My Rolls-Royce share price forecast includes a 360-degree examination to determine whether investors should consider this renowned aviation engine maker for the long haul.

This stock analysis report goes into detail on Rolls-Royce’s financial position, competitive strengths, industry outlook, valuation metrics, and analysts’ predictions to uncover whether Rolls-Royce shares actually present a golden long-term opportunity.

Read On: To find the Rolls-Royce share price forecast and my price target.

- Rolls-Royce Share Price (LON:RR)

- Rolls-Royce Background

- Rolls-Royce Business Model

- Rolls-Royce Earnings Breakdown

- Rolls-Royce Financials

- Rolls-Royce Competitive Advantage

- Rolls-Royce Shortcomings

- What is the Dividend Forecast for Rolls-Royce Shares?

- Are Rolls-Royce Shares Cheap?

- What is the Profit Forecast for Rolls-Royce Shares?

- What is the Rolls-Royce Share Price Forecast?

- What is the Price Target for Rolls-Royce Shares?

- Are Rolls-Royce Shares a Buy, Sell, or Hold?

Rolls-Royce Background

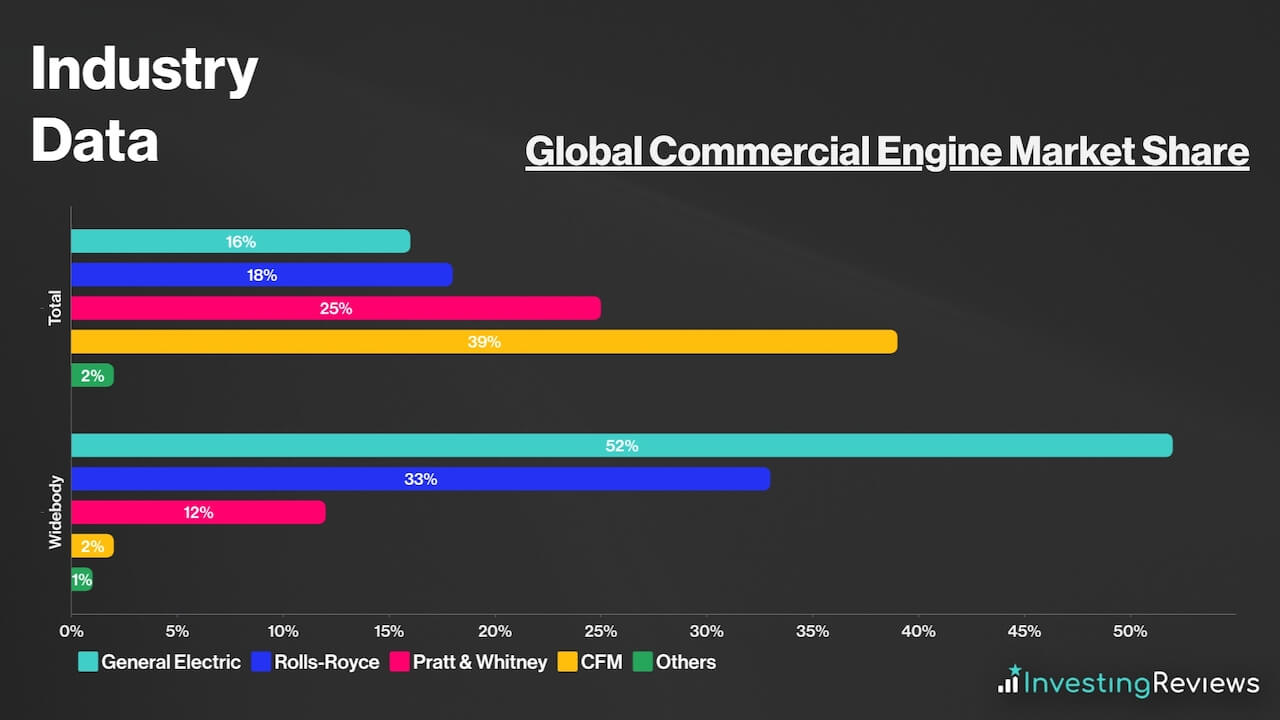

Rolls-Royce is a British multinational aerospace and defence company. It’s the world’s third-largest commercial engine manufacturer and mainly operates in the UK, although it has exposure to many European countries and the US.

It operates a group of businesses that include Civil Aerospace, Defence, Power Systems, and New Markets. Altogether, Rolls-Royce manufactures and distributes power systems for a variety of clients from both the public and private sectors in aviation and other industries. Aside from that, the company offers aftercare services to its clients, which allows it to generate recurring revenue.

Rolls-Royce shares trade on the London Stock Exchange and are constituents of the FTSE 100.

Find Out: How easy it is to buy Rolls-Royce shares in 6 simple steps.

Rolls-Royce Business Model

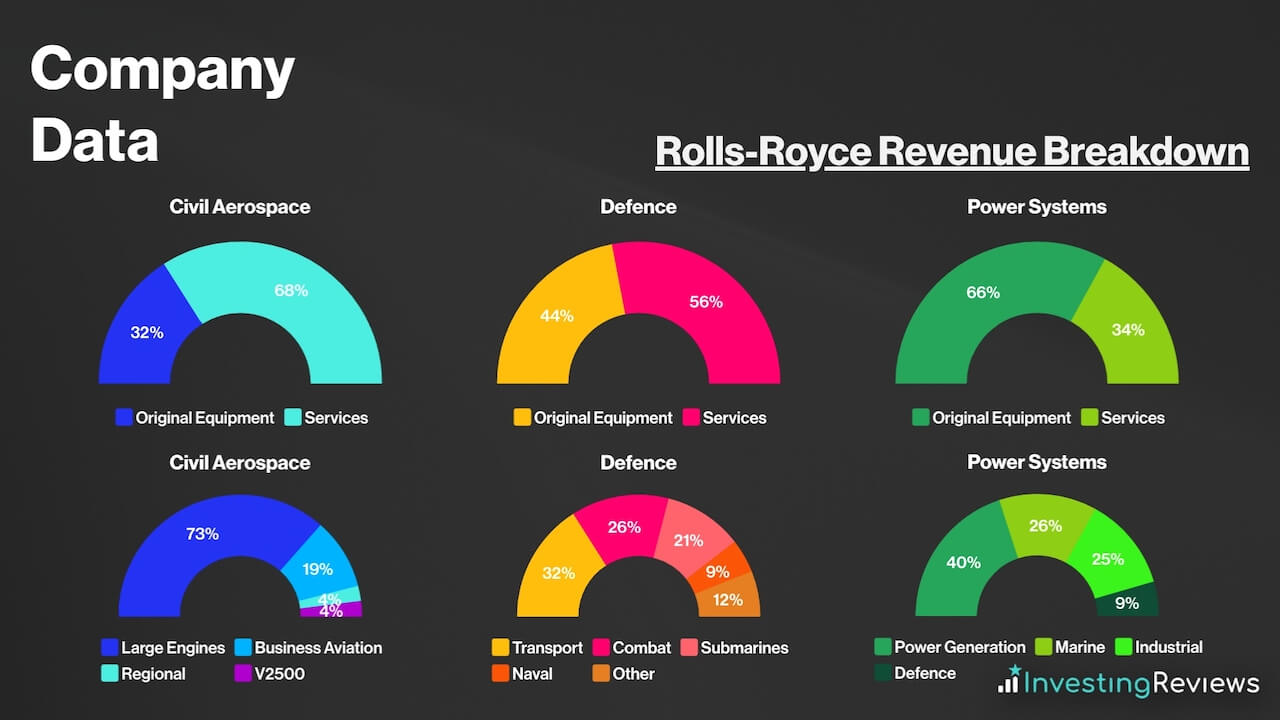

Rolls-Royce is renowned for its Civil Aerospace division. This is where it manufactures aircraft engines for clients. Most of these engines are made for widebody aircraft like the Boeing 787 and Airbus A350. Nonetheless, the bulk of its revenue is generated from conducting maintenance on those engines via the aftercare contracts it pens with specific airlines.

On the other hand, its Defence business is tasked with building engines for military aircraft and naval submarines. Most of the revenue from this segment also stems from maintenance. Then there’s Power Systems (MTU). The faction is a world-leading provider of integrated solutions for onsite power and propulsion. And unlike its previous two segments, the majority of MTU’s sales stems from original equipment manufacturing.

Finally, Rolls’ New Markets segment consists of early-stage businesses. They leverage existing, in-depth engineering expertise and capabilities to develop sustainable products for new markets with a focus on transitioning to net zero. Currently, its most exciting venture is its proposal to build small modular nuclear reactors (SMRs), which are supposedly more efficient and cost-effective.

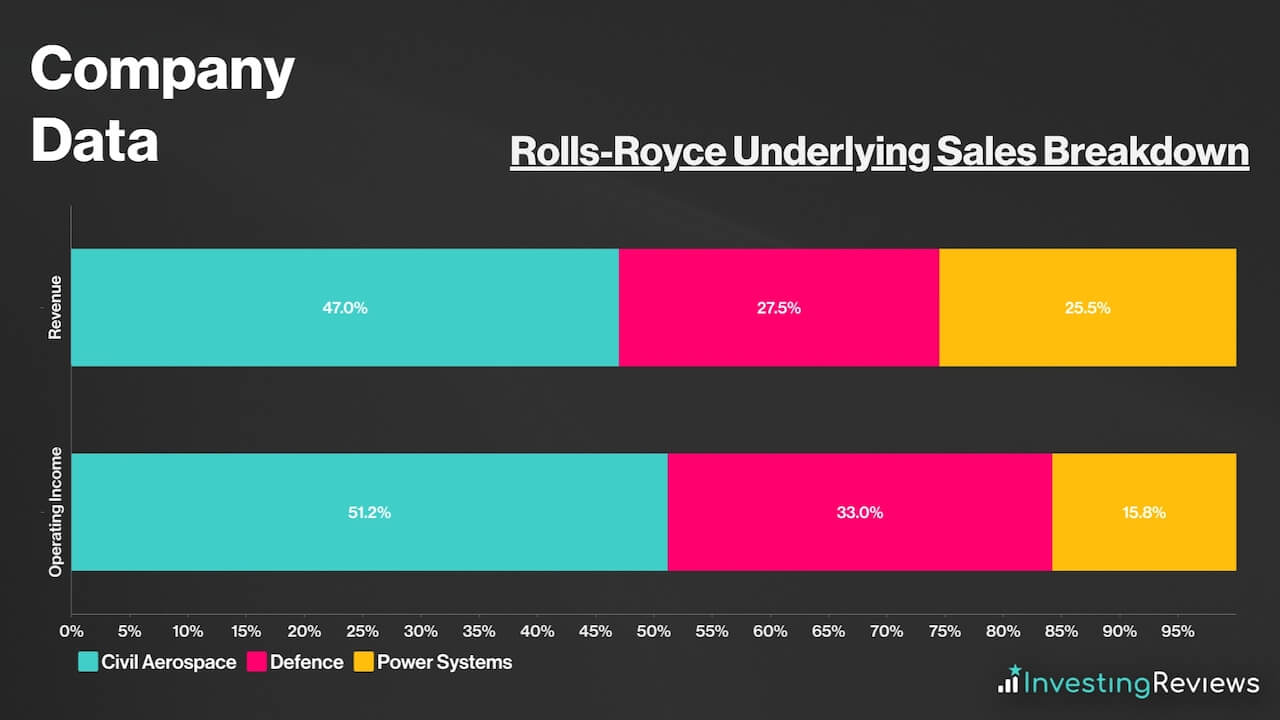

As a conglomerate, Rolls-Royce makes its money through a variety of revenue streams. However, the bulk of its revenue and profit stems from its Civil Aerospace arm as that business is more volume-centric than its other businesses. This is due to the vast number of aircraft deliveries and maintenance it has to conduct.

Rolls-Royce Earnings Breakdown

Rolls-Royce operates a hybrid manufacturing and maintenance business model for the most part. It earns its profits from manufacturing all sorts of propulsion systems — mainly engines — and then gathers recurring revenue from servicing them.

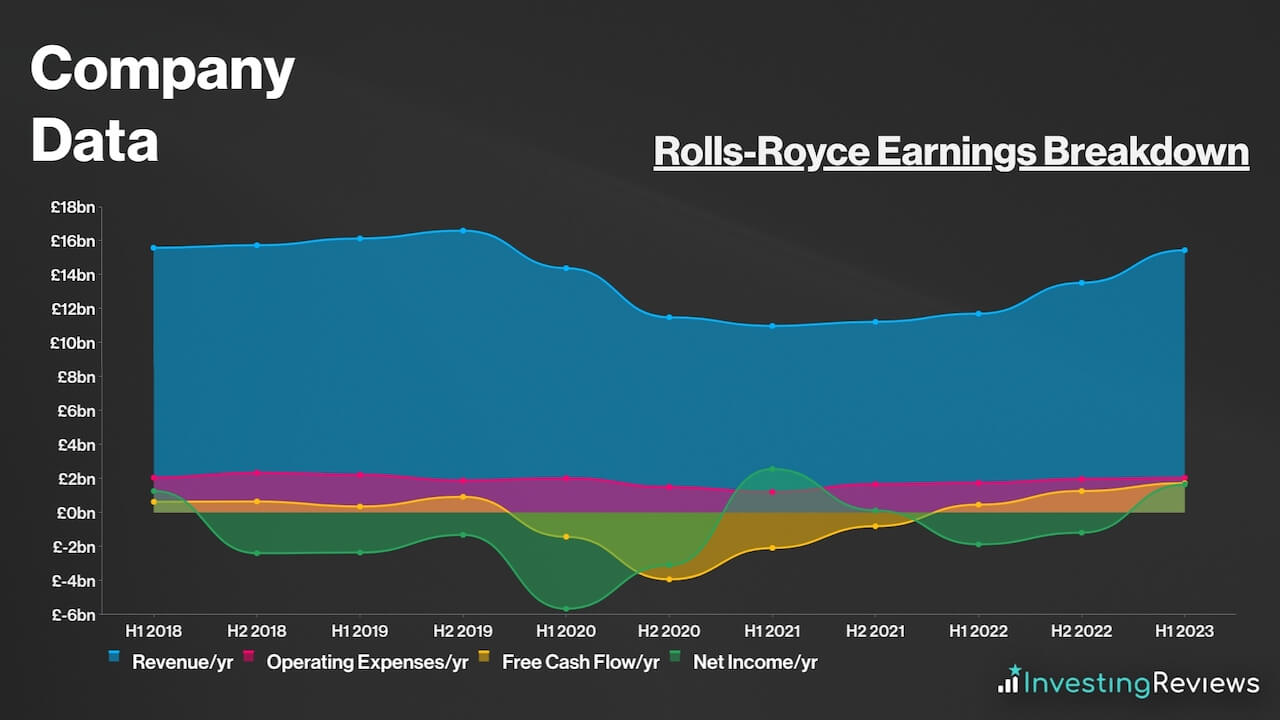

Due to several instances of capital mismanagement over the years, Rolls-Royce has had a terrible track record in maintaining profitability. This wasn’t helped by the pandemic as the bulk of its revenue was cut off when fleets across the world were grounded. That said, the firm has been selling off numerous underperforming brands that have weighed down on its profit.

But since new CEO Tufan Erginbilgic has taken the reins in early 2023, he’s enacted several cost-cutting measures as well in a bid to improve profit margins. This has beared fruit thus far with Rolls seeing a massive improvement since.

Rolls-Royce Financials

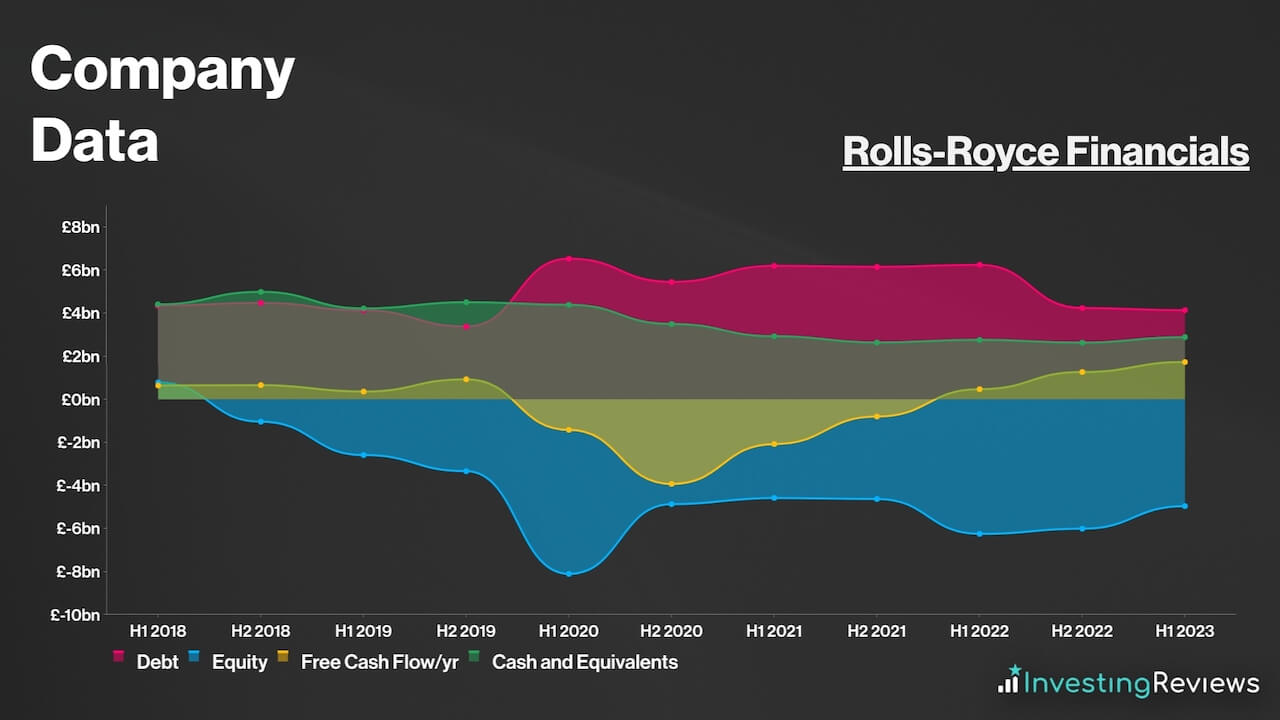

Despite seeing some improvement in recent months, Rolls-Royce’s balance sheet remains in a precarious state. Its total liabilities trump its total assets by £466m, resulting in negative shareholder equity. This is made worse by the fact that the group has a debt pile worth an eye-watering £4.13bn, amounting to a debt-to-equity ratio of -83%. What’s more, its debt can’t even be covered by its current cash levels and free cash flow.

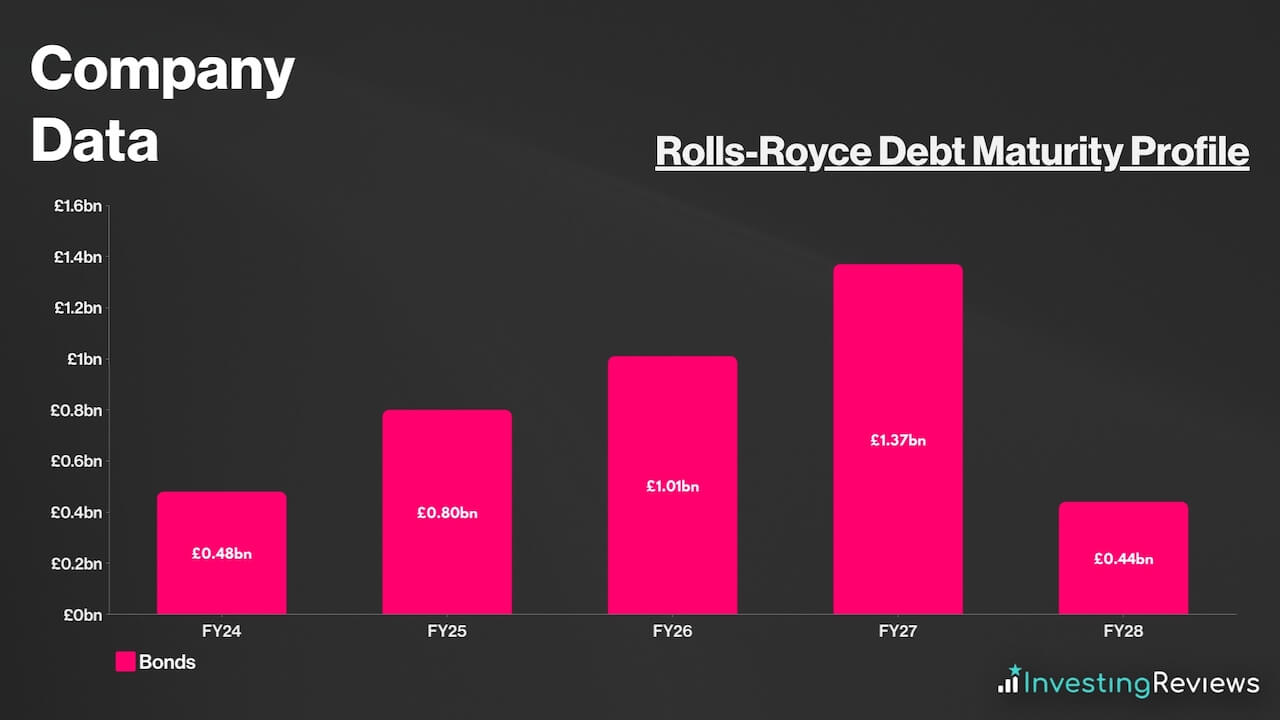

Thankfully though, Rolls-Royce’s debt maturity profile isn’t overly alarming for two reasons. The first is that all of its debt is under fixed rates. Given the current interest rate environment, this should ease financing costs. Secondly, the bulk of its repayments are only due beyond 2024. This buys the conglomerate some time to recuperate its profits and pay off its debt without having to refinance them at a higher rate.

With £2.68bn worth of operating cash flow projected for 2025, it should leave Rolls-Royce with sufficient liquidity to pay off its debt in the coming years, as long as it lives up to its projections. It’s also worth noting that Rolls-Royce has c.£8.50bn worth of revolving credit and term loan facilities. This means that it has the option to inject more liquidity into the business if it needs to.

Overall, Rolls-Royce currently has a net debt to EBITDA ratio of 2.2x. This is relatively impressive considering the state of its financials. Meanwhile, its fixed charge cover sits at a strong 3.2x, allowing it to sufficiently cover its fixed costs such as leases. For those reasons, it’s safe to say that the manufacturer’s debt pile is manageable for the time being.

Rolls-Royce Competitive Advantage

Having an economic moat (competitive advantage) over competitors is crucial in an industry like manufacturing, as it’ll allow companies to have pricing power and expand margins. Therefore, Rolls-Royce’s main competitive advantage is its unique blend of commercial and government clients, allowing it to capitalise on both ends of the propulsion market.

Within Civil Aerospace, Rolls operates in a ‘triopoly’ within the global commercial engine market, especially on the widebody front, and for good reason too. Its engines are recognised for their fuel efficiency, reliability, and performance. Additionally, it’s developing a groundbreaking new engine in UltraFan. This will be a more fuel-efficient, quieter, and more sustainable engine which is expected to enter service in the early 2030s.

On the Defence front, Rolls-Royce has a comprehensive product portfolio with excellent performance and reliability. This has allowed it to form long-standing relationships with many of its customers, especially the UK and US governments from which it draws most of its contract value from. And with defensive budgets expected to increase in light of the recent geopolitical tensions, Rolls-Royce is set to be one of the main beneficiaries of this.

As for Power Systems, the enterprise’s main advantage is its ability to provide integrated solutions for various applications. These include power generation, mining, construction, and rail. MTU power systems are known for their efficiency, durability, and adaptability, positioning it as a trusted provider.

Perhaps most excitingly, is the potential of Rolls-Royce’s SMRs within its New Markets business to become a market leader in providing clean and efficient nuclear energy. Rolls’ SMRs offer several advantages, including enhanced safety features, improved scalability, and lower construction and operational costs. And with no other competitor close to achieving what it has proposed so far, this could end up becoming Rolls-Royce’s market spinner.

Rolls-Royce Shortcomings

Despite being such a giant in the aerospace industry, Rolls-Royce also has its fair share of weaknesses. This could put investors off when buying Rolls-Royce shares.

Firstly, its profit margins are extremely volatile, ranging from -40% to 23% in a good year. This means that a black swan event could plunge Rolls-Royce into unprofitability. And with the corporation still recovering from the pandemic and in the midst of battling inflation, net profits are still in negative territory.

Moreover, it’s also got a bad history of managing costs. Delays, cost overruns, and technical setbacks in various projects have impacted profitability over the past five years or so — and even new CEO Tufan Erginbilgic has acknowledged this tremendous flaw as he plans to turn the entire operation around to be more efficient.

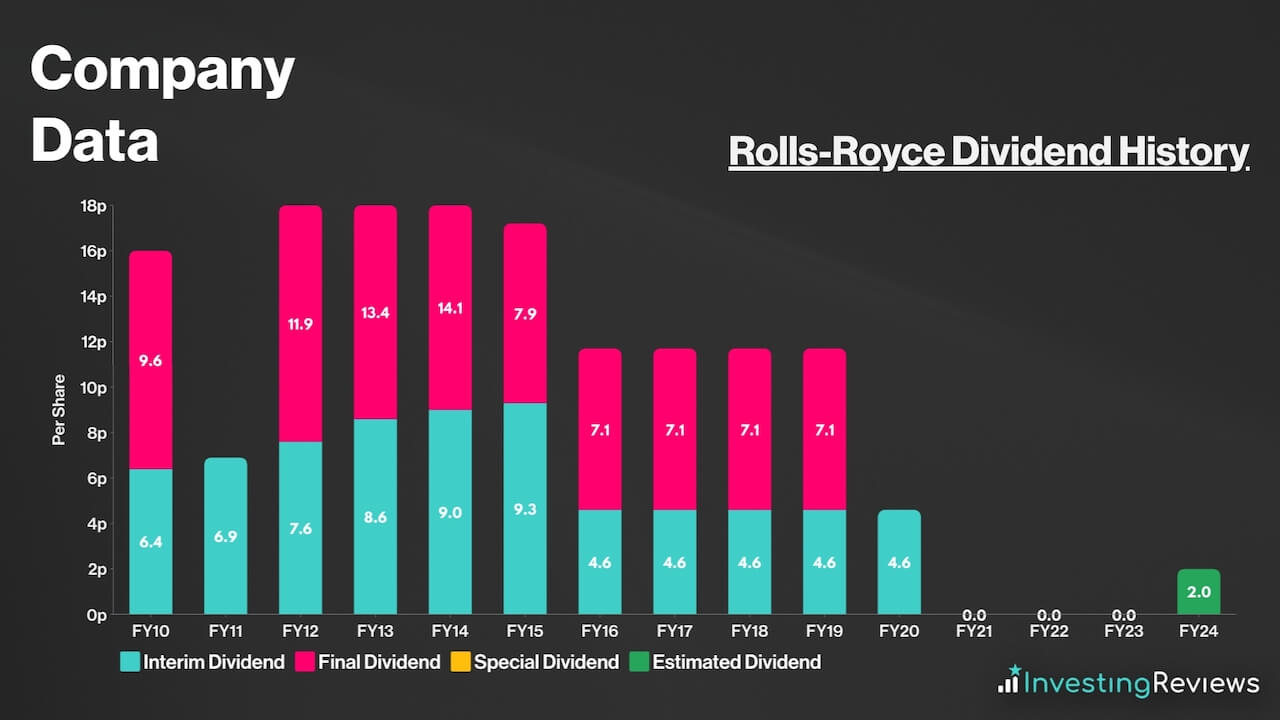

More importantly, especially for dividend investors, it hasn’t paid dividends since the onset of the pandemic. Considering that there are other blue-chip names out there with better prospects and higher dividends, this could dampen the buy case for Rolls-Royce shares.

Further exacerbating the issue, the cost-of-living crisis has seen inflation tick up. And despite seeing some cooling in recent months, it’s still way above the Bank of England’s target of 2%. As a consequence, costs will remain relatively high on the labour and commodities front, potentially squeezing margins.

Prior to the pandemic, Rolls-Royce paid dividends, although this has since been halted as the outfit remains unprofitable with debt to pay off. Still, prior to the stoppage, owners of Rolls-Royce shares were enjoying decent payouts, with dividend yields averaging around the 3% mark.

Due to its newly profitable status, analysts aren’t forecasting Rolls-Royce to pay a dividend this financial year. Having said that, provided it continues to achieve profitability in 2024 and improves its debt position, shareholder returns may resume.

Rolls-Royce is expecting to resume paying a dividend in FY24 with a minuscule yield before potentially ramping up payouts in the years to come.

Rolls-Royce shares are currently trading at a discount when compared to their industry competitors. Their P/E ratio on a trailing-12-month basis is very much below the index average too. What’s more, their P/S ratio sits around 1, which could indicate tremendous growth potential from its sales.

Among the 18 qualified analysts covering Rolls-Royce shares, the consensus is for Rolls-Royce to grow its top and bottom lines over the next two years, as it continues to recover from its pandemic slump.

| Metrics | FY22 (Reported) | FY23 | FY24 |

|---|---|---|---|

| Statutory Revenue | £13.52bn | £14.51bn | £15.68bn |

| Underlying Basic EPS | 1.95p | 9.15p | 11.03p |

Data source: Financial Times

Rolls-Royce shares currently have an average Hold rating from several brokers. With an average price target of 235p, analysts seem to agree that Rolls-Royce shares are close to hitting a peak, with limited upside potential and higher downside risks in the next 12 months.

| Date | Brokerage | Rating | Price Target |

|---|---|---|---|

| 17/10/2023 | UBS | Buy | 350p |

| 20/9/2023 | SocGen | Hold | 214p |

| 7/9/2023 | JPMorgan | Hold | 235p |

| 10/8/2023 | Barclays | Hold | 239p |

| 8/8/2023 | Citi | Buy | 294p |

| 7/8/2023 | Jefferies | Buy | 310p |

| 4/8/2023 | Deutsche | Buy | 210p |

| 28/7/2023 | Shore Capital | Buy | N/A |

| 11/7/2023 | Bernstein | Hold | 185p |

| 22/6/2023 | Berenberg | Hold | 100p |

| 13/6/2023 | Morgan Stanley | Hold | N/A |

| 7/6/2023 | Jefferies | Buy | 210p |

| 3/5/2023 | Bank of America | Buy | 190p |

| 28/2/2023 | Oddo BHF | Hold | 160p |

| 6/2/2023 | RBC | Sell | 70p |

| 16/1/2023 | Kepler Cheuvreux | Hold | N/A |

| 4/1/2023 | Panmure Gordon | Sell | N/A |

Data source: Market Screener

In short: Based on the calculations below, Rolls-Royce shares have an adjusted forward P/E ratio of 20.6. Assuming the price target is where Rolls-Royce’s fair adjusted P/E should trade at (25.0), this would give Rolls-Royce shares a price target of 250p.

Our price target for Rolls Royce shares was last updated on 18th August 2023.

| Metrics | Underlying FY23 (Projected) | Comments | |

|---|---|---|---|

| Civil Aerospace Revenue |

£7.11bn | c.25% growth — higher flying hours and strong demand for deliveries. | |

| Defence Revenue | £3.77bn | c.10% growth — higher than long-term average due to ramp-up in defence spending. | |

| Power Systems Revenue | £3.85bn | c.15% growth — H2 revenue seasonally better than H1. | |

| New Markets Revenue | £0.10bn | Assuming higher funding from governmental agencies and other interested parties for SMRs | |

| Group Revenue | £14.83bn | ||

| Cost of Sales | £11.86bn | c.80% of revenue — lower than last two years, taking cost savings into account. | |

| Gross Profit | £2.67bn | ||

| Commercial and Administrative Expenses | £1.04bn | c.7% of revenue — slightly lower than long-term average due to cost savings. | |

| Research and Development | £0.74bn | c.5% of revenue — slightly lower than long-term average due to cost savings. | |

| JV Income | £0.20bn | ||

| Operating Profit | £1.39bn | In line with guidance of £1.2bn to £1.4bn. | |

| Finance Income | £100m | Higher interest receivables. | |

| Finance Costs | £400m | Lower interest payables due to lower debt. | |

| Profit Before Tax | £1.09bn | ||

| Taxation | £251m | Effective Tax Rate of c.23%, in line with guidance. | |

| Profit for FY24 | £839m | ||

| Shares in Issue | 8.38bn | Assuming dilution at annualised rate between FY21 and FY22. | |

| Adjusted Diluted EPS | 10.01p | ||

| Price Target | 250p (BUY) | ||

There’s plenty to dislike about Rolls-Royce. Its atrocious financial position, negative shareholders’ equity, and incredible inefficiency over the past few years were further exacerbated by the pandemic. But things look to be turning around with new CEO Tufan Erginbilgic.

Most prominently, he’s returned the engineer back to profitability in such a short amount of time, thanks to his cost-cutting efforts and a tailwind from strong travel and defence demand. As a result, it’s no surprise to see Rolls-Royce shares more than double in value this year. The FTSE 100 constituent recently posted a strong set of results with an upgraded outlook.

The engine maker now expects to significantly beat prior expectations for its full-year operating profit and free cash flow, demonstrating Erginbilgic’s successful transformation efforts thus far. And despite the impressive rise it has witnessed, I believe there’s more upside potential to be realised. Hence, I reiterate my Buy rating for Rolls-Royce shares.

John Choong, Senior Equity Research Analyst

Please note: John Choong has positions in Rolls-Royce. These stock analysis reports are not personal recommendations or advice and should never be treated as such.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.