Gold is a constant presence in this day and age, with the World Gold Council estimating there to be around 205,238 tonnes [1] of the precious metal mined throughout history.

But can gold be a valuable addition to your investment portfolio? Find out how to buy gold, from gold stocks, to physical gold, all the way to gold funds, and the best gold ETFs UK.

Also consider: Understanding ETFs for UK Investors

4 steps to buying gold ETFs UK

- Choose an investment platform or broker and open an account. A large variety of platforms will give you access to various kinds of investment, including gold.

- Deposit funds to your account. Typically, you can do this online using a credit or debit card.

- Research gold ETFs. Make sure you know about the different investment merits and drawbacks of the ETFs you’re considering.

- Invest in your chosen gold ETFs. Remember to keep an eye on the performance of your investments and make adjustments where necessary.

Before we look at what the FTSE 100 is, here is a more detailed view on how to invest in FTSE 100.

5 Best investment providers to invest in gold ETFs

What is a gold ETF?

To understand how a gold ETF works, it’s first important to know what an ETF is.

An ETF, standing for “exchange-traded fund”, is a similar to many other investment funds in that it’s a basket of investments that you can put your money into in one go.

Rather than buying individual investments, you buy units of an ETF, which is sort of like buying shares in the fund itself. The value of these units will then rise and fall, depending on how the investments within the fund perform.

Many ETFs track the performance of an underlying asset or index. For example, some ETFs track stock market indexes such as the FTSE 100 in the UK or the S&P 500 in the US.

The main difference between an ETF and other investment funds is that ETFs can be traded on the stock market throughout the day, much like company shares.

That means you can try to capitalise on changes in value at various times of the day, rather than having a price set at certain times of day like other funds.

Gold ETFs can contain physical gold, shares, or both

Of course, in this case, the underlying asset is gold, so a gold ETF’s value is determined by gold prices.

There are many different types of gold ETFs. Some actually buy and hold gold physically themselves, storing assets such as gold bullion, whereas others invest in companies related to gold production and storage, such as a gold mining company.

For example, the SPDR Gold Shares ETF derives its value from gold bullion held by the fund itself.

Meanwhile, both the Sprott Gold Miners ETF and the iShares MSCI Global Gold Miners ETF are equity-based ETFs, made up of companies involved in the mining of gold and other precious metals.

How do I invest in gold UK?

There are many different ways to gain exposure to the gold market in the UK, from ETFs to gold mining companies, physical gold, and even potentially spread betting.

Buying gold ETFs

As you’ve seen above, buying gold ETFs is a potential way to introduce some gold into your portfolio.

Simply find the ETF that matches your needs and buy units in it – just like that, you’ve invested in gold!

eToro

- Compare top ETFs on an innovative and user-friendly platform.

- Get $100,000 to practise and improve your trading skills.

- Automatically copy top-performing investors in real time with CopyTrader™

{etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees

Are gold ETFs a good investment?

Gold ETFs can be a good investment as they give you access to gold investments without having to pay the high upfront costs of buying the gold yourself.

The fact that there are also many different kinds of ETFs means you can access gold in a variety of ways, all by simply buying units in a fund.

The downsides of ETFs are two-fold: firstly, while you can select the ETF that best suits your investment needs, you have no control over the assets contained within the fund. So, there may be a more appropriate investment decision for you if you’d prefer to be able to make more choices.

Secondly, ETFs can come with high management fees to invest in them. These fees can eat into your investment profits, making it less cost-effective.

What is the best ETF to invest in UK?

Many different metrics add up to determine how effective a gold ETF is, from total assets to expense ratios and annual yields.

As a result, it’s difficult to directly say that one ETF is better than another.

That said, there are some gold ETFs that regularly appear on stockbroker and tipster websites. These include:

- SPDR Gold Shares

- iShares Gold Trust

- SPDR Gold MiniShares Trust

- abrdn Physical Gold Shares ETF

- GraniteShares Gold Shares

Bear in mind that these are not personal recommendations for you. Research any investments to make sure they’re suitable for your personal financial situation before you buy.

Investing in gold companies

Rather than investing in ETFs that own gold or that invest in companies involved with gold, you could cut out the middleman and buy shares in such companies directly instead.

For example, these might be gold mining companies that are directly responsible for digging up new gold.

There are gold mines all over the world, from North and South America to Asia and Australasia, so there are plenty of companies that you could buy shares in.

Or it could be royalty companies that own the right to buy gold directly from miners and development projects, storing it securely on your behalf in return for investment.

Either way, there are plenty of options for buying such “gold stocks” instead.

Are gold company stocks a good investment?

Gold company stocks can certainly be a good investment, as they can give you access to gold as an investment while doing so through the more traditional medium of stocks and shares.

That means you can look at more typical metrics to assess whether these investments are right for you, such as company performance and the price-to-earnings ratio.

However, investing in companies instead does also open you up to greater market volatility. A company’s share value may fall or the company could even go bust, meaning you’d lose money on your investment.

As ever, make sure you carefully research the companies you intend to invest in.

Buying physical gold

Rather than buy ETFs or investing in gold mining companies, you could also buy physical gold yourself.

Types of gold you could consider buying might include:

- Gold bullion, which is usually in the form of bars or ingots

- Gold coins

- Gold jewellery.

Is buying physical gold a good investment?

Physical gold can certainly be a good investment, especially if you’re able to hold it over a long period.

However, there are a couple of downsides that can make buying gold directly less of a possibility for many investors.

Investment costs

Firstly, gold is very valuable, and so is typically quite expensive. At the time of writing on 22 April 2022, Gold.co.uk measured a single gram of gold to be worth £48.55.

So, you can see how your investment costs would quickly add up if you wanted to buy a considerable amount of gold.

Storage decisions and costs

Additionally, buying physical gold will require you to have the storage space to keep it. Even if you have a small piece of gold, you’ll need a place to store it that keeps it protected and ensures that it doesn’t become tarnished in any way.

This will need to be secure, too, as gold’s high value makes it a constant target for thieves.

As a result of these factors, directly investing like this will typically only be suitable for long-term investors who can afford to buy in directly, and who intend to hold onto their gold for multiple years.

Is physical gold better than a gold ETF?

In many ways, the high costs of initial investment and the need to pay for storage can make gold ETFs preferable to buying gold physically.

Equally, while the costs may be high to initially buy physical gold, you won’t have to pay a continuous management fee to a fund manager. There may be significant savings here, especially if the fund you’ve invested in has particularly high fees.

Spread betting on gold prices

Alternatively, rather than investing in gold through one of these methods, you could instead choose to spread bet on gold price movements.

Spread betting involves opening a position on whether an investment will rise or fall in value. This allows you to make money on both falling and rising gold prices, as you can take a short position if you think the value will fall or a long position if you think it will rise.

Is spread betting on gold a good investment?

Spread betting on gold could be a good investment for a couple of reasons. Firstly, as spread betting is typically considered to be gambling, there’s no tax to pay on your profits.

Secondly, and perhaps more significantly, spread betting means you don’t have to actually own the underlying asset that you bet on.

That means there’s a lower barrier to entry to spread bet, compared with buying gold outright or buying shares in an ETF which you then have to sell to profit from.

However, it’s important to note that spread betting is a form of leveraged trading and involves considerable risk. You may lose money rapidly by spread betting, and need to be comfortable with an increased chance of making a loss.

Make sure you take financial advice first if you’re unsure whether spread betting is right for you.

What is the most profitable way to buy gold?

It’s difficult to say which of these methods is the most profitable way to buy gold, as each comes with its own set of advantages and risk factors.

If you wanted to fully diversify your gold portfolio, arguably the most sensible thing to do is to invest in a combination of gold ETFs, gold stocks, and physical gold.

Even with the increased risk it presents, spread bets could play a role in diversifying your gold portfolio, too.

If you’re unsure how to do this, you may benefit from working with a financial advisor.

Is gold a better investment than stocks?

There are reasons to buy gold that can make it a better investment than buying stocks and shares.

Gold can provide some additional diversification

Firstly, gold can simply be a different kind of asset to hold, offering you another level of diversification.

Holding various asset classes in a portfolio is often a sensible choice, as it can help to protect you against market swings and dips.

If your entire portfolio was made up of just UK stocks and shares, that means you’d be at risk of losing value on all your investments if the UK stock market dipped.

Meanwhile, gold may be subject to different pressures to other stocks and shares, meaning it may retain or even rise in value while other investments are falling.

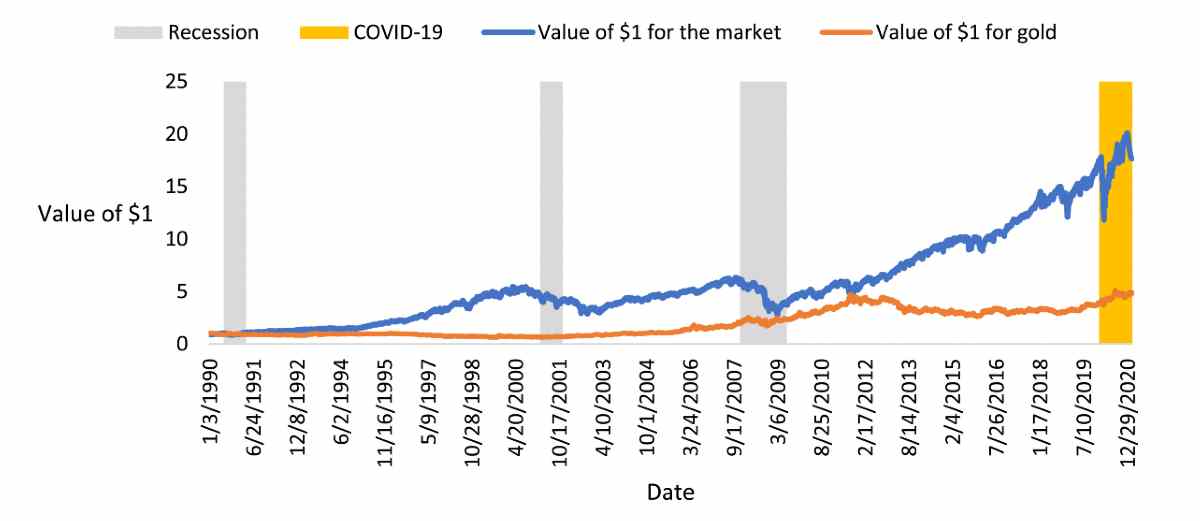

For example, the graph below from Science Direct compares the performance of the wider market against gold prices during the market volatility of the last three recessions and at the start of the Covid-19 pandemic:

Even though gold doesn’t perform as well as the market in the long term, its value tends to fluctuate less during periods of market upset.

So, by gaining some broad exposure to it and other precious metals, you may be able to further diversify your portfolio and be better positioned to ride out market dips.

A hedge against inflation

Many investors choose to invest in gold as it can be a useful hedge during periods of inflation.

While inflation erodes the value of currency over time, gold’s value tends to behave separately, meaning it can be an effective alternative investment that won’t succumb to inflationary pressure.

As a result, gold is often considered a relative “safe haven” during uncertain periods.

Gold is a fairly liquid asset

Unlike other investments, gold tends to be easy to sell in the market. That means it’s a fairly easy asset to liquidate, making it ideal if you need to cash in your holdings quickly.

So, if you want an asset in your portfolio that you know you’ll likely be able to sell at short notice, gold may be a good choice for you.

FAQs on how to buy gold stocks and gold ETFs

Which ETF has the most gold?

Is gold currently a good investment?

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Gold investments can be volatile and are made at your own risk.

Spread betting is a complex investment strategy and carries a high risk of losing money. Make sure you understand this risk before you invest. Seek professional advice if you’re unsure whether spread betting is suitable for you.

Sources: