In this review, I’ll outline the best spread betting platforms UK providers offer.

Spread betting is a method of speculating on price movements in financial markets. It’s a derivative strategy. That means, you won’t own the underlying assets you bet on; rather, you’ll be betting on whether the asset’s price is likely to rise or fall.

Best overall provider

Capital at risk. T&Cs apply.

17,000+ instruments to trade

- Unbeatable range of markets and products

- Competitive trading costs

- Excellent education resources

Best provider for trading on TradingView

Capital at risk. T&Cs apply.

Integration with TradingView

- No minimum deposit

- Low spreads

- Excellent customer service

Best provider for beginners

Capital at risk. T&Cs apply.

Demo account

- Demo account

- Low cost

- Quick and easy to open an account

Our best rated spread betting platforms in the UK, August 2025

- IG – Best overall spread betting platform

- Pepperstone – Best platform for trading on TradingView

- City Index – Best platform for traders of all levels

- SpreadEx – Best platform for customer service

- CMC Markets – Best for platform tools

- FX Pro – Best platform for trading on MT4/MT5

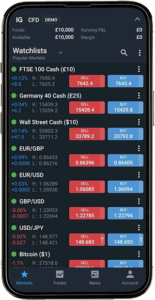

IG is a UK-based online trading provider, offering access to spread betting and CFD trading. IG have been providing investment services for over 45 years, having been the world’s first spread betting platform. They are the largest online CFD provider as well as one of the most competitive platforms available in terms of fees.

Key features

Key features

- 17,000+ instruments to trade

- Multiple trading platforms: Choose from IG’s proprietary online trading platform; mobile trading app; IG’s progressive web app (PWA); ProRealTime (PRT), or; MetaTrader 4 (MT4).

- Easy-to-navigate and customise

- IG Community: 78,000 members and is accessible from both the IG web trading platform and the IG mobile app.

- IG Academy: Daily live webinars and an impressive library of resources.

- Minimum deposit: No minimum.

- 24-hour customer support: Contact IG by phone, email or Twitter – 24 hours a day from 8am Saturday to 10pm Friday.

- Maximum leverage: 30:1.

- No commission: All trading costs are built into the spread.

- Demo account: Unlimited use.

Who should use IG?

IG is a great option for traders of all levels, but it’s particularly good for beginners as it offers unlimited use on the demo account and a wide range of well-put-together educational materials.

Final thoughts

IG offers access to an unbeatable range of markets and products and trading costs on IG are relatively low, too. The clear, crisp design of the web platform can be helpfully configured to suit your style, providing scope for moving windows around and changing layouts.

In addition to the excellent IG Academy, the IG forum is a great place to share and seek out trade ideas and discuss market opportunities, whether you are a beginner or more experienced trader.

Pros:

- Multiple options for funding and withdrawing money

- Inactivity fee not applied before 2 years of inactivity

- Unlimited use on demo account

- Trading platform is easy to navigate and customise

- Great for beginners – many IG academy courses now available without an account

Cons:

- No copy trading or backtesting integration

- Not optimal for infrequent traders

Typical fees:

Deposit / Withdrawal fees: Opening an account with IG is completely free and you won’t need to add funds until you’re ready to trade.

Buy/Sell spreads: Like many others in this list, IG makes its money through ‘the spread’. There is an added commission charge when trading CFDs, but this is added to either side of the market spread.

Current spreads are 0.6 points on key FX pairs, 0.8 points on major indices, and 0.1 points on commodities.

Overnight funding: Guaranteed Stop Order: In line with most other platforms, IG charges for guaranteed stop loss orders if they are triggered, and for positions held overnight.

Inactivity fee: The inactivity fee is £12 per month, but only applied after a generous two years of inactivity.

Spread betting is offered on:

- Forex

- Commodities

- Indices

- Stocks

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Pepperstone is an online forex and CFD broker. Pepperstone is a regulated broker in seven countries worldwide, providing CFDs and spread betting to global traders.

Key features

Key features

- 1200+ instruments to trade

- Multiple trading platforms: MetaTrader 4 (MT4), MT5, cTrader and TradingView. Pepperstone is one of only two brokers with the ability to integrate with TradingView.

- Advanced spread betting for professionals

- Education: Guides, videos and other resources available to help you learn the basics.

- 24-hour customer support: Assistance via email, call or message available 24 hours on weekdays and 18 hours on weekends.

- No minimum deposit.

- No commission: All trading costs are built into the spread.

- Maximum leverage: 30:1.

- Demo account: Available for a period of 30 days (or longer if you set up a live account and request continued access).

Who should use Pepperstone?

Pepperstone have positioned themselves as a good option for traders of all levels. It is the best spread betting platform for those who prioritise access to TradingView.

Final thoughts

The spread betting offering at Pepperstone provides access to automated trading, fast execution speeds, and competitive spreads. Pepperstone also offers advanced spread betting for professionals, which offers cash rebates on trades as well as exclusive benefits.

Where Pepperstone really shines is with its new integration with TradingView allowing users to place bets directly from the TradingView platform. Pepperstone is one of only two platforms with this capability.

Pros:

- Offers integration with TradingView

- No minimum deposit

- Low spreads

- No inactivity fee

- Excellent customer service

- Fast execution speeds

Cons:

- No proprietary trading app

- Limited to forex and CFDs

- Only 30 days to trial a demo account

Typical fees:

Pepperstone has two main account types and the trading fees you pay will vary depending on which account you choose.

- Pepperstone Standard account fees:

The standard account which is best placed for beginners, has zero commissions in addition to the spread. The spread is 0.60 pips on average on EUR/USD. This account represents excellent value.

- Pepperstone Razor account fees:

This is the raw spread account with average spreads at 0.17 pips on EUR/USD. I have yet to encounter a lower spread at any other forex broker I have reviewed. There is a commission charge which will depend on the trading platform you are using, the base currency you are trading in and your trading volume.

Overnight funding: A swap rate is charged for holding CFD or spread bet positions overnight. Up-to-date rates can be found on your chosen trading platform.

Inactivity fees: Pepperstone does not charge an inactivity fee.

Spread betting is offered on:

- Forex

- Commodities

- Indices

- Stocks

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

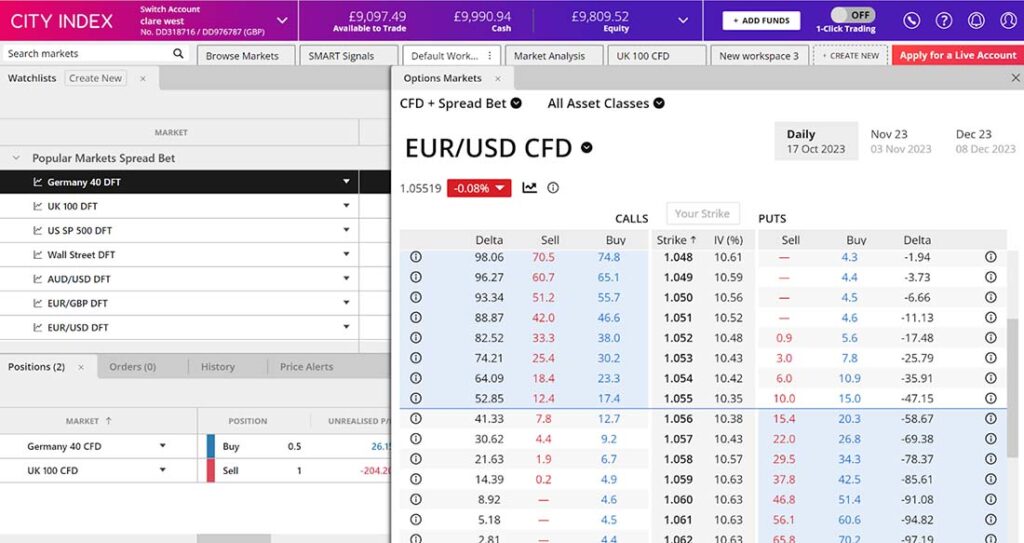

City Index is a global spread betting, FX and CFD Trading provider. City Index is part of the Nasdaq listed StoneX Group and is regulated in the UK, Australia and Singapore. It is used by more than 1 million traders worldwide.

Key features

- 8,500+ instruments to trade

- Choice of trading platforms: Metatrader 4 (MT4), a proprietary web trading platform and mobile app.

- 24/5 customer support: Customer support is available 24hrs Monday – Friday via chatbot, email helpdesk and phone.

- First-class research tools: An economic calendar, thriving social media presence, and quality news updates from Reuters in addition to analysis from the in-house research team on global markets.

- Educational resources: Great for beginners wanting to learn the foundations and finer points of derivatives trading.

- Demo account available: Although limited to 12 weeks’ use and £10,000 virtual credit.

- Minimum deposit: No minimum.

- No commission: All trading costs are built into the spread.

- Maximum leverage: 30:1.

Who should use City Index

City Index is the best spread betting platform for beginners and mid-level traders seeking an uncomplicated platform to access a large number of financial instruments.

Final thoughts

The lack of a social trading feature since the closure of City Index Connect is a shame. But thanks, in part, to their Trading Central, City Index has an excellent research facility that provides a good trading ideas resource based on quality technical analysis.

City Index has low trading fees and they publish live, minimum, and average spreads on their website in order to be completely transparent. The 36 months you’re given before an inactivity fee is applied, is particularly generous.

Pros:

- Low-cost trading platform

- Excellent range of research tools

- Wide range of assets

- Inactivity fees only applied after 36 months

Cons:

- No MetaTrader 5

- Limited use on the demo account

Typical fees:

Buy/Sell Spreads: City Index is commission-free on spread bets, though you will still be charged a trading fee, which is built into the spreads. You’ll need to open an account (or demo account) to see spreads on their 1,000s of markets but, depending on the market, both fixed and variable spreads are offered. These start at margins from 5% and fixed spreads from 0.4pts.

City Index does a great job of explaining how the spread works here if you’re still getting familiar with spreads.

Overnight funding: Overnight financing fees on both long and short positions are 2.5% +/- the benchmark regional interest rate.

Guaranteed Stop Order: A charge is made for use of this feature. For full details, check the website.

Deposit / Withdrawal fees: No charges.

Inactivity fee: A monthly inactivity fee of £12 will be applied for accounts that are inactive, though the good news it only kicks in after 36 months of inactivity.

Spread betting is offered on:

- Forex

- Commodities

- Indices

- Stocks

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Spreadex is a UK-based CFD, forex and spread betting broker that has continued to serve a vast customer base since it started operations in 1999. The Spreadex platform offers sports spread bets, CFDs and forex trading, Spreadex casino, and financial spread betting.

Key features

- Trade 10,000+ markets and products

- Web-based trading platform: Spreadex does not offer a MetaTrader platform but provides a convenient web-based trading platform which is suitable for professional traders and was winner of the Investment Trends Best Mobile/Platform App and Best Platform Reliability awards in 2023.

- Professional client status: For experienced traders. Access to a dedicated execution desk and may be able trade with credit.

- Award-winning customer service: Voted Best Telephone and Email Customer Service in the 2022 Investment Trends survey. Lines are open from 9pm Sunday – 9pm Friday.

- Education hub: Not the most comprehensive education offering but there are some articles and videos which explain things pretty well.

- No demo account available.

- No minimum deposit.

- Maximum leverage: 30:1.

Who should use Spreadex?

If you’re looking for a broker with low non-trading fees, then Spreadex could be the one for you. It has no minimum deposit and no inactivity fees whatsoever, although trading costs are slightly higher than some other brokers as there is a varied commission on trades and trading fees that are built into the spread. The lack of a demo account will be off-putting to less experienced traders though.

Final thoughts

Spreadex is one of the most established spread betting brokers with a platform built from scratch in-house. Their excellent record on customer service and the personal relationships they build with clients means they have many highly loyal customers.

Pros:

- Good range of markets and products

- Experienced traders can take a position on the price of cryptocurrencies

- No inactivity fees

- No minimum deposit

Cons:

- Higher than average trading costs

- No demo account

- Very limited education offering

Typical fees:

Buy/Sell spreads: There is no commission to pay on a spread bet. However, trading costs work out slightly higher than many competitors as there is a varied commission on trades and trading fees that are built into the spread.

Inactivity fee: No inactivity fees.

Deposit / Withdrawal fees: No deposit or withdrawal fees.

Overnight funding: You will need to pay a fee when you want to roll a daily position overnight.

Spread betting is offered on:

- ETFs

- Commodities

- Forex

- Indices

- Shares

- Bonds

- Interest rates

- Bitcoin (for professional clients)

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investors lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

What’s my methodology?

I’ve reviewed all UK regulated spread betting platforms, downloading apps, and testing each web and desktop platform and exploring important parameters such as fees, features, ease of use, assets, trading tools, market research, education, and customer service to provide you with my top picks for the top spread betting platforms in the UK.

Not recommended

The following are brokers that have been moved from my ‘Best of list’, to no longer recommended. This is usually due to fees that are too high, or lack of assets for spread betting.

Markets.com

You should note that while Markets.com offer spread betting, the trading costs are relatively high.

Indeed, there is a commission involved when you try spread betting on Markets.com, as well as trading fees that are built into the spreads.

Non-trading fees are also higher on Markets.com – the inactivity fee is $10 a month after three months of inactivity, and you are required to deposit $250 when you first open an account.

FXCM

One of the great things about this broker is its social investing service, which allows you to mirror other investors’ trades.

However, there is a far lower offering of markets and products on FXCM, with just over 290 available.

The good news is that there is no commission on trades made on FXCM, though there are trading fees built into the spreads.

Also, while the minimum deposit amount is slightly lower – $50 when you first open your account – there is an inactivity fee of $50 a month after one year of inactivity. This is one of the highest inactivity fees I have come across and effectively moves this platform onto my not recommended list.

6 easy steps to start spread betting now

Now that you’ve read about some of the best spread betting brokers available to you, you’re most likely wondering how you can start spread betting in the first place.

Well, continue reading my comprehensive guide and follow these six easy steps to start financial spread betting now.

1. Open an account with a broker

First things first, you need to open a spread betting account with a broker that allows you to spread bet.

Using my list above of some of the best spread betting brokers available, you should decide which broker best suits your needs.

For example, if you think you’ll be trading large volumes of spread bets, you may want to consider spread betting platforms with a low fee structure.

Or, if you wish to spread bet with smaller amounts of money, you may want to choose a broker that offers larger leverages.

And, of course, if you have a specific security you wish to open spread bets on, such as forex spread betting, you should ensure that your chosen broker offers access to these financial markets.

When you’ve decided on the best spread betting broker for you, you may need to supply them with any relevant information to prove your identity, perhaps a recent utility bill or personal details such as your National Insurance number.

After you’ve done all this, you should be able to open your spread betting account.

2. Deposit money to your trading account

Now that you’ve opened your brokerage account, the next step is depositing money into your account.

This should be easy enough – simply choose how much money you wish to deposit and ensure it enters your account.

When you’re depositing money to your trading account, you may want to only deposit the amount of money you intend to invest.

This is because you are unlikely to earn interest on any uninvested money, and due to inflation, your savings’ purchasing power could be eroded in real terms.

3. Find a market to open a spread bet in

The next step to spread betting is deciding what spread betting instruments you wish to trade.

You will have a wide variety of different financial markets and securities to spread bet on, the volatility of which may differ.

It may be worth spread betting in areas you’re more proficient in. For example, if you’re knowledgeable about tech stocks, you may want to spread bet on a tech company.

Or, if you regularly keep track of forex markets, you may want to spread bet on currency pairs.

4. Place your order

Now, you’re finally ready to place an order.

Simply search for your chosen security, decide whether you want to open a short or long position, and select the size of your bet.

At this stage, you’ll have the choice of whether you’d like to trade using leverage. Find out more about what this means later in my guide.

5. Set up stop loss limits

Congratulations, you’re now a spread better! The hard work doesn’t stop here, though. Since many spread betting markets can be volatile, you may want to think about setting up stop loss limits to mitigate risk.

Stop loss limits are orders that will automatically close your position when it reaches a specific value. You can read more about stop loss limits later in my guide.

6. Monitor your position and close it when the time is right

Even if you’ve set up stop loss limits, you should still continue to monitor any price movements that may occur.

When you feel as though you want to cut your losses, or are happy with your gains, you should close your position.

What is spread betting?

Spread betting is a form of derivative trading that involves “betting” on the price movement of a particular security over a certain period of time.

When you spread bet, you don’t actually purchase or own the underlying asset, you’re simply speculating on how the price of the asset will move.

One of the aspects of spread betting that makes it popular with investors is leverage. This is a ratio that your spread betting broker will offer you that allows you to open a larger position on a bet for less money upfront.

How does spread betting work?

When you spread bet, you can decide to open a long position, where you predict that an asset will increase in value, or a short position, where you speculate that the asset will decrease in value.

Depending on how the value of the underlying asset moves ultimately dictates your spread betting gains, or indeed, losses.

So, let’s say you open a short position against Apple. You could stake £100 against every point of negative movement Apple’s share price makes. If Apple’s share price did indeed fall by two points, you would earn £200.

Conversely, if Apple’s share value increased by two points, you would instead lose £200.

You can use leverage on your trades

As previously mentioned, leverage allows you to gain more market exposure to an underlying asset for less money.

These leverages are usually presented to you by your spread betting broker in the form of a ratio – these can range from 5:1 to 500:1.

Say your broker offered leverage of 5:1 on any spread bets you make. If you wanted to open a £100 position against Apple, it would only “cost” you £20. This initial deposit amount is called the “margin”.

This is part of the allure of spread betting – the leverage brings the potential for greater profits should your prediction come true.

However, it’s absolutely vital that you keep in mind that leverage is a double-edged sword; not only would any profits be magnified, but so would any losses.

This is because the total profits, or indeed losses, are based on the total value of the bet, not just the initial margin payment.

For example, say you opened a short position against Apple shares for £100, and the leverage on offer was 5:1 – meaning your margin payment was only £20.

If the value of Apple shares increased rather than decreased, you would lose the full £100 for every point of movement you bet on, rather than £20 for every point.

This is how you could end up losing far more money than you initially paid in, which makes spread betting particularly high risk.

It’s worth keeping in mind that FCA-regulated spread betting brokers will typically offer a maximum leverage of 30:1 to individual investors, as these are the regulator’s rules.

Meanwhile, many of these spread betting brokers will offer higher leverages to professional customers, sometimes as high as 500:1.

This is to protect less experienced traders from losing large sums of money due to leverage.

Spreads

The spread, which, strangely, isn’t related to the “spread” in spread betting, is the difference between the buy and sell prices for a particular position.

These spreads are usually based on the market price of the underlying asset and are sometimes called the “offer and bid” price.

Typically, you will find that brokers will build the cost of a trade into these spreads, which is why it’s essential to understand your broker’s fee structure before you start trading.

Unfortunately, these spreads mean that you’ll typically be buying spread bets slightly above the market price, and you’ll be selling slightly below it.

Some brokers may offer more competitive spreads than others, so it’s worth checking the spreads they offer before you open an account with a specific trading platform.

What underlying assets can you open spread bets against?

Another aspect of spread betting that makes it quite popular with investors is the wide range of different financial markets and underlying assets you can open spread bets on.

As mentioned, you aren’t actually purchasing or owning a security when you spread bet, but simply speculating on the underlying asset. This allows you to access a wide range of markets, including:

- Stocks and shares

- Indices around the world

- Commodities

- Forex currency pairs

- Bonds.

Of course, the process of spread betting varies depending on the type of underlying asset you bet on in the first place.

For example, forex spread betting price movements may be based on currency spreads, while spread bets on commodities are typically based on the value of the commodity in question.

So, if you wanted to speculate on a particular market, such as forex spread betting, you should first ensure that your broker offers access to the market.

How are spread bets taxed in the UK?

As spread betting is considered to be a form of gambling, this affects how spread bets are taxed.

Spread bets are entirely free from Capital Gains Tax (CGT) and Stamp Duty Land Tax (SDLT) in the UK. That means you don’t have to report any profits or losses to HMRC whatsoever.

Of course, if spread betting is your main source of income, you may face Income Tax.

What are the risks involved with spread betting?

As mentioned, most brokers will offer you leverage when you spread bet. While this can bring greater gains if your prediction is correct, it can also magnify your losses.

In fact, you could end up losing far more money than you initially paid in when you spread bet.

Many retail investor accounts in the UK have negative balance protection, meaning investors can’t lose amounts of money when trading which would bring them to a negative amount of money in their account.

However, it’s still essential to keep in mind that you could potentially lose all your invested money when financial spread betting, especially when trading with leverage.

Also, spread betting markets can be highly volatile at times. Sometimes, the underlying assets you’ve opened a position on can move rapidly without stopping at the levels in between.

If this happens, and you aren’t on your trading platform at the time to close your position, you could end up losing money rapidly.

Using stop loss orders to mitigate risk when spread betting

Of course, there are steps you can take to try and limit the risks your money is exposed to. One of these methods is stop loss limits. These are automated trading orders that specify when your positions will be closed.

For example, if you opened a long position against Apple, and the price at the time was £200 a share, you could set a stop order that will close your position automatically if Apple’s value falls to £190 a share.

This way, if you aren’t at your computer or can’t access your trading account and don’t notice that Apple’s value is falling, you can limit your losses.

Of course, you can always set stop orders when the price increases too. By doing so, you can catch any price increases before the value drops again. Even if the price continues to rise above your allocated stop loss limit, you may still want to consider taking your gains at this point, as you never know when the price could drop.

Best Spread Betting Platform UK FAQs

Is spread betting suitable for beginners?

You may find that spread betting is typically not suitable for beginners. This is because you typically need an in-depth knowledge of markets and what may affect prices in order to generate gains with spread betting.

Also, since there is additional risk involved due to leverage, you could lose all of your money if things don’t go your way.

Which is better: spread betting or CFDs?

The better option between spread betting and CFD trading really depends on your experience levels.

Both instruments are complex, but trading CFDs tend to be slightly more complicated. For example, the way that profits are calculated when trading CFDs tends to be trickier to understand than spread betting. So, if you’re still new to derivative trading, you may want to try spread betting over trading CFDs.

Please note

The value of your investments (and any income from them) can go down as well as up, and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

CFD trading and financial spread betting are complex instruments, and more than half of retail investor accounts lose money when trading CFDs and financial spread betting. Please make sure that you know these risks before you start trading and that you’re aware there’s a high chance of losing money rapidly on your investment.