Plus500 vs eToro – my verdict

The main difference between Plus500 and eToro is that while Plus500 only offers CFD-based products, eToro has a wider range of investment types

If you are searching for no commissions, spreads and other fees apply across a range of financial assets, then you may have whittled down your search to these two platforms.

I’ve performed an extensive analysis to identify that for day traders looking to trade solely in CFDs, Plus500 offers tight spreads and an excellent proprietary trading platform. However, if you are seeking real stocks or Cryptocurrencies, then these can only be found at eToro.

Read on to find out more.

- Plus500 vs eToro – my verdict

- Plus500 overview

- eToro overview

- Plus500 vs eToro Fees: Which platform is cheaper?

- Plus500 vs eToro: Which platform offers the most?

- Plus 500 vs eToro: Who has the most investments available?

- Plus500 vs eToro: Who has the best research?

- Plus500 vs eToro: Whoes customer service is best?

- Plus500 vs eToro: Who offers the best education?

- Plus500 vs eToro, which is better?

- FAQs about Plus500 vs eToro

Is Plus500 better than eToro?

Yes, Plus500 is better than eToro for trading CFDs, as Plus500 offers a better trading experience for advanced traders with slightly tighter spreads on forex. However, for a broader range of assets, eToro is the clear winner.

Key takeaways

Plus500 has outperformed eToro in the following areas:

- Excellent 24/7 customer support

- Slightly tighter spreads on forex

- Listed on the London Stock Exchange

- Excellent proprietary trading platform

- Lower withdrawal fees

eToro has outperformed Plus500 in the following areas:

- Wider range of investments available

- Excellent copy trading facilities

- Cryptocurrency trading

- Better education and research

|  | |

| Read Review | Read Review |

Overall Rating

| Platform | ||

|---|---|---|

| Ratings | Overall Rating:

90%

Fees:

90%

Account Opening:

90%

Deposit and Withdrawal:

90%

Trading Platform:

90%

Markets and Products:

90%

Research:

70%

Customer Service:

90%

Education:

70%

| Overall Rating:

90%

Fees:

90%

Account opening:

100%

Deposit and withdrawal:

70%

Trading platform:

90%

Markets and products:

80%

Research:

70%

Customer service:

70%

Education:

50%

|

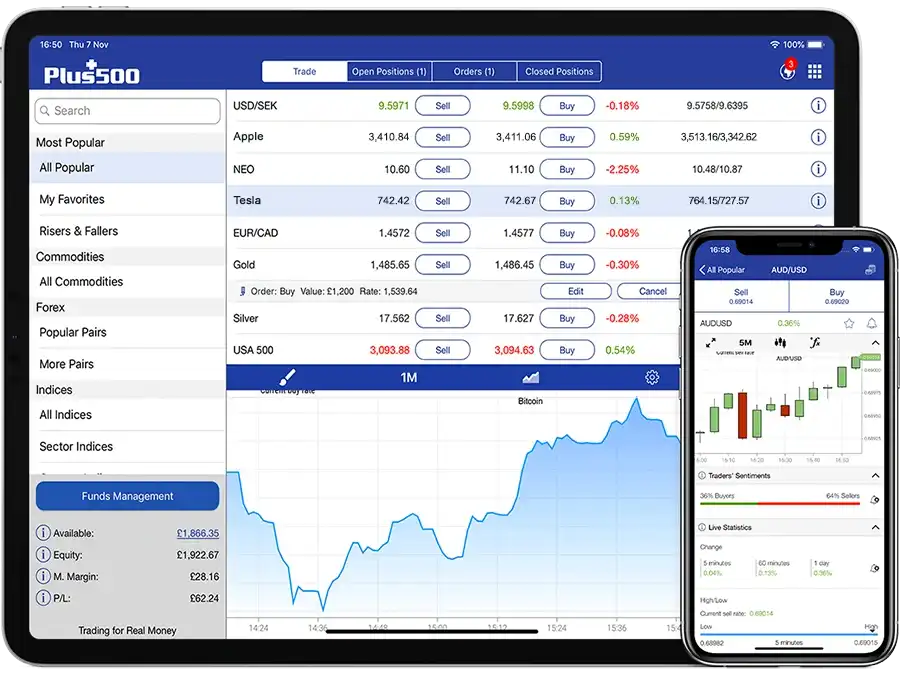

Plus500 overview

With access to over 2800 CFD contracts, it’s little surprise that Plus500 is one of the leading CFD brokers in the UK. Their no commissions, spreads and other fees apply and free lifetime demo account as well as the well-designed interface from which to trade, make them a long-standing and popular choice among traders.

Plus500 also has +Insights, which provides a real glimpse into the wisdom of the masses. Whilst not copy trading, it is a social trading tool where users can explore data on the most bought and sold positions.

Pros

- no commissions, spreads and other fees apply

- Easy-to-use platform

- Tight spreads

Cons

- Trading through CFDs only

- Inactivity fees

Read more in my Plus500 review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

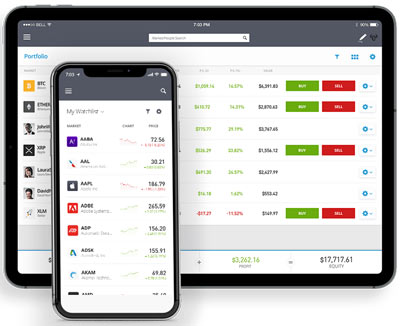

eToro overview

eToro is the world’s leading social trading and investing platform that allows users to automatically copy the trades of successful traders in real-time and provides access to a wide variety of assets, including stocks, forex, commodities, and cryptocurrencies.

Pros

- Free trading on stocks

- Very quick and easy to open an account

- Well-designed web trading platform with social trading available

Cons

- Very limited education

- Conversion and withdrawal fees

Read more in my eToro review

{etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees

Plus500 vs eToro Fees: Which platform is cheaper?

Fees

| Platform | ||

|---|---|---|

| Minimum DepositThe minimum amount required to open an account | £100 | $50 |

| Minimum TradeThe minimum amount to trade or buy shares | £0 | $1 |

| ETFs FeeFee per ETF trade | no direct ETF trading | 0% |

| Investment Trusts FeeFee per investment trust trade | NA | NA |

| Junior S&S ISA FeeSubscription fee per month and the platform fee | NA | NA |

| Non Trading FeeFee for not trading in a period | $10 after 3 months inactivity | $10 pcm after 1 year inactivity |

| Stocks & Shares ISA FeeSubscription fee per month and the platform fee | £0 | NA |

| Telephone Dealing FeeFee for trading over the telephone | NA | NA |

| Withdrawal FeeFee for withdrawing funds from your account | £0 | $5 |

Plus500 has cheaper Fees than eToro

There are a number of reasons I have made Plus500 the winner of the cheapest platform vs eToro.

The minimum deposit, whilst not a direct fee, is lower on eToro which does make it easier for beginners to start trading. There is no minimum trade on Plus500 but if you don’t use some money you don’t really make a trade! This is a draw as they are basically the same.

There are no ETF fees or commissions charged by Plus500 or eToro, all fees are built into the spread. This is often difficult to compare, but during my analysis, I found the spreads on Plus500 to be slightly tighter than the spreads at eToro. There is also a withdrawal fee to contend with at eToro of $5 for each withdrawal made.. This is currently free on Plus500 which is why it wins over eToro.

It was close; however, the withdrawal fees and spreads make Plus500 cheaper than eToro.

Plus500 vs eToro: Which platform offers the most?

Platforms & tools

| Platform | ||

|---|---|---|

| Android AppAn Android app available in the Google Play store | ||

| Copy TradingOffers the ability to copy other traders portfolios | ||

| Demo AccountOffers a demo account | ||

| iPhone AppAn app available for download from the iOS app store | ||

| Islamic AccountDoes the platform offer a sharia compliant Islamic account | ||

| MetaTrader 4Offers the MetaTrader 4 trading platform solution | ||

| MetaTrader 5Offers the MetaTrader 5 trading platform solution | ||

| Social TradingOffers the ability to share your trades on social media | ||

| Stock AlertsAbility to set price alerts, volume alerts | ||

| Web PlatformOffers a web-based browser trading platform |

Plus500 offers more for advanced traders

Assuming that you are looking to trade in CFDs only, Plus500 has a proprietary platform that is easy to use and provides an excellent user experience for all levels of traders with a greater selection of CFDs. There are excellent search functions and charting capabilities and the new +insights function allows traders to harness the wisdom of crowds to help with trading decisions. This is a functionality that I have not come across elsewhere.

However, eToro also provides an excellent trading experience, with the obvious benefit of a broader range of assets, and unrivalled copy trading facilities which can be invaluable for new traders.

Neither have access to MetaTrader.

Plus 500 vs eToro: Who has the most investments available?

Investments available

| Platform | ||

|---|---|---|

| Auto InvestingAbility to set auto-investing options, usually per month | ||

| CFD TradingOffers CFD trading | ||

| Corporate BondsOffers corporate bonds | ||

| CryptoAbility to buy and sell cryptocurrency: Availability subject to regulations | ||

| Ethical InvestmentsOffers ethical investment themed funds and ETFs | ||

| ETFsAbility to trade ETFs: Availability subject to regulations | ||

| ForexAble to trade Forex | ||

| Fractional SharesAble to buy fractional shares | ||

| FundsAble to buy funds | ||

| Government Bonds (Gilts)Able to buy government bonds and Gilts | ||

| Investment TrustsAble to buy investment trusts | ||

| Junior S&S ISAAble to buy a junior stocks and shares ISA | ||

| General Investment Account (GIA)Able to buy and sell shares | ||

| Spread BettingAble speculate on rising and falling of financial markets | ||

| Stocks & Shares ISAAble to buy a stocks and shares ISA |

eToro has the most investments available

There is little doubt that Plus500 is a great CFD based platform that does offer ETFs and Forex CFDs but little else. If you just want a general investment account or want to trade in crypto, then Plus500 isn’t the platform for you.

eToro offers a wide range of investments, including ETFs and Forex, alongside crypto and CFDs.

If you want to specialise in CFD trading, then Plus500 could be the right investment platform for you to use; however, for everything else, when looking specifically at Plus500 vs. eToro, you should consider eToro.

Plus500 vs eToro: Who has the best research?

eToro has better research than Plus500

Plus500 provides an economic calendar, charting tools, and market analysis; however, there is a distinct lack of recommendations or fundamental data.

eToro provide a more comprehensive set of research features including a great level of technical analysis and the social trading network which is an excellent resource.

As Plus500 only offers CFD-based products, eToro wins when you look directly at Plus500 vs eToro for research.

Plus500 vs eToro: Whoes customer service is best?

Customer service

| Platform | ||

|---|---|---|

| PhoneMain phone number for customer services | NA | NA |

| Live chatHas live chat available | Yes | Yes |

| EmailMain email address for customer services | Contact form | NA |

| 24/7 AvailabilityAvailable 24/7 for customer services | Yes | Yes |

| TrustPilot RatingThe TrustPilot rating of the platform | 4.0 - 11,677 Reviews | 4.4 - 20,229 reviews |

| TwitterThe Twitter account for the platform | https://twitter.com/plus500 | https://twitter.com/eToro |

Plus500 has better customer service than eToro

Plus500 has an outstanding live chat function which is available 24/7 and each time I used it, I got an almost instant response. eToro, on the other hand does have an adequate service but not as good as Plus500 and finding the live chat on eToro is a task in itself.

Live chat aside, whilst eToro has a better Trust pilot score, it is worth noting that Plus500 has fewer 1-star reviews (at the time of writing), which I think is a better indicator of overall ratings than just the score.

Plus500 vs eToro: Who offers the best education?

eToro offers better education than Plus500

Whilst eToro doesn’t have the best education available, it is currently available across more channels than Plus500 especially podcasts.

Plus500 does have a demo account with a traders guide, educational videos and a Trading Academy. It has a lack of interactive content and whilst this is an area they have taken steps to improve, it still needs improvement to beat eToro.

Plus500 vs eToro, which is better?

These two investment platforms are different in their offerings, with Plus500 concentrating on CFDs and CFD-based products, whilst eToro offers a wider set of investing opportunities.

If you are looking for CFDs then Plus500 are a good choice. Even with limited education you get lower withdrawal fees and 24/7 customer support.

For everything else, including crypto, in one place, eToro would be a good choice, although there are others and you should check out my full investment platform comparison tool.

FAQs about Plus500 vs eToro

Which is better Plus500 or eToro?

Is Plus500 regulated in the UK?

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.