Cryptocurrencies such as Bitcoin are incredibly popular assets in the UK. Indeed, according to Financial Conduct Authority (FCA) figures, in 2021 around 2.3 million UK investors owned crypto assets – that’s about 4% of all UK adults.

This may leave you wondering whether it’s possible to buy exchange-traded crypto funds, such as a Bitcoin ETF, here in the UK.

So, read my guide to find out what you need to know if you want to invest in a Bitcoin ETF UK.

Also consider: Best Crypto Exchanges UK

Key takeaways

- FCA regulations mean that there are currently no UK Bitcoin ETFs as they are not authorised and regulated.

- Other countries do have Bitcoin ETFs, including the US, Canada, Germany, and Brazil, but UK investors are unlikely to be able to access these through a UK broker.

- There are other investment products available that aren’t strictly speaking ETFs, but do track crypto performance across the market. These can make a viable alternative to UK Bitcoin ETFs.

Can I buy Bitcoin ETFs UK?

Before you go any further, you need to know this one piece of very important information:

UK residents cannot buy a UK Bitcoin ETF.

That’s because the FCA, the UK’s regulatory body for the financial services industry, has directly banned digital asset derivatives.

According to the Financial Times, the FCA refused to greenlight these complicated investments for retail investors until the regulator is “satisfied with [the] integrity of the underlying market.”

That means, at the time of writing in July 2022, there is still not a Bitcoin ETF provider in the UK, as the products themselves are entirely banned.

Worse still, you’ll likely be unable to invest in the handful of overseas Bitcoin ETFs that exist.

While regulators in the US, Canada, Germany, Sweden, and Brazil have all given permissions for Bitcoin ETFs as a safer crypto investment route, the lack of regulation in the UK means that you will find it difficult to access these.

2 best Bitcoin ETF UK alternatives

Fortunately, even though you are technically unable to access exchange-traded crypto funds directly, there are still ways for accessing crypto markets in the UK through other ETFs or similar investment vehicles.

These two alternatives to Bitcoin ETFs could allow you to gain exposure to the Bitcoin marketplace without having to buy crypto directly yourself:

- eToro’s ready-made crypto portfolios

- ARK Fintech Innovation ETF

Find out more about each of these options below.

Remember: cryptocurrencies and digital assets are not regulated in the UK, and the FCA’s position is that these are extremely volatile assets that lack a solid basis for their value.

If you have any doubts about whether crypto investments are suitable for you, please seek professional investment advice.

1. eToro’s ready-made crypto portfolios

Your first option is to invest in the popular online trading platform eToro’s crypto portfolios.

These are pre-built investment portfolios designed by the eToro Investment Committee.

There are two main portfolios you could consider investing in:

- CryptoPortfolio, made up of 32% Bitcoin as of July 2022

- CryptoEqual portfolio, made up of nearly 7% Bitcoin as of July 2022.

From an investment product perspective, eToro’s crypto portfolios are potentially as close to a Bitcoin ETF as you’ll find in the UK – although there is a risk warning on the eToro website that specifically states you should not consider these to be “exchange-traded funds or hedge funds”.

Even so, these portfolios invest in the full range of crypto assets available on eToro, meaning you can get exposure to Bitcoin as well as all these other crypto assets in a single purchase just as you would be able to do with an ETF.

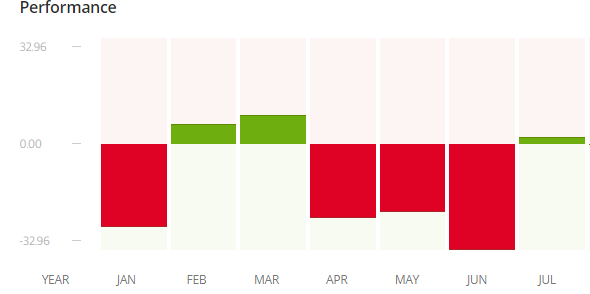

Performance of these portfolios from January to July 2022 has been patchy so far, to say the least, as demonstrated by the charts below:

CryptoPortfolio

Source: eToro

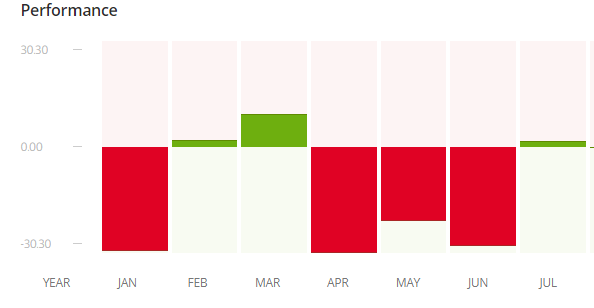

CryptoEqual

Source: eToro

Of course, this will have been greatly influenced by a notable drop in the crypto markets over the past couple of months.

Find out more about the crypto market decline later in my guide.

How to buy eToro’s crypto portfolios in 4 easy steps

- Open an eToro account. You can do this on the eToro website in just a few minutes.

- Deposit funds to the eToro platform. Please note that there is a minimum of $1,000 required for eToro crypto portfolio investments.

- Search for and select the eToro crypto portfolio that you’d like to buy.

- Choose how many units you want to buy.

I gave eToro a 4.5/5 when I reviewed the platform, and eToro accounts are favoured by UK users. You can read my entire review now on our website.

2. ARK Fintech Innovation ETF

The ARK Fintech Innovation ETF is a great workaround for not being able to invest in Bitcoin ETFs, as it can best be described as a “Bitcoin-related ETF” or a “crypto-centric ETF”.

Rather than investing in Bitcoin itself, the ARK Fintech Innovation ETF invests in companies surrounding the cryptocurrency industry as a whole.

The Ark Fintech Innovation ETF invests in companies that produce technology to support cryptocurrencies like Bitcoin, including businesses that produce the vital blockchain technology Bitcoin relies on.

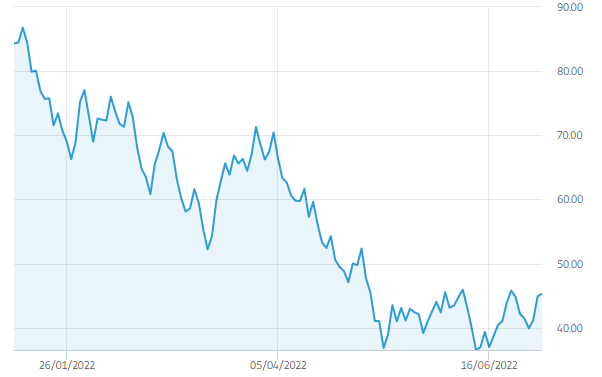

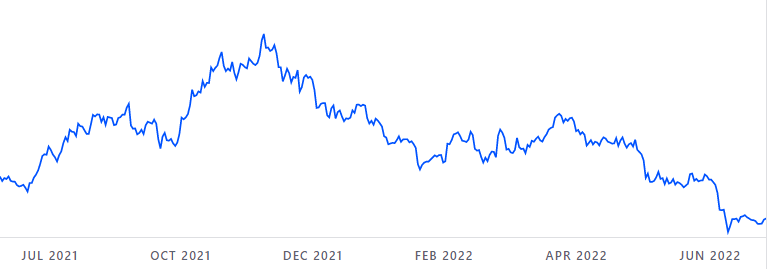

Performance of the ARK Fintech Innovation ETF in the six months up to July 2022 has been tumultuous, much like the wider Bitcoin market:

Source: eToro

Indeed, the company has currently registered a one-year return of a concerning -64.33%.

Despite this, the ETF closed on 5 July at $44.97, a considerable discount from highs of $86.78 in January 2022.

So, this could also be an opportunity to buy reasonably priced units in the fund that could rise in value if the crypto markets recover from the recent falls in value.

How to buy ARK Fintech Innovation ETF in 4 easy steps

- Open an account with a broker that offers access to the ARK Fintech Innovation ETF. You can invest in the ARK Fintech Innovation ETF using eToro.

- Deposit funds to your account.

- Search for and select the ARK Fintech Innovation ETF on your provider’s site. Please note that the ARK Innovation ETF is listed on the Nasdaq in the US, so you will need to complete any necessary documents that will allow you to trade US investments.

- Choose how many units you want to buy.

If you’re struggling to find the right investment platform for you, make sure you read my list of the best investment apps on our website.

What is a Bitcoin ETF?

To understand Bitcoin ETFs, it’s first important to understand what an ETF actually is and how it works.

An ETF, standing for “exchange-traded fund“, is a type of pooled investment fund that tracks the performance of an underlying asset, market, or index.

For example, this might include stocks on a particular index, such as the FTSE 100, a commodity such as gold, or in this case, a crypto asset like Bitcoin.

The main benefit of an ETF over other funds in general is that units in them are traded like shares on a stock market or exchange – hence “exchange-traded”.

That means you can trade them multiple times throughout the day, potentially allowing you to capitalise on smaller swings in value.

So, by buying a Bitcoin ETF, you would be able to invest in a fund that tracks the performance of Bitcoin itself. You’d then be able to buy and sell units in the fund throughout the trading day.

Are there Bitcoin ETFs elsewhere in the world?

Sadly, while the UK is left out of the party for Bitcoin ETFs, the funds do exist around the world on financial markets in other jurisdictions.

Names you may come across when researching Bitcoin ETFs might include:

- Purpose Bitcoin ETF, the world’s first Bitcoin ETF. Based in Canada, the fund deals in actual crypto tokens, rather than in speculative trades such as a Bitcoin futures ETF.

- CI Galaxy Bitcoin ETF, another Bitcoin ETF based in Canada. With a net asset value of CAD $231.10 million as of 6 July 2022, this ETF offers access to Bitcoin, albeit with a relatively high level of risk.

- QR Capital Bitcoin ETF, a fund that has been running since June 2021. QR Capital is a Brazilian blockchain investment company.

Remember that, as I previously explained, you are unlikely to be able to invest in these ETFs from the UK.

Of course, if the FCA does change the rules in the near future, these may be the best Bitcoin ETFs for you to consider.

Pros and cons of investing in Bitcoin ETFs UK

While investing in UK Bitcoin ETFs is perhaps not as straightforward as you might have hoped, the alternatives available may make it worthwhile.

Below are some pros and cons that apply to both formal Bitcoin ETFs, as well as the alternative products I have suggested.

Pros of investing in Bitcoin ETFs

Read a couple of benefits that come with investing in Bitcoin ETFs.

A low-cost way to invest in crypto assets

The first major benefit of an ETF is that it provides lower-cost access to expensive assets.

At its peak in November 2021, Bitcoin traded for £51,000. The price has come down significantly from this point, with a single Bitcoin trading for £16,921 as of 6 July 2022.

While you can invest directly in smaller parts of a single coin, ETFs and similar portfolios offer exposure to Bitcoin at a lower price.

This may mean you’re able to invest in Bitcoin when you were previously unable to.

Potentially safer than directly buying Bitcoin

Another benefit of ETFs is that you may receive additional diversification on your investment that you don’t get from investing in a single asset or coin.

Imagine that you invested in ETF holding multiple types of cryptocurrency. If Bitcoin then fell in value, other coins such as Ethereum or TRON might retain theirs.

As a result, investing in an ETF potentially offers a bit of additional diversification, giving you some protection from dips in value.

However, bear in mind that falls in the value of different coins can occur at the same time, especially as these are assets in the exact same industry and sector.

You may get back less than you invest when investing in ETFs, regardless of how diversified they are.

Cons of investing in Bitcoin ETFs

Of course, just as there are advantages, investing in Bitcoin ETFs also comes with some significant downsides.

Read two cons of Bitcoin ETF investments.

Bitcoin can be a highly volatile asset

The biggest and most important point to be aware of when trading Bitcoin is that it’s incredibly volatile, and this does not go away when investing ETFs.

Indeed, you may have seen the wide decline in value of many digital currencies, including Bitcoin, in the past few months.

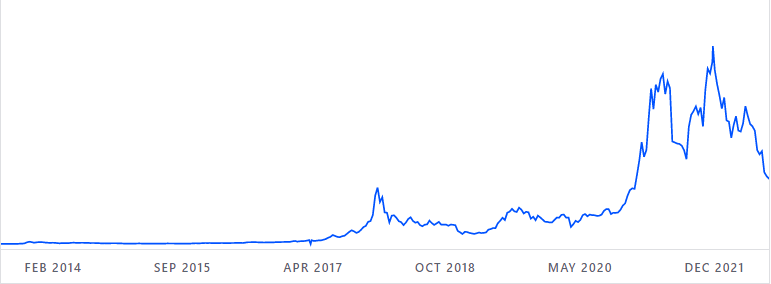

The chart below shows Bitcoin’s value over the past decade:

Source: Coinbase

From the lows that the crypto started at, the very first Bitcoin investors have seen a 19,135% increase on their investment, as of July 2022.

Now look at the Bitcoin price in the past 12 months:

Source: Coinbase

From July 2021 to 6 July 2022, Bitcoin has lost 41% of its value.

You’re partially protected from the entirety of this risk by investing in ETFs, as you don’t actually own the underlying assets that the fund invests in.

However, the value of the ETF or portfolio you’re invested in will be linked to the performance of the digital tokens it holds.

That means a Bitcoin investment at the wrong time would put you at significant risk of losing money. Make sure you understand the risk involved before you invest.

It is an unregulated market

Crucially, as I’ve discussed in this guide already, UK regulators are hesitant to give Bitcoin ETFs the greenlight.

Crypto assets are still relatively new and are yet to be fully authorised and regulated. So, if you are a more cautious investor, it may be worth waiting to see whether the FCA will give permissions for ETFs.

But indeed, if they never do, it may be indicative of an asset that’s too risky for you.

Invest in Bitcoin ETF UK FAQs

Are crypto ETFs legal in UK?

Is there an ETF that has Bitcoin?

Currently, as of July 2022, no UK ETF offers access to Bitcoin directly, and only a handful of Bitcoin ETFs elsewhere in the world.

However, there are other UK funds and crypto-related stocks that are similar to Bitcoin ETFs which may give you the exposure you want to the Bitcoin market.

Please note

Crypto assets are not regulated financial products so please be aware that trading them carries a considerable amount of risk for your capital. Cryptocurrencies are also not covered by existing consumer protection laws.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.