My IAG share price forecast includes a 360-degree examination to determine whether investors should consider this renowned aviation engine maker for the long haul.

This stock analysis report goes into detail on IAG’s financial position, competitive strengths, industry outlook, valuation metrics, and analysts’ predictions to uncover whether IAG shares actually present a golden long-term opportunity.

Read On: To find the IAG share price forecast and my price target.

- IAG Share Price (LON:IAG)

- IAG Background

- IAG Business Model

- IAG Earnings Breakdown

- IAG Financials

- IAG Competitive Advantage

- IAG Shortcomings

- What is the Dividend Forecast for IAG Shares?

- Are IAG Shares Cheap?

- What is the Profit Forecast for IAG Shares?

- What is the IAG Share Price Forecast?

- What is the Price Target for IAG Shares?

- Are IAG Shares a Buy, Sell, or Hold?

IAG Background

IAG is Britain’s biggest airline by fleet size and is the parent company of the UK’s flag carrier, British Airways (BA). Together, the group consists of several consolidated airlines that include BA itself, Iberia, Aer Lingus, Vueling, and LEVEL.

Altogether, they operate flights to almost 300 destinations around the world. IAG sells a variety of products and services. These include flight bookings, holiday packages, as well as cargo services.

IAG shares trade on the London Stock Exchange and are constituents of the FTSE 100.

Find Out: How easy it is to buy IAG shares in 6 simple steps.

IAG Business Model

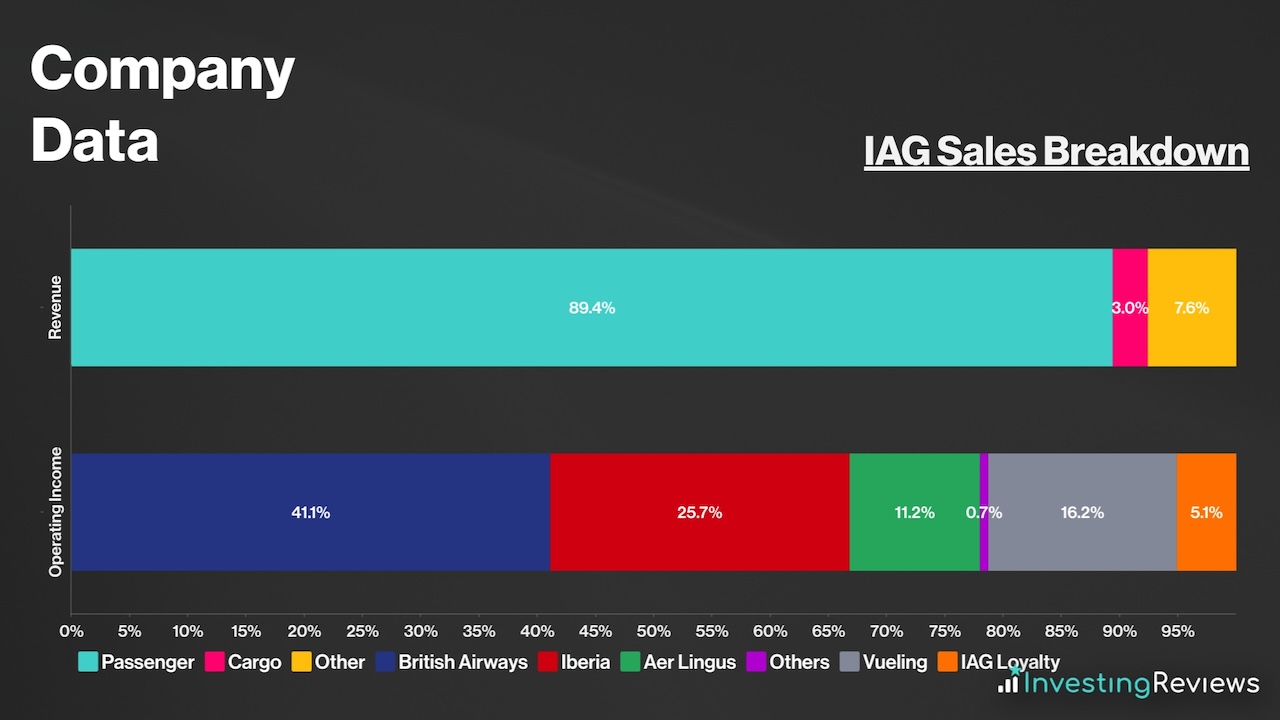

As a conglomerate, IAG makes its money from a number of revenue streams. The bulk of its sales stems from passengers where it sells flight tickets. On top of that, IAG also generates revenue from add-ons like seat selection, extra baggage allowance, upgrades, etc.

On the geographical front, the firm predominantly operates out of the UK from its base at London’s Heathrow Airport. However, IAG also has other operating bases in key airports with lots of traffic. These include London Gatwick, Dublin, Barcelona, and Madrid, where its other flag carriers are based.

Nonetheless, the airline also earns revenue through other streams. For instance, more than a quarter of its revenue comes from other avenues such as cargo, holiday packages, insurance, maintenance, and its own loyalty scheme in IAG Loyalty.

Gross margins from flight tickets range from minuscule to wide, but this depends on the type of flights operated. Short-haul flights tend to yield lower margins due to the competitive market it operates in. For that reason, the business model thrives on economies of scale, as more passengers per flight result in higher profits. But on the other hand, long-haul flights with more premium options will yield higher margins.

IAG Earnings Breakdown

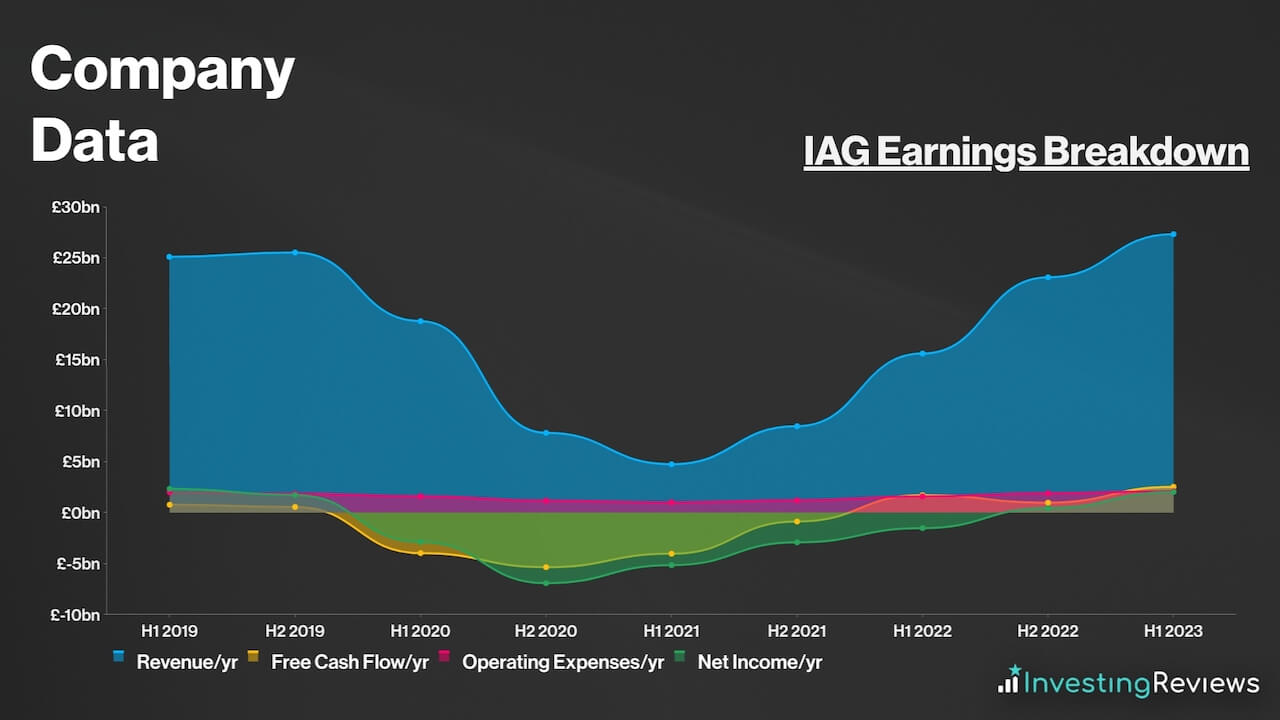

While IAG was an unprofitable business during the pandemic, it recently returned to profitability in its most recent half. Most of its income stems from selling flight tickets and the add-ons associated with them. Although revenues have picked up, profits continue to lag behind as a result of elevated fuel and labour costs.

Because a considerable amount of IAG’s profits thrive on economies of scale, profit margins are still considered to be relatively low vs pre-pandemic levels. That’s because its short-haul business operates on a high-volume basis to earn profits.

As such, the focus will be for IAG to continue building its capacity in the business, premium, and long-haul segments. That’s because those customers tend to spend more, with these tickets yielding higher returns. And with travel to Asia, business travel, and premium tickets all still lagging pre-pandemic levels, there’s some potential profit to be realised in the medium to long term.

IAG Financials

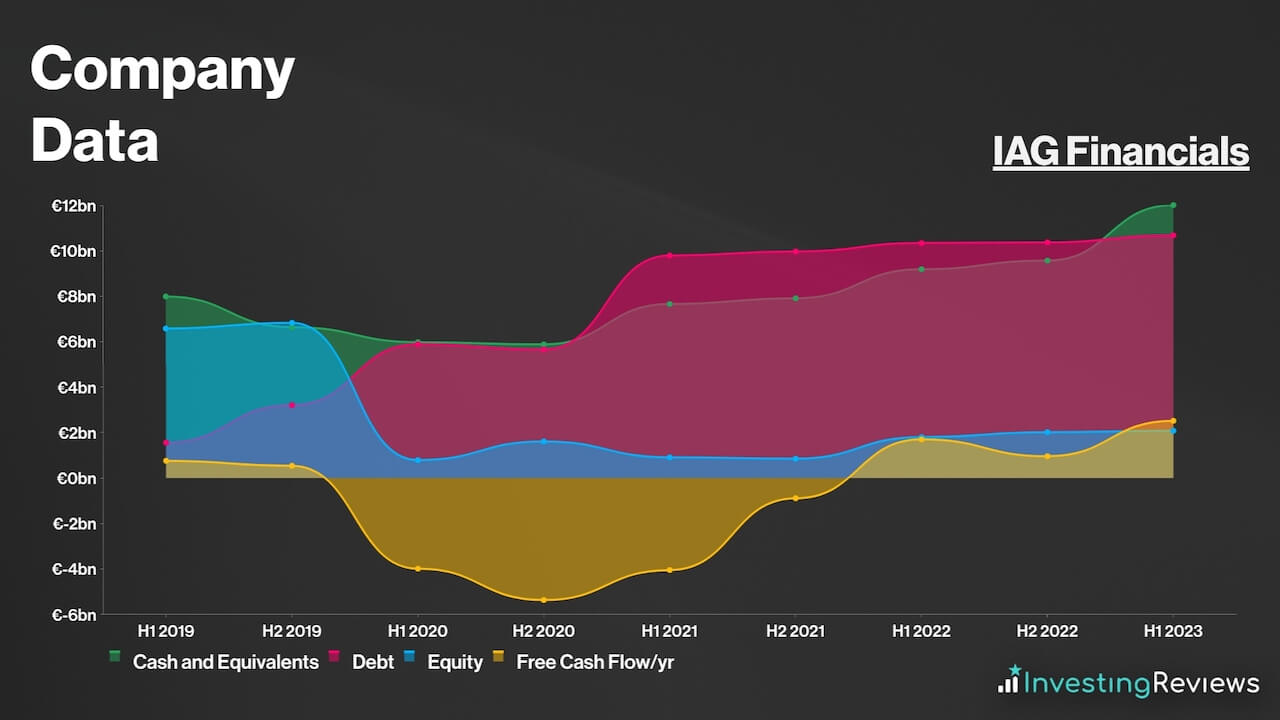

On the face of it, IAG’s balance sheet may be off-putting to some as its current liabilities trump its current assets by €4.88bn. Nonetheless, when contextualised, IAG’s financials actually look a little better given its sizeable cash position.

| Airlines | Net Debt | Cash and Equivalents |

|---|---|---|

| easyJet | -£0.04bn | £2.90bn |

| IAG | €8.01bn | €7.80bn |

| Lufthansa | €6.72bn | €1.43bn |

| Air France-KLM | €4.90bn | €6.17bn |

| Ryanair | -€0.98bn | €2.95bn |

| Wizz Air | €3.89bn | €1.79bn |

Data source: easyJet, IAG, Lufthansa, Air France-KLM, Ryanair, Wizz Air

Like many of its peers, airlines took on massive amounts of debt during the pandemic in order to continue running its operations. Hence, it’s no surprise to see IAG’s debt levels rise monumentally in 2020. Nevertheless, the operator now has enough cash and equivalents to cover its debt.

That said, IAG’s balance sheet leaves plenty to be desired. Not only does it have an extremely high debt-to-equity ratio, its debt is also higher than its market cap, with slow progress being made to alleviate it. What’s more, it holds the highest amount of debt among its European peers.

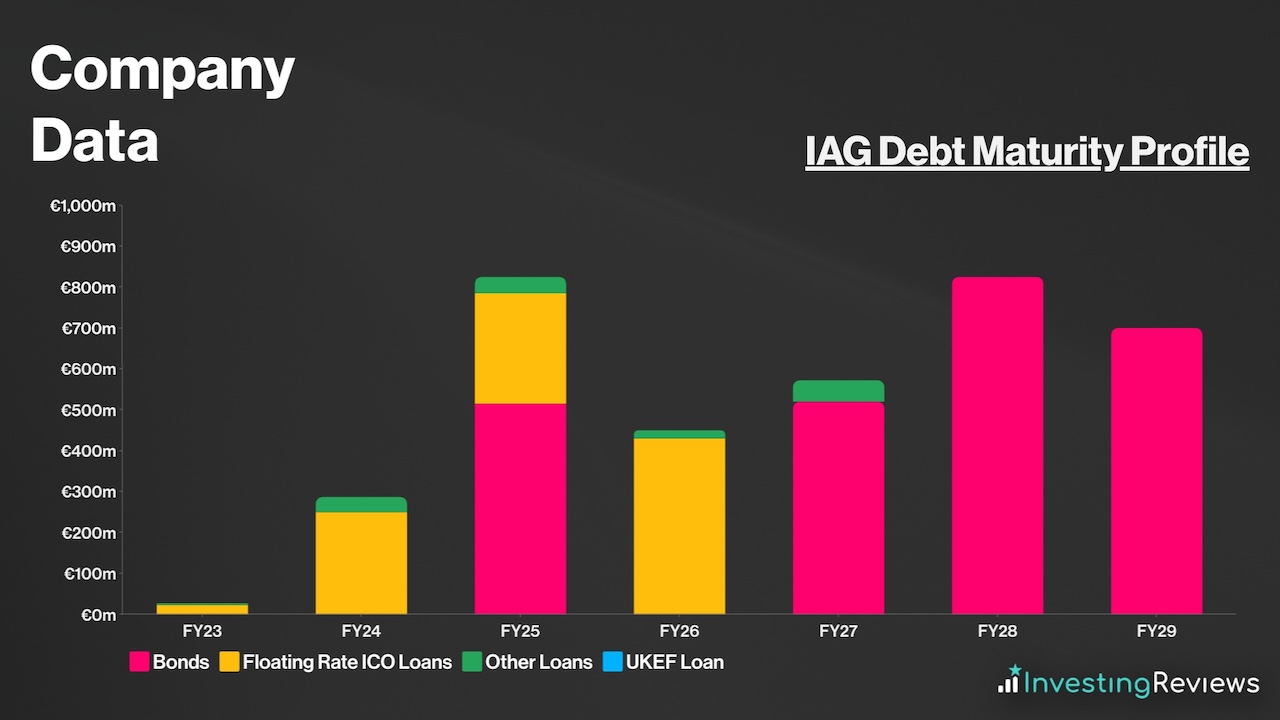

To make matters worse, its debt maturity profile presents plenty of risks. A sizeable chunk of its income will go towards repaying its debt. With a sizeable portion of its debt (ICO loans) subject to higher financing costs from the higher interest rate environment, IAG may have to end up forking out more of its cash and/or earnings to repay its creditors.

Even so, with less than £1bn due per year over the next decade, IAG should have sufficient liquidity to pay off its debt in the coming years, as long as it continues to generate cash at these levels.

IAG Competitive Advantage

Having an economic moat (competitive advantage) over competitors is crucial in saturated industries such as civil aviation, where profit margins are competitive, with medium barriers to entry.

Thankfully, IAG has a couple of competitive advantages. The first is its size — being a consolidated group of airlines allows the entire group’s operations to run smoothly, and with lower costs. This is due to the synergies involved in operating each airline, with the business able to combine training programmes, mechanical parts, crews, etc.

Apart from that, IAG also has an array of strengths. Most prominently, its biggest airline, British Airways ranks highest in customer satisfaction among its European peers.

In addition, its flagship airlines are also part of the OneWorld Alliance. This allows them to improve their customer proposition by being able to offer more destinations. These tend to work as a part of codeshare agreements, where IAG pays or receives revenue from/to another airline for flights they don't operate.

Moreover, its status as Britain's, Spain's, and Ireland's flagship carriers means that it's got a substantial number of bases scattered throughout those countries. This provides better accessibility to passengers, which attracts more customers due to the convenience it provides.

IAG Shortcomings

Despite being such a giant in the airline space, IAG also has its fair share of weaknesses. This could put investors off when buying IAG shares.

Most notably, the state of its balance sheet. Having a debt-to-equity ratio over 500% is never soothing for investors. It limits potential future earnings, and even more so when a substantial portion of debt is repayable on variable interest rates given the current environment. Plus, it makes the entire company vulnerable to shocks or even bankruptcy in a black swan event like a pandemic.

More recently, BA’s hubs such as Heathrow Airport have also suffered an array of difficulties. From technical issues to industrial action, BA and Iberia have had to deal with a flurry of stumbling blocks — all of which could end up displeasing customers. This could end up resulting in lower sales recovery with the FTSE 100 stalwart potentially losing market share.

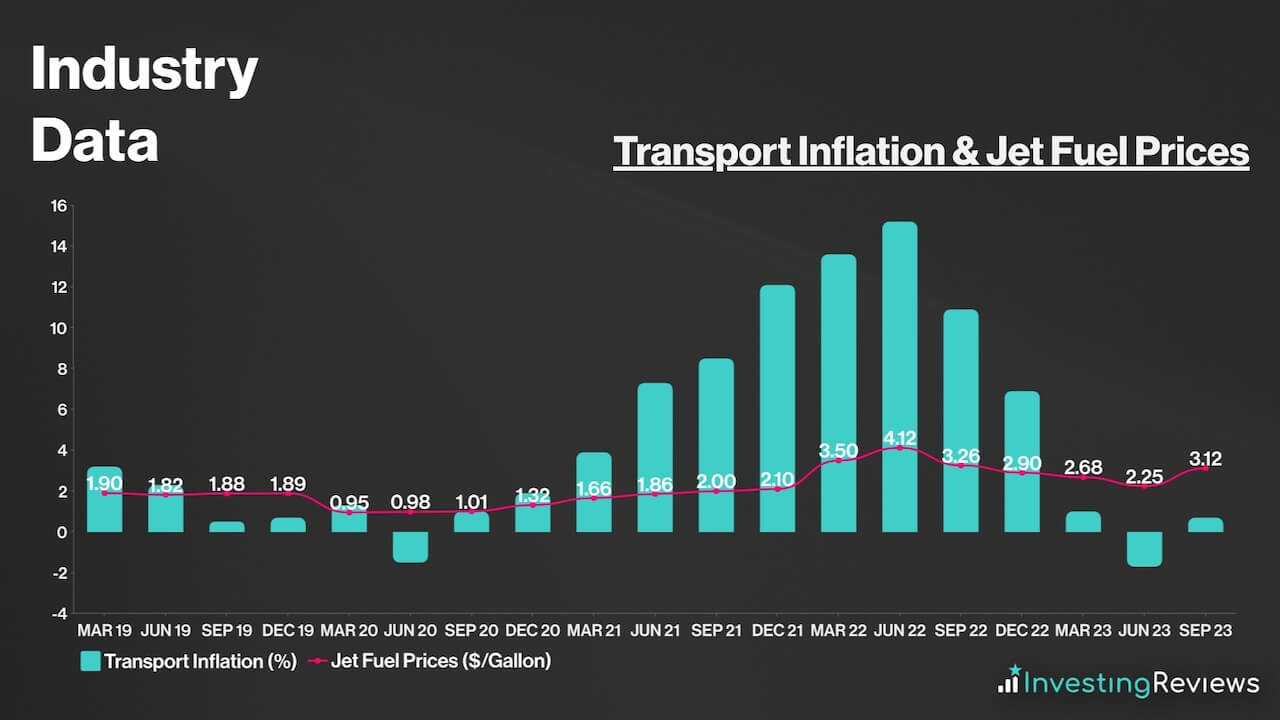

In addition to this, jet fuel prices continue to remain stubbornly elevated as well. As a consequence, it’s been finding it difficult to turn a profit due to the high costs of the black gold.

On the other hand, the cost-of-living crisis remains at the forefront of issues, as household affordability and real wages continue to decline every month. If this lasts for a prolonged period, the travel industry could start stalling out, which could inadvertently affect the strong performance IAG shares have seen this year.

Furthermore, possible strikes and disruptions from ground staff at IAG’s airports may impact operations too. Last summer’s disruptions serve as a reminder of what ramifications could follow when industrial action takes place. And given that several of IAG’s flights operate on quick turnaround schedules, one minor hiccup could result in severe delays for the rest of the day.

Another notable threat would be its potential acquisition of Air Europa, which could further deteriorate its already delicate balance sheet. A veto from competition authorities could see IAG pay massive impairment charges on a failed deal with a huge deposit already paid. All of these aren’t ideal when its debt levels are already sky high.

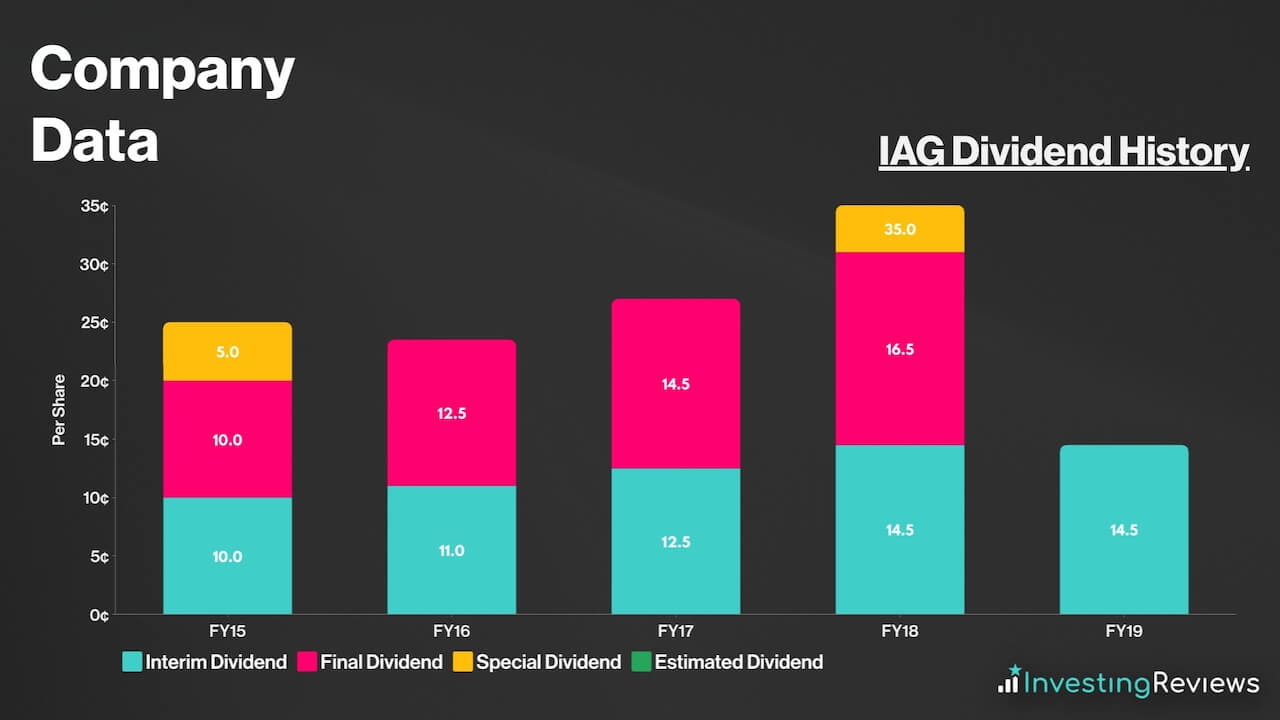

Prior to the pandemic, IAG paid dividends, although this has since been halted as the outfit has short-term and immediate debt to pay off. Still, prior to the stoppage, owners of IAG shares were enjoying hefty payouts, with dividend yields of up to 8% at that time.

Due to its agreement with BA’s New Airways Pension Scheme (NAPS), analysts aren’t forecasting IAG to pay a dividend this or the next financial year. Having said that, provided the carrier achieves profitability by 2024, a resumption of shareholder returns may occur.

The agreement states that IAG will not pay a dividend in 2023, but if it does decide to pay a dividend in 2024, there must be a 50% matching contribution to NAPS. Further, any dividend will be limited to 50% of pre-exceptional profit after tax, and any payouts above this level would require additional payments to NAPS if the scheme is not at least 100% funded by then.

Currently, the scheme is in surplus, up from a £1.65bn deficit in March 2021, according to IAG as of December 2022. The improvement has come in large part due to IAG setting aside more money to pay for its employees’ pensions in the future. As a consequence, BA doesn’t expect to be required to make further contributions to NAPS for the foreseeable future.

One key thing to note, however, is that BA has to maintain a minimum cash level of £1.6bn after all dividends and matching contributions have been paid. This could restrict the stock’s dividend yield if IAG’s financials continue to remain in an unhealthy position.

IAG shares are currently trading at a discount when compared to their industry competitors. Their P/E ratio and forward P/E are very much below the FTSE 100’s average too. What’s more, their P/S ratio sits comfortably below 1, which could indicate tremendous growth potential from its sales.

Among the 17 qualified analysts covering IAG shares, the consensus is for IAG to grow its top and bottom lines over the next two years. Unfortunately, though, dividend payments aren’t forecasted to return any time soon.

| Metrics | FY22 (Reported) | FY23 | FY24 |

|---|---|---|---|

| Revenue | €23.07bn | €28.83bn | €29.78bn |

| Diluted EPS | €0.06 | €0.38 | €0.37 |

Data source: IAG, Financial Times

IAG shares currently have an average Buy rating from several brokers. With an average price target of 189p, analysts seem to agree that there’s upside potential for IAG shares in the next 12 months.

| Date | Brokerage | Rating | Price Target |

|---|---|---|---|

| 30/10/2023 | Barclays | Buy | 250p |

| 30/10/2023 | Deutsche | Hold | 200p |

| 30/10/2023 | UBS | Hold | 175p |

| 30/10/2023 | Bernstein | Buy | 190p |

| 18/10/2023 | Citi | Buy | 175p |

| 4/10/2023 | JPMorgan | Hold | 253p |

| 1/8/2023 | RBC | Hold | 210p |

| 1/8/2023 | Goldman Sachs | Hold | 210p |

| 31/7/2023 | Oddo BHF | Buy | N/A |

| 12/4/2023 | Bank of America | Buy | 240p |

| 8/3/2023 | Peel Hunt | Hold | 165p |

| 24/2/2023 | Liberum | Buy | 220p |

Data source: Market Screener

My price target for IAG shares was last updated on 19th September 2023.

| Metrics | Headline FY23 (Projected) | Comments | |

|---|---|---|---|

| Passenger Revenue | €25.30bn | c.30% growth — higher capacity in H2 to offset lower air fares as compared to H1. | |

| Cargo Revenue | €1.13bn | -c.30% growth — slowing global economy and demand for freight combined with reallocation of capacity for passenger revenue. | |

| Other Revenue | €2.49bn | c.25% growth — in line with industry trends of pick up in travel packages; Iberia maintenance take up to help as well. | |

| Revenue | €28.92bn | ||

| Fuel and Emissions Costs | €7.59bn | c.30% of passenger revenue — lower jet fuel prices to lower cost pressures, but hedging contracts at higher rates to offset what would’ve potentially been a larger decline. | |

| Employee Costs | €5.58bn | c.20% of passenger revenue — lower than long-term average due to effective restructuring. | |

| Handling and Catering Costs | €3.80bn | c.15% of passenger revenue — higher than long-term average due to high inflation and airport disruptions. | |

| Landing Fees | €2.53bn | c.10% of passenger revenue — in line with long-term average. | |

| Engineering and Maintenance Costs | €2.53bn | c.10% of passenger revenue — in line with long-term average. | |

| Property and IT Costs | €1.16bn | c.4% of total revenue — in line with long-term average. | |

| Selling and Marketing Costs | €1.16bn | c.4% of total revenue — in line with long-term average. | |

| Depreciation, Amortisation, and Impairments | €2.00bn | In line with long-term average. | |

| Currency Differences | €0.00bn | Depreciation of GBP vs EUR in H2 to offset appreciation in H1. | |

| Operating Profit | €2.57bn | ||

| Finance Income | €0.28bn | Higher interest receivables from higher interest rates. | |

| Finance Costs | €1.20bn | Higher interest from floating rate loans. | |

| Net Change in Financial Instruments | -€0.01bn | ||

| Net Finance Change to Pensions | €0.10bn | ||

| Foreign Exchange Gain | €0.30bn | Assuming same rate as H1. | |

| Other Non-Operating Costs | €0.01bn | ||

| Profit Before Tax | €2.05bn | ||

| Taxation | €410m | Effective Tax Rate of c.20%, with higher tax rate in H2 to offset lower tax rate in H1 thanks to tax credits. | |

| Profit for FY23 | €1.64bn | ||

| Shares in Issue | 4.97bn | ||

| Headline Diluted EPS | 33¢/28.44p | ||

| Target Price | 213p (BUY) | ||

Shareholders have been bogged down by several factors including the failure of NATS which caused widespread disruptions across the UK. But one main factor that’s been weighing down investor sentiment is the rapid rise in oil prices, and by extensions, jet fuel. Therefore, there are fears that this could eat into IAG’s bottom line.

Nonetheless, a closer look at the firm’s fuel hedging strategy will provide some relief to investors. The group has c.70% of its fuel hedged for the rest of the year at a relatively lower spot price which should allow it to traverse the current spike in costs. This should allow IAG’s airlines to price their tickets more favourably and potentially capture market share from its US competitors who don’t have hedging strategies in place.

With the belief that CEO Luis Gallego can turn this current threat into an opportunity, IAG may end up with a better-than-expected set of full-year results. With the stock already trading at a cheap valuation, I see IAG shares as an opportunity for steady growth over the next year, and is why I reiterate my Buy rating.

John Choong, Senior Equity Research Analyst

Please note: John Choong has no positions in IAG. These stock analysis reports are not personal recommendations or advice and should never be treated as such.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.