I found Trading 212 to be excellent on many levels. The sheer range of investments, including over 12,000 shares, will outperform many available platforms. But perhaps one of the most compelling reasons to pick this platform is the exceptionally low trading and non-trading fees.

There’s something for everyone here. Of course, I did uncover some minor weaknesses, such as the lack of copy trading or cryptocurrencies, but overall, this platform gets the thumbs up from me.

Read on to see how Trading 212 stacks up against its competitors.

Important: The Trading 212 waiting list may apply to some countries, but they are now accepting new customers from the UK.

Use promo code INVESTUK

When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results

Get a Free Fractional Share Worth up to £100

Register a new account and deposit at least £1 to get a random free fractional share worth up to £100. Use code “INVESTUK”

“To get free fractional shares worth up to 100 EUR/GBP, you can open an account with Trading 212 through this link. Terms apply”.

When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results

Trading 212 was launched in the UK in 2013 with the aim of making trading in various assets easy and accessible to everyone. Based in London and approved by the Financial Conduct Authority, the Trading 212 mobile app is now ranked number one in the UK.

Trading 212 offers investors a freemium business model, allowing users to utilise the basic features of the platform for free; however, if you want to make use of some of the more sophisticated features, you will be charged a fee.

Trading 212 Ratings

Overall

Pros

- Exceptionally low cost across the board

- Massive choice of investments

- Highly functional, user-friendly mobile app

Cons

- No copy trading

- No cryptocurrencies

- No two-step login for extra security

Who is Trading 212?

Trading 212 is a global online financial trading platform and multi-asset online broker based in London that provides investors with commission-free trading in forex, global stocks, and Exchange Traded Funds.

The zero-commission fee structure has helped cement its place as one of the most popular trading apps in the world.

Who owns Trading 212?

Trading 212 is a fintech start-up that was founded by Ivan Ashminov, who plans to use his background in computer science to introduce new and innovative additions to the platform. Trading 212 is the Trading name of Trading 212 UK Ltd.

Trading 212 Product Range Overview

At the time of this Trading 212 review, it had four main account types: Trading 212 Invest, Trading 212 ISA, and Trading 212 Pro, which I will look at in more detail.

Trading 212 Invest Review

An appealing feature of Trading 212 Invest accounts is that you can start free trading with as little as £1 in over 3,000 stocks, shares, and ETFs. Trading 212 offers users zero commission fees, which is great when compared to other trading platforms such as Halifax, which charges £12.50 per trade. With Trading 212 Invest, shares can be purchased from within the UK, Germany, America, theNetherlands, Switzerland, and Madrid, which is a great choice.

The only negative I could find was an FX fee of 0.15% for trades that are conducted in a currency other than the account base currency. This is still excellent value when compared to other platforms.

Watch the Trading212 video on how to buy your first share with their Trading212 Invest solution.

Trading 212 ISA Review

Again, I found the Trading 212 ISA account to be a great offering with a minimum deposit of only £1 and no fees for administration, commission, or dividend investment.

The Trading212 ISA account allows UK residents to take advantage of everything the Invest Account offers, with the additional benefit of being tax-free. The UK allows traders to invest up to £20,000 per tax year; however, it is prudent to know that the Trading 212 ISA requires traders to create their own portfolio, and therefore, for the purposes of this Trading 212 review, I have found this to be more suitable for experienced investors looking for a tax-free account from which to conduct trades.

Trading 212 Fractional Shares

Both the Trading 212 Invest and ISA accounts offer investing and trading in fractional shares. This can be accessed by enabling the Fractional Shares Indicator from Trading Preferences in the settings menu on your account.

Once enabled, a small circle will appear above each instrument where fractional shares are available.

“To get free fractional shares worth up to 100 EUR/GBP, you can open an account with Trading 212 through this link. Terms apply”.

Trading 212 Platform Review

Trading 212 offers investors both web trading platforms and mobile trading platforms, which I will look at in more detail in this Trading 212 review.

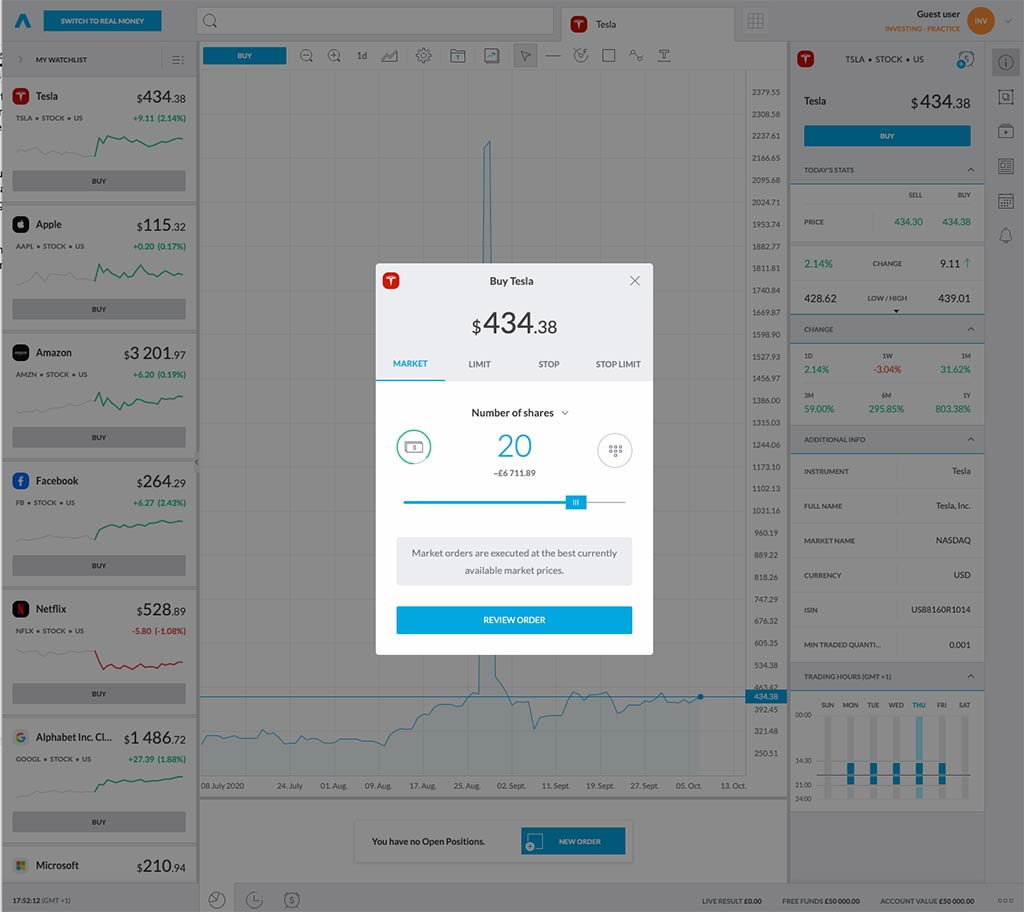

Web Trading Platform

Trading 212 has their own in-house-designed web trading platform, which I found to be really easy to use and simple to navigate. One of the outstanding features was its customizability and search functions. As well as this, there are other handy little functions such as alerts and notifications, in addition to portfolio and fee reports giving you access to your results, interest charged and earned, and other useful bits of information.

Another feature that I really liked was the ability to place trades in several ways and execute several manoeuvres on the same trading pair at the same time.

Trading 212 App Review

While conducting this Trading 212 review, I found using the mobile trading app to be a great experience for both novice and more experienced traders. It has a clean, modern interface that is easy to use. Simple swipes can help you switch between different functions and areas of the app, and there is the capability of setting price alerts and accessing forums and training videos via the menu.

The mobile app also gives new traders the option of using a demo account so they can experiment with the platform without risking their investment funds, and it takes less than a minute to set up and start trading. This demo account can then be switched between real and practise funds should you decide to take advantage of one of the three account types on offer and start trading with real money.

On the downside, security could have been a little tighter with a two-step login option and features such as touch or face ID login.

Research Service and Tools Review

Research and tools can be a bit hit-and-miss with Trading 212. While users can take advantage of daily trading ideas and their charting includes over 60 technical indicators, making it one of the most comprehensive offerings on the market, their news feed is extremely limited.

That being said, they do offer a detailed economic calendar and technical analysis to their users, as well as tutorials on how trading works in all its elements within their education section. Trading 212 also offers research-backed analysis on financial markets and investments from top analysts, and traders are able to set price alerts and notifications about entities such as executed orders, important news, or margin calls.

Trading 212 Fees

Trading 212 offers users very low fees, in particular their zero-commission stock and ETFs

When it comes to comparing their fees to those of other brokers, they are comparable to eToro, with slightly higher trading fees, which they make up for by scrapping the inactivity fee that eToro charges. Forex trading fees are comparatively high at Trading 212 when held up against other online brokers, which is worth consideration should you be intending to trade forex.

When it comes to fees, Trading 212 is certainly an attractive offering, although they have indicated in the past that they plan to add more ‘premium’ financial services to the platform, which users will almost certainly need to pay for to access.

In terms of non-trading fees, Trading 212 does not charge account fees, inactivity fees, deposit fees, foreign exchange fees, or withdrawal fees.

From January 4, 2021, they will offer a lifetime limit on free deposits via all payment methods except bank transfers and instant bank transfers, otherwise known as Open Banking.

If you fund your Trading 212 account with credit or debit cards, Google Pay, Apple Pay, or Skrill, there are no fees until you have deposited £2,000 in total. After this, a fee of 0.7% will be applied, which, in their words “is to cover costs levied by payment providers and card companies”.

A bank transfer remains free unless your bank charges you for making it.

Future plans in 2021 include BACS Direct Debit, which enables you to make recurring and one-off bank transfers in the UK, or SEPA Direct Debit if you reside in the EU.

It is also worth noting that if you make a deposit into your account, this will remain fee-free without any limits.

Trading 212 Invest fees

| Fee type | Fee amount |

|---|---|

| Trading commission | Free |

| Custody fee | Free |

| FX fee | 0.15% |

| Deposits via bank transfer | Free |

| Deposits via Cards, Google Pay, Apple Pay & other | Free up to £2,000, 0.7% thereafter |

| Withdrawals | Free |

Trading 212 ISA fees

| Fee type | Fee amount |

|---|---|

| Trading commission | Free |

| Custody fee | Free |

| FX fee | 0.15% |

| Deposits via bank transfer | Free |

| Deposits via Cards, Google Pay, Apple Pay & other | Free up to £2,000, 0.7% thereafter |

| Withdrawals | Free |

Trading 212 fees

| Fee type | Fee amount |

|---|---|

| Trading commission | Free |

| Custody fee | Free |

| Spread | Dynamic |

| FX fee | 0.5% on results only |

| Deposits | Free |

| Withdrawals | Free |

| Overnight holding fee | Dependent on instrument |

Trading 212 FAQs

Is Trading 212 any good?

Is Trading 212 safe?

Trading 212 Customer reviews

You cannot change your account’s currency to a different one than your country’s. I prefer US dollar because of US market dominance but my home country use Euro

- Fees

- Account opening

- Deposit and withdrawal

- Customer service

The app was one of the first which saw huge popularity in the UK at the start of the Covid Pandemic, I was able to sign up early luckily but I am aware that now there is a huge waiting list. It has very low fees, instant deposits and fast withdrawals, no minimum amount nonsense. It also offers “Gambling” accounts aka CFDs for those with a much higher tolerance to risk. Overall it’s a solid app, the UI is readable and well presented and it doesn’t trick you with any of its terminology.

- Deposit and withdrawal

- Customer service

A good app overall, slightly confusing at first but easy to learn. All the information is displayed on there. Useful notifications/emails. Reward upon opening the account if you’re referred/refer someone so good to use.

- Account opening

- Customer service