Established in 2012, Coinbase is now one of the leading cryptocurrency exchange brokers in the world, offering a simplistic platform from which to buy, sell, spend, earn, save, and use crypto.

Read my full Coinbase review UK to discover why this is an excellent choice for traders looking for an easy to use platform with access to a large number of cryptocurrencies.

Who are Coinbase?

Coinbase are an American based cryptocurrency broker, often used by inexperienced investors looking to dip a toe into the world of crypto for the first time.

Coinbase claim that they now have over 35 million customers since its launch in 2012, in over 103 countries worldwide including more than 20 billion in assets under management.

Who owns Coinbase?

Coinbase was co-founded by Brian Armstrong, a former Airbnb software engineer, and Fred Ehrsam, a former currency trader. Brian Armstrong retains his role as CEO to this day.

Coinbase Global Inc. is listed on the NASDAQ exchange where investors can buy Coinbase shares at the current rate.

Coinbase product range overview

Coinbase provides access to over 3,000 crypto assets like Bitcoin and Ethereum, as well as access to some of the more obscure assets that you wouldn’t find at other brokers.

There are two main account types at Coinbase; Coinbase and Coinbase Pro which I have gone into in more detail below.

Coinbase

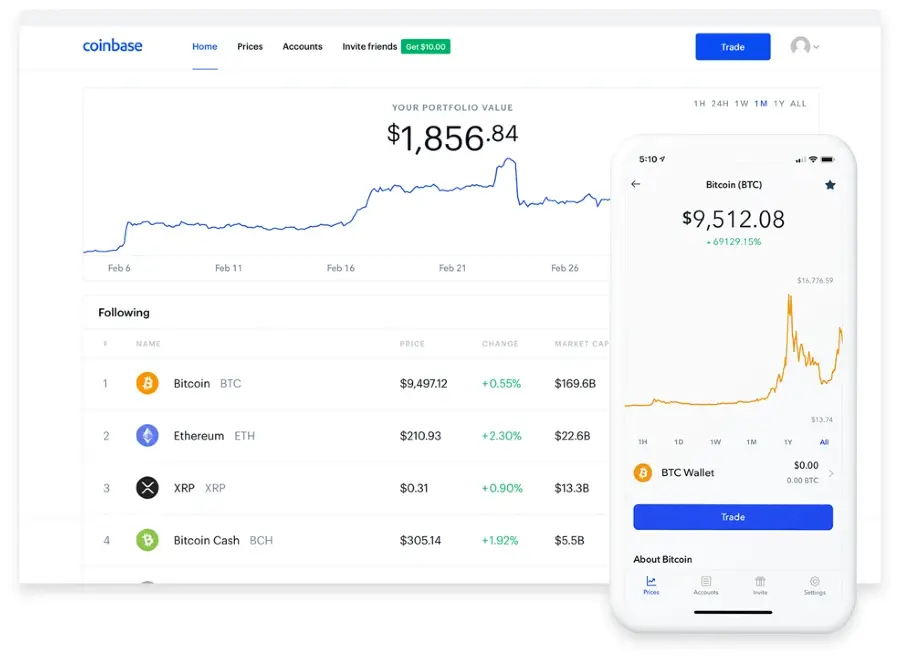

For a crypto newbie, this is the perfect vehicle from which to launch into the world of crypto investments. The Coinbase platform is well known for its simplistic and easy to use interface which can be accessed via a browser or on an app.

Once logged in, users are immediately faced with their portfolio balance on the main dashboard as well as the performance of their portfolio across a set time frame. This time frame is easily adjustable, providing users with an accurate depiction of how their assets are performing.

Buying crypto is easy and straightforward and can be done directly via the main dashboard. In addition, you have the option to convert or sell cryptocurrency, as well as have standing orders in place to send and receive crypto.

Coinbase Pro

Coinbase Pro caters more towards the more experienced cryptocurrency investor with all the trading options that can be found on the basic Coinbase account as well as the option to trade crypto to crypto. This is all supported by a decent range of charting tools.

Whilst the interface on the Coinbase Pro platform is still excellent in its design and easy to navigate, there are advanced charting tools that may be confusing for beginners. More experienced users will appreciate the functionality, including being able to track the market and view their trading history. There is also the ability to buy or sell orders. This enables trading of any particular asset, once it reaches a predetermined price.

One of the main advantages to Coinbase Pro is that there is the opportunity to drastically reduce or even completely eliminate the fees, depending on the value of the trade.

On the negative side of the coin, Coinbase Pro does lack some of the more advanced functionality that you might find at MT4 such as technical indicators and advanced charting tools.

Coinbase Wallet

Once you have purchased your cryptocurrency, the next issue is how to store them securely, and to this end, Coinbase have provided a crypto wallet. The Coinbase Wallet is a secure place to store your crypto and comes in two formats, the web wallet, and the Coinbase mobile wallet.

Coinbase insist that their web wallet is fully secure with less than 2% of cryptocurrency holdings being kept online and the rest held in cold storage, a hardware wallet, completely free from any online breaches. I will go into this in more detail in the security section of this review.

The mobile app wallet gives users complete control over their digital assets in a fully secure app that utilises biometric ID to keep your funds secure. There is also a QR scanner tool for easy transfers.

Watch the following video to learn more about the Coinbase wallet.

Coinbase Card

Coinbase also offer their users a Coinbase Visa Debit card, allowing them to spend their crypto anywhere in the world. This works in exactly the same way as it would a fiat currency, including contactless options, PIN, and cash withdrawals from any ATM.

Of course with crypto you often have more than one currency in your account, however Coinbase provide the means for you to choose which crypto you wish to pay with through the Coinbase app. This process takes a few seconds and can be done on the go as and when you decide to switch currencies.

The app also provides you with instant notifications on spending, transaction receipts, and spending summaries.

Coinbase education

An excellent education section whereby users can earn actual crypto while learning about trading and the various coins available.

The education section within Coinbase, Coinbase Earn, is nothing short of impressive, with the option to earn actual crypto while you learn about it, a worthwhile incentive.

This is all facilitated via a series of video classes and tests which are designed to educate users in cryptocurrency trading as well as some of the more obscure currencies on offer at Coinbase. Users are able to earn up to $115 should they manage to achieve successful results in the exams provided.

Given the volatile nature of cryptocurrencies and the fact that many newbies are being stung upon entering the world of crypto, I do believe this is an excellent feature that certainly sets Coinbase apart from many of their competition.

Coinbase fees

There is no denying that Coinbase remains one of the more expensive options when it comes to cryptocurrency exchanges. The high trading fees and transaction fees can start to chip away at your gains, especially for smaller transactions.

One of the main fees to be aware of is the 3.99% levied on debit/credit card transactions which is very high. Coinbase charges either the flat fee, or a variable percentage fee, depending on which is greater.

There are several fees that make up the complex structure at Coinbase. The Coinbase spread, transaction fees and trading fees. I have gone into these in some detail.

Coinbase spread

Essentially this is the difference between the price Coinbase buys the coins for and the price you then pay for those coins. The spread at Coinbase is currently in the region of 0.50%, however, you will need to take fluctuations in the market value of each cryptocurrency into account.

Coinbase fee

Coinbase’s fees can be calculated either as a flat fee or as a percentage fee, depending on which is greater. The flat fee is applicable on transactions below the value of $200 and is calculated depending on the transaction amount as below:

| Transaction amount | Fee |

|---|---|

| $10 or less | $0.99 |

| More than $10 but less than or equal to $25 | $1.49 |

| More than $25 but less than or equal to $50 | $1.99 |

| More than $50 but less than or equal to $200 | $2.99 |

| More than $200 | Variable percentage fee applies |

The percentage fees are calculated as follows:

| Transaction Method | Fee |

|---|---|

| Bank transfer | 1.49% |

| Debit/credit card | 3.99% |

| SEPA Bank transfers in or out | Free/€0.15 |

| Faster Payments | Free |

| Instant card withdrawals | Up to 2%, minimum fee £0.55 |

As you can see, the fees change considerably depending on your preferred payment method, however, these are high in the industry, especially the fee for debit/credit cards.

To give you an idea of how this would work out, in order to buy £100 of Bitcoin using a debit/credit card, you would incur a cost of £3.99 as the percentage fee would outweigh the flat fee of $2.99.

Coinbase Pro fees

For advanced traders this is the most cost effective way of trading at Coinbase. A Coinbase Pro account comes with a relatively simple fee structure whereby your fees are calculated according to your trading volume in the previous 30 days.

There are two main fees to be aware of, the ‘taker fee’ and the ‘maker fee’. The taker fee is calculated each time you place an order at the market price and your order is filled immediately. Conversely, a maker fee applies when you place an order which is not immediately matched by an existing order and your order is therefore stored in an order book in anticipation of another customer placing an order that is the exact match of your order.

Should part of your order be matched immediately, and part of it stored for a later match, your order will be split, with the matched portion attracting the taker fee and the stored portion attracting the maker fee.

However your order is completed, the main thing you need to know is that the fees charged for Coinbase Pro are considerably less than with a regular Coinbase account.

| Total Trading Volume | Taker Fee | Maker Fee |

|---|---|---|

| Up to $10,000 | 0.50% | 0.50% |

| $10,000 – $50,000 | 0.35% | 0.35% |

| $50,000 – $100,000 | 0.25% | 0.15% |

| $100,000 – $1 million | 0.20% | 0.10% |

| $1 million – $10 million | 0.18% | 0.18% |

| $10 million – $50 million | 0.15% | 0.05% |

| $50 million – $100 million | 0.10% | 0% |

| $100 million – $300 million | 0.07% | 0% |

| $300 million – $500 million | 0.05% | 0% |

| $500 million – $1 billion | 0.04% | 0% |

| More than $1 billion | 0.04% | 0% |

Coinbase FAQs

Is Coinbase any good?

How long does it take to withdraw money from Coinbase?

Does Coinbase accept Paypal?

Coinbase Customer reviews

i like coinbase mostly because of its instant withdrawals. it allows me to be flexible and saves time when taking money out. it also has a Pro exchange where i can place trades on the market which i have tried with other exchanges like crypto.com but the login page does not work. overall it provides a clean and simple structure to invest in crypto.

- Deposit and withdrawal

- Customer service

I was interested in cryptocurrency so I did my homework and saw that Coinbase was highly recommended. The interface is easy to navigate and it started you off with a bit of money to try different features with. I liked that I could compare different cryptocurrencies at one glance. I’m still a novice but it seems designed for novices with not much financial know how. I can clearly understand my gains and losses. (More losses recently than gains, but that’s how it goes.)

- Fees

- Account opening

- Customer service

It is great as long as you are using Coinbase Pro instead of standard Coinbase, as standard Coinbase as crazy high fees which can be hard to justify especially if only buying small amounts of crypto at a time. Customer service can be a pain to get a hold of but usually the service runs smoothly so there is no need to contact them that often anyway.