It is finally possible for select expats to retire in Qatar, provided they have made sound financial plans for their future whilst living and working in this vibrant multinational community.

Even if you are still deciding where to retire or do not yet fit these special circumstances, Doha is the ideal place to begin accumulating serious wealth for later life, wherever you ultimately choose to spend it.

Also consider: My international SIPPs explained guide

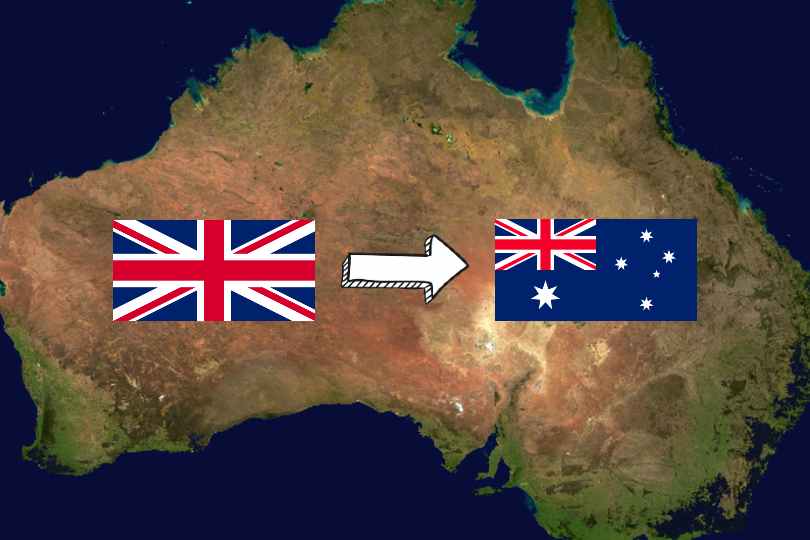

Looking to transfer your UK pension?

Speak to me, Dan Ward, about transferring your UK pension funds to Qatar.

Checklist for transferring a UK pension to Qatar

Here are the mandatory first steps, all of which I can manage for you while providing expert advice, for UK pension transfers:

- Collate all existing UK pensions

- Request a CETV (Cash Equivalent Transfer Value)

- Conduct a cost and performance comparison

- Research the best overseas scheme before or after moving abroad

- Submit transfer request documentation to both your existing and new providers

It is important to note that your existing UK adviser can only help you when they are additionally qualified and licensed overseas, which is unlikely. This statutory requirement aims to protect your retirement funds from poor advice.

I will handle the necessary paperwork as an appropriately qualified and regulated expatriate financial adviser. I have years of experience and expertise and can help with all aspects of living abroad and transferring your pension.

Which UK Pension do you have?

Before you can transfer your pension, first you need to determine which of the following UK registered pensions you currently have.

Some of the most usual pension schemes are a workplace pension, personal pension, or a self-invested personal pension (SIPP).

Some company directors, senior executives and relatives may also have a small self-administered scheme (SASS).

Workplace Pension

If you have been employed in the UK since 2012, you should have been compulsorily enrolled into a workplace pension plan.

People often accumulate several pensions in this way, and you can use the Pensions Tracing Service to track down any lost pension savings.

Workplace pensions tend to be either defined benefit (DB), that is “final salary”, or defined contribution (DC) schemes, depending upon who you worked for and when.

In both cases, your contributions are eligible for tax relief at your marginal rate of Income Tax while the scheme provider invests your money.

Personal Pensions

Many people choose to open private pensions, separately from the workplace.

Generally, these take the form of defined contribution plans and work in the same way as workplace pensions. The pension provider invests your retirement savings for you while your contributions receive tax relief as above.

Self-Invested Personal Pension

A SIPP is a modern, portable and flexible DC pension plan. They are easily converted into an international SIPP for people who want to live or work in various parts of the world.

As with other schemes, you receive tax relief on your contributions yet, one of the key benefits is that you take personal responsibility for the investment decisions made with your retirement savings.

You can be as hands-on as you like with a SIPP or work with a regulated financial adviser like me to identify the best investment options for your unique risk profile.

For the under 75s, one sensible way of preparing to transfer your pension funds for living and working in a new country is by consolidating all your existing pensions into a SIPP. There are two critical reasons for this:

- First, all your pension funds are in one place.

- Also, you will have access to a new range of global investments which may not be available to your current provider. This can make transferring your pension fund much easier when later moving abroad.

As with any pension transfer, consulting with someone qualified to offer advice on your situation is vital.

Small Self-Administered Scheme (SSAS)

This flexible workplace pension is available for senior executives, company directors and relatives in private firms. In addition, up to eleven individuals can participate in an SSAS and benefit from its tax-efficient estate planning advantages.

Contributions are eligible for the same tax relief as other occupational schemes but plan members take control of all investment decisions, which can lead to far greater returns.

Looking to transfer your UK pension?

Speak to me, Dan Ward, about transferring your UK pension funds to Qatar.

What are the options for transferring your pension overseas?

There are two main ways a UK pension can safely be transferred to an overseas scheme, an international SIPP or a qualifying recognised overseas pension scheme (QROPS).

Many factors determine the best pension options for you, the chief of which is the total value of your current pension pot.

Roughly speaking, the smaller the pot, under £150,000, the more suitable an iSIPP will be. But, on the other hand, for retirement funds closer to the Lifetime Allowance (at the time of writing in May 2023, this is £1,073,100), a QROPS could be appropriate.

Please note that under current pension rules, specific governmental schemes such as NHS, police or overseas service pensions are not eligible for pension transfers even within the UK.

Additionally, even if your pension is not locked into the UK, there is no obligation to make such a transfer at all. You could do nothing and simply leave your pension where it is. Still, then you might miss out on Qatari tax advantages, investment opportunities and the potential for a much higher pension income later in life.

International SIPP (iSIPP)

iSIPPs are configured in the same way as their domestic counterpart, the SIPP, and both are regulated by the Financial Conduct Authority in the UK.

An iSIPP can be an excellent choice if you plan to return to live in the UK at some point. This is because it allows you to keep your current fund in the UK even if you opt to receive benefits from it in a different currency.

You can continue making further contributions to your iSIPP if you are considering a phased approach to retirement.

Qualifying Recognised Overseas Pension Schemes (QROPS)

QROPS are overseas pension schemes which can accept UK pension transfers. So British ex-pats and foreign nationals who have worked in the UK, with over £150,000 in their pensions, can enjoy greater flexibility and other benefits by opting for a QROPS.

They are regulated by His Majesty’s Revenue and Customs (HMRC) who regularly update a list of worldwide providers on their website. Always check with HMRC to verify that any QROPS you are considering is genuine. Otherwise, you could be hit with a tax charge of 55%.

Choosing a QROPS removes the Lifetime Allowance limit on your pension funds, lets you withdraw up to 30% as a pension commencement lump sum and can be the most tax efficient course of action for some.

However, pension transfers to a QROPS can be lengthy and often become highly complex. This is another reason to only do so after seeking qualified advice which takes all of your circumstances and personal goals into account.

You can always ask me whether a QROPS is a safe and suitable way to move your UK pension overseas. Without suitable advice, you may be hit with a high tax charge on the pension transfer.

It is also essential to seek advice before withdrawing a lump sum so that you do not incur a tax charge for an unauthorised payment.

Looking to transfer your UK pension?

Speak to me, Dan Ward, about transferring your UK pension funds to Qatar.

Choosing an Overseas Pension Scheme for Qatar

Although there are currently no local providers in Qatar, you could choose a European economic area QROPS. Depending on your individual circumstances, Malta can be the ideal EEA country to base your new pension. There are also QROPS providers in other countries we could consider.

Moving pensions abroad is a huge decision. I can advise whether a recognised overseas pension scheme is or is not right for you and if it is more appropriate to transfer your pension to an international SIPP instead.

For example, when your pension fund is still a long way from the Lifetime Allowance, the tax benefits of working in Qatar will allow you to grow your iSIPP quickly.

Pension transfers to both International SIPPS and QROPS can grant protection from exchange rates and allow you to take a tax-free lump sum.

Your sponsoring employer in Qatar may also provide a pension abroad. As an independent financial adviser I can help you reduce currency risk with all aspects of any overseas pension.

Will I have to pay UK Income Tax?

Tax rules state that if you are a Non-UK resident you will not usually have to pay UK income tax.

It is generally best to take a tax-free lump sum from your pension fund, if you want, while you are still a UK resident.

I am fully conversant with UK rules and can protect your retirement income from unnecessary tax.

Pension Income in Qatar

The generous tax benefits of working in Qatar are widely known, and this also applies to retirement income.

Whether you pay tax and how much when transferring your pension overseas will depend upon which scheme you choose and your visa and residency status in the new country.

As a retiree, your financial status, health and fluency in Arabic, among other factors, must satisfy Qatari requirements before residency permits are granted.

Looking to transfer your UK pension?

Speak to me, Dan Ward, about transferring your UK pension funds to Qatar.

How do I transfer my UK pension to Qatar FAQs

Can I transfer my UK pension to UAE?

Will I lose my UK pension if I move abroad?

Further Reading:

Please note

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

Overseas pension transfers can be complex. Make sure you take financial advice before you transfer your funds.

- Learn how to invest in the FTSE100

- Have you considered transferring your pension?

- Find the best trading platforms