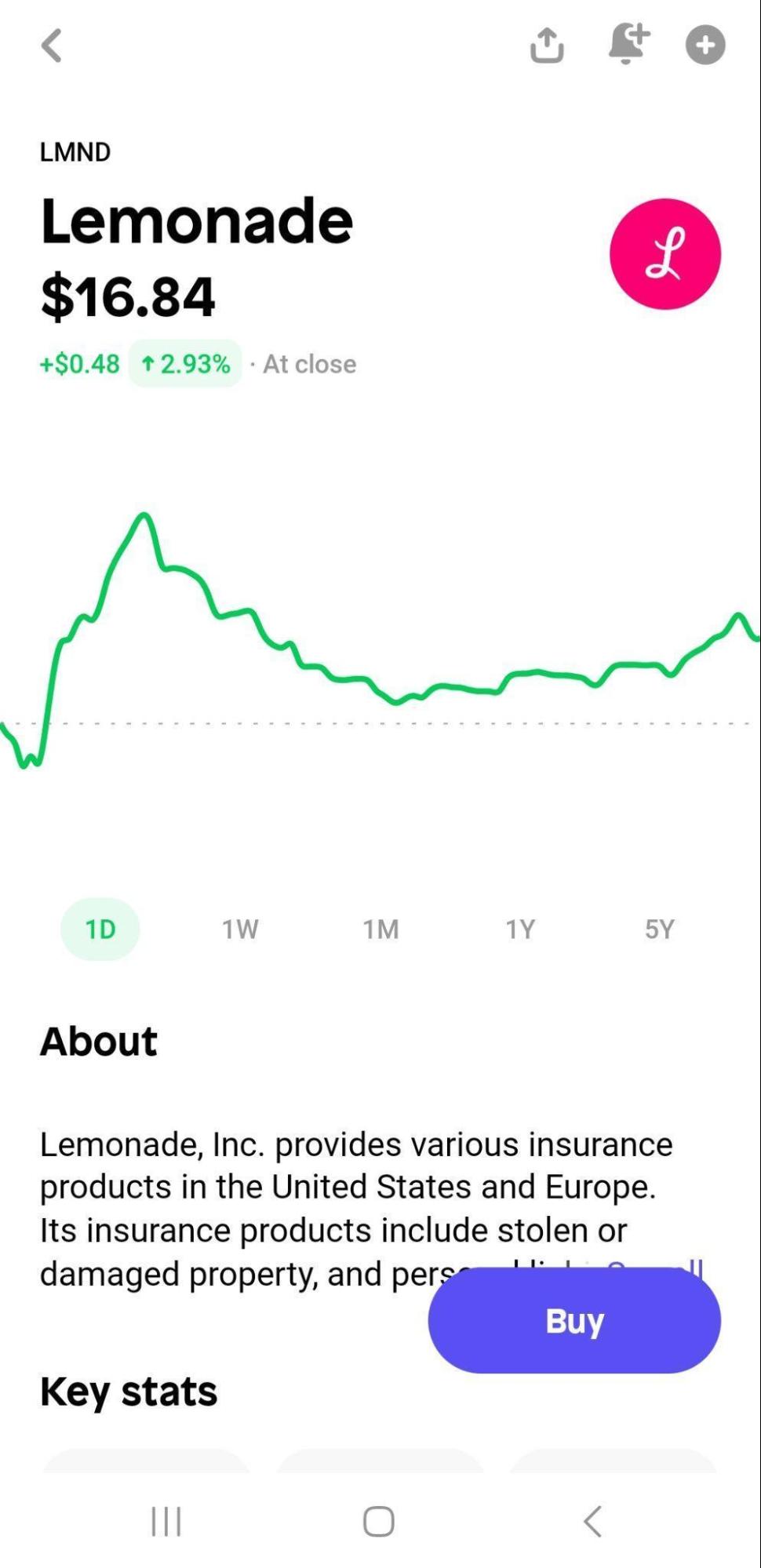

There are some nice features on the app – such as the stock watchlist, news ticker, and stock screener – that will help you research and monitor the health of the stocks you’re watching, and factors affecting price.

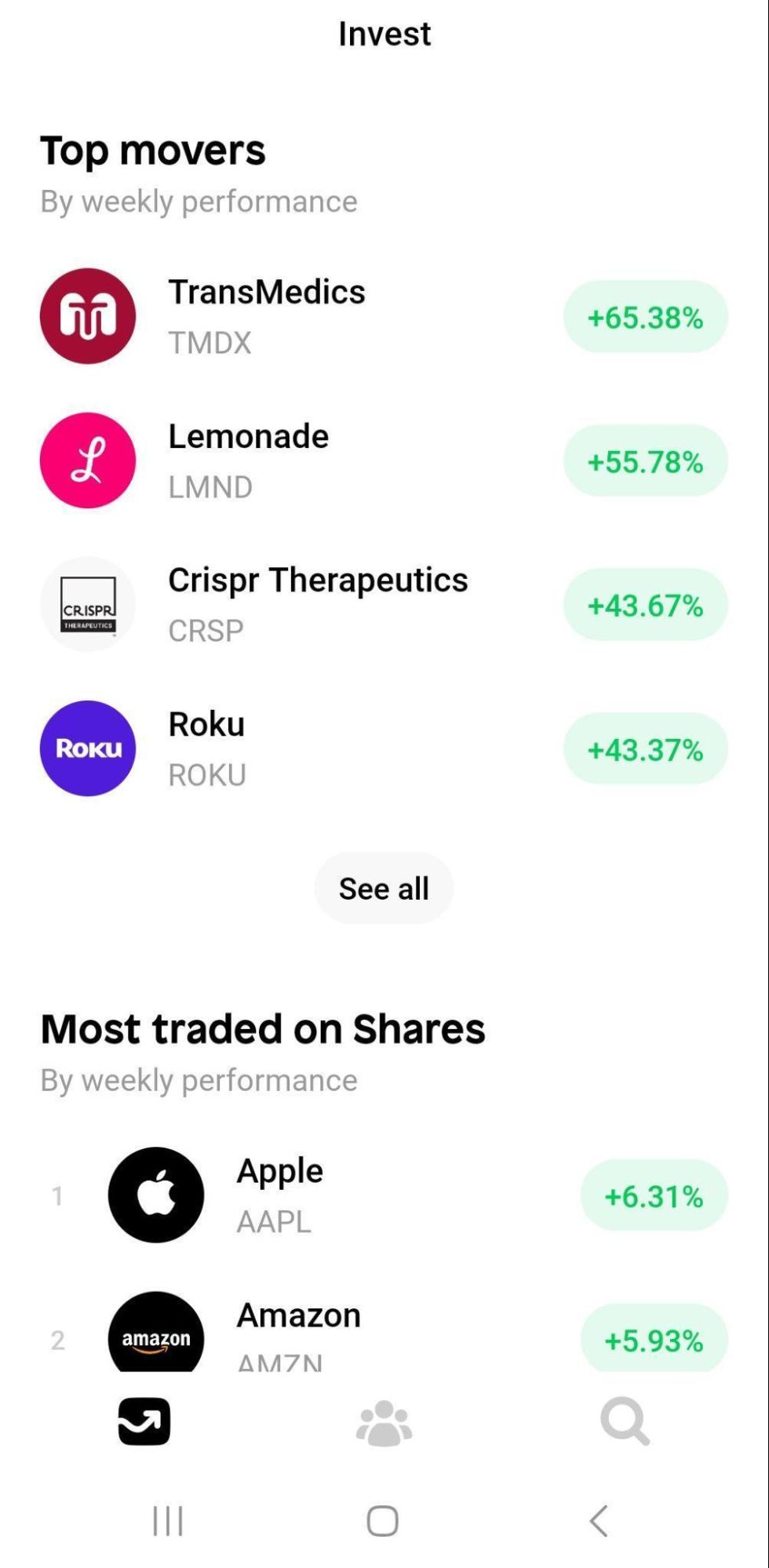

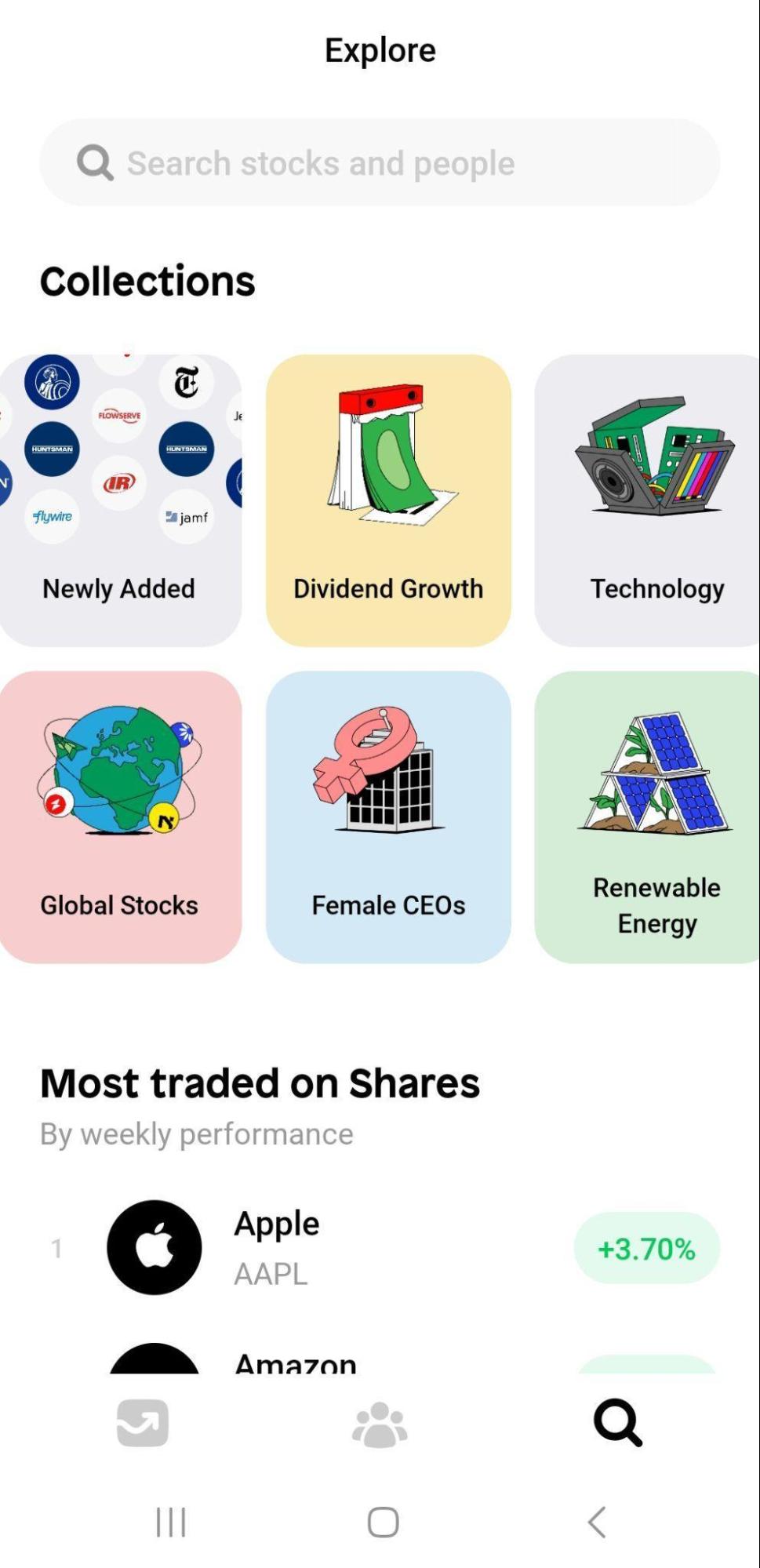

The ‘explore’ page includes information on top movers by weekly performance, most traded shares, and the stock screener, which makes it really easy to search for stocks based on factors like dividend yield, performance, market cap and sector.

There’s also a function that groups shares into ‘collections’, so you can go straight to particular themes or priorities for you, such as companies with female CEOs, renewable energy companies, healthcare, and newly listed stocks.

All the features have been carefully designed with plenty of white space and attractive graphics – that might be something that matters to you if you’ve found other platforms overwhelming.

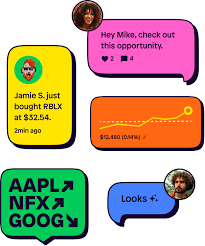

Shares labels itself as a social investing platform so it’s no surprise that the social investing features are a key element of the app. You’re encouraged to allow access to your contacts when signing up to enable Shares to flag up friends already on the app who you might want to connect and create chats with. It’s a great app for this and very user friendly.

The problem I had was, if you don’t have existing friends to connect with, it’s unclear how you go about deciding who you should be connecting with – and, therefore, how you make the most of the social aspect. There is no copy trading capability, and no ‘Discover People’ tool as you get on eToro so it feels more like it’s set up for friends who already exist as a social community rather than people looking to connect via a trading account.

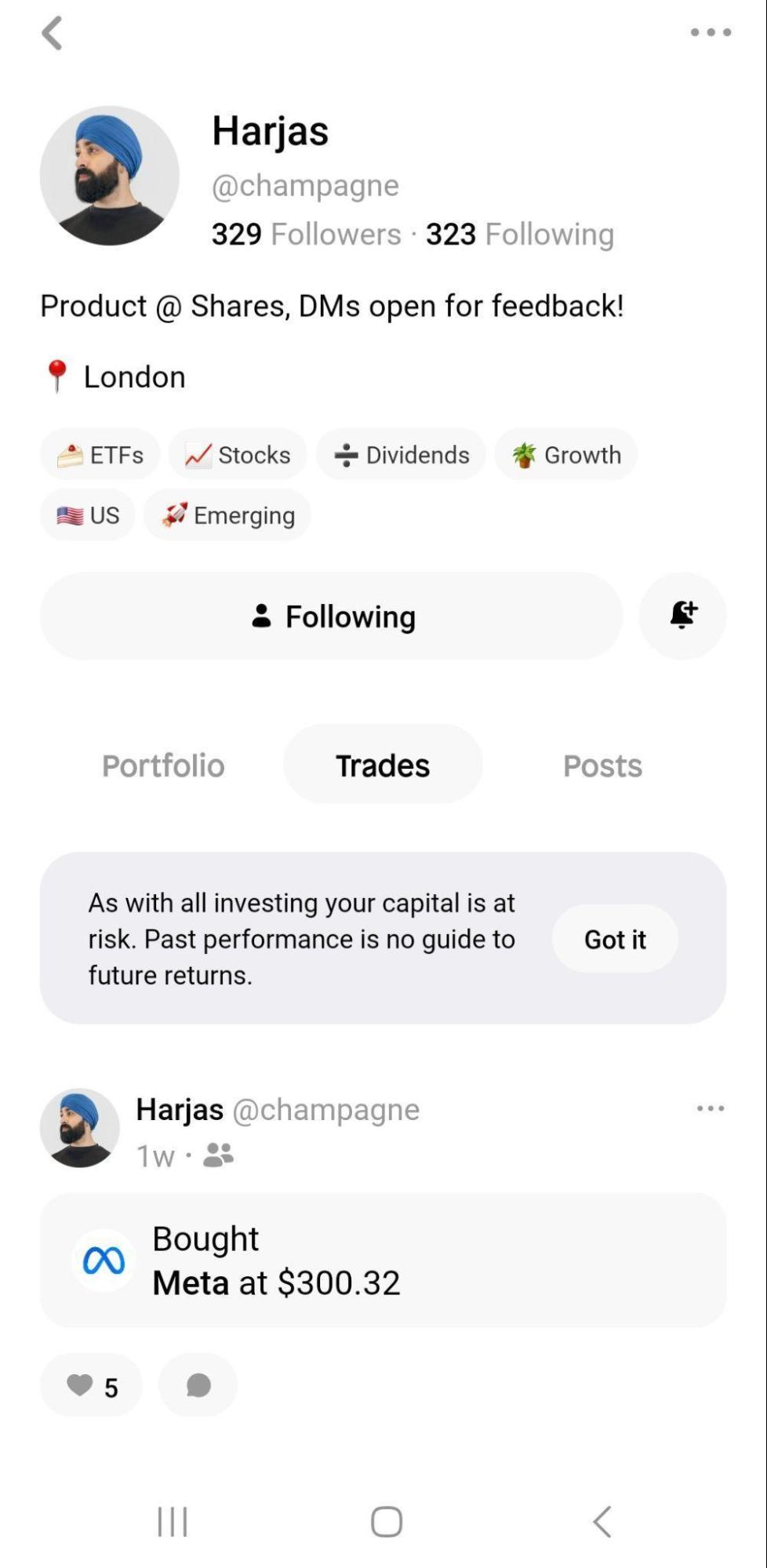

But one thing I do like is that their approach means you’re less likely to get pushed down the wrong path by the kind of dubious financial influencers (“finfluencers”) you might find on a social media site, or fellow investment platforms.

I also like the fact that you can see what friends are buying and selling. You can’t see any of those details unless your request to connect is accepted (your activities are private by default) and you can’t see the amounts others are investing (Shares says this is to prevent any possible attempts at market manipulation), but you can see the prices people buy and sell at, and interestingly, whether people are as good as they say they are! This is potentially a very effective way to develop powerful investment strategies.

Harjas Singh, Shares Chief Product Officer, said in a recent interview with InvestingReviews CEO, Simon Jones that social investing works because people tend to want to know what decisions their close friends would make in similar circumstances. We are social beings, after all. But you’ll need to build your community up yourself, and of course, not everyone wants to open themselves up to sharing their strategies (whether successful or failed).

Some of the usual risk management tools you get access to on more advanced platforms, are not available on Shares. So, there is no stop-loss functionality, for example, to help cut down on losses, and no demo account for you to practise and develop powerful investment strategies with virtual funds before committing your own money. However, you can set up notifications when an asset reaches a particular price.

Shares delivers straightforward, relatively low fees that feel like a breath of fresh air when compared to the complex fee tables used by other platforms.

Shares.io fees are low. And simple. Buying or selling a stock costs a flat fee of just £1 – no matter what your order value. With lower order values that might seem as a significant share of overall investment. However, the fee doesn’t increase along with the investment and that’s where economies of scale play their role.

On deposits and withdrawals, there’s a 2% charge if you use a debit card, but zero costs on withdrawals via bank transfer or open banking so you have other options.

Even better, there are no custody charges, FX fees or other costs to take into consideration, making Shares by far a cheaper trading account when compared to the likes of AJ Bell (0.25% a year), Hargreaves Lansdown (£5.95 per trade), and IG (£3-£8 per US trade). Fees as of November 2023.

If your eyes glaze over when reading other providers’ fee tables, and you’re freaked out by the formulas you need to use to work out total fees on other providers’ websites, then this is your platform.

Opening an account is quick and easy and you don’t need to deposit any funds or verify your identity until you are ready to invest.

In order to register with Shares, you’ll need to download the Shares app. It’s available for both Android and iOS. Click on the ‘Get the app’ button on the Shares website homepage and you’ll be presented with a QR code to scan. (Note, you’ll need to be 18+ and a UK resident to register.)

Create your profile by following the instructions on-screen.

If you want to start investing immediately, complete your profile by initiating the identity verification process. You will be asked for personal information such as your legal name, date of birth, National Insurance number, home address, and funding source.

You will also need to upload some documents. You may be asked for documents that will prove your identity (such as your passport) and address, and you may also be asked for information on the source of your funds. Verification happened in real-time in my own experience.

The Shares app has a 4.2 star rating from more than 50k downloads on the Google Play Store.

The platform is clearly tailored to an audience that won’t settle for anything less than stand-out UX, and it delivers on that. With its limited product range to invest in, the social aspect is Shares’ main appeal. But there is no desktop version of the app, which will be off-putting for more advanced traders.

This is one of the most attractive and intuitive investing apps I’ve ever used. It has a highly-refined, well-designed user interface that wouldn’t be amiss on an Apple product. It feels like an app for the TikTok generation. It’s very much built for collaboration, encouraging you to find friends on the app via your phone contact list, and to utilise the app to build networks and investing strategies.

There will undoubtedly be some users who find the lack of a desktop version of the app restrictive, and the inability to view different data sets simultaneously, irritating.

There will undoubtedly be some users who find the lack of a desktop version of the app restrictive, and the inability to view different data sets simultaneously, irritating.

There is no customer support advertised on the website, either, so the only way to ask a question is by registering for the app.

Education on the site is offered via Scoop by Shares (https://blog.shares.io/) which has a lot of educational articles. Accessible by tapping “learn more” on the website.

Shares’ social media channels also act as educational tools, with lots of interesting discussion points and insights delivered as engaging, bite-size, content.

With no phone or email support available, customer support is limited to in-app chat during daytime hours on weekdays, which is a shame.

There is an intercom chat in the help centre which appears when a person indicates that the article wasn’t helpful. . You must register for the app if you have questions you want answered by a human. Within the app, click on your profile and select “Support” to access the in-app chat facility.

Customer service is available Monday – Friday: 6:30 am – 9:30 pm (GMT).

Depositing and withdrawing funds from Shares is simple and free for bank transfers and open banking. Using a debit card incurs a 2% fee, however.

Shares currently offers four deposit methods: open banking, regular bank transfer, Apple Pay and debit card. Here are a couple of key points to note before adding cash to your Shares account.

- In order to deposit funds, your Shares account needs to be verified.

- You can only deposit from an account that is held in your name.

For your first deposit, you must use a traditional bank transfer or open banking. You will be able to deposit with your debit card and Apple Pay from the second deposit onwards.

Shares is regulated by the UK Financial Conduct Authority.

Shares is an appointed representative of RiskSave Technologies Ltd., which is authorised and regulated by the Financial Conduct Authority (FCA).

Funds are covered through a partnership with Modulr, an FCA-regulated firm who safeguard 100% of client funds. US investments are protected up to £500,000 by the Securities Investor Protection Corporation (SIPC).

While joining a social account is a great way to learn about investment opportunities, if you are unsure about the right investment decisions for your capital, you should always consult a qualified financial advisor who can help you make informed decisions and invest in stocks that are suited to your financial goals and circumstances.

Shares states that it is intended for rookies and financial veterans alike. However, in reality, it’ll appeal more to beginners.

Its limited product and investment range mean it’s not suitable for those looking to link up a GIA with their ISA or SIPP, or for those who want to use a greater range of investment vehicles to accumulate their wealth.

Comparing platforms? In this part of my Shares.io review, I’ll explore how Shares stacks up against some of their closest competitors in key areas:

Shares vs eToro

Investment choice: eToro is the world’s leading social trading platform. Unsurprisingly, therefore, it offers far greater choice with over 3,190 stocks, 420 ETFs, 32 commodities, 51 currencies and 21 indices to select from. It, therefore, has a much greater range of options than Shares. Shares is only suitable for those looking to trade US stocks and you won’t have the ability to trade CFDs or crypto, which eToro offers.

Education and social trading: eToro also allows you to copytrade, which may be more appealing to a new investor than simply watching and discussing the kinds of trades people are making on Shares. eToro also offers a really solid education via its eToro Academy, something Shares is missing.

Fees: On price, however, Shares is more attractive with its simple, flat fee of £1 per trade, no matter what its value. That’s hard to beat. With eToro, you’ll need to factor in FX costs, the spread and $5 withdrawal fees. It’s more complicated and more expensive.

Platform: There’s a desktop platform as well as a mobile app with eToro, but, if you’re happy trading from your mobile, Shares edges ahead on app design.

Products: Neither platform provides an ISA or SIPP.

Who is it suitable for? Those learning their craft will find something to attract them on both platforms. Shares feels like it’s designed for friends who want to learn how to invest and build a portfolio, rather than those who live for trading. If you’re in the latter category, you are more likely to gravitate towards eToro, as it is a more developed platform, with desktop functionality and a far greater choice of investment vehicles and tools.

Shares vs Freetrade

Investment choice: Freetrade offers commission-free trading in over 6,000 UK, US and European stocks and ETFs, so again, it provides more choice than Shares.

Education and social trading: Freetrade provides a decent education offering, tailored to new investors, on its website; something Shares is lacking. Signing up to Freetrade gives you access to a vibrant community forum where you can gain knowledge and ideas from other investors, as well as access to helpful articles outlining upcoming updates and potentially powerful insights.

Fees: Freetrade’s affordability has made it a popular choice among millennial investors, but is it a cheaper option than Shares? To get access to the full range of 6,000 shares, you’ll need to upgrade from the free account to either the £4.99/mo Basic Account, or the £9.99/mo Plus Account. Otherwise, you’ll only have access to 1,500 stocks. Let’s compare the free account as it’s most similar to what Shares offers. You’ll need to factor in an FX fee (charged on all US and European orders) of 0.99% and, if you want a same day transfer of your funds, a £5 transaction fee. Your order value would, therefore, need to be low to work out cheaper than Shares’ flat £1 fee per trade.That said, if you’re trading UK stocks on Freetrade, you’ll be able to trade free of charge. Something Shares can’t offer.

Platform: Similar to Shares, it is an app-only platform and is well-designed with those new to investing in mind. Freetrade provides access to automated order types, including limit orders and stop losses, in addition to advanced stock fundamentals, something Shares is lacking.

Products: Freetrade also offers an ISA and a SIPP, which means you can manage all your products within one platform – something you can’t do just yet at Shares (or eToro).

Who is it suitable for? Again, those new to investing and looking for low cost trading with a social aspect could find a home on either platform. If you want anything other than US stock trading, however, Freetrade is a better option.

Useful Information

This section contains useful information to make your experience at Shares as seamless as possible.

How do I contact Shares?

There is no option to speak to customer support agents by phone or email at Shares. Live chat is accessible through the app once you have registered for an account. You do not need to deposit any money into your account to register.

How do I close my account at Shares?

Closing your account is very straightforward. Log into your app, click on your profile, and select ‘Close account’ from the menu.

FAQs

Is Shares any good?

Shares is a good option for those new to trading and those who want a social trading experience with the chance to learn strategies and discuss trading ideas with others. Shares offers the potential to change the way the average person approaches investing.

How long does it take to withdraw money from Shares?

Withdrawals from Shares to a bank account typically take one day. Withdrawals through debit cards often arrive instantly, but on rare occasions can take up to 3 working days.

There are no reviews yet. Be the first one to write one.

- Learn how to invest in the FTSE100

- Have you considered transferring your pension?

- Find the best trading platforms