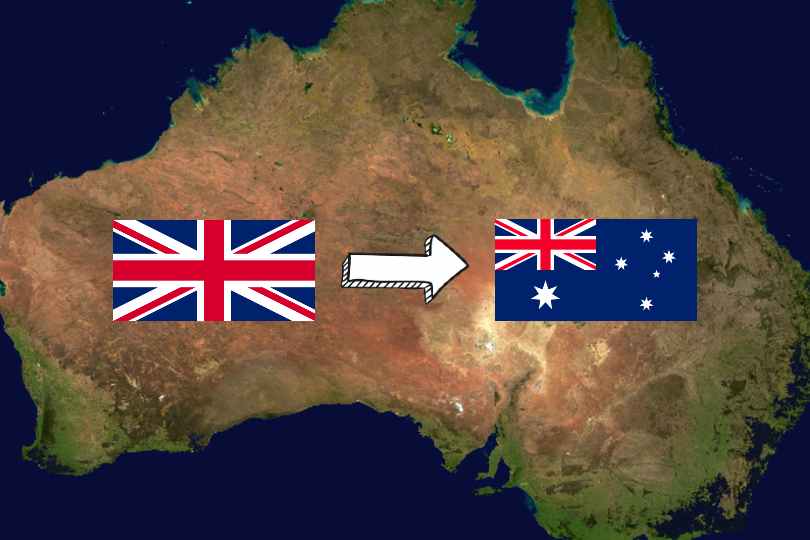

If you want to transfer your UK pension to the United Arab Emirates but don’t know where to start, read on to learn how to make an informed decision taking all the potential risks and benefits into account.

Also consider reading: How to transfer a UK pension to Qatar as an expat

Looking to transfer your UK pension?

Speak to me, Dan Ward, about transferring your UK pension to Dubai.

Where do I begin in moving my UK pension to Dubai?

First and foremost you will need to have your existing pension information to hand. I can then collate this for you, handling all the paperwork. I will also take care of all of the following requirements I’ve outlined in the checklist below:

Checklist for transferring a UK pension to Dubai

- Collate existing UK pensions

- Request a CETV (Cash Equivalent Transfer Value)

- Conduct a cost and performance comparison

- Identify the best solution for UAE

- Submit transfer request documentation to the existing and new provider

What is a UK pension scheme?

What is a UK pension plan, and how do you know whether you have one? There are three categories, and most people who have lived or worked in the UK are likely to have at least one.

- Workplace scheme

- Private plan

- UK state pension

Every UK pension attracts generous tax relief on your pension contributions which may be applied automatically or, in the case of some higher rate taxpayers, must be claimed via completion of a self-assessment tax return in certain circumstances.

If invested, the growth of your pension pot is also tax-free, and many plans allow you to withdraw a lump sum of up to 25% of the fund’s value without needing to pay UK tax, such as capital gains tax. If you are considering this, it is best to do so whilst you are still a UK resident. Doing so while a non-UK resident means you may have to pay tax charges.

Tax on UK Pension Income

In fact, you only ever pay UK income tax on your pension income when you withdraw it upon retirement, and only if it exceeds your tax allowance. By transferring to an overseas pension scheme, you might avoid having to pay UK tax at all because the UAE will not tax your personal income.

All this is subject to a maximum annual allowance of £60,000.00 in tax-free pension savings for UK residents, provided your income is under £200,000.00 per tax year. You will pay tax on any contributions over the limit. Adjustments are made by tapering the allowance for those whose earnings exceed this threshold.

Not every UK pension scheme is suitable for transfer outside the UK. I explain how to determine whether yours is and what you can do if it is not.

Workplace Pension Plans

Since 2012 employers must automatically enrol employees in an occupational scheme, and in this way, it is common to have more than one such UK pension unless you opted out. You can get help tracking down any company pension plans you’ve accumulated over the years via the government’s Pension Tracing Service online. I’ll explain the benefits of consolidating these into one ready for living abroad.

Occupational UK schemes will always be a defined benefit or a defined contribution arrangement. Falling under the heading of defined contribution plans, you may also have a small self-administered scheme (SSAS) or a group self-invested personal pension (group SIPP).

If you are still determining which type of pension your workplace provides, you can ask the pension manager at work or speak with someone in the human resources department.

Defined Benefit

This UK pension is most common in the public sector, but a few private employers offer it too. They are also known as ‘final salary’ or ‘unfunded’ schemes because they guarantee a proportion of your former salary, funded by the taxpayer or your employer rather than from the investment growth of your individual pension pot.

Should you have any defined benefit scheme and wish to transfer your pension to your new country, speak with your UK provider first. There are many advantages to this scheme, all of which will be vulnerable to considerable risk when transferring to a defined contribution plan.

Some private sector schemes and a few funded public sector arrangements may be suitable for transfer to overseas pension schemes.

Defined Contribution

All other forms of UK pension will be a defined contribution scheme, often called ‘money purchase’ plans. Usually, the pension provider invests your contributions into a restricted range of funds, and the growth of your pension pot depends very much upon the performance of those investments.

However, if you are a professional such as an accountant or a solicitor, working with others, you may be more hands-on and hold your pension savings in a group SIPP.

Group or Workplace SIPP

A group SIPP is a way to aggregate a few individual pensions to increase purchasing power, for example, by investing in commercial premises to rent back to your business.

Any UK SIPP grants access to a virtually limitless range of investment opportunities, with the critical exception of residential property. I explain more about SIPPs under private pensions below, as they are often the ideal method for transferring your UK pension abroad.

It is possible to manage your workplace SIPP yourself fully. As long as everyone taking part shares the same provider, it is still a group SIPP. Your individual pot will likely be suitable for transfer to an overseas pension scheme when you move to Dubai.

Small Self-Administered Scheme, SSAS

This defined contribution workplace arrangement is only available to senior executives, company directors and relatives. There is an upper limit of 11 individuals with any single SSAS.

Often, there is no pension provider with an SSAS but rather, the participants become trustees of the scheme. They can enjoy freedom from some of the more restrictive pension legislation applicable to other arrangements.

However, tax relief on contributions applies in precisely the same way as any other UK pension scheme.

Looking to transfer your UK pension?

Speak to me, Dan Ward, about transferring your UK pension to Dubai.

Private Pension Plans

A private or personal plan is any UK pension scheme arranged separately from the workplace. You may have done so via an insurance company, bank or building society. They are always a defined contribution scheme, but some older products may force you to purchase an annuity out of your pot in return for a guaranteed pension income.

Tax relief applies as above, and you should be entitled to withdraw at least 25% of the fund, sometimes more with older pensions, as a tax-free lump sum at commencement.

Every year you should receive a statement summarising how much you have saved and how well the investments are performing. There will be information in your statement about the specific type of pension savings you hold, and two of the most popular forms are stakeholder and SIPPs. They are both generally suitable for transfer to an overseas pension scheme.

Stakeholder Pension

A stakeholder is a low-risk and low-cost plan with guaranteed freedom from pension transfer fees if you wish to grow your pension savings elsewhere.

In readiness for becoming an overseas resident in any other jurisdiction, a SIPP can be an excellent way to consolidate your various workplace and private pensions.

UK SIPP

This defined contribution plan allows you to consolidate your other pensions into one, invest in an almost limitless range of investment funds and convert to an international SIPP ready for moving to the UAE.

Always research as much as possible to find the best SIPP provider for your circumstances, and consider seeking professional advice. Some SIPP providers do not work directly with the public and are accessible only via an independent financial adviser.

The ongoing charges can sometimes be higher with a SIPP, but you can always ask me for help finding the most cost-efficient solution. We can often negotiate lower fees.

UK State Pension

All UK residents who have paid ten or more years of qualifying national insurance contributions may be entitled to a state pension.

You can check your eligibility, likely pension income and state retirement age on the UK government’s forecaster website. There you will also find information about how to increase your state pension, if applicable.

This pension is not transferable to any overseas pension scheme, but you should still be able to access it via the direct payment method into a bank account.

Pension Transfer Overseas Scheme Options for Dubai

Generally, your UK pension overseas transfer options for the UAE are between an international SIPP or a qualifying recognised overseas pension scheme.

Both offer several expat-friendly benefits, such as the option to denominate an international currency and reduce currency risk, access to global investment funds and the ability to hold all your retirement savings in one easy-to-manage pot.

So which overseas scheme is the best way to transfer your UK pension to Dubai?

Qualifying Recognised Overseas Pension Scheme

This overseas scheme, also known as QROPS or ROPS, adheres to HMRC rules to accept pension transfers outside of the UK. On the 1st and 15th of every month, HMRC updates a list of providers on their website. It is your responsibility to check this list. If not, your provider may refuse to make the transfer, and you could have to pay tax charges.

Although no providers are currently listed for the UAE, consider a QROPS based in an EEA country such as Malta. As you will be living outside the European economic area, you must pay tax in the form of a 25% overseas transfer charge should you choose to transfer your pension this way.

Before the UK government scrapped the lifetime allowance in April 2023, a QROPS was frequently the ideal choice for pension pots exceeding £250,000.00. The transfer process can be lengthy and complicated, often costing far more than an international SIPP.

International SIPP, iSIPP

If you are considering a phased approach to retirement, plan to return to the UK in the future, or want to keep your options open, an iSIPP is an ideal way to transfer your pension to Dubai. Despite the name, it is not based outside the UK. It remains under the protection of the Financial Conduct Authority, and only providers regulated by them may offer international SIPPs.

The transfer process can be markedly quicker and cheaper than a QROPS, allowing you to live abroad anywhere outside the UK without triggering an overseas transfer charge.

If you would like to discuss transferring your UK pension overseas to Dubai or elsewhere, do get in touch.

Looking to transfer your UK pension?

Speak to me, Dan Ward, about transferring your UK pension to Dubai.

How to transfer UK pension to Dubai FAQs

Can I transfer my UK pension to UAE?

Will I lose my UK pension if I move abroad?

Please note

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

Overseas pension transfers can be complex. Make sure you take financial advice before you transfer your funds.

- Learn how to invest in the FTSE100

- Have you considered transferring your pension?

- Find the best trading platforms