Spread betting is a deceptively simple piece of jargon. On one hand, it is theoretically simple but in practise, there can be a lot of things that you’ll have to bear in mind. This financial trading strategy can result in strong returns but to do so without being properly informed raises the risk of losing money rapidly. In fact, many retail investor accounts lose money when spread betting.

So, read on to find your comprehensive guide to spread betting in financial markets.

Also consider: Best Spread Betting Platforms

Top spread betting platforms at a glance

IG Investments

- Best for Spread Betting & CFD Trading

- Free withdrawals and deposits

- Execution on more than 17,000 markets

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

So what is financial spread betting exactly?

To put it simply, financial spread betting is a flexible way to trade derivatives. Essentially, this strategy allows you to speculate on whether an investment will rise or fall in value.

However, with spread betting, you don’t have to actually take ownership of the underlying asset. Furthermore, profits made from financial spread betting are typically tax-free and exempt from Stamp Duty.

This can make it a potentially attractive strategy for investors, as it offers them the chance to make significant amounts of money as there is no tax to eat into their profit margins.

Of course, it can also be very risky and, as I mentioned earlier, many retail investor accounts lose money if they aren’t careful. This is why it’s important to do your research before you start spread betting.

How does spread betting work?

Essentially, financial spread betting works by using bets instead of actually buying and selling assets physically. For example, in a traditional trade, you might buy a share in Company X, hold it while it appreciates in value, and then sell it for a profit.

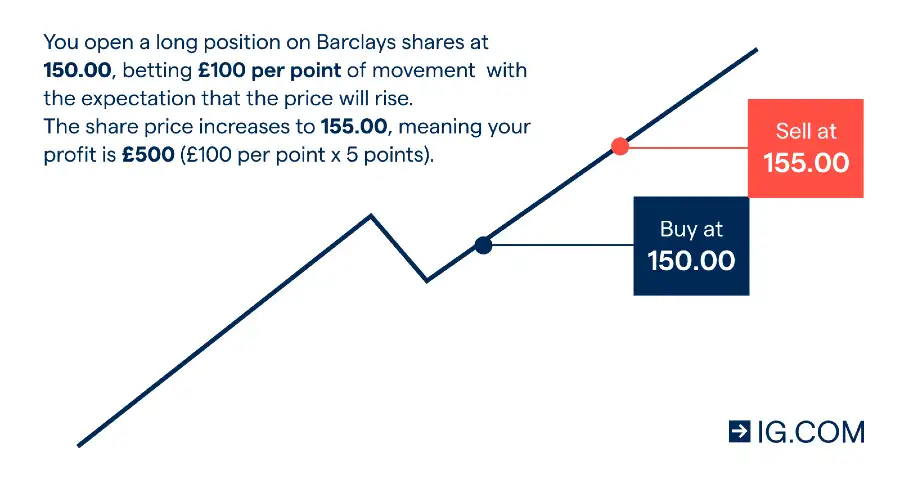

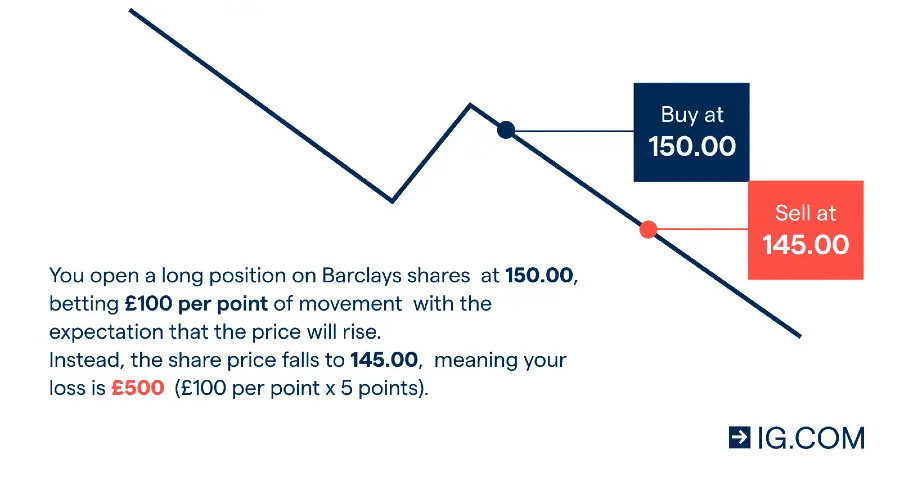

With spread betting, you can make that profit by betting that the shares in company X will increase in value. The further that this value moves in the direction you chose, the more profit you can make.

That means you can make money on both rising and falling markets if you correctly predict and bet on shares that subsequently move in that direction.

Of course, this goes both ways, as if the underlying market moves away from you, the greater your financial loss will be.

What is a spread betting example?

All of this might sound confusing, but as you’ll see with this spread betting example, it’s often more simple than it sounds.

Let’s assume that you want to spread bet on shares in Company X, which are worth £201.50 each. In this scenario, your broker is quoting the ask at £200 and £203 for you to act on.

In this spread betting example, let’s also say that you think this stock will fall in value, so you hit the bid to sell at £200. You also decide to spread bet £10 for every point that the stock falls to below £200.

If the value of the stock fell to £185, you could close your trade with a profit of £150.

(£200-£185= £15) x £10 = £150

On the other hand, if the sell price rose to £220 then you would lose £200.

(£200-£220= -£20) x £10 = -£200

What is the difference between spread betting and CFDs?

Typically, many spread betting platforms will also allow you to trade in CFDS (contracts for difference), which are somewhat similar. Essentially, these are derivative contracts where investors can bet on short-term price moves.

While CFD trading allows investors to trade the price movements of futures, they are not futures contracts themselves. CFDs also don’t have an expiration date with preset prices, but rather trade like any other security.

On the other hand, spread bets do have a fixed expiration date from when you first place the bet. CFD trading also typically involves a greater amount of commissions and transaction fees.

However, there are some similarities. For example, both spread bets and CFDs are subject to dividend payouts if you take a long position contract. While you do not actually own the underlying asset, your spread betting provider or company will pay you dividends if the asset does well.

Such distribution of dividends can be a hugely useful part of a spread betting or CFD trading strategy, providing another way to make money on your investments.

Of course, one issue to note is that when you make a profit from trading CFDs, it is subject to Capital Gains Tax. Conversely, any profit made from spread betting is tax-free. Interestingly, both CFD trades and spread bets are exempt from Stamp Duty.

If you want to know more about trading CFDs, read my guide to the best CFD trading platforms to find out everything you need to know.

How do I enter and exit a spread bet?

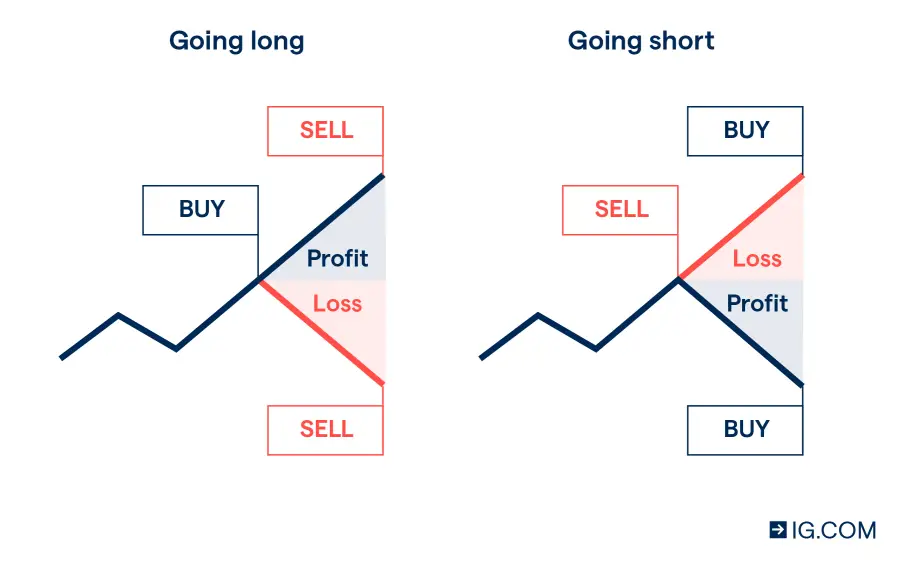

When you open a spread bet, you’ll be able to see two prices listed. These are the “buy” or “bid price” and the “sell price”. You can then use the buy or sell price to help you decide whether you want to go long or short.

If you think your chosen asset’s price will rise, then click buy. If you think the value will fall, then you instead click sell.

When you want to close a spread bet, you essentially just trade in the opposite direction to when you first opened it. This means that if you bought to enter the trade, you would have to sell to exit it, and vice versa.

What financial markets can I spread bet in?

Spread betting can allow you to speculate on the price movement of a wide range of financial instruments. This can include stocks and shares, forex, and commodities.

Since you are essentially betting on whether the market will rise or fall, it can seem like a fairly simple strategy, which makes it attractive to many investors. Furthermore, the proceeds of these investments are often paid free from tax, such as Capital Gains Tax. This can allow you to easily profit from bull and bear markets.

Another thing to note is that spread betting is a leveraged product. As I mentioned in my previous guide about leverage in trading, this means you only need to deposit a small fraction of the trade’s value.

Risk management in spread betting

As I previously mentioned, while you can potentially earn large amounts of money by spread betting, there is also the potential for losing money rapidly due to leverage if you aren’t careful about it. According to figures from the Financial Conduct Authority, published by the Independent, more than three-quarters of retail investor accounts lose money when trading using this strategy.

If you want to avoid this high risk of losing, it’s important to consider risk management tools and steps. Thankfully, there are a couple of things you can do here.

Standard stop-loss orders

A “stop-loss” order reduces the risk that you are exposed to by automatically closing a trade when the market reaches a certain price level. Typically, for a standard stop-loss, the order will close the trade at the best possible buy or sell price, depending on what you instruct.

As you might imagine, this means there is a small delay between the reaching of the value and the close. As a result, if the market is particularly volatile, it is possible that your trade could be closed out at a worse price than that of the stop trigger.

Guaranteed stop-loss orders

This is similar to a standard stop-loss order, though it guarantees to close your trade at the exact value that you have set, regardless of any of the underlying market conditions. This can give you much greater peace of mind to know that you won’t make any unexpected losses.

However, there is one downside to this, as you will typically be charged a fee to put a guaranteed stop-loss order in place.

What are the benefits of spread betting?

While it can be risky, spread betting can be a potentially lucrative way to invest. Here are some of the main benefits of this strategy:

Long and shorting

One of the biggest advantages of spread betting is that you can bet on both rising and falling prices, letting you take advantage of both bullish and bearish markets.

Furthermore, if you were trading physical shares, you would have to borrow the stock that you intended to short sell. This can be both time-consuming and potentially costly, but spread betting makes short-selling just as easy as buying.

No commissions

Another benefit of investing in this way is that you typically do not have to pay any commission or extra fees on your trades. This is because spread betting companies usually make their profit through the spread that they offer to investors.

Since there are no extra charges or fees, it can be easier for you to keep an eye on your trading costs and accurately assess your spread betting position size.

Of course, as I mentioned earlier, if you want to take advantage of a guaranteed stop-loss order then you may have to pay a small charge for that.

Bear in mind that some platforms may charge commission or other fees. Make sure you know what these are before you start spread betting. It’s also often sensible to only spread bet with a broker or company registered with the Financial Conduct Authority.

Potential tax benefits

Since it’s often considered to be gambling in some countries, any spread betting profits that you make from trades may be tax-free from costs such as Capital Gains Tax or Stamp Duty.

Of course, this isn’t always the case, and you may see your spread bets taxed. So, if you want to start spread betting, you may want to keep accurate records and seek professional financial advice, in case you run into any unforeseen tax issues.

Bear in mind that tax treatment may also vary depending on local law and tax rules in the particular country that you live in or where your investments are domiciled.

What are the drawbacks of spread betting?

On the other hand, while there are many good reasons to spread bet, it can also have some downsides, including:

Margin calls

As I mentioned earlier, investors who don’t properly understand leverage can sometimes take positions that are simply too large for their account when they spread bet. This can result in margin calls.

Typically, investors should only risk a small portion of their capital in any one trade and always be aware of the value of the bet they intend to open. This kind of risk management can prevent you from losing too much money if the stock market moves against you.

Wide spreads

Sometimes, during periods of volatility, spread betting companies can widen their spreads. The downside to this is that it can trigger stop-loss orders and potentially increase trading costs. It’s important to be wary about placing orders immediately before a company announces its earnings and other economic reports.

A note on financial spread betting:

Spread betting and CFDs are complex instruments and may not be suitable for all investors.

This article is for informational purposes only and does not constitute financial advice. All contents are based on my understanding of HMRC legislation, which is subject to change.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Financial spread betting FAQs

What are financial spread bets?

Can you make money from financial spread betting?

If you can make a well-informed financial decision, then spread betting offers the potential to make a significant amount of money. Spread betting works by predicting the future price movements of assets and, if you spread bet correctly, then you can generate returns.

However, you also have the potential to lose money when trading if you aren’t careful. This is why it’s important to do thorough research and build up your spread betting knowledge before you invest, and never bet so much that it could result in a margin call.

Is spread betting a good idea?

Depending on your circumstances, financial spread betting can be a good way to make money. However, these are highly complex instruments so it’s important to be able to make an informed decision. Otherwise, you could be taking a significant risk with your spread bets.

If you want to know more about whether it’s right for you, you could benefit from seeking professional financial advice.