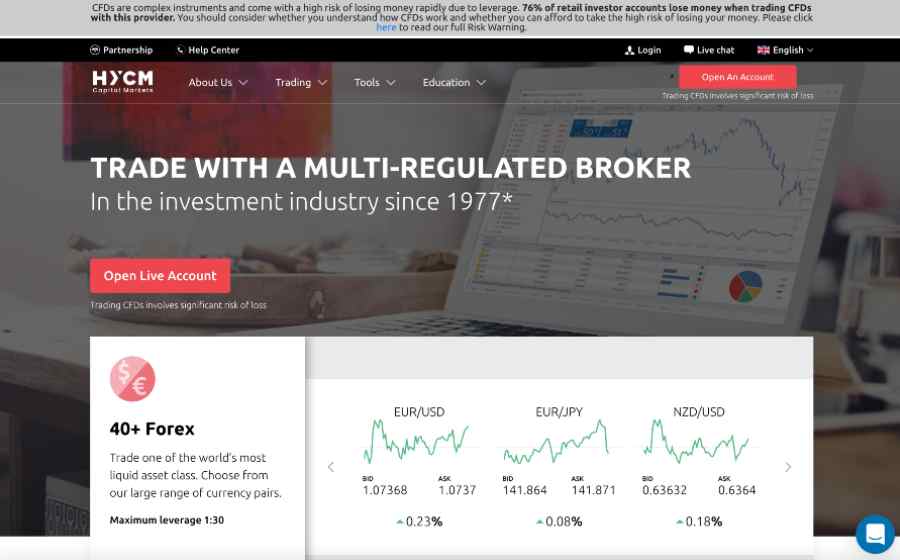

HYCM Capital Markets, otherwise known as Henyep Markets, is a global CFD and forex broker offering a range of assets via the MetaTrader platform.

With their range of account options, HYCM is a viable option for most levels of trader. However, the platform is limited to MetaTrader and those seeking assets other than forex or CFDs would be best served elsewhere.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

HYCM is part of the Henyep Group, a long-established financial holding company headquartered in London.

HYCM offers trading on more than 100 trading instruments using a low-cost model across a number of trading accounts. This ensures that regardless of your trading experience, or how often you intend to conduct trades, there should be a trading account to suit you. Of particular note is the HYCM low-cost Raw Account which offers spreads starting at just 0.1 pips.

A robust suite of educational tools is designed to enhance HYCM traders’ knowledge of the financial markets and there are a number of safety features, including negative balance protection to help prevent traders from losses in excess of their capital allocated for trading.

HYCM offer trading across the globe on the well-known MetaTrader platform. They continue to evolve their offering and in 2022 they launched their own proprietary trading app, HYCM Trader.

HYCM have won a good array of awards including most recently Best Mobile Trading App at the 2022 Forex Expo and Best FX Broker at the 2021 World Finance Awards.

- HYCM Ratings

- Who are HYCM?

- Who owns HYCM?

- HYCM product range overview

- HYCM fees

- HYCM accounts

- HYCM account opening

- HYCM Deposit and Withdrawal

- HYCM trading platforms

- HYCM research

- HYCM education

- HYCM customer service review

- HYCM safety

- Who is HYCM suitable for?

- Useful Information

- HYCM FAQs

- HYCM Customer reviews

HYCM Ratings

Overall

Pros

- Very low pips on the Raw Account

- Low CFD fees

- Award-winning mobile app

Cons

- Commission free account has high spreads

- Inactivity fee

- Limited product range

Who are HYCM?

HYCM Investment is the direct result of 40 years of cumulative experience in the financial sector offering trading services to a global client base in over 140 counties and offices in the worlds leading financial centres.

HYCM Limited is an International Business Company registered in Saint Vincent and the Grenadines.

Who owns HYCM?

HYCM is owned by Henyep Capital Markets (UK) Limited, a global corporation founded in Hong Kong in 1977 to provide financial services, investments, property, education, and charity.

HYCM product range overview

The product range at HYCM is limited to forex trading and trading CFDs on commodities, stock indices, futures and shares. The number of assets available is around average, although they are stronger for forex.

With over 70 currency pairs available and account options to help you keep costs low, HYCM is an excellent environment for forex trading.

In terms of CFDs, the offering isn’t as robust with 15 stock index CFDs which is below average, and 65 stock CFDs, compared to other providers who can have over 1,000 stock CFDs.

In addition, traders can access 17 commodity CFDs but the cryptos are not available to UK traders following a ban.

HYCM fees

The fees you pay to trade forex and CFDs at HYCM will vary depending on the account type your select. Generally speaking, CFD fees are low but forex fees are average.

Non-trading fees are around the industry average among forex brokers with no deposit or account fees.

The three trading account types on offer at HYCM are suited to different experience levels and types of traders. However, there is no doubt that the Raw Account, designed to meet the needs of the more frequent trader, is the best value you will find here with tight spreads from 0.1 pips and a $4 per round commission. This is low-cost when compared to other brokers in the industry. That being said, the trading fees on the other two accounts would come out significantly higher.

Calculating the exact trading costs is a complex process, not least because HYCM only publish their starting spreads, however, when I tested various scenarios, it was clear that CFD fees were low compared to similar brokers, and forex fees were average. Of course, all this depends on the asset, the spread, your trading volume, and how long you hold your position.

Non-Trading Fees

Non-trading fees came in as average when compared to other brokers. HYCM do not charge an account fee or deposit fee. There are some withdrawal fees which are only applicable in the following circumstances:

- $30 charged for withdrawals via bank transfer of less than $300

- 1% processing fee for withdrawals via Neteller or Skill of more than $5,000

In addition to this, account holders will be charged an inactivity fee of $10 per month after three months of zero activity. This is average in the industry.

HYCM accounts

There are three account types on offer designed to meet the needs of all levels of trading experience. Of note are the two commission-free accounts, however, traders looking for tight spreads are also catered for.

All the account types below are also available as Islamic accounts and there is a swap-free option which eradicates overnight interest in exchange for an administrative fee when you hold a leveraged position overnight. Each account has a maximum leverage of 30:1.

Fixed Account

Fixed accounts are suitable for beginners and traders with limited experience who are looking to start trading. The low minimum deposit of $100 ensures a comfortable entry-level and there are fixed spreads from just 1.5 pips.

As the name would suggest, spreads are fixed on this account, however, all trading is commission-free.

Classic account

Unlike the Fixed account, the Classic account offers variable spreads starting at 1.20 pips. Whether you choose variable or fixed spreads will depend on your trading style, with variable spreads being lower during peak times but considerably higher during quiet periods. Fixed spreads will offer protection against these fluctuations.

This account still offers commission-free trading and a low minimum deposit of $100 making it suitable for beginners and traders with limited experience. The classic account also offers access to expert advisors which is a feature that is unavailable on the Fixed account.

Raw Account

With raw spreads from around 0.1 pips, this is a highly competitively priced account for frequent traders. There is a commission of $4 per round to contend with and it is worth being aware that the minimum deposit is increased to $200.

The raw spread account also provides access to Expert Advisors which is a useful program that can be installed onto the platform and will automatically follow a trader’s instructions once certain criteria have been met.

HYCM account opening

The account opening process is extremely easy and can be done completely online. You will need to verify your identity, however, this is common practice among trading platforms.

The first step towards opening an account is to select the account type that is best suited to your trading style and experience. I have gone into this in some detail above to assist you with this decision. From there the process of opening your account is very simple and can be completed using the following steps:

- Select ‘Open Account’

- Fill in your personal details including your name, email address, phone number, date of birth, and residential address.

- Choose the platform you wish to trade from (more information on the platforms available is provided below)

- Choose your base currency

- Answer a few questions regarding your financial status and trading experience

- Go through ID verification by uploading a copy of your national ID, passport or driver’s licence. You will also be required to provide proof of address such as a utility bill or bank statement.

HYCM Deposit and Withdrawal

Deposits and withdrawals are uncomplicated and quick to process via a variety of channels including bank transfer from client bank accounts, credit cards, and e-wallets.

There are 6 base currencies available at HYCM which is around the industry average. One of the useful aspects of this is the ability to open multiple accounts in different base currencies making trading assets in the same currency more cost-effective by avoiding currency conversion fees.

There are no fees associated with making a deposit at HYCM and deposit methods include bank wire, credit/debit cards, Skrill, Neteller, and WebMoney.

Bank transfers will take several days to appear in your HYCM account, however, deposits via credit/debit card will appear instantly.

There are two HYCM withdrawal fees to be aware of as follows:

- Skrill or Neteller withdrawals over $5,000 are subject to a 1% processing fee.

- Bank transfers under $300 are subject to a $30 handling fee.

Withdrawals are usually completed after 3 business days.

HYCM trading platforms

HYCM have a web platform and two desktop trading platforms provided by MetaTrader 4 and MetaTrader 5 in addition to their own proprietary mobile trading platform which won Best Mobile Trading App at the 2022 Forex Expo.

A loyalist of the trading conditions found on the MetaTrader platform won’t be disappointed at HYCM with a choice of both MetaTrader 4 and MetaTrader 5. MetaTrader 4 is always recommended for beginner traders and intermediate traders, whilst MetaTrader 5 is more suited to experienced traders.

Web trading platform

As you would expect from MetaTrader there is a high level of customizability with traders easily able to make changes to the size and position of the tabs. There are also some good search functions, although I felt this could be improved. Assets are grouped into categories but traders are unable to locate a particular asset by typing in the name or ticker.

You can place market orders, limit orders, stop orders, and trailing stop orders in addition to order time limits including good ‘til cancelled and good ‘til time. There are also some handy portfolio and fee reports that can provide an overview of your profit-loss balance and the commissions you have paid. MetaTrader is easy to use, feature rich, and has automated trading abilities.

There is only a one-step login provided by HYCM and as always with MetaTrader, the platform does feel a little outdated in its design. Another downside to the web trading platform is the inability to set price alerts and notifications.

Desktop trading platform

The desktop platform is very similar in design and functionality to the web trading platform with one major difference being that from the desktop you are able to set price alerts and notifications. This can take the form of mobile push and email notifications.

Mobile trading platform

This is HYCM’s own award-winning mobile platform although fans of MetaTrader can still access the MetaTrader mobile app should they wish.

It stands for good reason that this mobile app has won awards as I found it to be excellent in both its design and functionality. It is easy to use and the search function makes finding an asset a breeze. The same order types are available as you would find on MetaTrader and time limits are also a feature. Alerts and notifications are present and easy enough to set.

The only aspect missing from the mobile app is the lack of biometric identification.

HYCM research

HYCM use a third-party tool called Trading Central to provide information based on technical analysis. They also have a good economic calendar. Their newsfeed is a little limited and charting tools are below the industry average.

HYCM provide an average number of trading tools to aid your trading strategy. On the HYCM website, you can access their trading calculators which include a pip calculator, a currency converter, and a margin calculator. Here you will also find the economic calendar, packed with forex-related news and events and fundamental data. However, I didn’t find the economic calendar very user-friendly.

Trading Central provides trading ideas based on technical analysis which covers some commodities, stock indices, and FX pairs. The information provided can be filtered by timeframe.

Charting tools could be better, however, there is still access to 31 technical indicators should you be using the MetaTrader platform.

HYCM education

HYCM have provided an excellent level of educational content including a demo account and videos and webinars designed to aid your trading strategies and skills. I found this to be above the industry average.

Whilst the educational material provided is mainly aimed at assisting beginners, it is still a fairly comprehensive offering with several well-laid-out, relevant topics to consider.

In terms of Webinars, there is a regular weekly webinar which takes place every Monday, looking at the FX week ahead including live market analysis. This seeks to analyse market movements and arm beginners with the knowledge they require to engage successfully with market-moving events.

In addition, there is a weekly workshop every Wednesday. Led by an industry expert, this is an ideal way for beginners to learn how to trade in real-time using a demo account and how professional traders make their decisions.

There are live seminars available, however, unless you are willing to travel to Dubai or Kuwait these are of little help.

Demo Account

The demo account comes completely free of charge so is definitely worth a try if you want to get to grips with the platform and try your investment strategies without any risk to your personal funds.

You will automatically be assigned 50,000 virtual funds in the base currency of your choice and unless your account remains inactive for more than 3 months, you can use it for any length of time.

The demo account is available on both the MT4 and MT5 platforms.

HYCM customer service review

HYCM offer support via phone, live chat, and email. I tested several customer service channels and found support to be responsive with live chat being the fastest in terms of response times.

HYCM support is good, with agents available from 5 am to 6 pm across several channels. Whilst responses on the live chat were not immediate like on some trading platforms, you receive a notification to your email when the agent responds to your query. Generally, I received a response within a timely manner, however, there were instances where I waited for several hours.

HYCM safety

HYCM is considered a safe place to trade with regulation by several financial authorities including the UK’s Financial Conduct Authority (FCA).

HYCM is regulated by several financial authorities including

- Financial Conduct Authority (FCA) for UK clients

- Cyprus Securities and Exchange Commission (CySEC) for European clients (EU + European Economic Area)

- Customers from other countries are onboarded via HYCM’s legal entity registered in St. Vincent & the Grenadines

- Dubai Financial Services Authority (DFSA) & Cayman Islands Monetary Authority (CIMA) licenses currently not used

In the UK, trading with HYCM is covered by investor protection up to the value of £85,000 should the company become insolvent. In addition, HYCM provides negative balance protection, meaning should your account go into negative for any reason, you are protected.

Who is HYCM suitable for?

With its range of account options and platforms, HYCM are well suited to all levels of traders, however, frequent traders will benefit from the low-cost model of the Raw Account. There is also an excellent array of educational materials available for beginners.

Whilst there are a decent number of financial instruments on offer, they are limited to forex and CFD trading and therefore those wishing to trade stocks would be best served elsewhere.

Useful Information

This section contains useful information to make your experience at HYCM as seamless as possible.

How do I contact HYCM?

HYCM live chat can be accessed on the website or from within the online trading platform. Alternatively, you can email [email protected].

How do I withdraw money from my HYCM savings account?

In order to complete a withdrawal simply follow these steps:

- Log in to your HYCM account

- Select ‘Funds Management’

- Select ‘Withdrawal’

- Enter the amount you wish to withdraw

- Select ‘Submit’

How do I close my account at HYCM?

To close your account at HYCM, simply close off any remaining positions and withdraw your funds. Once this has been completed you should contact customer service and inform them that you would like your account to be closed.

HYCM FAQs

Is HYCM any good?

Is HYCM safe?

HYCM Customer reviews

This broker has tremendous experience in brokerage activities. After realizing that, there can be no question about the quality of its services. They are world-class.

- Fees

- Account opening

- Deposit and withdrawal

- Customer service

Hycm really ensures the best pricing on all of the instruments, not just on the major currency pairs or gold. Those are the most liquid ones, but it’s hard to provide attractive spreads on minor pairs for example but the broker does that. It doesn’t depend on the account type really. Of course if you choose to trade on a Raw account, the spreads will be close to zero.

However the Classic account has competitive pricing too.

- Fees

- Account opening

- Deposit and withdrawal

- Customer service

I would definitely stand by this broker. They saved me a great amount of time. After finding them, I did not really have to go and look for another broker. They’ve been around for a lot of years, hard not to assume that they will stick around in the years to come.

Opened my account and deposited with ease, downloaded their own app on my phone, got MT on my computer, got to trading and it is ridiculous how good the platforms work, and their app is also very well designed. Very good to have them as my broker.

- Fees

- Account opening

- Deposit and withdrawal

- Customer service

- Learn how to invest in the FTSE100

- Have you considered transferring your pension?

- Find the best trading platforms