When you first make the decision to invest your money, there can be a lot of things to think about. Not only do you have to weigh up the pros and cons of different types of asset class – from cash to shares – but also the types of funds themselves..

If you’ve had a look at some of the options for investing, one of the questions you might have is “What is the difference between a unit trust and an investment trust?”

While it’s easy to be put off by the names, it’s actually much more simple than you might think. Read on to find out everything you need to know about these two types of funds.

- Investment Trusts vs Unit Trusts: 9 Key Differences

- What are collective investments?

- What is an investment trust?

- Where does an investment trust invest?

- What are the benefits of investment trusts?

- What are unit trusts and OEICs?

- What are the benefits of unit trusts and OEICs?

- What’s the difference between an OEIC vs investment trust?

- What is gearing?

- Are investment trusts better than funds?

- What is “net asset value”?

- Is there a difference between unit trust and investment trust fees?

- How can the trust’s structure influence the strategy of the fund manager?

- Should I seek financial advice first?

Key Takeaways

- The main difference between investment trusts and unit trusts is that unit trusts must contain liquid assets that can be sold quickly.

- An investment trust is more able to hold onto illiquid assets, such as property.

- Investment trusts are able to borrow money to invest – this process is known as “gearing”.

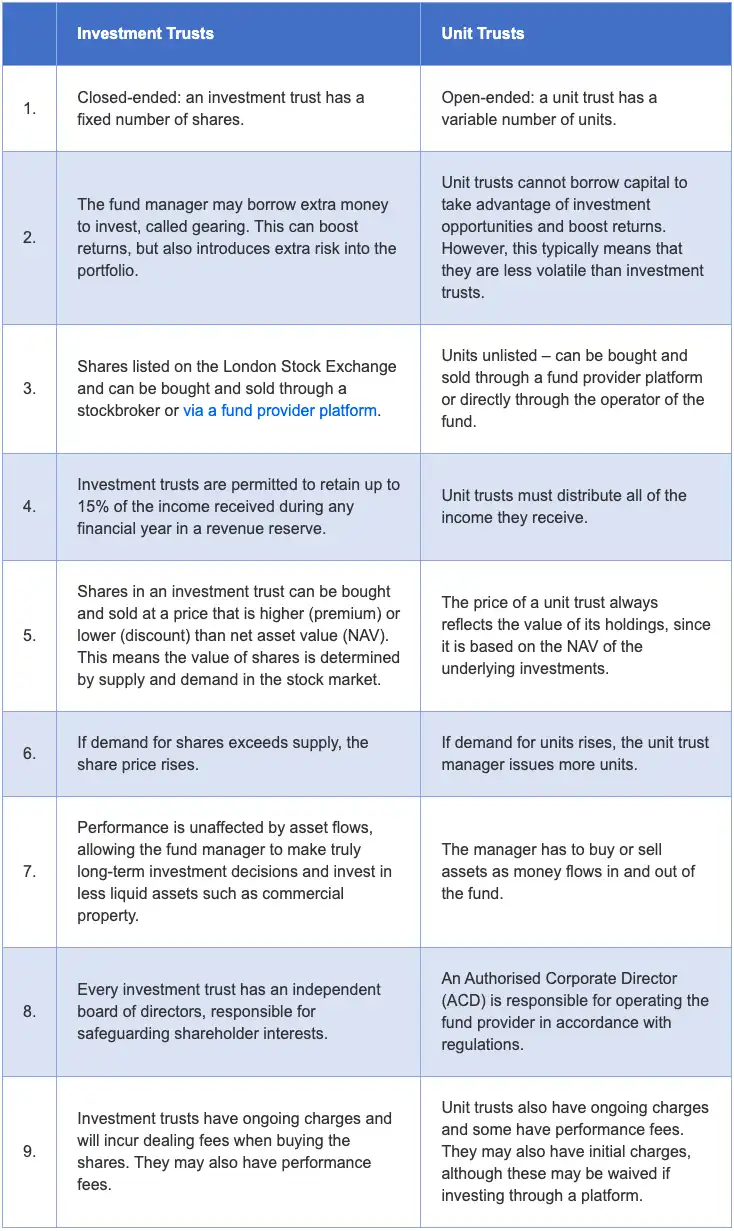

Investment Trusts vs Unit Trusts: 9 Key Differences

Source: Schroders

What are collective investments?

When you invest, it can be tempting to micromanage the process by doing research and choosing individual investments. However, while this approach can give you a greater sense of control, it also has disadvantages.

For example, when choosing your investments, your portfolio may be overly reliant on a particular sector or asset. Furthermore, managing such a portfolio can also take up significant amounts of your time.

This is where collective investments can benefit you, as they spread your money across many different companies, sectors and regions. Typically, they either track a particular index or are overseen by a fund manager and an independent board of directors.

The main benefit of a collective fund, sometimes known as a “mutual fund”, is that it can give you a more diverse portfolio than if you chose your investments yourself. If you have too many assets in a particular sector, a market crash can have a significant effect on your wealth.

Investment trusts and unit trusts are two distinct types of collective investment schemes, so it’s important to know what the difference is.

Unit trusts are one of the most common types of collective investment scheme in the UK and are also referred to as open-ended funds,

What is an investment trust?

An investment trust is essentially a company that buys and holds financial assets and is typically run by a manager. It is a public limited company (PLC) traded on the London Stock Exchange. While they usually invest heavily in company shares, they can also buy other assets.

They are sometimes known as “closed-ended” funds since they have a fixed number of shares when they’re set up, which investors can buy and sell on the stock market.

While investment trusts usually cover the same sectors as unit trusts and “open-ended investment companies” (OEICs), they tend to have a more varied investment strategy. For example, they can hold more unusual assets such as specialist properties, private equity, and esoteric illiquid assets.

Investment trusts can also be a good place to store dividends, although you may want to decide whether the dividend payments are taken or reinvested. The profit from any dividends paid could be used to grow your investing portfolio.

Where does an investment trust invest?

Investment trusts are often grouped by the geographical area and type of investment with which they are involved.

The Association of Investment Companies (AIC), the trade body that represents investment trusts, lists more than 30 different sectors. These include:

- UK Growth

- Global Growth

- Europe

- Private equity

- Property

What are the benefits of investment trusts?

Since there are a fixed number of shares, the benefit of an investment trust is that the trust managers have a fixed amount of cash at their disposal.

The fact that they don’t have to buy or sell to meet market demand means that they typically have a greater degree of stability, which the manager of an open-ended trust may lack. This allows them to have a more long-term view, which can be beneficial when seeking returns.

What are unit trusts and OEICs?

A unit trust or an OEIC (open-ended investment company) are some of the most common types of collective investment schemes in the UK.

While, in practice, they are very similar, there is a key difference when it comes to their legal structure. OEICs are set up as investment companies while unit trusts are set up as trusts, as the name would imply.

Both are sometimes referred to as being “open-ended”. What this means is that they are always able to accept more cash when a new investor wants to buy in, unlike with a “closed-ended” investment trust.

There are two main types of unit trust available: income and accumulation. The former pays out any income generated by the fund’s underlying assets, while the latter adds the income to the value of the unit, essentially reinvesting it for you.

What are the benefits of unit trusts and OEICs?

One of the main benefits of these types of investments is that they can have greater flexibility. If investor demand rises and more people want to buy in, they can become larger.

However, this can be a double-edged sword, as the fund will shrink when more investors sell their shares than new ones buy in.

Another benefit of unit trusts and OEICs is that there are usually more of these funds available, giving you greater choice when investing.

Finally, investment trusts are allowed to borrow money in order to invest. This is known as “gearing” and can boost your returns.

What’s the difference between an OEIC vs investment trust?

If you’re interested in investing in these products, you may be wondering what the difference is between OEICs and investment trusts.

To put it simply, the underlying assets in an OEIC must be able to be sold quickly if market sentiment turns against them, meaning that they’re “liquid”. Investment trusts, on the other hand, can afford to hold onto some illiquid assets.

OEICs are typically better suited for investments such as bonds or equities while investment trusts are better for holding illiquid assets, such as an investment in property.

What is gearing?

One major difference between investment trusts and unit trusts is that the former has the ability to borrow money in order to invest. This is known as “gearing” and can have a significant effect on your investments.

The amount of gearing that an investment company uses is often expressed with a rating. If it is at 100 then that means there is no borrowing, while a rating of 110 means that there is gearing of 10%. In practice, this means your gains or losses will be magnified by this amount.

For example, if you invest £1,000 into an investment trust with 10% gearing, the trust is deploying £1,100 into the stock market for you.

Provided the return the investment trust generates is greater than the interest they are paying on the borrowed money, it should be good for the trust and for shareholders – when stock markets are rising. When markets rise, the share price of a geared trust will rise faster.

Gearing has the potential to increase the returns on your investments but can also result in greater losses when there is a fall in the market. A trust with a high level of gearing may offer greater returns but also comes with greater risk, making an investment trust riskier and more volatile than other investments.

When markets fall, a geared trust’s shares will fall further, which can be worrying. For example, in the 2008 global financial crisis when stock markets fell sharply, some highly geared investment trusts ran into trouble.

Over a longer period – perhaps 5 or 10 years – the overall effect of moderate gearing is usually positive. It is the main reason why investment trusts have generally outperformed other types of investment funds (for example, unit trusts) that can’t gear.

While borrowing money can sometimes be a good idea, it can also be risky. If you aren’t sure if investing in a fund that uses gearing would be right for you, you may benefit from seeking professional advice.

Are investment trusts better than funds?

Investment trusts and funds have a lot in common but there are also key differences. For example, funds tend to have lower fees, although this isn’t a hard and fast rule.

While both can have their uses as investment vehicles, it really depends on your investing strategy and goals. Neither one is better than the other, they are simply different products for different ends.

What is “net asset value”?

If you’ve done some research on investment trusts, one of the phrases that you may have come across is the “net asset value” (NAV). This sounds complicated but is much simpler than it may seem.

Essentially, this is the value of the assets held by the trust. It is usually expressed as pence per share. So, if a particular trust holds £1 million worth of assets and has 1 million shares, then the NAV will be 100p.

Unlike unit trusts, where the price of the units directly reflects the value of the assets held by the trust, the price of shares will be determined by supply and demand. This means that the price you pay will usually be different to the NAV.

Is there a difference between unit trust and investment trust fees?

Typically, both open ended funds and closed-ended funds are similar in terms of cost. While many investors argue that investment trusts are cheaper, since they have lower running expenses, the fact that some of their costs are absorbed by the company makes it difficult to properly compare the two.

However, some benefits that closed-ended trusts have over their counterparts is that, since they have an independent board of directors who represent the interests of the shareholders, they can often negotiate lower charges. This can translate to a lower price for investors.

However, it’s also worth bearing in mind that since you have to buy the shares on an exchange, such as the London Stock Exchange, you may have to factor in the cost of a stockbroker’s commission.

How can the trust’s structure influence the strategy of the fund manager?

As previously mentioned, since investment trusts have a limited number of shares, their fund managers are able to make long-term decisions more easily than open-ended funds.

Since they don’t have to accommodate for investors joining or leaving the fund, they can choose the best opportunity to buy and sell. Fund managers of open-ended funds could be forced to sell assets when their price is low or buy them when they are high, for example.

This can give closed-ended trusts a significant advantage over open ended funds.

Should I seek financial advice first?

While you may do a considerable amount of research before investing, it’s important to note that past performance is not a reliable indicator of future returns. That’s why, if you want to be able to invest with confidence, it’s important to speak to a professional for investment advice.

When you work with a financial advisor, they can use their in-depth knowledge of financial services and markets to ensure that wherever you choose to invest, it’s the right choice for you.

This can help to give you a greater sense of confidence that, whatever financial services you require when you seek independent financial advice, you know that you can now make an informed decision.

Financial advisors can also help you to assess your financial goals and risk tolerance, enabling you to grow your wealth more effectively. Because of this, you may benefit from seeking independent financial advice before you invest, so you can do so with peace of mind.

Please note:

This article is for informational purposes only and does not constitute financial advice. All contents are based on my understanding of HMRC legislation, which is subject to change. Please seek independent advice before acting on anything you have read in this article.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments and their future performance should be considered over the longer term and should fit in with your overall investment style, attitude to risk, and financial circumstances.