The Nasdaq Stock Exchange is one of the largest stock markets in the world, second only to the New York Stock Exchange, so it’s understandable why UK investors would want to buy Nasdaq stocks to their investment portfolio.

Read below to find out how to invest in Nasdaq from UK.

Best NASDAQ trading platforms at a glance

How to invest in Nasdaq stocks in 5 easy steps

- Find a trading platform or stockbroker in the UK that suits your needs and open a trading account. Many different UK brokers and platforms allow you to trade Nasdaq shares. Check out my list of the Best Investment Apps to find the right one for you.

- Deposit funds onto your chosen platform. Typically, you will be able to do this online using a credit or debit card. Your platform will then exchange your GBP into USD.

- Fill out the W-8BEN form. A W-8BEN is a tax form that UK residents must complete to comply with US tax rules. Find out more about trading Nasdaq stocks and tax below.

- Research your investments. Read up on different Nasdaq-listed companies and ways to invest before you buy.

- Start trading! You’re ready to start investing in the Nasdaq.

Browse the top Nasdaq trading platforms for April 2025

Before you can invest in Nasdaq, you need to find a trading platform in the UK that suits your needs. This is my list of the best Nasdaq trading platforms. Please review each provider before making a decision on which one is best for your needs.

eToro – Best for 0% commissions and copy trading

eToro have one of the largest social trading networks in the UK, which means if you are less than confident, and would rather mirror the trades of their top performing investors, this is the ideal platform for you.

eToro is an excellent platform for keeping costs low. There are no account fees, management fees, or commissions on trading stocks or funds. The only issue to really be aware of is the conversion fee as eToro only allows trading in USD. This can be mitigated by opening a multicurrency wallet.

What I like about trading on the Nasdaq exchange on eToro

eToro allows you to see the top traded stocks in the Nasdaq exchange market using data from its extensive social trading network. On eToro you can also participate in contracts for differences (CFDs) in order to profit from price changes.

eToro also allows traders to set a target price to sell or a stop-loss to avoid losses. These are useful tools when trading on the Nasdaq exchange.

Fees: $0 commission for buying and selling stocks

Minimum balance: £50

Products available: General Investment Account, ISA, SIPP

{etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees

InvestEngine – Best for low-cost ETFs

InvestEngine is an ETF platform, that provides access to hundreds of ETFs at an unbeatable cost. DIY portfolios are completely free, whereas managed portfolios come in at just 0.25%. You can even invest using their ISA, which is completely free of charge.

What I like about investing on the Nasdaq exchange on InvestEngine

There are a good number of ETFs that track the Nasdaq exchange including ETFs from Invesco, First Trust, and iShares.

We know that this kind of investment can be risky, however, InvestEngine have provided a number of automation tools including smart orders, one-click rebalancing, auto-invest, and smart top-ups.

Fees: 0.25% for fully managed portfolios

Minimum balance: £100

Products available: Individual Savings Account, General Account, Business Account

With investment, your capital is at risk. This could mean the value of your investments goes down as well as up.

Freetrade – Best for investing in Nasdaq shares

Freetrade is another very cost-effective platform with zero-commission trading. However, unlike InvestEngine, you will pay £4.99 a month to use the ISA account here

What I like about investing on the Nasdaq exchange on Freetrade

On Freetrade you can invest in thousands of companies listed on the Nasdaq whilst also accessing up-to-date business and financial news from US companies to help with your buying decisions.

There is also the option to buy fractional shares at Freetrade, giving you the option to own shares listed on Nasdaq from as little as £2.

Fees: Commission-free trading on all stocks, shares and ETFs

Minimum balance: £0

Products available: General Investing Account, Stocks and Shares ISA, SIPP, Freetrade Plus

When you invest your capital is at risk, the value of your investments can go down as well as up and you may get back less than what you invest. *Other charges apply. Free share terms and conditions apply. The probability is weighted, so more expensive free shares will be rarer.

interactive investor – Best for DIY investors

interactive investor have an extensive range of assets for DIY investors to choose from.

Whilst the flat rate of £9.99 per month used to be prohibitive for smaller investment pots, interactive investor have counteracted this by launching Investor Essentials, a budget account for people investing under £30,000 and priced at just £4.99 per month.

What I like about investing on the Nasdaq exchange on interactive investor

One of the considerations when trading foreign currencies is the exchange fee, which currently stands at 1.5% when you trade on the Nasdaq in pounds at interactive investor. However, interactive investor have made it possible for investors to swerve this fee when trading on the Nasdaq by offering the option to hold up to 9 currencies in your ii account.

Fees: £4.99 – £19.99 a month plus £5.99 for trades.

Minimum balance: £0

Products available: Trading Account, Stocks and Shares ISA, SIPP, Junior ISA, Joint Trading Account, Company Account, Pension Trading Account

Capital at risk.

Moneybox – Best for people saving for a first home

If you are a beginner and new to investing in the stock market, but would like to learn as you go, including obtaining an understanding of the terminology, then Moneybox is a great option. They provide investors with excellent levels of information including tools to help predict the future value of your investments.

One of the areas I felt Moneybox really stand out from the competition is with their award winning Lifetime ISA. This represents the most efficient way to save for a first home.

Moneybox also have a great round-up feature that allows you to drip-feed money into your investment account as you spend. They have a range of portfolios to suit your risk appetite as well as a socially responsible fund for those who wish to invest in line with their values.

Why I like the Moneybox app

The Moneybox investment app provides investors with a truly modern, slick, investing experience. This has been widely recognised with awards including Best Money App and Best for Beginners in The Times and Sunday Times.

I found the app to have plenty of functionality as well as newsletters and articles on the stock market. It is easy to use, allowing you to access all your accounts and adjust your investment portfolio on the move. The Moneybox app has an excellent score of 4.8 out of 5 on the App Store.

Fees: £1 per month subscription fee, 0.45% platform fee, 0.12%-0.30% fund management fee

Minimum balance: £1

Products available: Stocks and Shares ISA, stocks and shares Lifetime ISA, Junior ISA, General Investment Account, Pensions, 32 Day Notice 45 Day Notice, 95 Day Notice Account, 120 Day Notice, Cash Lifetime ISA

- How to invest in Nasdaq stocks in 5 easy steps

- Browse the top Nasdaq trading platforms for April 2025

- How to buy Nasdaq US stocks in the UK

- Is investing in the Nasdaq a good idea?

- Nasdaq investments and tax rules

- Costs of trading US shares

- What exactly is the Nasdaq?

- Nasdaq indexes

- Nasdaq market hours

- NASDAQ FAQs

How to buy Nasdaq US stocks in the UK

There are a few different ways you can invest in the Nasdaq from the UK.

Buying Nasdaq shares

The main way to access the Nasdaq is to directly buy stocks and shares in Nasdaq-listed companies.

Some of the largest stocks in the world are listed on the Nasdaq. In particular, the exchange is known for its access to technology stocks, with around half of all companies listed coming from the technology sector.

The table below shows a few of these companies, as well as their “ticker code” so you can find them easily on your broker’s website:

| Company name | Ticker code |

|---|---|

| Alphabet Inc. Class A (Google) | GOOGL |

| Amazon | AMZN |

| Apple | AAPL |

| Meta Platforms Inc. Class A (Facebook) | FB |

| Tesla | TSLA |

Simply search the name or ticker code of the company you want to buy shares in, check that the live price suits your needs, and click buy.

Bear in mind that prices will be quoted in US dollars (USD), and so you’ll have to exchange your Great British pounds (GBP) to buy your investments.

Find out more about the exchange rate later on in this guide.

Buying Nasdaq funds

Rather than trading stocks and shares directly, you could instead consider buying funds of Nasdaq investments.

Funds are a bundle of investments in one package. You buy units of a fund much like you would buy stocks and shares, and the price of these units will rise and fall depending on how the investments within the fund perform.

A great benefit of investing in funds in this way is that you can do so through a UK stock exchange, such as the London Stock Exchange (LSE). This allows you to make your investment in GBP rather than USD, meaning you don’t have to worry about exchange rates or fees.

Two kinds of funds that you could consider are index funds and exchange-traded funds.

Index funds

Index funds, also known as “tracker” funds, are automated to buy investments listed on a specific stock market index.

These kinds of funds are known as “passive” as they simply buy investments that meet the criteria of the fund. As this is done automatically and there’s generally no fund manager involved, index funds tend to be cheaper than other fund options.

Two popular indexes that many funds are based around for Nasdaq stocks are the Nasdaq Composite Index and the Nasdaq 100 Index. You can find out more about these indexes later in this guide.

Alternatively, you could buy units in a fund for another index that involves Nasdaq-listed companies. For example, the Dow Jones Industrial Average is an index containing 30 different US companies, of which a handful are typically Nasdaq stocks.

This means you’ll gain some exposure to Nasdaq stocks, as well as companies listed on other exchanges.

Trades in index funds are executed once a day, rather than fluctuating throughout like company shares.

Exchange-traded funds

An exchange-traded fund (ETF) works in exactly the same way as any other fund, except it can be traded just like a stock or share on a stock market throughout the day.

Typically, an ETF will have a fund manager to oversee the investments and make changes. That means you may have to pay a higher fee than for a passive fund, but you’ll have a professional actively keeping an eye on the investments.

Many different Nasdaq ETFs are listed on the London Stock Exchange (LSE). Simply find the one that suits your needs and buy as many units as you’d like.

Trading CFDs

Instead of buying stocks and shares or funds of Nasdaq-listed companies, you could trade contracts for difference (CFDs) in them instead.

CFD trading involves predicting the price movements of an asset, putting your money on a “margin” of a trade rather than buying shares in a company. CFD trading is a type of leveraged trading, as you never own the underlying asset you invest in.

CFD trading is actually banned in the US. But, because trading CFDs is legal in the UK, you are able to trade CFDs on US stocks and shares using UK platforms.

Read more about trading CFDs for UK investors.

CFDs and risk

Bear in mind that there are risks involved with trading CFDs. In fact, these trades are so risky that providers in the UK are legally required to display how many retail investor accounts lose money when trading CFDs on their platform.

This is because CFDs are complex financial instruments and may put you at risk of losing money rapidly.

Make sure you take personal advice before you trade CFDs.

Spread betting

Another option to get involved in Nasdaq stocks is to spread bet on them.

A spread bet involves predicting the movement of share prices, with your profits coming when your prediction is correct.

For example, if you bet that a Nasdaq company’s shares will increase in value, then you’ll receive a payout if the share price rises.

Of course, if you are wrong, you’ll lose the money on your bet.

You can find out more about spread bets in my guide to spread betting, including everything you need to know.

Is investing in the Nasdaq a good idea?

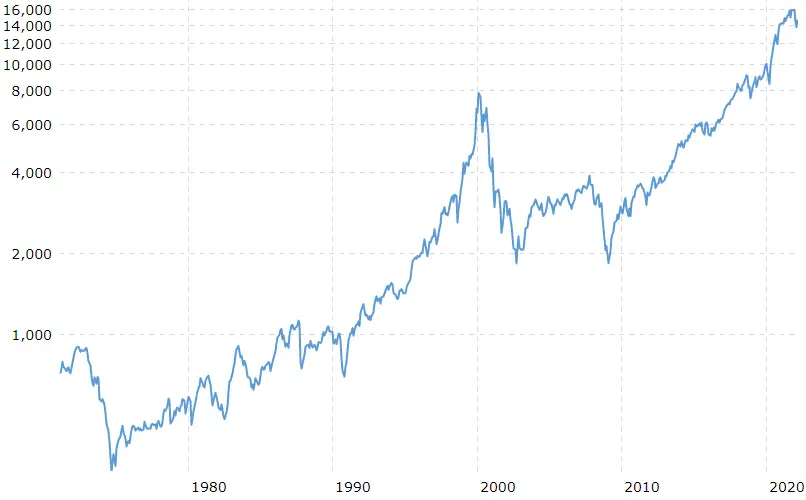

Historically, the value of the Nasdaq as a whole has generally risen over the long term.

The chart below, taken from macrotrends, shows the performance of the Nasdaq Composite Index since its inception in 1971 up to 29 March 2022:

As you can see, the index has steadily climbed over time. Even after periods of economic recession, the market has typically recovered and continued growing in value.

Of course, it’s important to remember that past performance is not an indicator of future performance. All investing comes with risk and you may get back less than you invested.

Nasdaq investments and tax rules

As with any kind of investing, it’s important to be aware of any taxes you may have to pay. And, as you’re investing in companies in another country, these rules may be slightly more complicated for Nasdaq stocks.

The W-8BEN form you fill out confers certain tax advantages to you as a non-US resident. This includes both US Dividend Tax and Capital Gains Tax (CGT).

Dividend Tax in the US

You may be subject to US Dividend Tax if you invest in a company registered in the US with stock paying dividends.

As standard, US Dividend Tax is charged at 30%. Fortunately, you’ll benefit from a reduced rate of 15% Dividend Tax on your Nasdaq investments if you’re not a US tax resident.

Even better, your US Dividend Tax rate may be reduced to 0% if your investments are held in a self-invested personal pension (SIPP).

Capital Gains Tax in the US

As a UK resident, you’ll be entirely exempt from CGT in the US.

Nasdaq investments and UK tax

Just because you’re partially protected from taxes in the US, you may still be liable to pay Dividend Tax or CGT in the UK.

Your investments may be subject to tax if you exceed the tax-free allowances for either of these taxes in a single tax year.

In the 2022/23 tax year, you can earn up to:

- £2,000 in dividends before Dividend Tax is due

- £12,300 in gains in value on your investments before CGT is due.

After this, the rate of tax you’ll pay on each will depend on your marginal rate of Income Tax. You can see the tax rates for the 2022/23 tax year in the table below:

| Rate of Income Tax | Dividend Tax | Capital Gains Tax (CGT) |

|---|---|---|

| Non-taxpayer or basic-rate taxpayer | 8.75% | 10% (18% for property that isn’t your main residence) |

| Higher-rate taxpayer | 33.75% | 20% (28% for property that isn’t your main residence) |

| Additional-rate taxpayer | 39.35% | 20% (28% for property that isn’t your main residence) |

Alternatively, you could hold your investments in a Stocks and Shares ISA. ISAs are tax-efficient accounts that will shield your investments from CGT.

Make sure you seek personal tax advice if you’re unsure whether you owe tax in the UK.

Aside from tax concerns, there are three other major costs to be aware of when trading US shares: account fees, commission, and foreign exchange fees.

Account fees

To hold an account with many platforms and brokers in the UK, you may need to pay an account fee.

Generally, platforms will either charge this as a fixed fee on each trade you make, or they may calculate it as a percentage of the total amount you hold with them.

Make sure you compare account fees across platforms to make sure you’re investing with the right broker in your personal circumstances.

Commission

When you place trades, many stockbrokers and investment platforms will charge a commission fee as part of the deal.

Some platforms, such as Freetrade and eToro, do allow you to trade without having to pay commission. These platforms could present a cost-effective way to make the most of Nasdaq investments.

Whichever platform you choose, make sure you know what sort of commission it charges, as you may find these costs eating into your trading profits.

Foreign exchange fee

As stocks in the US trade in dollars, an additional concern for buying investments listed on the Nasdaq will be the exchange rate or fee.

Your broker or platform will need to exchange your GBP into USD to make your trades. As a result, you may lose value on your pounds if the exchange rate is not favourable when you place your trade.

Platforms may also charge a separate fee to do this, further increasing the costs to you while trading.

Make sure you factor in the exchange rate or fees when making your trades.

Remember – you entirely remove the issue of foreign exchange fees and rates by investing in UK-listed funds and ETFs.

What exactly is the Nasdaq?

Based in New York City, the Nasdaq Stock Exchange is an American stock exchange where you can invest in some of the biggest companies in the world.

According to Statista, there were more than 3,700 companies listed on the Nasdaq in January 2021. This includes big-name brands such as:

- Amazon

- Apple

- Facebook (trading as “Meta Platforms”)

- Google (trading as “Alphabet Inc.”)

- Tesla

The Nasdaq is the world’s second-largest stock exchange by market capitalisation (or “market cap”). As of March 2022, the Nasdaq’s market cap is around $22.5 trillion.

It is second only to the New York Stock Exchange, which has a market cap of just under $28 trillion, as of March 2022.

The name “Nasdaq” is an acronym of “National Association of Securities Dealers Automated Quotations”, as it was initially founded by the National Association of Securities Dealers (NASD) in 1971.

NASD is now known as the “Financial Industry Regulatory Authority (FINRA)”, and is a self-regulatory body for brokerage firms and exchange markets in the US.

Nasdaq indexes

The Nasdaq also operates two separate indexes that contain companies trading on its exchange: the Nasdaq Composite Index, and the Nasdaq 100 Index.

These are two examples of indexes that you can buy tracker funds for, giving you exposure to all the investments contained in the fund. Below are a few details of each index.

Nasdaq Composite Index

The Nasdaq Composite Index is considered to be one of the biggest stock market indexes in the US, alongside the Dow Jones Industrial Average and the S&P 500.

Nearly all Nasdaq-listed stocks are included on this index, provided that they are exclusively listed on the Nasdaq and not on another stock exchange. There are some exceptions to this rule, such as if they have a dual listing.

Around 50% of the Nasdaq Composite Index is made up of technology stocks, with the remainder spread across a range of other industries including healthcare, utilities, and oil.

Nasdaq 100 Index

By contrast, the Nasdaq 100 Index only includes the top 100 largest companies listed on the Nasdaq Stock Exchange by market cap.

As the Nasdaq 100 Index only includes the biggest companies across the exchange, it is also greatly dominated by companies in the technology sector.

Nasdaq market hours

One important thing to bear in mind when trading on the Nasdaq from the UK is the time difference.

The Nasdaq operates in New York City, and so functions on Eastern Time (EST) in the US. The table below shows the time difference between the US and UK for standard trading, as well as the opening session and extended trading hours, on the Nasdaq:

| Trading session | Time in US (EST) | Time in UK (GMT) |

|---|---|---|

| Standard trading | 9:30 to 16:00 | 14:30 to 21:00 |

| Opening session | 4:00 to 9:30 | 9:00 to 14:30 |

| Extended trading hours | 16:00 to 20:00 | 21:00 to 1:00 |

Bear in mind that UK times will need to be adjusted to account for the switch to British summer time (BST) between March and October.

NASDAQ FAQs

How can I invest in the Nasdaq?

How can I trade in the US stock market from the UK?

You can buy and hold US stocks and shares directly, or purchase UK-listed funds of US companies.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Your pension income could also be affected by the interest rates at the time you take your benefits. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

CFD trading is a high-risk investment strategy and is not suitable for all investors.