The first ever Consumer Vices Index (CVI) reveals that life’s guilty pleasures have become relatively cheaper despite widespread panic over a broader cost of living crisis.

Investing Reviews commissioned leading independent economist John Hawksworth to create a basket of around 100 goods that are considered minor vices in an effort to track the cost of Britain’s bad habits.

Key takeaways

- InvestingReviews.co.uk commissioned leading economist John Hawksworth to create a new cost-of-living index which tracks the affordability of life’s guilty pleasures — including booze, tobacco and chocs

- Incredibly, the first ever Consumer Vices Index (CVI) reveals Britain’s bad habits have become cheaper relative to wages over the last 12 months

- Findings come despite a broader cost-of-living squeeze driven by a spike in the price of essentials like fuel and energy

Categories included off-licence alcohol, tobacco, fast-food, fizzy drinks, chocolate, horse-racing, and boozy package holidays. The index was weighted according to how much households on average spend on each category proportionately.

Surprisingly, while the government’s official measure of inflation known as the Consumer Prices Index (CPI) is running at an eye-watering 9%, the CVI’s basket of goods only rose by half that (4.5%), and actually became 1.1% cheaper relative to median pay growth over the 12 months to April 2022.

News of the findings will provide some comfort to struggling households amid the daily drip feed of grim economic data.

The study merged selected price data collected by the Office of National Statistics (ONS) with Real Time PAYE Employment and Earnings analysis based on figures produced by HMRC.

Analysis revealed that the prices of most of our ‘vices’ – with the exception of tobacco products and fast food – have risen more slowly than median pay growth.

In the 12 months to April, CVI prices climbed by 4.5% while pay grew by 5.6%, meaning life’s guilty pleasures are actually becoming more affordable. This contrasts with the government’s official Consumer Prices Inflation (CPI) being much higher than median pay growth (9% vs 5.6%) over the same period

7 Sins that make up Consumer VICES Index

Here’s a breakdown of how the seven sins which made up our index are performing relative to pay:

- Booze: The price of off-licence alcohol has dipped 4.4% relative to wage growth.

- Chocolate biscuits, ice-cream, confectionery, sugar etc: Snacks linked to obesity have fallen in price by a tasty 2.5% relative to pay.

- Soft drinks: Sugary drinks targeted by a new Treasury tax drive have dipped 0.6% in price relative to wages.

- Horse racing: Critics say it’s a “gateway to gambling addiction” but the official data shows that a day-out at the Gee-Gees has never been cheaper. Admission fees are down by 5.5% year-on-year relative to pay.

- Package holidays: Politicians in Spain recently slapped a six-drink limit on holidaymakers to combat a rise in anti-social behaviour. But deals are becoming more affordable. Down by 2.5% relative to pay.

- Fast food and takeaways: Curries, burgers, pizzas and other takeaway treats linked to obesity are starting to creep up in price — but only by a mere 1% relative to pay.

- Tobacco: The highest climber of all, but still only up in price by only 2.2% relative to wages.

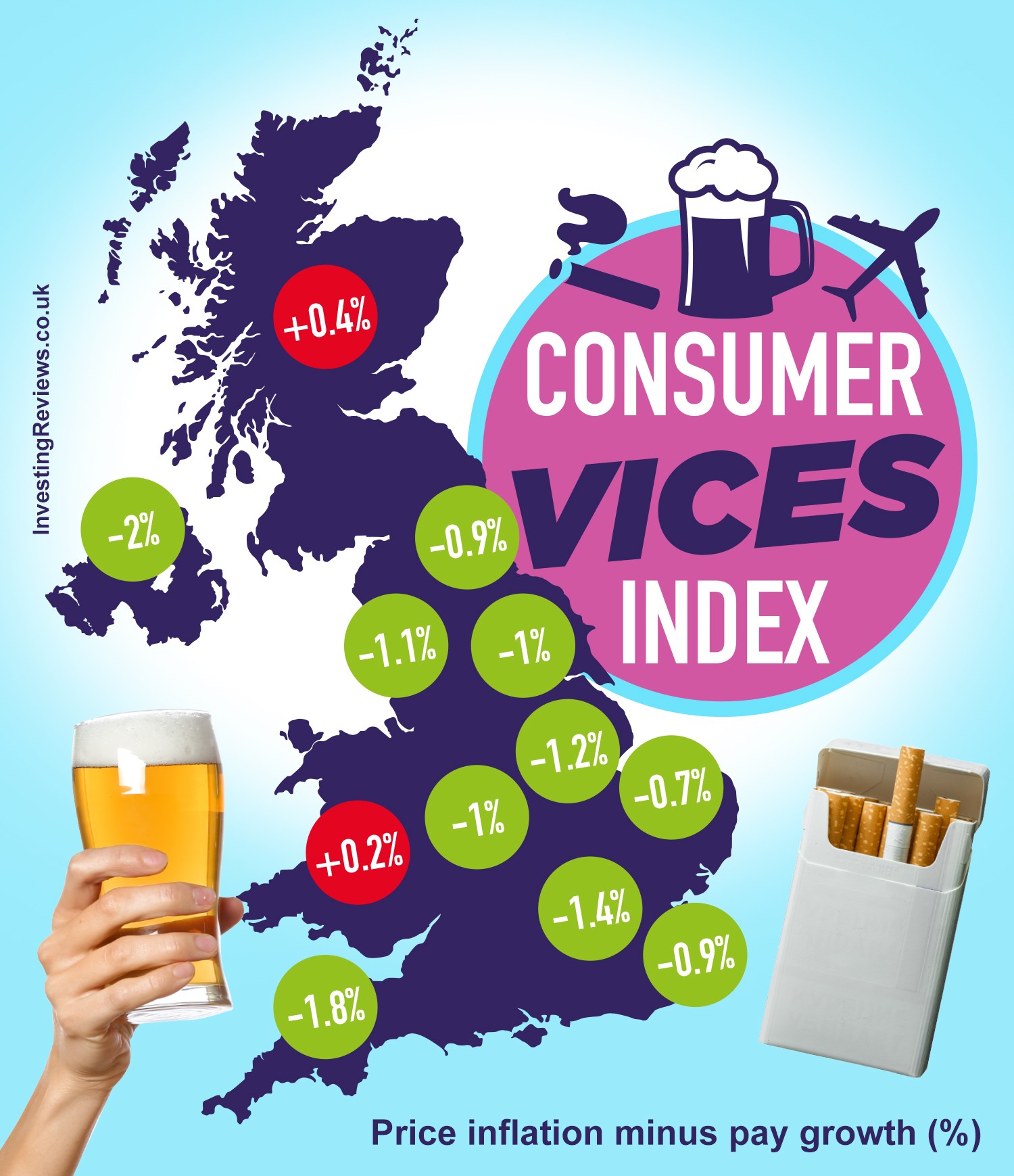

The study also offered a snapshot across the regions using expenditure patterns from the ONS Family Spending Survey.

Table: CVI inflation minus pay growth

| Region/Country | CVI inflation minus pay growth |

|---|---|

| Scotland | 0.40% |

| Wales | 0.20% |

| East | -0.70% |

| South East | -0.90% |

| North East | -0.90% |

| West Midlands | -1% |

| Yorkshire & Humber | -1% |

| North West | -1.10% |

| East Midlands | -1.20% |

| London | -1.40% |

| South West | -1.80% |

| Northern Ireland | -2% |

Source: Investingreviews.co.uk

Scotland (0.4%) tops the table due to relatively modest pay growth and a greater spend on tobacco products, which have risen rapidly in price over the past year. Wales (0.2%) came second mainly because of subdued wage growth.

Despite Northern Ireland’s Brexit woes, life’s indulgences in the Six Counties were relatively cheapest at -2% thanks mainly to strong wage growth. Northern Ireland was followed in second by the South West (-1.8%) and London (-1.4%) in third.

According to the research, the capital has a higher share of spending on takeaway food (which has recently gone up in price relatively rapidly) and a lower than average share of spending on package holidays (where prices are estimated to have gone up less rapidly). But above average pay growth in the capital more than compensated for higher price growth.

InvestingReviews.co.uk CEO Simon Jones said: “At long last we have some positive data to report. Booze, choccie biscuits, and even a trip to the local racetrack are all becoming more affordable.

“No one is pretending any of these things are remotely good for you, but with all the doom and gloom around, people are entitled to live a little.”

Economist John Hawksworth said: “Families have been hit hard in recent months by sharp rises in energy, petrol and basic food bills that have pushed headline inflation rates to the highest seen in a generation.

But our analysis shows that there is a small silver lining in that a tight labour market has pushed up pay growth relative to pre-Covid norms across the UK. This has made some of life’s guilty pleasures – from cake and biscuits to alcohol and package holidays – relatively more affordable over the past year, even as other cost of living pressures have increased.”

About John Hawksworth

John Hawksworth is an independent economist with over 35 years of experience as an economic researcher and consultant to leading public and private sector organisations. He was formerly chief economist at PriceWaterhouseCoopers (PwC) between 2010 and 2020. He was working on this project in a personal capacity.

John was also commissioned for the UK’s first ever Greggs Sausage Roll Index.