Scottish Friendly are one of the largest mutuals in the UK offering a range of financial services including access to 10 funds via tax-efficient accounts.

They are suitable for hands-off, beginner investors, although their fees are a little on the high side for a service of this nature. This would not suit experienced investors who like to pick their own investments.

Scottish Friendly occupies a unique position in UK finance. Unlike the fintech startups like Nutmeg or old-guard asset managers like JP Morgan, Scottish Friendly isn’t a Public Limited Company. It’s a type of financial services organisation called a mutual. To find out more, read on.

Are you looking for a way to invest for your future but feel uninspired after a review of the latest startups?

You might do what millions of people have done over the past few hundred years: turn to one of the UK’s many friendly societies, like Scottish Friendly.

Mutuals are organisations owned by their members (i.e. you, the customer). Rather than running the company to benefit shareholders, mutuals like Scottish Friendly are run in a way that serves the members. All profits either get redistributed to members or reinvested in a way that benefits members, so there are no shareholders who get paid before you or impulse to run the company in a way that benefits those shareholders but not necessarily the customer.

Mutuals are a very old way of sustaining the financial health of communities. Scottish Friendly was founded in 1862. While they date back hundreds of years, mutuals remain a huge part of the UK finance landscape. Mutuals nationwide manage £125 billion in assets and boast 30 million members.

Keep reading my review to learn whether Scottish Friendly’s financial products might secure you the future you want.

- Scottish Friendly Ratings

- Who is Scottish Friendly?

- Who owns Scottish Friendly?

- Scottish Friendly Product Range

- Scottish Friendly Investment ISA Review

- Research Services & Tools

- Fees & Charges

- Transferring Your Investments to Scottish Friendly

- Customer Service

- Who is Scottish Friendly Suitable for?

- Opening an Account

- Scottish Friendly FAQs

- Scottish Friendly Customer reviews

Who is Scottish Friendly?

Scottish Friendly is one of the largest mutual life offices in the UK, offering ISAs, insurance, savings and investments for the last 160 years.

Who owns Scottish Friendly?

Scottish Friendly is a group of companies. It began life as the City of Glasgow Friendly Society in 1862. In 1992, the company adopted the name Scottish Friendly Assurance after transferring from a Scottish-based mutual organisation. All profits are used in a way that benefits its members without any need to pay shareholders.

Scottish Friendly Product Range

Scottish Friendly offers the following account types:

Scottish Friendly offers a simple product range:

- Scottish Friendly Investment ISA

- Scottish Friendly Junior ISA

- Life Cover

- Child Trust Fund Maturities

Although the mutual places an emphasis on investing solutions free from capital gains tax, Scottish Friendly doesn’t offer any pension options, which is something to keep in mind if a private pension is on the cards for you.

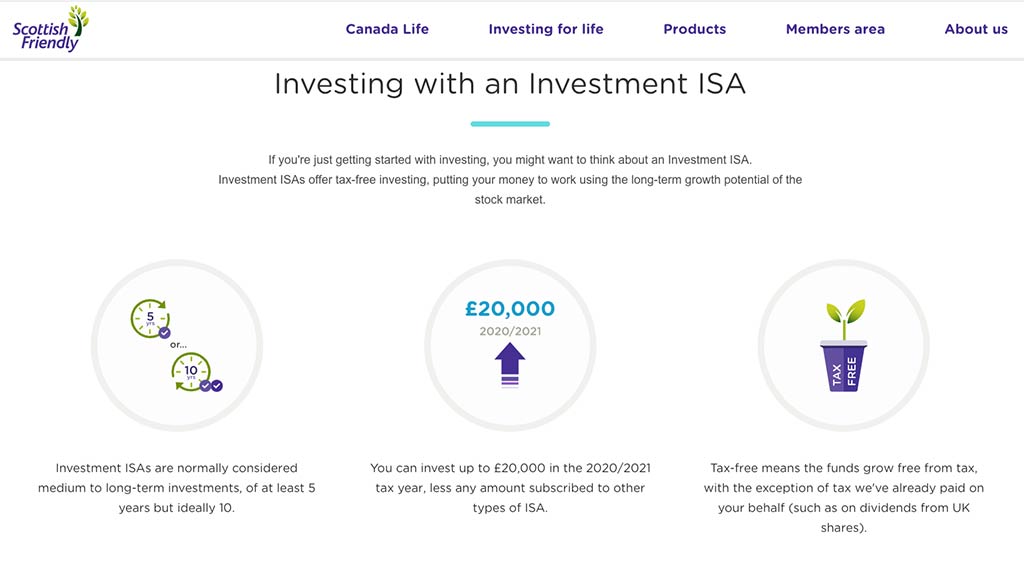

Scottish Friendly Investment ISA Review

Scottish Friendly provides four investment ISA options.

Let’s start with the mandatory minimum investments. The big attraction to the My Easy Choice or My Choice ISA accounts is the low barriers to entry.

Scottish Friendly allows you to minimise and even stop payments without any kind of penalty. In effect, it opens up the chance to invest for a group of people who may still be ignored by many providers, even with the changes in the market trending towards providing easy access to investors of all backgrounds.

Overwhelmed with how to invest?

Connect with a Financial Adviser near you for FREE.

Now, let’s talk about fund choice. Scottish Friendly only offers ten fund choices, which is a pretty small number given the sheer number of funds available. What’s more, there’s a significant likelihood that you’ll miss out on the best-performing funds given that they do change over time. To accept the limited fund options, you need to be confident in Scottish Friendly’s choices and management. You should also keep in mind that you only get the best fund choice when you agree to a My Choice or My Prime account whereas the My Ethical Choice will only give you access to one fund.

Scottish Friendly doesn’t offer any groundbreaking or even exciting features. The one thing anyone considering opening a Scottish Friendly account should look closely at is the fees which I will go into in more detail below.

The My Easy Choice and My Choice fees are astronomical for the value offered by the accounts. In reality, the My Easy Choice and My Choice plans are really more of a high-interest savings plan than an investment account if only because the fees eat up any ordinary gains you might make. Keep in mind that high-interest savings plans don’t come with the risk of market volatility, so you may actually earn more with the right savings program. The guarantee that the investor will receive at least their minimum investment amount after 10 years suggests that Scottish Friendly knows this is the case, too. In some ways, the guarantee means Scottish Friendly won’t eat into your principal when taking out its fees rather than acting as a promise of protection from market volatility.

Finally, it’s worth noting that one of the ways Scottish Friendly attempts to attract new users is through sign-up gifts. You’ll get a gift card in the post when you open a Scottish Friendly ISA account. The amounts vary depending on your investment amount, but they are never more than £45. These are one-off gifts, and you should remember there’s a chance that the high fees mean you’ll spend more on management costs than you received in the sign-up bonus.

Overall, a review of the Scottish Friendly Investment ISA products suggests that they benefit a pretty select group of people, usually those who are locked out of other providers’ products and who don’t have the lump sum needed for the savings accounts with the best rates. Even My Prime ISA doesn’t offer the benefits associated with other products in the same bracket: a lack of choice in funds really damages its ability to compete with other providers.

Scottish Friendly offers four investment ISAs under the umbrella of ‘Scottish Friendly My Plans:

- My Easy Choice

- My Choice

- My Prime

- My Ethical Choice

If you previously considered opening an ISA at Scottish Friendly, you’ll notice the account names changed in the last few years.

Account holders can choose between ten funds depending on the investment ISA product chosen and according to their personal risk level.

My Easy Choice is the entry-level ISA available to brand-new savers and investors who aren’t able to commit to investing larger sums just yet. You can begin investing in a My Easy Choice investment ISA with £10 a month or by putting in a lump sum of only £100. You don’t have any choice in funds. Instead, you hand over your money, and Scottish Friendly manages it.

The big feature offered by My Easy Choice is the Scottish Friendly guarantee. If you keep the account for ten years, you are guaranteed to get back the balance you invested. In other words, you won’t make a loss as long as you stay the course.

This option will set you back 1.5%

My Choice represents the next tier in the provider’s investment options. The same minimums apply (£10 monthly or £100 deposit), but you have the chance to pick the funds that appeal to you based on your risk preference. It’s a way to ‘level-up’ from the basic account without taking hold of the reins.

This option will set you back 1.5%

My Prime is a relatively new product for investors who are serious about saving and willing to commit £100 each month to their account or a lump sum of £2,000. It caters to a group of investors outside of Scottish Friendly’s core customer base: those with high net wealth. There’s no flexibility with the £100 minimum, so it’s important that you’re able to foot this debit comfortably. As a My Prime account holder, you get a short-list of funds to choose from.

This option will set you back 1.5% however, should you remain invested for a minimum of 1 year, Scottish Friendly will reduce this to 0.5%

My Ethical Choice is the most recent offering to complete the suite of investment ISAs on offer at Scottish Friendly. It offers access to the International Ethical Fund which is ideally suited to those looking to invest in line with their values. This fund avoids companies that have exposure to non-renewable energy, adult entertainment, alcohol, gambling, tobacco, weapons, and companies that do not meet UN Global Compact Principles.

This fund comes at a cost of 1.5% of your investment

Scottish Friendly Junior ISA Review

The My Select Junior ISA provides access to 100 funds with varying risk and reward profiles. You can get a £50 bonus when you start investing for your child, however, you will forfeit this should the money be withdrawn before 5 years.

Research Services & Tools

Scottish Friendly doesn’t offer any financial advice. Instead, the mutual direct all potential members with questions about the suitability of investments to an independent financial adviser or other financial institution authorised by the Financial Conduct Authority to offer financial advice.

While choosing not to provide advice is very common, Scottish Friendly doesn’t provide much investor-focused information at all. The marketing team uses the blog to keep members up-to-date with mutual announcements and competitions.

At the same time, you also don’t need much in the way of knowledge of financial markets to use the Scottish Friendly Investment ISA. Everything is managed on your behalf by Scottish Friendly’s team. All you need to do is check your account on the Scottish Friendly website and wait for the needle to move.

Fees & Charges

Scottish Friendly fees are considered high for a service of this nature.

If you read any Scottish Friendly reviews in the papers or elsewhere on the web, you’ll see a big focus on the mutual’s fee schedule.

The first fee of note, and not one to be taken lightly, is the 4% set up fee. A set up fee is unusual for any provider of this nature, in fact, this may be the first one I have come across. 4% is also very high and will actually mean that you have reduced the value of your investments before you have even started. As an example, should you wish to invest £50 with Scottish Friendly, you will actually only have £48 of your starting capital invested from the outset.

In addition, Scottish Friendly assesses a 1.5% annual management charge on a daily basis with the exception of the My Prime account, which enjoys a reduced rate of 0.5% management charge should you commit to your monthly investment amount for one year. It covers both Scottish Friendly’s fee and the management for the underlying fund.

A 1.5% annual management charge is a seriously hefty fee. For example, Hargreaves Lansdown charges only 0.45% on the first £250,000 in an investment ISA.

While a difference of 1% may seem fairly small at first glance, discrepancies like this impact your investment no matter how much or how little money you add to your account.

For example, if you put £10 a month for £10 a year into an ISA with a 1.5% management fee, you will have £1582.94 assuming it grows by 7% a year.

If you invest the same way with a 0.45% management fee, you have £1,677.5 at the end of ten years (again assuming a 7% growth).

Fees like 1.5% can stop your money from growing over time, so you need to be sure that Scottish Friendly offer a value proposition that makes the fee worthwhile for you.

Transferring Your Investments to Scottish Friendly

Scottish Friendly allows you to transfer your existing ISA into one of its products.

To transfer in, you must complete the ISA Transfer Application Form. Your current ISA manager will then sell off your existing holdings and make the transfer to Scottish Friendly in cash.

You can’t transfer into a My Choice ISA from a flexible ISA.

Customer Service

The Scottish Friendly customer service team welcomes feedback and complaints via phone and post.

Those with accounts at Scottish Friendly say that the online platform makes it easy to set up and manage an account. But there are some reports that the response time on query emails leaves a lot to be desired.

Overall, customers’ experience with Scottish Friendly customer service seems to be neutral verging on positive.

As for my own experience, I found the website to lack transparency when it comes to fees, and after much searching I decided to give them a call. My call was answered straight away, and whilst the agent also found it difficult to locate the information I was after, he went above and beyond to obtain the information I required.

Who is Scottish Friendly Suitable for?

Scottish Friendly best suits new investors and those with small investment appetites. The ISA products, in particular, offer an exchange that caters to a very select crowd. In exchange for the freedom to change (and lower) your payment whenever you like, you do pay quite a high fee.

Opening an Account

Scottish Friendly makes it easy to open an account thanks to the focus on user experience offered on its website. Most Scottish Friendly reviews from customers say that set-up is almost always simple and straightforward. However, the site can be confusing because Scottish Friendly changes the names of its packages, which means old documents are still discoverable through search, even when they no longer accept new investors.

To open a Scottish Friendly Investment ISA or Junior ISA, you can start an account with £10. All applications can be completed online or with phone support if you need extra help.

Before starting the application, make sure you have your National Insurance number and a form of payment to hand. You must provide your bank account details (sort code and account number) to set up a direct debit or use your debit card to provide a lump sum.

If you don’t have your NI number handy, you can provide it later on in the process. It’s better to provide it with the application if you can because doing so seems much less complicated.

Once set up, you can then manage your account online using the My Plans platform either on the website or on Scottish Friendly’s mobile app.

Scottish Friendly FAQs

Who Owns Scottish Friendly?

How Safe is Scottish Friendly?

Scottish Friendly Customer reviews

Now in my third week of trying to withdraw my money whilst Scottish Friendly drag their feet and find every excuse not to pay out after nearly ten years of regular saving. Avoid.

- Fees

- Account opening

- Deposit and withdrawal

- Customer service