The last few years have seen a tricky landscape for investors with the war in Ukraine, inflation, the European energy supply crisis, the cost of living crisis, all taking their toll on the performance of many funds.

Volatile markets can start to shake investor confidence, with many investors moving their assets to lower-yielding, safer funds to help protect their cash.

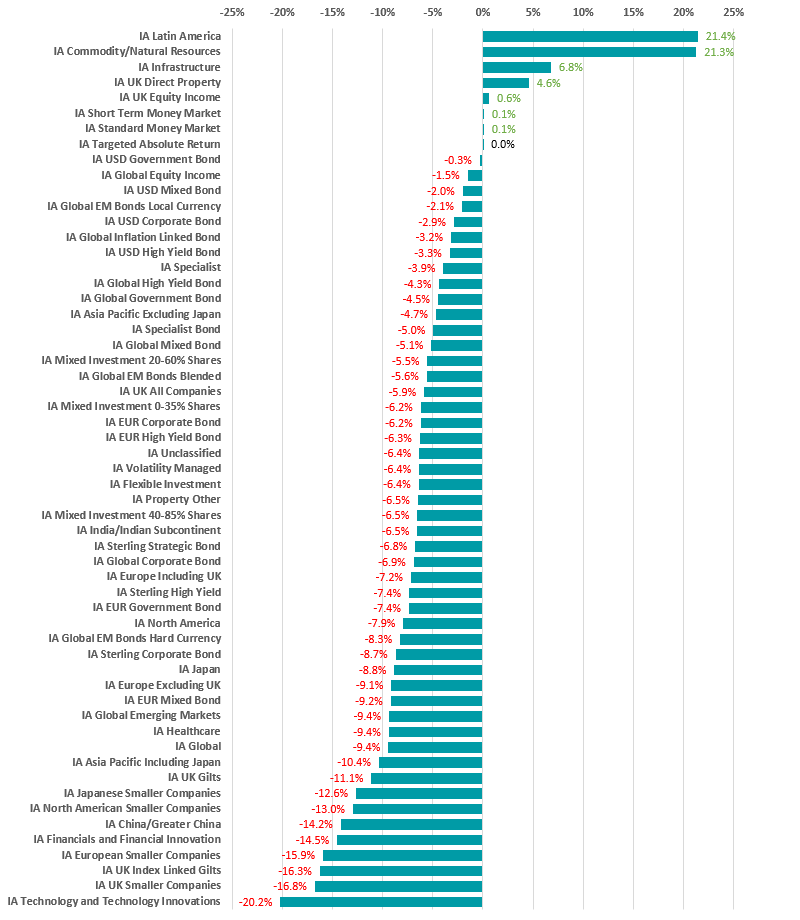

However, the news wasn’t doom and gloom across all sectors with energy and Latin America coming out on top. EFTs tracking US energy indices stole the top three places as they benefited from the 36% rise in oil prices in the first quarter of the year.

Also consider: Read my guide to the best-performing pension funds if that’s what you are looking for.

Best performing funds of 2022 so far

| Fund | Sector | Total return |

|---|---|---|

| SSGA SPDR S&P U.S. Energy Select Sector UCITS ETF | IA North America | 70.5% |

| iShares S&P 500 Energy Sector UCITS ETF | IA Commodity/Natural Resources | 70.3% |

| Xtrackers MSCI USA Energy UCITS ETF | IA Commodity/Natural Resources | 68.9% |

| BlackRock BGF World Energy | IA Commodity/Natural Resources | 61.3% |

| iShares Oil & Gas Exploration & Production UCITS ETF | IA Commodity/Natural Resources | 61.1% |

| Xtrackers MSCI World Energy UCITS ETF | IA Commodity/Natural Resources | 57.0% |

| SSGA SPDR MSCI World Energy UCITS ETF | IA Global | 56.9% |

| Schroder ISF Global Energy | IA Global | 56.6% |

| GS North America Energy & Energy Infrastructure Equity Portfolio | IA Specialist | 50.6% |

| TB Guinness Global Energy | IA Commodity/Natural Resources | 49.6% |

| Guinness Global Energy | IA Commodity/Natural Resources | 47.5% |

| Vontobel Commodity | IA Specialist | 47.3% |

| AQR Systematic Total Return UCITS | IA Targeted Absolute Return | 42.7% |

| Jul Baer Multicooperation SICAV GAM Commodity | IA Commodity/Natural Resources | 41.1% |

| SSGA SPDR MSCI Europe Energy UCITS ETF | IA Europe Including UK | 38.2% |

| JPM Natural Resources | IA Commodity/Natural Resources | 36.7% |

| Xtrackers MSCI Brazil UCITS ETF | IA Specialist | 36.2% |

| HSBC MSCI Brazil UCITS ETF | IA Specialist | 35.8% |

| HAN Alerian Midstream Energy Dividend UCITS ETF | IA Unclassified | 35.8% |

| iShares MSCI Brazil UCITS ETF Inc | IA Specialist | 35.6% |

| Franklin FTSE Brazil UCITS ETF | IA Specialist | 34.4% |

| BlackRock Natural Resources Growth & Income | IA Commodity/Natural Resources | 33.8% |

| Pimco GIS Commodity Real Return | IA Specialist | 33.4% |

| Barings Latin America | IA Latin America | 31.0% |

| HSBC GIF Brazil Equity | IA Specialist | 30.6% |

Source: FE Analytics

In terms of sector, Latin American equities enjoyed great success on the back of the surge in the cost of nickel, a key commodity and export of Brazil. In addition, Commodity/Natural Resources experienced unexpected highs as the cost of oil inflated.

Source: FE Analytics

Overview of the best and worst funds of 2021

It’s important to understand that past performance is no indicator of future performance and in order to illustrate this, I have included below the best and worse performing funds of 2021. You will instantly see that very few of the best performers have retained their position for 2022. Choosing funds based on their history should always be avoided.

Best performers for 2021 and beyond

| Name | Sector | Manager Name | 2021 TR% EUR | 2020 TR% EUR | 3 year TR% EUR | 5 year TR% EUR |

|---|---|---|---|---|---|---|

| Lumen Vietnam Fund USD R | Equity EM Asia | Mario Timpanaro | 60.97 | 15.55 | 99.69 | 101.99 |

| Danske Invest Sverige Småbolag WA SEK | Equity Sweden Sm & Med Co. | Joel Backesten; Max Frydén | 59.22 | 42.84 | 223.46 | |

| BIT Global Internet Ldrs SICAV-FIS I | Equity Technology | Jan Beckers | 58.12 | 216.53 | 633.64 | |

| ODIN Small Cap E SEK | Equity Sweden Sm & Med Co. | Jonathan Schönbäck | 57.45 | |||

| LGT Crown Listed Private Eq A EUR Acc | Equity Private Equity | Benjamin Isler | 57.08 | 2.51 | 119.24 | 135.34 |

Source: Morningstar

None of these funds appear in the top performer’s list for 2022, with performance figures further illustrating that past performance is no indication of future performance and there is always a chance that you will get back less than you originally invested.

Worst performing funds for 2021 and beyond

| Name | Sector | Manager Name | 2021 TR% EUR | 2020 TR% EUR | 3 year TR% EUR | 5 year TR% EUR |

|---|---|---|---|---|---|---|

| BANOR SICAV Greater China Equity S USD | Alt Ucits Emerging Markets | Giacomo Mergoni | -43.81 | 41.74 | 20.44 | 45.02 |

| Quadriga Investors Igneo A Dist | Commodities – Precious Metals | Diego Parrilla | -35.91 | 3.92 | -32.79 | |

| Carmignac China New Economy I EUR Acc | Equity Greater China | Haiyan Li-Labbé | -29.34 | 93.36 | ||

| HSBC GIF Brazil Equity AC | Equity Brazil | Victor Benavides | -23.28 | -32.06 | -33.71 | -28.80 |

| Invesco PRC Equity Z USD AD | Equity China | Mike Shiao; William Yuen | -21.03 | 20.47 | 15.51 | 33.11 |

Source: Morningstar

Brazillian equity funds had two funds in the bottom 10, however, these have made an exceptional recovery and are in the top-performing funds for the first quarter of 2022.

Best performing fund managers

These are the top five performing managers whose funds have consistently performed well over the past 10 years to bring the best returns.

| Fund Manager | 10yr Returns | Biggest current fund |

|---|---|---|

| Tom Slater | 549.4 | Baillie Gifford American |

| Mark Urquhart | 480.3 | Baillie Gifford Long Term Global Growth Investment |

| Carlos Morena | 292.0 | Premier Miton European Opportunities |

| Nick Ford | 286.5 | Premier Miton US Opportunities |

| James Thomson | 266.7 | Rathbone Global Opportunities Fund |

Despite the common perception that you should align yourself to a fund manager and remain loyal to them, it is actually a mistake to pick your funds in this way. Of course, it is prudent to check the credentials of the fund manager in question, however, never assume that a manager who has had past success will continue to do so. The fund manager at the top of this list, Tom Slater, has endured substantial losses in 2022.

Fund with the highest return for the last 10 years

According to data supplied by FE Analytics, Morgan Stanley Global Brands achieved the most positive months in the last 10 years, with their two funds including big names such as Microsoft, Phillip Morris, Visa and Thermo Fisher in their top 10 holdings. Morgan Stanley Global Brands returned a total of 279% over the past 10 years, beating their closest rivals.

Why have funds fallen in the last six months?

It’s been a challenging year for investors with global markets now close to entering a bear market. The reasons for this have been clearly established: inflation, the energy crisis compounded by the war in Ukraine, and rising interest rates all taking their part.

These three factors have all influenced each other, harming investor sentiment and economic growth, which in turn has led to fears of recession. It is safe to say that investors have experienced a white knuckle ride, with widespread losses and a complete about-turn in stock market leadership with US tech giants and other growth companies suffering the devaluing effects of inflation on their predicted future earnings. Some of the highest performing portfolios, including investment trust, Scottish Mortgage, have seen a significant portion of their value wiped out.

However, history has clearly illustrated that markets can recover from setbacks and even in times of recession, you should look to remain invested. Investors are advised to resist the urge to try and time the market but alternatively drip feed their money into the market in smaller increments.

Best funds to invest in for 2022

Sadly, the volatile effects of the war in Ukraine as well as rising inflation look set to continue dominating the investment markets for the remainder of 2022. However, investors should still look to beat inflation in the long term by drip-feeding their money into the market over regular intervals, thus helping to smooth out the highs and lows.

Funds to consider include global index trackers which will track and replicate the performance of the wider market. These make good building blocks in times of uncertainty and pave the way for riskier, more exciting investments in the future.

Passively managed funds, such as index funds and exchange-traded funds, provide a low-cost way to create a balanced portfolio.

Safest funds to invest in the UK

There is no one fund that can offer you guaranteed returns, especially in times of market volatility. However, there are ways to mitigate your risk.

As mentioned previously, drip-feeding your money into the market is an excellent way to mitigate risk as you will average out the price that you buy in at. But which fund should you choose?

The answer to managing your risk as effectively as possible is to select a range of top-rated funds across different sectors and countries. Spreading your investments in this way can help to level out fluctuations or falls in prices. Just because Latin America is doing well now, doesn’t mean it will retain its position and it is a mistake to buy when the price is high.

Should you be struggling to come up with investment ideas then you may want to consider the services of an investment manager or robo advisor, depending on the total value of your investment pot. Some of the most popular funds should be avoided so it’s important not to just follow the crowd when making your investment decision.

FAQs about funds

Will I be taxed on my investments?

Your tax treatment depends on your individual circumstances. If you are in any doubt then you should consult a financial advisor, however, it is also worth remembering that any investments held within a stocks and shares ISA are protected from the taxman. There are of course limits as to how much you can pay into an ISA in any one tax year in order to remain tax-free, with the current allowance standing at £20,000. If you are investing more than this, you may have to open a General Investment Account, where your gains will be subject to tax.

Everyone in the UK is subject to Capital Gains Tax, however, depending on your tax bracket, there is a personal allowance that you can earn tax-free.

What is the best UK equity fund?

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.