Choosing the right broker isn’t just about low fees or flashy tools — more me, it’s about finding a platform that aligns with my goals, my strategy and how I prefer to invest or trade. That’s where Interactive Brokers (IBKR) sets itself apart.

Originally built for professionals and institutional investors, IBKR has evolved into a global powerhouse for everyday UK investors. With over 3 million client accounts and $426 billion in total customer equity, this isn’t a platform built for newbies alone — it’s designed for anyone who wants full control, wide market access and deep functionality.

But does its scale and sophistication translate well for retail users? Or is it still best suited to the pros?

In this review, I’ll break down what IBKR really offers UK-based investors, from its pricing and tools to platform usability and support. This is how I figured out if Interactive Brokers was a fit for my portfolio and long-term goals.

In this Interactive Brokers review, we have taken the time to compare Interactive Brokers’ fees to other brokers, personally tested their investment interface and tools, and gauged what you can expect from their customer service team. Read on to find out why we feel Interactive Brokers have successfully catered to all traders, regardless of experience.

We have also downloaded their app and opened an account, as we have done with all the other investment apps we have reviewed, to bring you the most comprehensive Interactive Brokers review, so that you can make an informed decision.

Interactive Brokers is a Nasdaq-listed (IBKR), long-established, low-cost, global investment platform operating out of the US. There is little doubt that Interactive Brokers offers an excellent range of investments that can be accessed with low commissions and no added spreads.

This trading platform continues to attract sophisticated investors looking to engage with the vast range of asset classes and advanced trading tools available on the platform.

- Interactive Brokers Ratings

- Who are Interactive Brokers?

- A Complete Overview of IBKR’s Products – What Can You Trade with Interactive Brokers?

- IBKR Platform Overview

- IBKR Mobile Trading Platform

- Research & Market Data

- IBKR Mobile Trading Platform

- Interactive Brokers FAQs

- Interactive Brokers Customer reviews

Who are Interactive Brokers?

Interactive Brokers (IBKR) is one of the world’s largest and most established online brokerage firms. Founded in 1978 by Thomas Peterffy, a pioneer in electronic trading, the company has grown into a global financial powerhouse that serves both retail and institutional investors.

Today, IBKR operates under Interactive Brokers Group, Inc., a publicly traded company on the NASDAQ. 23.5% of the firm is publicly owned, while a significant 74.2% remains in the hands of employees and their affiliates – a structure that reflects long-term thinking, operational stability and strong internal alignment.

Headquartered in the United States, Interactive Brokers operates in more than 150 markets worldwide, including a strong and growing presence in the UK. Regulated by the Financial Conduct Authority (FCA) in the UK and several major financial bodies globally, IBKR is known for its transparency, financial strength and innovation.

What makes IBKR stand out isn’t just its reach – it’s the depth of its platform. No matter if you’re trading stocks, options, ETFs, forex, bonds, futures, or even crypto, IBKR offers direct access to global markets with low fees and advanced tools usually reserved for professionals.

In 2025, Interactive Brokers is now one of the most trusted and capable brokerages in the world. It’s a platform that’s given me the type of control and insights I’ve been looking for.

A Complete Overview of IBKR’s Products – What Can You Trade with Interactive Brokers?

Interactive Brokers doesn’t just give me access to global markets — it puts an entire financial universe at my fingertips. Whether I’m a long-term investor, an active trader, or somewhere in between, IBKR’s product offering is one of the most expansive in the industry.

I can trade on over 150 global markets, with access to 90+ stock exchanges across North America, Europe, Asia and emerging regions. From blue-chip equities to niche derivatives, here’s what’s available through a single IBKR account:

Stocks & Shares

Interactive Brokers offers direct access to more than 90 stock markets worldwide, including the London Stock Exchange (LSE), NYSE, NASDAQ, Euronext, Deutsche Börse, Tokyo Stock Exchange and Australian Securities Exchange (ASX) — just to name a few.

I can trade shares in thousands of companies across developed and emerging economies, with real-time execution and competitive commission structures. Fractional shares are also available for US stocks, letting me invest in high-value companies like Amazon or Tesla without buying a full share.

Exchange-Traded Funds (ETFs)

I found over 15,000 ETFs globally, covering virtually every theme, sector, region and asset class. Whether I’m looking for passive market trackers, smart beta funds, or leveraged ETFs, they’re all here. Markets include:

- US (NYSE Arca, NASDAQ, Cboe)

- UK (LSE)

- Europe (XETRA, Borsa Italiana, SIX Swiss, Euronext)

- Canada, Hong Kong, Singapore and more.

Screeners and filters allow you to choose ETFs based on expense ratios, performance, ESG scores and asset composition — an ideal tool for how I manage my own portfolio.

Forex (FX)

I was able to access 100+ currency pairs with real-time streaming quotes, institutional-level spreads and low commission-based pricing.

I traded major, minor and exotic pairs — including GBP/USD, EUR/USD, USD/JPY and less common pairs like USD/ZAR or AUD/SGD. Execution is direct to the interbank market, and margin requirements are transparent and efficient.

- Spreads: as low as 0.1 pips

- Commissions: from $2.00 per $100,000 traded

- No markup on quoted prices

Mutual Funds

IBKR offers one of the largest mutual fund marketplaces in the world, with access to more than 48,000 funds, including over 19,000 with no transaction fees. This includes UK OEICs and US mutual funds, plus global options from providers like Fidelity, Vanguard, BlackRock and more.

Funds can be filtered by:

- Region (UK, US, EU, Asia)

- Asset type (equity, fixed income, money market)

- Provider and cost structure

- ESG scores

This breadth is perfect for building long-term, diversified portfolios like my own.

Bonds & Fixed Income

The bond desk at Interactive Brokers offers 1 million+ fixed-income instruments across corporate, government, municipal and agency debt. I got access to both primary and secondary markets.

Options include:

- UK Gilts

- US Treasuries

- EU Sovereign Bonds

- Investment Grade and High-Yield Corporate Bonds

Municipal Bonds (US)

Bond trading includes real-time quotes and aggregated liquidity from multiple dealers, with commissions starting at just $1 or 0.1% of trade value.

Options

IBKR supports options trading on stocks, indices and ETFs across major markets. I built everything from basic calls and puts to complex multi-leg strategies.

- Markets covered: 30+ global options exchanges

- Pricing: from $0.65 per contract (US), or £1.70 per contract (UK)

- Tools: Options Strategy Lab, Risk Navigator, Volatility Lab

Ideal for hedging, income generation, or directional trading, all with professional-level analytics.

Futures & Inter-Commodity Spreads

I also traded futures contracts available 35+ global exchanges, covering:

- Equity indices (S&P 500, FTSE 100, DAX)

- Commodities (oil, gold, soybeans, copper)

- Interest rates

- Currencies

- Volatility indices

IBKR also supports inter-commodity spreads, allowing me to construct relative-value strategies with reduced margin requirements.

- Commission: from $0.85 per contract

- Markets: CME, ICE, EUREX, SGX, LME and more

CFDs (Contracts for Difference)

For traders looking for leveraged exposure without owning the underlying asset, IBKR offers CFDs on stocks, indices, forex and commodities — all executed with tight spreads and no hidden markups. This is not something I use often, but it’s nice to know the feature is there if you need it.

You can trade stock CFDs from the UK, US, Europe and Asia, with real-time pricing and full transparency on margin and financing costs.

Cryptocurrencies

IBKR offers direct crypto trading through Paxos, with institutional-grade pricing and no need for external wallets or exchanges.

- Assets offered: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH)

- Fees: 0.12%–0.18% of trade value

- Custody: Crypto held in regulated, insured custody via Paxos

Crypto ETFs and futures are also available on select exchanges for indirect exposure.

Structured Products & Warrants

More sophisticated investors can trade structured products such as capital-protected notes, yield-enhanced products and autocallables. IBKR offers access to these through third-party providers and issue platforms.

Warrants, including covered warrants traded on major European exchanges, are also available, often used for leverage or hedging.

Combinations & Strategy Trading

IBKR supports multi-leg combination orders across options and futures. I built some complex structures like:

- Iron condors

- Calendar spreads

- Butterfly spreads

- Diagonal spreads

These can be executed as a single order, with real-time margin and risk analysis that helps guide my position sizing.

Physical Metals

For direct exposure to precious metals, Interactive Brokers provides access to allocated and unallocated physical gold and silver, traded on major global exchanges or via third-party partners. These are settled in vaults, not synthetic derivatives.

Hedge Funds via IBKR Marketplace

I was able to browse and allocate to hundreds of hedge funds via the IBKR Hedge Fund Marketplace. The platform offers access to audited performance data, strategy descriptions and minimum investment requirements.

This service is best suited for high-net-worth individuals, family offices, or institutional clients seeking alternative investments.

Interactive Brokers SIPP (Self-Invested Personal Pension)

IBKR offers SIPP accounts through UK-registered SIPP administrators, allowing investors to build a tax-efficient retirement portfolio. You’ll have full access to global markets, thousands of ETFs and diversified fixed-income products, all within a pension wrapper.

Stocks and Shares ISA

UK residents can open an ISA to invest up to the annual allowance (£20,000 in 2024/25) without paying Capital Gains Tax or dividend tax. IBKR’s ISA includes the same market access as a regular account, including ETFs, stocks and bonds.

Junior ISA

Parents and guardians can open a Junior ISA on behalf of a child under 18, with up to £9,000 in contributions annually (2024/25). It’s an ideal tool for long-term growth, with no tax on gains or income.

Recurring Investment Plans

Good investing is often about consistency. IBKR’s Recurring Investment feature automates this process, which allowed me to schedule regular purchases of stocks or ETFs at intervals that suit my strategy — daily, weekly, monthly, or even quarterly.

This approach supports my dollar cost averaging approach, which can smooth out the impact of market volatility over time. It’s particularly useful for those building positions in high-quality stocks or ETFs without worrying about timing the market.

Fractional shares make this even more powerful. Even with small amounts — say £25 or £50 per trade — you can gain exposure to major U.S. companies that might otherwise feel out of reach due to their high per-share price.

All transactions are executed at the market open, so it’s best used as a long-term tool rather than a precision trading method.

This suits both beginners and those using pound-cost averaging strategies.

Socially Responsible Investing

Today’s investors are increasingly interested in putting their money where their values are. Interactive Brokers makes this easier with tools that allow you to filter investments based on environmental, social and governance (ESG) criteria.

Their IMPACT app and ESG dashboard let you define what matters most — be it reducing carbon exposure, promoting gender equality, or excluding unethical industries. Once your values are set, the platform helps you evaluate companies and ETFs accordingly, using independent data to score ESG alignment.

This isn’t just a feel-good option. Many ESG-aligned portfolios have performed competitively, making it a viable long-term investment strategy. And with IBKR’s access to global markets, you’re not restricted to a small ESG fund—you’re free to build a custom, values-driven portfolio with the same analytical tools used by professionals.

Commission-Free Trading (IBKR Lite)

IBKR Lite is designed for investors who want to trade U.S.-listed stocks and ETFs without paying commission. That’s a big win for me as a cost-conscious investor focused on long-term compounding — I see it in a way that every saved penny boosts my returns.

However, it’s important to understand what you’re trading off. Unlike IBKR Pro, which uses sophisticated order routing to seek price improvement, IBKR Lite routes orders to market makers, which may not always result in the best execution. For many retail investors, this difference is negligible, but active traders might find the Pro model more suitable.

Still, if you’re simply looking to build a portfolio of low-cost ETFs or individual U.S. stocks, IBKR Lite makes entry effortless. There’s no minimum deposit required, and you still get access to a professional-grade platform.

Bank Sweep Program

Idle cash in your account doesn’t have to sit still. The Bank Sweep Program automatically transfers unused cash into interest-bearing accounts at participating banks, allowing your uninvested funds to earn competitive rates daily.

Overall

Interactive Brokers doesn’t just offer variety — it offers depth, execution quality and institutional-level access across every asset class. Few platforms can match this scale. Whether you’re buying a single ETF or constructing a multi-market, multi-asset portfolio with hedging strategies and leverage, IBKR is built to handle it, all from one account.

If you want breadth, control and serious global exposure, this is as close as it gets to a professional trading desk for everyday investors.

IBKR Platform Overview

Interactive Brokers (IBKR) isn’t just another trading platform, it’s a vast ecosystem tailored to serious investors, professionals and institutions who need more than just “buy and sell” buttons. Whether I’m managing a personal ISA or running algorithmic strategies for a fund, IBKR’s platform delivers powerful tools, granular control and intelligent insights. Let’s explore it, one layer at a time.

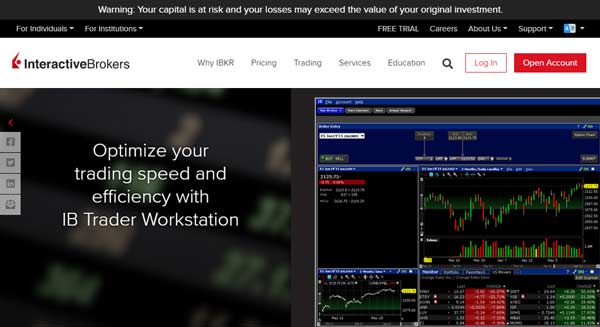

Trader Workstation (TWS)

Trader Workstation, or TWS, is IBKR’s desktop powerhouse — built for high-performance traders. It’s dense, fast and highly customisable. Think of it as a command centre where you can simultaneously monitor dozens of charts, news feeds, option chains, forex ladders and live positions.

I also customised the layout to suit my exact trading workflow, where I can use over 100 different technical indicators and create multi-leg option strategies without leaving the interface. It’s also one of the few platforms I’ve found that supports advanced order types like bracket orders, iceberg orders and conditional strategies with ease.

If you’re trading complex instruments or working across multiple asset classes, TWS is your cockpit.

Client Portal

Where TWS is built for power, the Client Portal is built for clarity. Accessible via browser, this is where most users go to manage their account day-to-day.

Here, I found a sleek dashboard showing my portfolio value, real-time P&L, available margin and recent activity. From this single interface, I can trade, check balances, fund your account, run reports and even access tools like the Portfolio Analyst without any technical know-how.

Perfect for investors who don’t need a wall of monitors, but still want transparency and fast execution.

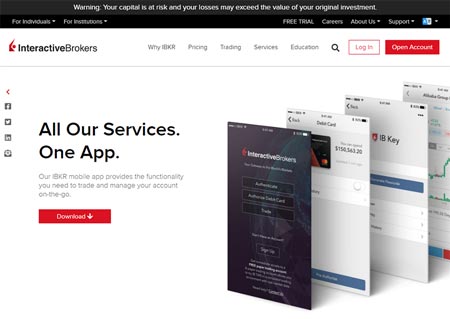

IBKR Mobile Trading Platform

The IBKR mobile trading platform allows access to all the great functionality on the go. Data streaming is conducted in real-time, however, only on one platform at a time, which could be an issue for some traders. That being said, all the advanced trading tools were available, including over 400 data columns, option exercise templates, and spread templates. It’s definitely intuitive enough for trading on the go, and it even lets you deposit checks straight into your Interactive Brokers account.

Security has all been taken care of with a two-step login (I consider this a minimum) and biometric authentication. IBot is also available on the mobile app, ready to swing into action on your behalf.

Interactive Brokers offers mobile apps for both Android and iOS.

IBKR Global Trader

The IBKR GlobalTrader app brings global investing to your fingertips, literally. It’s IBKR’s mobile-first platform, designed for modern investors who want fast, global access without the steep learning curve.

You can buy fractional shares of big-name US stocks, convert currency on the fly, or research international companies all from one clean interface. The app’s guided investment flows make it approachable for beginners, while still providing access to over 90 stock exchanges worldwide.

It’s trading that fits in your pocket but still packs IBKR’s global punch.

IBKR APIs

Interactive Brokers doesn’t just offer trading tools, it opens the hood for developers. With IBKR APIs, you can code your own trading logic, build data dashboards, or integrate IBKR execution into a larger system.

APIs are available in Python, Java, C++ and more. Whether you want to automate trades, pull historical market data, or execute orders based on external triggers (like economic news or technical signals), IBKR gives you the framework to build it all.

This is algorithmic trading without platform restrictions.

Research & Market Data

IBKR’s research tools go well beyond a few news headlines. I got access to global news sources, analyst ratings, economic calendars, insider activity, and institutional-grade research reports, much of it free.

I also tracked earnings reports, drilled down into company fundamentals, and used screeners to identify undervalued opportunities. The Fundamentals Explorer is particularly useful for long-term investors — it breaks down key ratios, revenue sources, ESG scores and historical performance into clean visuals.

Knowledge is power, and IBKR hands it to you in real time.

Recommendations

Most of the recommendations on the platform are free, although there are a few that will incur a small fee. They are provided by entities such as Thomson Reuters, Morningstar, and Dow Jones free of charge in real-time.

For something a bit more comprehensive, traders can access tools such as Validea, which provides an analysis of a stock’s potential with BUY/SELL/HOLD ratings as well as an overview of the historical ratings and investment opportunities. Stock reports and ratings with Validea will cost $10.80 per month following a free trial for their basic package.

Fundamental Data

For investors looking for income statements, a dividend calendar, company profiles, financials, and industry comparisons, there is a great selection of fundamental data on the client portal in the Fundamentals Explorer. This is all completely free of charge and provides scope to analyse and compare companies with their competitors for a more informed investment strategy.

Charting Options

Good charts do more than look pretty, they help you time your entries and exits with precision. While using IBKR’s platforms, I found professional-level charting tools with real-time tick data, adjustable timeframes, custom indicators and drawing tools.

You can overlay multiple instruments (for pair trading or correlation), set up alerts based on price or indicator movements and even run backtests using historical patterns.

Charts are also interactive. Clicking a candlestick can show order book depth, trade history, or news events that coincided with the move.

Impact Dashboard

For me, IBKR’s Impact Dashboard is a standout feature. It helped me score my portfolio based on ESG metrics — environmental sustainability, social impact and governance ethics.

I was able to prioritise what matters most to me, like avoiding companies that invest in fossil fuels, or supporting ones that promote diversity. The dashboard then analysed my holdings and showed me how well they align with my priorities.

It’s a simple but powerful way to make value-driven investing part of your strategy.

Automated Trading

IBKR supports a full range of automation — from simple conditional orders to fully algorithmic strategies run via API or third-party tools.

You can create rules like: “Buy 50 shares of Tesla if it drops 3% and RSI is below 30,” or “Sell my ETF position if the S&P 500 breaks below its 200-day average.” These aren’t static orders, though, you can stack logic and add fallbacks, making it ideal for traders who don’t want to be glued to screens.

They also support third-party automation tools like MetaTrader and QuantConnect.

Demo Account

Before diving in with real funds, you can try IBKR’s full feature set in a paper trading account. This demo environment mirrors real market data and lets you execute trades, test order types and explore the platform risk-free.

It’s especially useful if you’re trying to learn TWS or test a new strategy. Unlike many brokers who offer “lite” demos, IBKR’s paper account is nearly identical to live trading, minus the emotions.

Recommendations & Indicators

IBKR goes beyond price charts by offering curated insights, analyst recommendations, over 150 indicators and sentiment signals.

Whether you’re researching a stock or looking for momentum plays, I found a consensus of buy/hold/sell ratings, earnings projections and even how the company scores on sustainability or governance.

It’s an investor’s cheat sheet, available natively within the trading platform.

News Feed

News moves markets, and with IBKR, I felt plugged into a live feed from top-tier sources. Think Reuters, Morningstar and Dow Jones, streaming headlines and alerts as they happen.

I could filter news by your watchlist or asset class, and many stories are integrated into charts and screeners for instant context. No more jumping between platforms.

Advanced Order Types

IBKR is known for offering one of the most sophisticated order type libraries in the business. I didn’t feel limited to just basic market or limit orders — I was able to design trades that react dynamically to the market.

Some examples:

- Bracket Orders to protect both profit and downside.

- Stop with Protection, useful during volatile market swings.

- Trailing Stops, adjusting in real-time as the price moves in your favour.

These tools are essential for active traders and long-term investors who want precise risk management.

MultiSort Screener

This screening tool let me sort through thousands of global stocks based on multiple criteria. Price, earnings growth, dividend yield, volatility — I could stack them all together, and the screener will surface the best matches.

I could save screen settings, compare past results and click straight into analysis tools or trading windows. It’s research made actionable.

Discover Tool

The Discover Tool is like a personal investment guide. It introduces you to new sectors, industries, ETFs and stocks based on what’s trending or what aligns with your preferences.

It’s especially helpful for investors who want to broaden their scope beyond familiar markets. You’ll find ideas like “Clean Energy Leaders” or “Emerging Markets Healthcare”—each with supporting data and performance metrics.

Portfolio Analyst

This was my financial command centre. Portfolio Analyst consolidates your entire financial picture – even linking outside accounts – and breaks down returns, asset allocation, risk exposure and historical performance.

I could easily view my time-weighted returns, Sharpe ratio and compare my performance to benchmarks like the S&P 500. I found it as useful for tax prep as it was for investment strategy.

If IBKR’s platform sounds like a lot, it is. But it’s not bloated or overwhelming. It’s layered. I started with what I needed and grew into the features as my strategy matured. That’s what makes it one of the most respected platforms in the world.

IBKR Mobile Trading Platform

The IBKR Mobile app is more than a mobile companion. It’s a full-featured trading platform built for serious investing on the go. Whether you’re watching the markets from your office like me or placing a trade on your commute, the mobile platform brings Interactive Brokers’ global reach and sophisticated tools into the palm of your hand, without sacrificing power or precision.

Let’s explore what makes it one of the most complete mobile platforms in the brokerage world.

Seamless Access to Global Markets

With the IBKR Mobile app, I got real-time access to over 90+ global exchanges across 33 countries where I could trade 23 different currencies. Want to invest in a pharmaceutical company listed in Tokyo, a tech stock in Frankfurt, or a mining ETF in Canada? I did all of that from my phone.

Fractional shares? Covered. Currency conversion? Built-in. And the app makes it easy to switch between markets and asset classes, offering a seamless, borderless experience for global investors.

Full Asset Class Support

Unlike many mobile trading apps that only support stocks and ETFs, the IBKR Mobile platform let me trade the full suite of instruments offered by Interactive Brokers. This includes:

- Stocks & ETFs

- Options (multi-leg strategies supported)

- Futures

- Forex

- Bonds

- CFDs

- Cryptocurrencies (via Paxos)

- Mutual Funds

- Commodities and Metals

- Warrants & Structured Products

Clean Interface, Built for Efficiency

The UI is clean, intuitive and fully customisable. I found my watchlists, charts, orders and positions quickly from the start, usually just a tap away. The swipe-based navigation kept things smooth, while real-time quotes and depth-of-market (DOM) views let you respond quickly to changing market conditions.

The app also includes intelligent search functionality, so I could look up any ticker, fund, or asset in seconds, even if I was unsure of the exact name.

Charting and Technical Analysis

Charting on mobile often feels like an afterthought. Not here.

IBKR Mobile offers interactive, real-time charts with dozens of technical indicators, customisable time frames and pinch-to-zoom features for close-up views. I managed to overlay indicators like RSI, MACD, Bollinger Bands and moving averages to support technical decision-making, right from my phone.

Tap any data point to view trade history, related news, or market impact.

Order Types and Trade Execution

You’re not limited to basic buy/sell. The app supports a full range of advanced order types, including:

- Limit

- Stop

- Trailing Stop

- Market on Close

- Bracket Orders

It even supports algo orders like Accumulate/Distribute, Adaptive and Iceberg, allowing professional-grade execution strategies without needing to sit at a trading desk.

Live News and Alerts

It was easy to stay informed without being overwhelmed. The app integrates global news feeds, company-specific alerts and real-time event updates. I set price alerts, volume alerts, and received updates on my portfolio performance.

I could even tailor the news section to my watchlist and links directly to company profiles, charts and order pages for swift action.

Secure, Fast and Customisable

Security is top priority. IBKR Mobile uses two-factor authentication (2FA), Face ID / Touch ID login, end-to-end encryption and session timeout features to protect my account.

I also configured custom layouts, set my preferred home screen (watchlist, portfolio, news), changed font sizes, toggled dark mode and selected trading defaults to make the experience truly yours.

IBot and Voice Commands

Unique to IBKR, IBot is a conversational AI assistant integrated into the app. You can type or speak commands like “Buy 10 shares of Apple at market” or “Show me today’s top gainers” and it will execute or display results instantly.

I liked this feature for when I wanted fast insights or trades without navigating through multiple tabs.

Portfolio Overview and Risk Metrics

The app offers a real-time snapshot of your account balance, margin status, net liquidity and market exposure. You can break down your portfolio by asset class, region, or currency.

Risk tools such as Value at Risk (VaR), Greeks for options and margin utilisation give you deeper insights into your exposure, so you’re never trading blind.

IBKR GlobalTrader: The Simplified Experience

For investors who want a lighter, more guided version of mobile trading, IBKR GlobalTrader is available as an alternative app. It simplifies access to fractional shares, ETFs and long-term investing, with intuitive flows for newer investors or those who prefer simplicity without compromising access to global markets.

The IBKR Mobile app isn’t a stripped-down afterthought, it’s a robust, professional-grade platform that let me easily monitor markets, manage risk, execute advanced trades and analyse my portfolio in real time.

Interactive Brokers FAQs

Are the fees Interactive Brokers offers competitive in the UK?

What happens if Interactive Brokers goes bust?

Interactive Brokers Customer reviews

The user interface is quite congested with a lot of information on display, this could easily deter a new investor from being overwhelmed. Fees are higher than others, but dont feel this is a short term trading app, more of a long term hold service. Onboarding was slightly longer and more complicated than expected, but feel this is for added security for this expert brand.

The account is easy to use and has loads of UK and foreign investments. The fee structure is fixed so it would be good for people with more money in an account (most of my investments are with vanguard) but for me theres probably cheaper alternatives for smaller amounts.

The fees are too high. I used interactive brokers to trade futures with NInja Trader but then switched to Ninja Trader as a broker instead which I found better with both customers service and fees. I found transfering money to Interactive Brokers from a GBP bank account was more complex than it needed to be. I only used the app as an emergency back up to get out of a trade if my PC were to fail. Also, I only traded futures and didn’t buy and hold any stocks long term so can’t commit on that aspect.