Chip is an automatic saving and investment app that provides access to market-leading interest rates and a selection of BlackRock investment funds. There are several great features that harness artificial intelligence and Chip are constantly improving their service.

However, there are cheaper options available so I’ve taken the time to assess whether Chip are the best solution on the market for auto investing and saving.

In this Chip app review, I’ve taken a detailed look under the hood of this automatic saving app which claims to make saving easy and accessible to everyone, regardless of your current financial circumstances.

Saving money doesn’t always come naturally to everyone, however, a new generation of saving apps are using artificial intelligence to analyse your income and spending habits in order to help you squirrel away money without even noticing it.

Having thoroughly tested this method of saving over a considerable period of time, I can confirm that it is an effective and painless way to put money aside, but that being said, Chip isn’t the only saving app on the market so I’ve taken the time to test this offering against its main competitors to find out if Chip’s 300,000 users have chosen the best saving platform available.

That being said, I would encourage you to read my entire Chip app review, in order to obtain a completely impartial account of the savings app and whether it would be a good option for you.

Who are Chip?

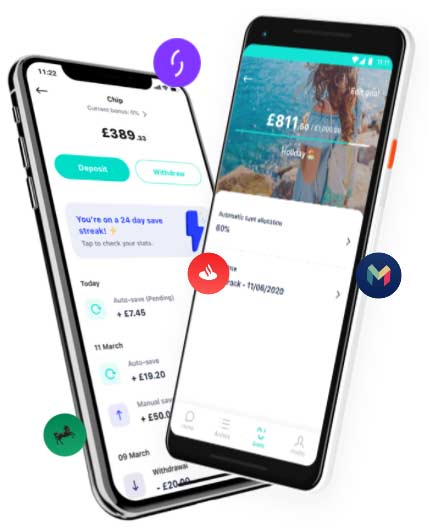

Chip is an automatic saving app that connects to your current account through Open Banking. It utilises complex algorithms to establish how much you can afford to save and then places that cash in a saving or investment account on your behalf.

Who owns Chip?

Chip was founded in 2016 by Nick Ustinov and Simon Rabin. Simon Rabin retains his role on the board of directors to this day.

Chip Product Range Overview

Chip offers savers the following products to help generate great saving habits:

Prize Savings Account

This is a more recent addition and whilst you won’t earn any interest here, you will be entered in a prize draw to win over £10,000 in prizes each month as long as your balance is above £100. Every £10 gets you one entry, so the more you save, the more chance you have of winning.

Whilst there are no charges for using this account, the current rate of inflation would mean that should you fail to secure a prize in the draw, your funds would actually be losing value over time.

Allica Bank Easy Access Savings Account

Returns: 1.1% AER

As of August 2021, Chip have launched their new easy-access savings account with an AER of 1.1% with FSCS protection for your funds. Interest is paid daily, so you can take advantage of compounding and you can access your funds whenever you like.

This is a decent interest rate at the moment, and Chip have suggested there are more savings accounts to come.

90-day Notice Account

Returns: 2.15 AER

If you don’t think you will need to get your hands on your savings quickly, then this is by far the best interest rate on offer at Chip. This account is powered by OakNorth Bank and accounts holders are required to give 90 days notice in order to withdraw their funds.

Chip Plans

Basic Plan

This is the free plan. You can earn a great interest rate of 2.15% on the 90-Day Notice Account and 1.1% AER on the Easy Access Savings Account using this plan and the great thing is that it is completely free of charge.The Basic Chip plan comes with a choice of savings accounts and most importantly the auto-saving technology and savings goals. You can also access the General Investment Account (GIA) with an annual platform fee of 0.5% (min. £1 per month) and the basic investment funds from BlackRock, however, the full range of funds is only available with the ChipX plan.

ChipX Plan

This is the plan that unlocks the full range of funds and the investment ISA, at a cost of £4.99 per 28 days. This includes ethical and clean energy funds emerging markets fund and new funds that are constantly being added. In addition there is no platform fee to contend with which is very competitive in the industry.

Chip Investments

Chip have partnered up with BlackRock in order to provide their investment offering.

There are several funds to choose from including

S&P 500 Tech Companies:

Average annual return: 21.58%*

Risk rating: 6/7

FTSE 100:

Average annual return: 3.48%*

Risk rating: 5/7

Crypto Companies:

Average annual return: 20.74%*

Risk rating: 7/7

Healthcare Innovations:

Average annual return: 7.32%*

Risk rating: 6/7

Emerging Markets:

Average annual return: 3.95%

Risk rating: 6/7

Global Companies Fund:

Average annual return: 7.91%*

Risk rating: 6/7

Physical Gold:

Average annual return: 5.3%*

Risk rating: 4/7

Clean Energy:

Average annual return: 21.24%*

Risk rating: 7/7

It is important to note that Chip does not offer any financial advice and investing is entirely at your own risk. The value of your investments can go up as well as down and you may not get back the original amount you invested.

Of note out of the funds on offer is the lack of low risk funds. It is also important to note that the average returns may give you an indication of how the fund has performed in the past, however, this is no guarantee of future performance.

Chip Fees

As previously mentioned there are two payment plans at Chip, the Basic plan that is free of charge and ChipX which will set you back £4.99 a month.

The standard plan actually provides a lot of features that can all be accessed for free and is definitely the better option for small investment pots that won’t generate a big tax bill. However, once your investments start to grow you will probably want a tax wrapper and sadly the ISA can only be accessed by paying for ChipX.

It is also worth noting that Chip charge a withdrawal fee of £0.50 should you withdraw more than once in any 28 day period.

Chip App FAQs

Is the Chip app safe?

Can I save extra into my Chip account?

Can I link a new bank account to my Chip account?

Chip Customer reviews

I used to have an account, but due to constant changing plans (chip, chip x, now prize savings, what is next?) and now fees, I closed my account and now switched to Plum

- Account opening

- Deposit and withdrawal

- Customer service

- Fees

As an investor I am disappointed that they are not maintaining differentiation on vanilla savings interest rates, now focussed on alternative investment offers. Unless base rates return the fall in rankings will continue. I have moved funds away to other banks … the shine is definitely beginning to dull.

- Account opening

- Deposit and withdrawal

- Customer service

- Fees

I was with Chip until November last year and I am a crowd investor in them so I want them to do well. I’ve been monitoring them with a view of going back when they are better, but to my disappointment they are getting worse. From October they are going to charge for every autosave that they make into your account which is quite shocking given they control this, it’s charging you to deposit money into your account and NO OTHER autosave app charges you for this feature (e.g. Plum). They are also charging for withdrawals more than 1 in a 28 day period. But it’s free to deposit money directly into their account. Their interest rates for savers is WAY OFF from competing against the best in the market which as of today 8th September is 2.10% for easy access (no charges to deposit money or withdraw it as many times as you wish). Its really sad to see all of this, new customers will not be attracted to Chip now, and existing customers will probably leave them once they start seeing the new charges hit their accounts.

- Fees

- Account opening

- Deposit and withdrawal

- Customer service