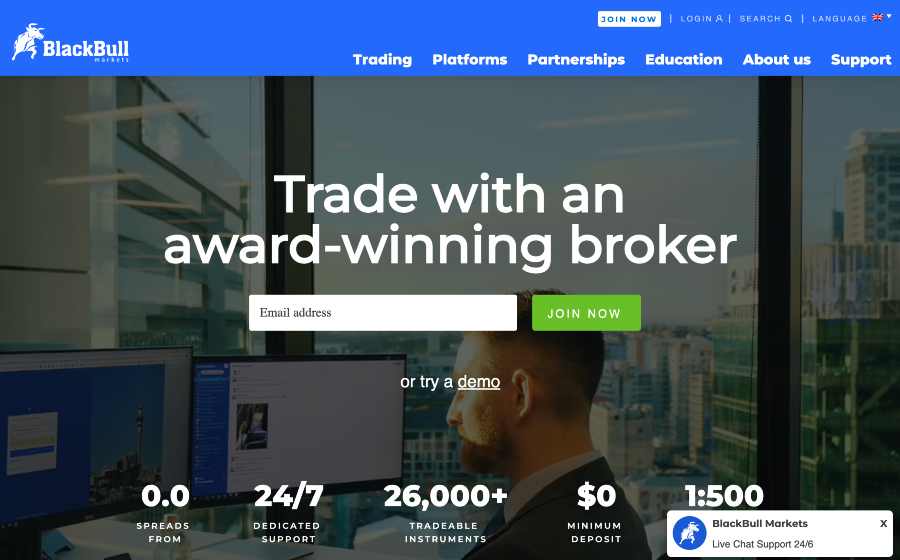

If you are looking for a reliable and trustworthy forex and CFD broker, look no further than BlackBull Markets. The award-winning broker is a New Zealand-based forex and CFD platform, offering a wide range of financial instruments to trade with. These include CFDs, currencies, commodities, equities, indices, and cryptocurrencies.

In my BlackBull Markets review, I look at the services BlackBull Markets offers, it’s pricing, customer service, tools, and features in order to determine whether it offers a good user experience.

- BlackBull Markets Ratings

- Who are BlackBull Markets?

- Who owns BlackBull Markets?

- Who is BlackBull Markets suitable for?

- BlackBull Markets product range overview

- BlackBull Markets web trading platform

- BlackBull mobile trading platform

- BlackBull Markets deposits and withdrawals

- BlackBull Markets research

- BlackBull Markets education

- BlackBull Markets fees

- BlackBull Markets FAQs

- BlackBull Markets Customer reviews

Blackbull Markets is known for its competitive spreads and fast trade execution. The broker offers the highly popular MetaTrader 4, MetaTrader 5, and TradingView platforms to trade on. Meanwhile, for equities, users can utilise its BlackBull Markets Share Trading Platform to trade. This plethora of choices allows traders of all backgrounds to use the platform seamlessly while being able to access the global financial markets with ease.

Blackbull Markets is also known for its good customer service, which is available around the clock to assist users with any queries or concerns they might have.

Who are BlackBull Markets?

BlackBull Markets was founded in the bustling financial hub of Auckland, New Zealand. The founders of BlackBull Markets came together in 2014 with the aim of revolutionising the trading and investing retail space while providing clients with top-notch trading services.

Today, BlackBull Markets is one among many forex brokers that cater to tens of thousands of traders from over 180 countries, while constantly striving to enhance their clients’ trading experience. BlackBull Markets is a fully regulated broker with a comprehensive offering of more than 26,000 tradable instruments, including equities, forex, CFDs, and commodities, all of which are accessible through a range of platforms such as MetaTrader 4, MetaTrader 5, WebTrader, TradingView, and BlackBull Shares. It also offers a variety of account types and even offers an ECN prime account.

Who owns BlackBull Markets?

Black Bull Group Limited, the owner of BlackBull Markets, was founded in 2014 by Michael Walker, a former institutional forex trader. The company is headquartered in Auckland, New Zealand. It’s regulated by the Financial Markets Authority (FMA) of New Zealand and the Financial Conduct Authority (FCA) of the United Kingdom.

In addition to its New Zealand entity, BlackBull Limited Group has also established separate entities in the UK and Seychelles to serve its clients in those regions. Overall, BlackBull Markets has built a strong reputation for transparency, reliability, and client satisfaction in the competitive world of online trading.

Who is BlackBull Markets suitable for?

BlackBull Markets is suitable for a wide range of traders, from novices to experts, due to its variety of trading platforms and account types. It offers three types of accounts. These include Standard, Prime, and Institutional — all of which have corresponding benefits, such as lower spreads, better execution, and more favourable trading conditions. The broker also has a swap-free Islamic account for traders who follow Islamic principles.

In addition to that, BlackBull Markets is suitable for traders who value transparency and security. The broker works hard to ensure that client’s funds are secure by keeping them in segregated accounts and using advanced encryption methods to protect personal information. It is also regulated and licensed by reputable financial authorities, including the Financial Markets Authority (FMA) in New Zealand and the Financial Conduct Authority (FCA) in the UK.

BlackBull Markets is also suitable for traders who want to learn and improve their trading skills. The broker offers educational resources, including webinars, tutorials, and trading guides, for free to all BlackBull Markets clients. Moreover, it provides a demo account for traders to practice their trading strategies without risking real money.

BlackBull Markets product range overview

With so many financial instruments on hand, BlackBull Markets has an array of products that users can trade with.

Trading Forex

Offering over 70 currency pairs for forex trading, including majors, minors, and exotics, BlackBull Markets offers competitive spreads from 0.0 pips and up to 30:1 maximum leverage. This allows traders to maximise their potential profits. Traders can also trade on the MetaTrader 4 and MetaTrader 5 platforms available on its brokerage.

Precious Metals

BlackBull Markets offers trading in gold, silver, and platinum with competitive spreads and commission rates too.

Energy

Traders can also trade with two of the most popular commodities in the world — crude oil and natural gas.

Indices

Those who prefer to invest in index funds will be glad to know that BlackBull Markets also offers the option to invest in a variety of indices. Examples include the US Dow Jones, S&P 500, NASDAQ 100, and even European indices such as the UK’s FTSE 100, and German DAX.

Stocks and Shares

In the event equity traders prefer to go down the route of stock trading instead, BlackBull Markets also offers a vast selection of stocks and shares to trade with. Big names such as Alphabet, Meta, and Amazon are all available, and traders can trade with low commissions.

Cryptocurrency

On the other hand, those who prefer trading cryptocurrency have the option to do so as well. That’s because BlackBull Markets allows traders to trade major cryptocurrencies such as Bitcoin and Ethereum. The low spreads and reasonable leverage makes trading cryptocurrencies accessible to all traders.

Social Trading

Finally, BlackBull Markets offers social trading. This feature allows traders to follow and copy the trades of other traders if they so choose. The add-on is available on the MetaTrader 4 and MetaTrader 5 platforms and enables traders to learn from experienced traders and potentially improve their own trading performance.

BlackBull Markets web trading platform

The BlackBull Markets web trading platform is excellent in both design and functionality for traders of all skill levels. It’s accessible through any web browser and provides access to a wide range of trading instruments.

Nonetheless, the real kicker is the advanced charting capabilities that let users customise their charts using features such as technical indicators, chart types, and timeframes. Plus, the platform provides real-time market data, news, and analysis to help traders make informed trading decisions.

Furthermore, the website has an intuitive order management system that allows users to open and close their positions, set stop-losses, take-profit levels, and track their trading performance in real time. And for those who have an interest in algorithmic trading, the platform also supports Expert Advisors (EAs) on the MetaTrader 4 and 5 platforms.

BlackBull mobile trading platform

Just like its web platform, BlackBull Markets also has an excellent mobile trading app that’s user-friendly with excellent tools.

Nevertheless, the downside would be that the smaller screen could make it more difficult for traders to navigate graphs and utilise their tools effectively. That said, plenty of the website’s functions are also available on the mobile app, with a few additional perks. For example, traders can set up alerts and create watchlists directly on the app. This allows you to stay on top of the markets and receive notifications when specific price levels are reached.

BlackBull Markets deposits and withdrawals

BlackBull Markets offers a range of funding methods for deposits and withdrawals. Deposits can be made through multiple payment methods, allowing users to start trading in less than five minutes with no minimum deposit. Blackbull Markets minimum deposit is £0 meaning retail investors can engage in CFD trading with a low starting point.

Users can deposit funds through the following methods:

- Debit/credit card (Visa/Mastercard)

- Bank transfers.

The following payment service providers are also accepted:

- AstroPay

- Beeteller

- Boleto

- China Union Pay

- Crypto

- Deposit channel

- FasaPay

- FXPay 88

- Help2Pay

- Interac

- Neteller

- Skrill

- OpenPayd

- PaymentAsia

- PicPay

- PIX payment

- Poli

- Thai QR Payment

- Transferência Eletrônica Disponível

BlackBull Markets accept deposits in the following currencies:

- United States Dollar (USD)

- Euro (EUR)

- Great British Pound (GBP)

- Australian Dollar (AUD)

- New Zealand Dollar (NZD)

- Singapore Dollar (SGD)

- Canadian Dollar (CAD)

- Japanese Yen (JPY)

- South African Rand (ZA)

For those who want to deposit cryptocurrencies, the platform also accepts the following:

- Bitcoin

- Bitcoin Cash

- Ethereum

- Litecoin

- Ripple

- Dogecoin

- Cardano

- Polkadot

- Chainlink

- EOS

- Stellar

On the other hand, withdrawals can be made through the Secure Client Portal. This process involves certain fees and rules which are specific to each withdrawal method. These include:

- $5 withdrawal fee regardless of method.

- Withdrawals can be done via bank transfer.

- Withdrawals via credit card are only permitted to the credit card originally used to fund the deposit.

- The maximum amount that can be withdrawn via credit card is the total amount deposited with the same card.

- Withdrawals via a payment service provider are only permitted to the same provider originally used to fund the deposit.

BlackBull Markets strives to process all client withdrawal requests in under 24 hours. Hence, providing clients with quick and reliable access to their funds. In the event of an issue, the firm offers customer support through phone lines in multiple countries, where users can resolve their issues.

BlackBull Markets research

BlackBull Markets provides research tools such as market analysis, economic calendars, and trading signals. Together with that, it also offers a range of research tools such as technical analysis, charting tools, and backtesting capabilities.

That being said, users will find a number of key tools missing, such as quality news or more complex valuation models and multiples.

BlackBull Markets education

BlackBull Markets offers a wide range of educational tools on its platform. The platform produces a daily series featuring technical and fundamental analysis for specific trading instruments. These series include the Trade in 60 Seconds recordings which focus on a particular trading symbol such as a given forex pair or CFD.

Additionally, BlackBull Markets offers great educational mediums such as webinars, video tutorials, and seminars to help traders understand the markets better in addition to a comprehensive trading glossary which contains a list of common terms you would expect to encounter when trading forex and CFDs.

BlackBull Markets fees

Overall, BlackBull Markets offers a variety of services to its customers and charges a variety of fees whenever traders use these services.

On the bright side, unlike other forex and CFD brokers, BlackBull Markets doesn’t charge inactivity, deposit, or account fees. Having said that, there are a number of non-trading fees to consider including an obligatory $5 charge whenever a user decides to withdraw funds from their account and currency conversion fees. These non-trading fees are on the high side when compared to similar brokers.

Apart from that, BlackBull Markets also charges a commission and other fees whenever CFD and forex trades are made. It also has financing rates which are considered to be average when compared to its peers.

A full breakdown of Blackbull Markets trading fees is as follows:

Spreads:

- For an ECN Standard Account, the spreads start from 0.9pips;

- For an ECN Prime Account, the spreads start from 0.1pips;

- For an ECN Institutional Account, the spreads start from 0.0pips.

Commissions:

- For an ECN Standard Account, there is no commission;

- For an ECN Prime Account, the commission is USD 6.00 per lot (charged on the opening of the trade);

- For an ECN Institutional Account commission on this Account is negotiable.

BlackBull Markets FAQs

Is BlackBull Markets safe?

How long does it take to withdraw money from BlackBull Markets?

BlackBull Markets Customer reviews

There are no reviews yet. Be the first one to write one.