My Deliveroo share price forecast includes a 360-degree examination to determine whether investors should consider this renowned retailer and add the stock to their baskets.

This stock analysis report goes into detail on Deliveroo’s financial position, competitive strengths, industry outlook, valuation metrics, and analysts’ predictions to uncover whether Deliveroo shares actually present a golden long-term opportunity.

Read On: To find the Deliveroo share price forecast and my price target.

- Deliveroo Share Price (LON:ROO)

- Deliveroo Background

- Deliveroo Business Model

- Deliveroo Earnings Breakdown

- Deliveroo Financials

- Deliveroo Competitive Advantage

- Deliveroo Shortcomings

- Deliveroo Dividend History

- Are Deliveroo Shares Cheap?

- What is the Profit Forecast for Deliveroo Shares?

- Brokers Ratings for Deliveroo Shares

- What is the Price Target for Deliveroo Shares?

- Are Deliveroo Shares a Buy, Sell, or Hold?

Deliveroo Background

Deliveroo is an online food delivery. It operates in the United Kingdom and Ireland, as well as in numerous other international territories. These include France, Belgium, Italy, Singapore, Hong Kong, the UAE, Kuwait, and Qatar.

The company operates as a middleman, acting as a delivery service for mainly restaurants to customers. It started off by conducting food deliveries initially, but eventually ventured into delivering other items such as groceries, pharmaceutical products, beauty products, and everyday items.

Deliveroo also operates a couple of subsidiary operations. Namely, Deliveroo Editions operates ghost kitchens (kitchens not on restaurant sites) for the preparation of delivery-only meals. Another is Deliveroo Hop, which operates from delivery-only grocery stores run by Deliveroo, in partnership with existing grocers and retailers.

Deliveroo shares trade on the London Stock Exchange and are constituents of the FTSE.

Find Out: How easy it is to buy Deliveroo shares in 6 simple steps.

Deliveroo Business Model

As a food delivery service, Deliveroo earns its money through a variety of revenue streams. The bulk of its sales stems from deliveries, where it takes a portion of customers’ gross transaction value (GTV) as revenue. This tends to include fees such as service fees and commissions. On top of that, Deliveroo also generates revenue from subscriptions like Deliveroo Plus, where customers get exclusive offers and free delivery.

On the merchant front, Deliveroo also generates some revenue from Deliveroo Editions and Deliveroo Hop, where vendors and supermarkets pay higher commissions to operate ghost kitchens in high-traffic areas, allowing them to broaden their reach to customers.

In addition to that, Deliveroo earns some revenue from advertisements. This is where restaurants and shops pay a fee to get featured on the home page of the app. Nonetheless, this segment doesn’t generate a meaningful amount of revenue yet.

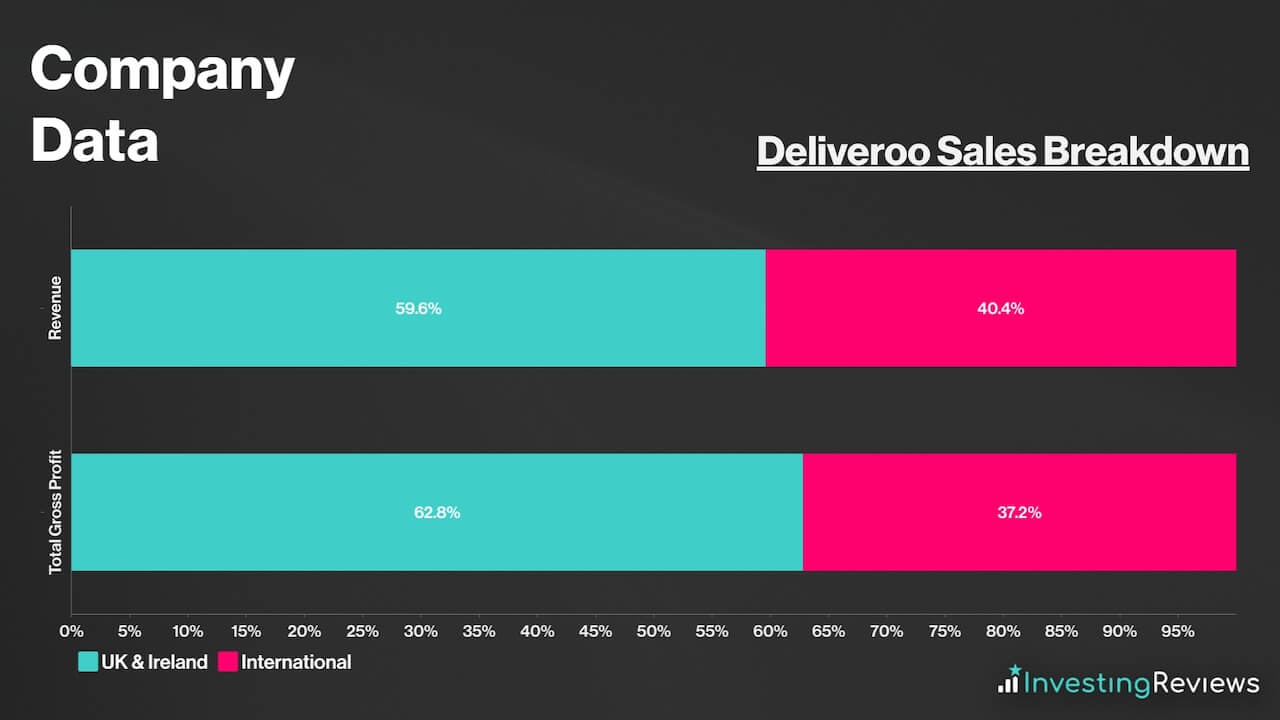

On the geographical front, the company predominantly operates in the UK and Republic of Ireland, where it earns most of its money from. However, Deliveroo also has operations internationally.

Having said that, it’s worth noting that Deliveroo generates more of its gross profit from the UK & Ireland. This is because the group is more established in those markets which amplifies economies of scale through the network effect of having more restaurants.

Deliveroo Earnings Breakdown

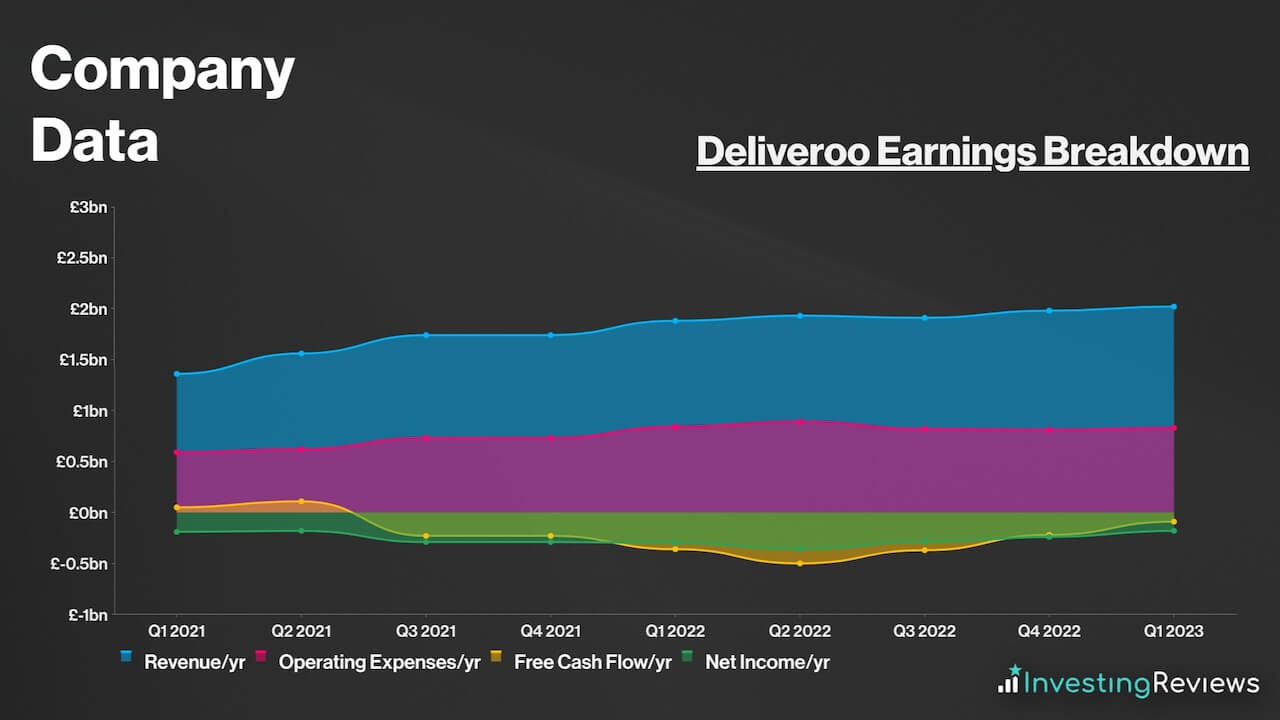

Like many, if not all of its food delivery peers, Deliveroo is not a profitable business yet. It operates a service business model — which should on paper — yield higher margins and make the route to profitability an ‘easier’ path than if it were to sell goods directly to customers.

However, this hasn’t been the case for Deliveroo. One such reason is that the business operates with a rather shallow economic moat in an extremely competitive industry. This hampers its ability to charge higher fees and expand its margins. That’s because other players can undercut Deliveroo by offering lower fees and commission rates, which could dampen the Blue Kangaroo’s market share.

What’s more, Deliveroo mainly operates in a low-margin market — food. The main appeal for customers using the service is the convenience and potentially cheaper value proposition than eating out. If Deliveroo were to charge much higher fees, it would end up offsetting any perceived gains customers would otherwise get from eating or shopping out. That said, Deliveroo expects to achieve EBITDA profitability this year.

Deliveroo Financials

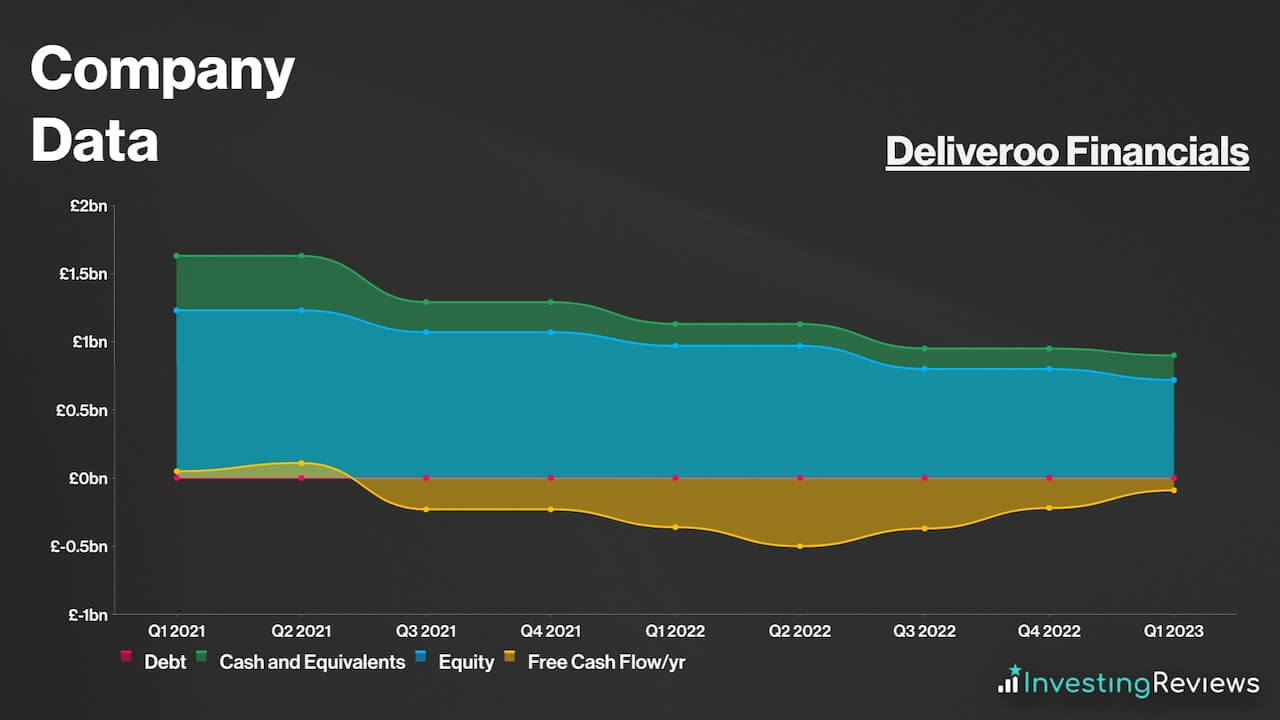

On the face of it, Deliveroo’s balance sheet is ‘flawless’, as its current assets trump its current liabilities by £734m. This is considered to be a norm for a young company, especially as it requires a significant amount of capital to spearhead its growth and achieve profitability.

With virtually no debt, the FTSE stalwart should have sufficient liquidity to continue operating in the coming years, as long as it generates free cash flow at a rate that’s higher than its cash burn. It’s also worth noting that Deliveroo has £150m worth of undrawn committed facilities. This means that it has the option to inject more liquidity into the business if it needs to.

That being said, shareholders should also note the risk of being blindsighted by these seemingly flawless numbers. This is because disruptive companies such as Deliveroo have a tendency to underestimate the capital they require before achieving profitability. This means that it may have to raise capital in the future, which may be difficult to do via debt. Therefore, they may have to resort to selling shares instead, and diluting shareholder value.

While this has yet to happen on a large scale since its initial public offering (IPO), the fact that Deliveroo remains an unprofitable business while generating negative free cash flow could become a concern if it doesn’t achieve profitability soon.

Deliveroo Competitive Advantage

Having an economic moat (competitive advantage) over competitors is crucial in saturated industries such as food delivery and retail, where profit margins aren’t the highest, with low barriers to entry.

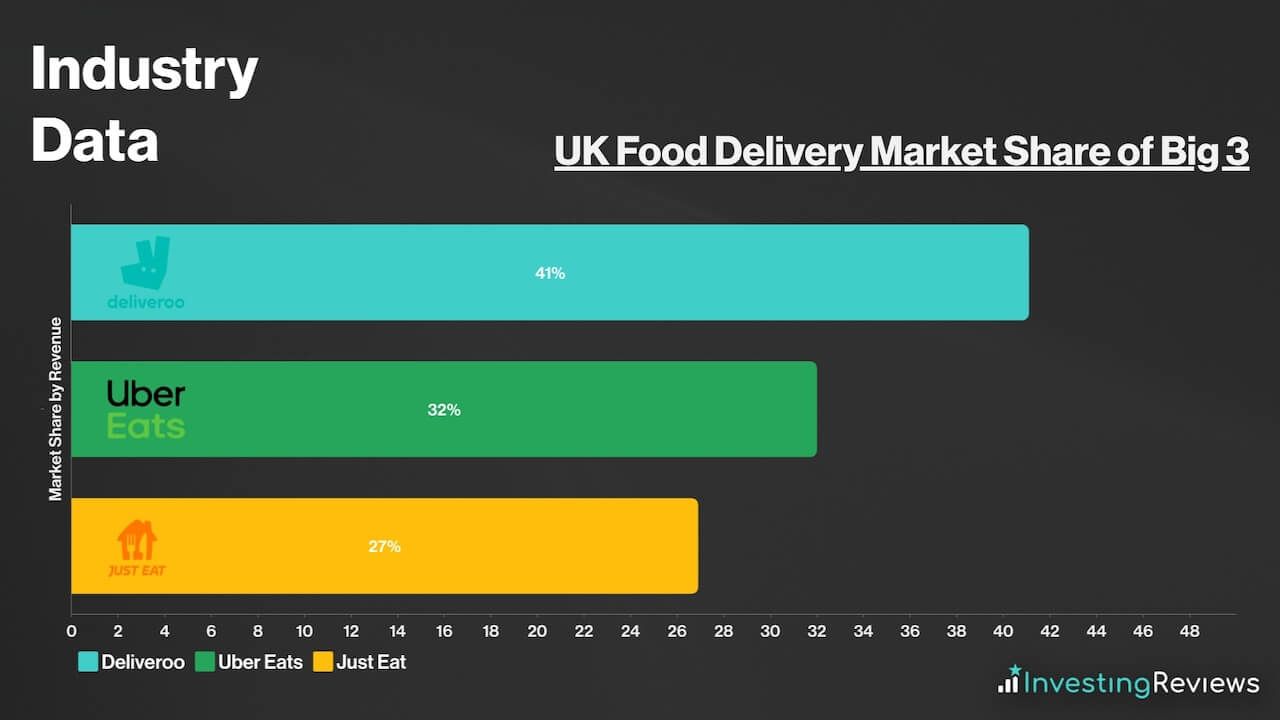

As such, Deliveroo’s main competitive advantage is its dominant market share in the UK. The London-based corporation takes up the lion’s share of the UK’s food delivery market. It is the biggest of the top three food delivery service brands that include itself, Uber Eats, and Just Eat.

With approximately 176,000 merchants registered on the platform, Deliveroo can be found in almost every city across its multiple geographies, cementing its place as the go-to delivery service for many customers in those regions. To complement this, it has millions of users who are registered for its Deliveroo Plus programme, especially after its recent partnership with Amazon.

Due to its massive user base, Deliveroo leverages this by offering perks to those who have a Deliveroo Plus membership. Aside from free deliveries for orders over a certain amount, users can also accrue points when ordering from the same merchants. These can eventually be redeemed for vouchers and exclusive discounts. As a result, Deliveroo Plus is by far, the most appealing loyalty programme amongst food delivery services in Great Britain.

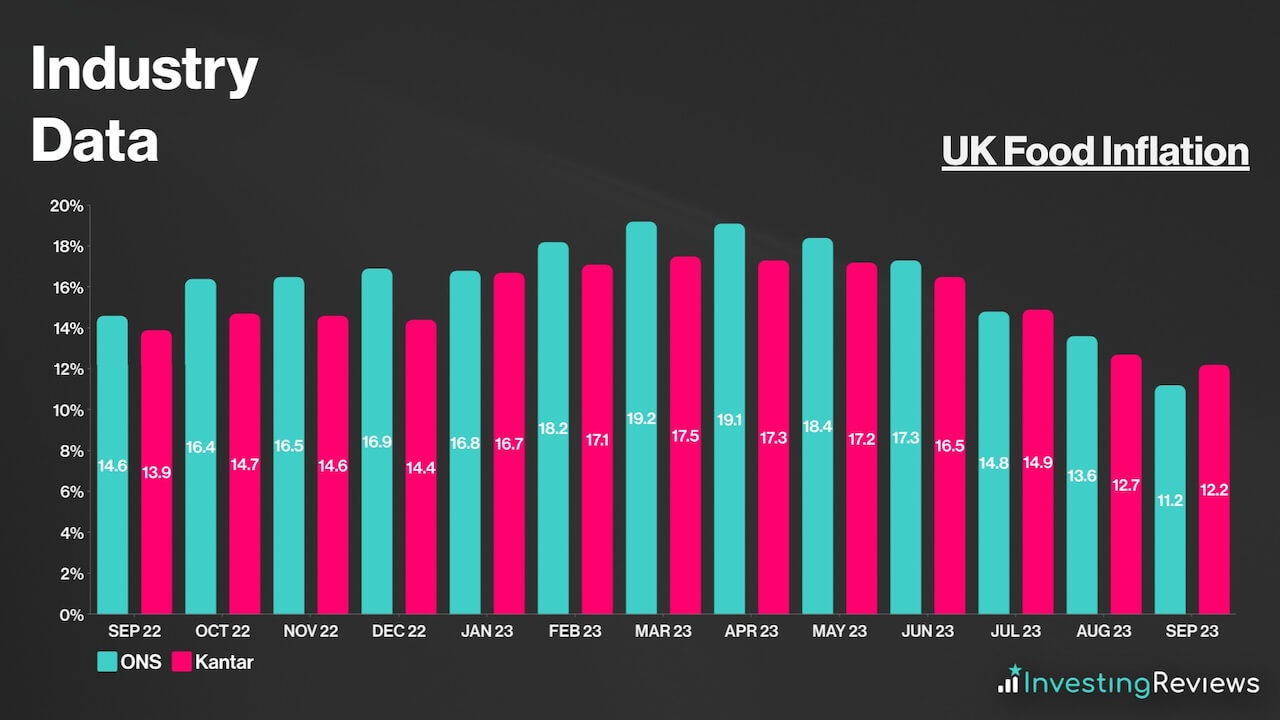

Not only that, the bulk of Deliveroo’s customer base leans towards the more affluent side. This has seen order frequencies hold up relatively steady despite sky-high inflation and diminishing household discretionary income.

Deliveroo Shortcomings

Despite being such a giant in the food delivery space, Deliveroo also has its fair share of weaknesses. This could put investors off when buying Deliveroo shares.

For one, it’s still an unprofitable business, and any profits in the future will have margins that are relatively slim — ranging from approximately 3% to 5%. This means that a black swan event like a widespread systemic glitch, for example, could plunge Deliveroo into unprofitability. And in the current cost-of-living crisis, net profits have been hard to come by, showing how delicate Deliveroo’s margins are.

On that point, it’s worth stating that no other food delivery service has achieved net profitability sustainably, which doesn’t do Deliveroo any favours. It could be one of, if not the first to achieve such a feat, but given that many other companies have failed to do so even in a booming economy, there’s a big question mark whether such a business model is truly sustainable.

Further exacerbating the issue, customers have been cutting down their discretionary spending in this cost-of-living crisis. This has resulted in the lack of growth of orders from customers. On the other hand, elevated energy and labour costs continue to bite down on Deliveroo’s bottom line.

Plus, Deliveroo also has regulatory issues with authorities in the EU surrounding the classification of its riders as self-employed. The courts argue that these workers should be considered employees. And if the courts rule against Deliveroo, the tech platform will then be obliged by law to pay a minimum wage, sick leave, and holiday pay. These factors could end up costing Deliveroo and vastly change its investment case.

Deliveroo Dividend History

Deliveroo doesn’t pay a dividend and isn’t expected to pay a dividend for the foreseeable future. The food delivery service provider is still in its growth stages and remains unprofitable. Hence, any excess profits in the short to medium term will most likely be reinvested into the business to explore further avenues of profit.

Due to the fact that Deliveroo is still an unprofitable business, it doesn’t have a P/E ratio. That being said, its P/S ratio can serve as a useful forward multiple to indicate whether the stock is currently trading at fair value in relation to potential profits it can generate from future sales. With a P/S ratio of less than 1, this could indicate tremendous growth potential from its sales.

Among the 13 qualified analysts covering Deliveroo shares, the consensus is for Deliveroo to grow both its top and bottom lines over the next two years. Revenue growth is expected to be aided by a slight boost from higher inflation. Meanwhile, earnings growth is modelled based on dissipating headwinds from lower energy costs, stabilising wages, its exit from unprofitable markets.

| Metrics | FY22 (Reported) | FY23 | FY24 |

|---|---|---|---|

| Revenue | £1.97bn | £2.06bn | £2.24bn |

| Basic EPS | -13.0p | -2.60p | -0.10p |

Data source: Deliveroo, Financial Times

Deliveroo shares currently have an average Buy rating from several brokers. With an average price target of 142p, brokers seem to agree that there’s upside potential for Deliveroo shares over the next 12 months.

| Date | Brokerage | Rating | Price Target |

|---|---|---|---|

| 13/10/2023 | JPMorgan | Hold | 142p |

| 10/10/2023 | Barclays | Hold | 120p |

| 9/10/2023 | Bank of America | Buy | 151p |

| 4/10/2023 | Goldman Sachs | Buy | 162p |

| 11/8/2023 | Credit Suisse | Buy | 183p |

| 11/8/2023 | Morgan Stanley | Buy | 140p |

| 7/7/2023 | BNP Paribas | Sell | 105p |

| 3/7/2023 | Jefferies | Buy | 170p |

| 21/3/2023 | Citi | Hold | 90p |

| 13/3/2023 | Bernstein | Buy | 170p |

Data source: Market Screener

My price target for Deliveroo shares was last updated on 18th October 2023.

| Metrics | FY23 (Projected EBITDA) | Comments | |

|---|---|---|---|

| UKI GTV | £4.21bn | c.8.2% growth — higher disposable income to offset lower food inflation tailwind with expansion into groceries to help in H2. | |

| International GTV | £2.87bn | c.-3.1% growth — More difficult comparisons post-lockdown era with return to normality, although ‘easier’ comps in H2 to ease negative growth. | |

| Total GTV | £7.08bn | c.3% growth — in line with guidance. | |

| Take Rate | 28.9% | In line with improving long-term trend, but investments in customer value proposition (CVP) to lower rate in H2 vs H1. | |

| Revenue | £2.05bn | ||

| Cost of Sales | £1.33bn | c.65% of revenue — improving cost structure through rider network efficiencies. | |

| Gross Profit | £0.72bn | ||

| Marketing and Overheads | £644m | c.9.1% of GTV with dial down of advertising. | |

| Adjusted EBITDA | £76m | In line with guidance. | |

| Shares in Issue | 1.72bn | Assuming dilution at annualised rate between FY21 and FY22. | |

| Basic EBITDA per Share | 4.42p | ||

| Price Target | 133p (HOLD) | ||

| Metrics | FY23 (Projected) | Comments | |

|---|---|---|---|

| UKI GTV | £4.21bn | c.8.2% growth — higher disposable income to offset lower food inflation tailwind with expansion into groceries to help in H2. | |

| International GTV | £2.87bn | c.-3.1% growth — More difficult comparisons post-lockdown era with return to normality, although ‘easier’ comps in H2 to ease negative growth. | |

| Total GTV | £7.08bn | c.3% growth — top end of guidance. | |

| Take Rate | 28.9% | In line with improving long-term trend, but investments in customer value proposition (CVP) to lower rate in H2 vs H1. | |

| Revenue | £2.05bn | ||

| Cost of Sales | £1.33bn | c.65% of revenue — improving cost structure through rider network efficiencies. | |

| Gross Profit | £0.72bn | ||

| Administrative Expenses | £800m | From c.9% of workforce leaving. | |

| Other Operating Expenses | £5m | Lower rider kit costs from onboarding fewer new riders. | |

| Other Operating Income | £6m | In line with long-term average. | |

| Operating Profit | -£79m | ||

| Finance Income | £40m | Higher interest receivables offset by stronger GBP. | |

| Finance Costs | £5m | Higher interest from leases. | |

| Profit Before Tax | -£44m | ||

| Taxation | N/A due to unprofitability. | ||

| Profit for FY23 | -£44m | ||

| Shares in Issue | 1.72bn | Assuming dilution at annualised rate between FY21 and FY22. | |

| Basic EPS | -2.56p | ||

Deliveroo has seen its growth rates slow considerably as it laps tough comparisons from the year before, especially on an international level where customers were stuck at home. Even so, this shouldn’t discount the growth potential Deliveroo has as the online food delivery market is expected to grow at a CAGR of c.11% over the next five years; Deliveroo set to be one of the main beneficiaries of this.

Despite that, it should go without saying that the industry remains unprofitable to this day. Deliveroo could very well be set to achieve EBITDA profitability later this year, but question marks surrounding its sales growth and long-term earnings potential persists; even more so when its competitors are slowly catching up in market share, not to forget the regulatory risks associated with its self-employed drivers.

Be that as it may, Deliveroo shares are still trading below their fair value based on their current P/S ratio. Thus, on the basis that Deliveroo can achieve and maintain profitability in the medium term, its current sales ratio could hint at a rather lucrative entry point. But due to doubts surrounding its ability to sustain long-term profitability, I rate Deliveroo shares a Hold for now.

John Choong, Senior Equity Research Analyst

Please note: John Choong has no positions in Deliveroo. These stock analysis reports are not personal recommendations or advice and should never be treated as such.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.