Plus500 vs AvaTrade – my verdict

The main difference between Plus500 and AvaTrade is that while Plus500 has focused its efforts on providing a broad range of CFDs with some advanced trading tools, AvaTrade is better known for trading forex, but also offers a range of CFDs .

If you are searching for commission-free trading across a wide range of CFDs, then you may have narrowed your search to these two platforms.

I’ve performed an extensive analysis to identify that, as of this time, Plus500 could be the better platform for trading CFDs. Read on to find out why.

- Plus500 vs AvaTrade – my verdict

- Plus500 overview

- AvaTrade overview

- Plus500 vs AvaTrade: Which platform is cheaper?

- Plus500 vs AvaTrade: Which platform offers the most?

- Plus500 vs AvaTrade: Who has the most investments available?

- Plus500 vs AvaTrade:Who has the best research?

- Plus500 vs AvaTrade: Who’s customer service is best?

- Plus500 vs AvaTrade: Who offers the best education?

- Plus500 vs AvaTrade, which is better?

- FAQs about Plus500 vs AvaTrade

Is Plus500 better than AvaTrade?

Yes, Plus500 is better than AvaTrade for trading CFDs, as they have slightly better pricing, better market research, and a more advanced mobile trading app.

However, if you are interested in trading forex, then AvaTrade is a better option.

Key takeaways

Plus500 has outperformed AvaTrade in the following areas:

- Excellent 24/7 customer support

- Lower inactivity fees

- Publicly listed company that is well trusted

- Selection of over 2,000 CFDs

- Easy to use platform

- +insights

|  | |

| Read Review | Read Review |

Overall Rating

| Platform | ||

|---|---|---|

| Ratings | Overall Rating:

90%

Fees:

90%

Account Opening:

90%

Deposit and Withdrawal:

90%

Trading Platform:

90%

Markets and Products:

90%

Research:

70%

Customer Service:

90%

Education:

70%

| Overall Rating:

80%

Fees:

90%

Account Opening:

90%

Deposit and Withdrawal:

80%

Trading Platform:

90%

Markets and Products:

80%

Research:

80%

Education:

90%

Customer Service:

80%

|

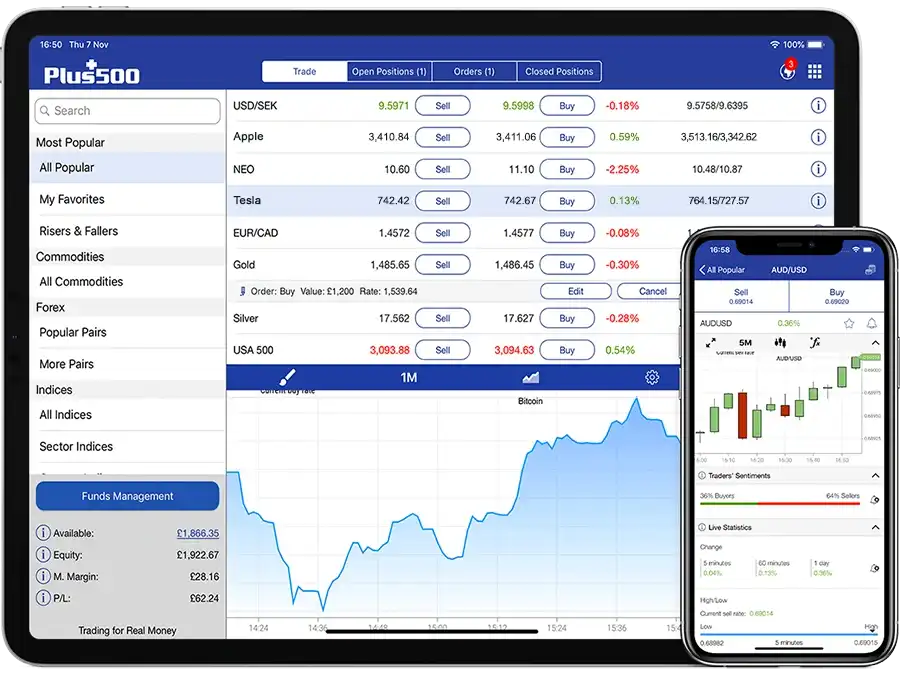

Plus500 overview

With access to over 2800 CFD contracts, it’s little surprise that Plus500 are one of the leading CFD brokers in the UK. Their commission-free trading and free lifetime demo account as well as the well-designed interface from which to trade, make them a long-standing and popular choice among traders.

Plus500 also has +Insights, which provides a real glimpse into the wisdom of the masses. Whilst not copy trading, it is a social trading tool where users can explore data on the most bought and sold positions.

Pros

- Commission-free trading

- Easy-to-use platform

- Tight spreads

Cons

- Trading through CFDs only

- Inactivity fees

Read more in my Plus500 review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

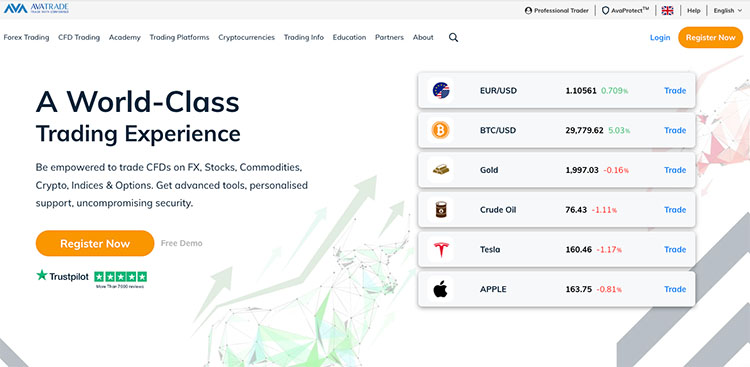

AvaTrade overview

The AvaTrade trading account provides access to over 250 financial instruments including forex trading, CFDs, commodities, cryptocurrency indices, stocks, bonds, vanilla options ETFs, spread betting, and copy trading.

AvaTrade is primarily a forex broker offering 55 major currency pairs with which to perform forex trading which is fairly on par with some of their main competitors. They also offer a range of CFDs including stock CFDs, ETF CFDs, stock index CFDs and commodity CFDs

Pros

- Good educational content

- Excellent selection of trading platforms

- Quick and easy to open an account

Cons

- Average forex fees

- Limited range of tradable assets

- High inactivity fees

Read more in my AvaTrade Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Plus500 vs AvaTrade: Which platform is cheaper?

Fees

| Platform | ||

|---|---|---|

| Minimum DepositThe minimum amount required to open an account | £100 | £100 |

| Minimum TradeThe minimum amount to trade or buy shares | £0 | £0.01 |

| ETFs FeeFee per ETF trade | No trading fees or commissions | 0.15% |

| Investment Trusts FeeFee per investment trust trade | NA | NA |

| Junior S&S ISA FeeSubscription fee per month and the platform fee | NA | NA |

| Non Trading FeeFee for not trading in a period | $10 after 3 months inactivity | $50 after 3 months |

| Stocks & Shares ISA FeeSubscription fee per month and the platform fee | £0 | NA |

| Telephone Dealing FeeFee for trading over the telephone | NA | NA |

| Withdrawal FeeFee for withdrawing funds from your account | £0 | $0 |

Plus500 is cheaper than AvaTrade

Both of these platforms low-cost with zero commission on most products, with the exception of ETFs on AvaTrade which do have a Fee.

Plus500 is also cheaper then AvaTrade for inactive accounts, charging only £10/$10/€10 where AvaTrade charges $50 after three months of inactivity.

.

Plus500 vs AvaTrade: Which platform offers the most?

Platforms & tools

| Platform | ||

|---|---|---|

| Android AppAn Android app available in the Google Play store | ||

| Copy TradingOffers the ability to copy other traders portfolios | ||

| Demo AccountOffers a demo account | ||

| iPhone AppAn app available for download from the iOS app store | ||

| Islamic AccountDoes the platform offer a sharia compliant Islamic account | ||

| MetaTrader 4Offers the MetaTrader 4 trading platform solution | ||

| MetaTrader 5Offers the MetaTrader 5 trading platform solution | ||

| Social TradingOffers the ability to share your trades on social media | ||

| Stock AlertsAbility to set price alerts, volume alerts | ||

| Web PlatformOffers a web-based browser trading platform |

AvaTrade platform offers more than Plus500

Plus500 has a proprietary platform that provides an excellent user experience for all levels of traders.

There are excellent search functions and charting capabilities, and the new +insights function allows traders to harness the wisdom of crowds to help with trading decisions.

With two proprietary AvaTrade platforms, a full MetaTrader suite, Zulu Trade, and DupliTrade, AvaTrade have provided a trading platform to suit all styles and levels of experience.

In addition to this, the AvaTrade trading platform offers an intuitive design that is easy to use and provides unique order types to minimise any losses.

Plus500 vs AvaTrade: Who has the most investments available?

Investments available

| Platform | ||

|---|---|---|

| Auto InvestingAbility to set auto-investing options, usually per month | ||

| CFD TradingOffers CFD trading | ||

| Corporate BondsOffers corporate bonds | ||

| CryptoAbility to buy and sell cryptocurrency: Availability subject to regulations | ||

| Ethical InvestmentsOffers ethical investment themed funds and ETFs | ||

| ETFsAbility to trade ETFs: Availability subject to regulations | ||

| ForexAble to trade Forex | ||

| Fractional SharesAble to buy fractional shares | ||

| FundsAble to buy funds | ||

| Government Bonds (Gilts)Able to buy government bonds and Gilts | ||

| Investment TrustsAble to buy investment trusts | ||

| Junior S&S ISAAble to buy a junior stocks and shares ISA | ||

| General Investment Account (GIA)Able to buy and sell shares | ||

| Spread BettingAble speculate on rising and falling of financial markets | ||

| Stocks & Shares ISAAble to buy a stocks and shares ISA |

Plus500 has the most investments available

There is little doubt that Plus500 is a great CFD based platform that does offer ETFs via CFDS and Forex CFDs. You can also trade crypto via CFD and of course single stock CFDs.

AvaTrade offers a wide range of investments, including CFDs, stocks, crypto and ETFs.

If you want to specialise in CFD trading, then Plus500 could be the right investment platform for you to use.

However, if you don’t want to trade everything via CFDs, when looking specifically at Plus500 vs. AvaTrade, you should consider AvaTrade.

Plus500 vs AvaTrade:Who has the best research?

AvaTrade has better research than Plus500

Plus500 provides an economic calendar, charting tools, and market analysis; however, there is a distinct lack of recommendations or fundamental data.

Where Plus500 stands out is with their new +insights, which provides data on market sentimentality, allowing traders to harness the wisdom of crowds rather than placing all their faith in a single trader, as would be the case with copy trading.

This was an exceptionally close race, with AvaTrade pulling slightly ahead with their provision of Autochartist and forex news.

Autochartist is a useful tool that monitors the markets 24 hours a day, utilising technical indicators in order to alert retail traders to opportunities in real time.

Plus500 vs AvaTrade: Who’s customer service is best?

Customer service

| Platform | ||

|---|---|---|

| PhoneMain phone number for customer services | NA | +(44)2033074336 |

| Live chatHas live chat available | Yes | Yes |

| EmailMain email address for customer services | Contact form | |

| 24/7 AvailabilityAvailable 24/7 for customer services | Yes | Yes |

| TrustPilot RatingThe TrustPilot rating of the platform | 4.0 - 11,677 Reviews | 4.7 |

| TwitterThe Twitter account for the platform | https://twitter.com/plus500 | @AvaTrade |

Plus500 has better customer service

Plus500 has an outstanding live chat function that is available 24/7 and each time I used it, I got an almost instant response.

Certainly the outstanding customer service at AvaTrade is hard to beat. They are quick to respond to queries 24/5 on channels that include email, telephone and live chat.

For the 24/7 coverage, Plus500 is the winner for customer service vs AvaTrade.

Plus500 vs AvaTrade: Who offers the best education?

AvaTrade offers better education than Plus500

Plus500 does have a demo account with a traders guide, educational videos, and a Trading Academy. However, it has a lack of interactive content, and while this is an area they have taken steps to improve, it still needs improvement.

This is one area where AvaTrade really shine, regardless of which trading platform you are comparing them to. They have a robust education section with both an excellent selection of in-house material and comprehensive content from third parties such as SharpTrader and Trading Central.

Both of these platforms provide a demo account.

Plus500 vs AvaTrade, which is better?

These two investment platforms are different in their offerings, with Plus500 concentrating on CFDs and CFD based products, while AvaTrade offers more Forex alongside CFDs.

Both Plus500 and AvaTrade offer customers a range of investments, high quality customer service and are both regulated in by the UK’s Financial Conduct Authority, with Plus500 shares available on the UK stock exchange.

For a broker who offers everything in one place, you may want to check out my full investment platform comparison tool.

FAQs about Plus500 vs AvaTrade

Is AvaTrade trustworthy?

Does AvaTrade or Plus500 offer lower pricing?

- Learn how to invest in the FTSE100

- Have you considered transferring your pension?

- Find the best trading platforms