eToro is my top best trading platforms in the UK.

With its extensive menu of assets including 6000+ instruments, unlimited demo account use, low fees and 5-star social trading credentials, it’s a great option if you’re new to the trading world and would like the option to mirror the moves of high-performing traders.

{etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees

- eToro Ratings

- Our eToro review in 60 seconds

- Who is eToro suitable for and Why?

- eToro Product Range Overview

- eToro CopyTrader Review

- eToro CopyPortfolio Review

- eToro Accounts vs Interactive Investor and Hargreaves Lansdown

- eToro Platform Review

- eToro Research Service and Tools Review

- eToro Fees and Charges Review

- eToro Deposit and Withdrawal Review

- eToro FAQs

- eToro Customer reviews

This review is based on my own first-hand experience and research. When conducting reviews, the main points I look for (and which you should also be on the lookout for) are:

- Assets available

- Product offerings

- Fees

- Account options

- Education and tools

- Ease of use

- Customer service

Our eToro review in 60 seconds

Who is eToro suitable for and Why?

Their platform is designed for everyone. Beginners can ease their way into a live investment portfolio with the help of an unlimited demo account to practice trading and even try their hand at copy trading from there before risking any real funds. I like their CopyTrade, it is a quick way to kick-start newcomers’ investment journey. Investors can build an investment portfolio from over 5,500 stocks and shares, or choose a ready-made option based on personal priorities and risk appetite.

More experienced traders are going to find the excellent range of assets enticing as well as the low trading fees. There are also rewards on offer for traders who are successful enough to appeal to traders looking for someone to copy.

eToro Product Range Overview

eToro offers:

- CFDs

- Forex

- Real stocks

- ETFs

- Cryptocurrencies

- Commodities

- Indices

Alongside commodity, cryptocurrency and ETF trading, eToro offers a wide selection of stocks to enable investors to further diversify their portfolio. The large asset choice gets 5 stars from me.

It’s a comprehensive offering; but let’s compare it with two of the largest platforms in the United Kingdom, Interactive Investor and Hargreaves Lansdown, so you can get a direct comparison.

Related: Guide to ETFs for UK Investors

eToro CopyTrader Review

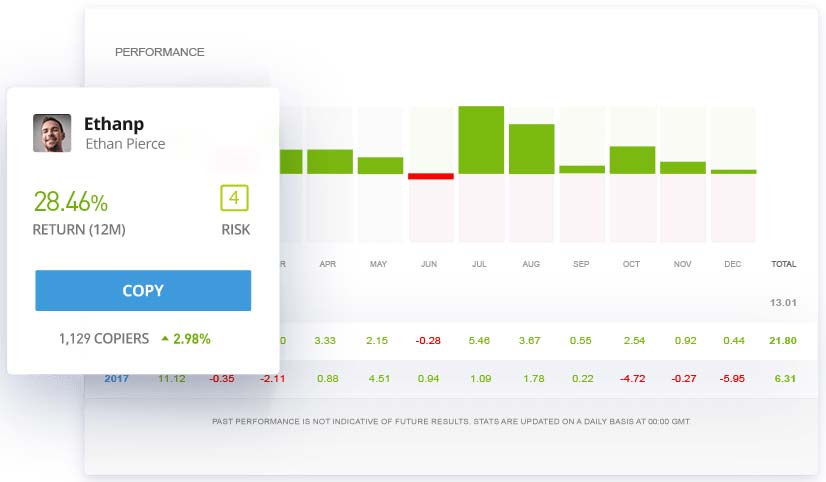

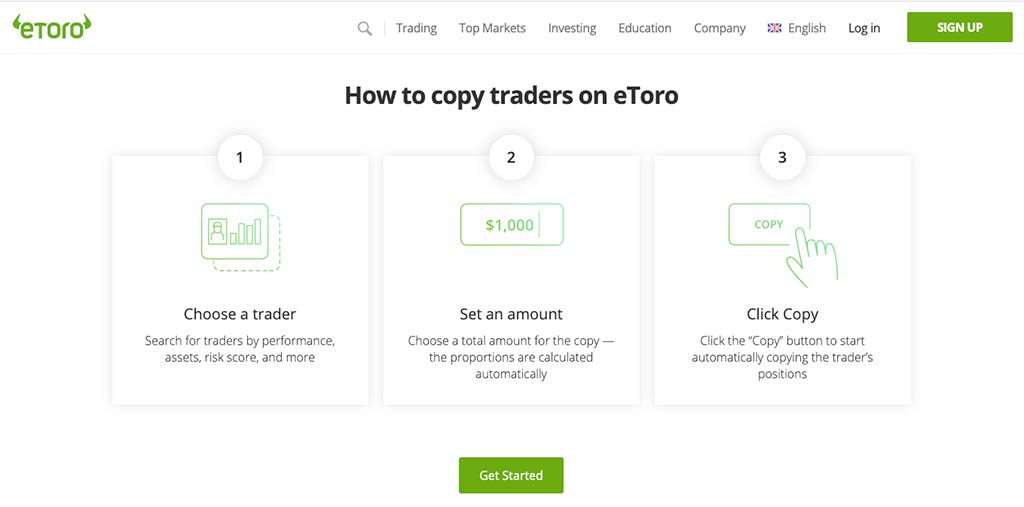

Just as the name suggests, CopyTrader allows you to copy the investment portfolio of more experienced or successful eToro users by browsing through profiles and selecting traders based on their previous performance, both on an annual and monthly level.

Past performance is not an indication of future results.

eToro gives you the ability to copy up to 100 eToro users at the same time.

To help make your selections a bit easier, eToro assigns each trader a ‘risk score’, as well as providing information on the number of trades per week, average holding time, charted performance, and news feed comments. This is enough information to give you real insight.

I found one of the great advantages of CopyTrader is that you can start copying other traders with no extra charge as there are no management fees. However, the minimum amount you can start trading with at eToro is $100.

eToro CopyPortfolio Review

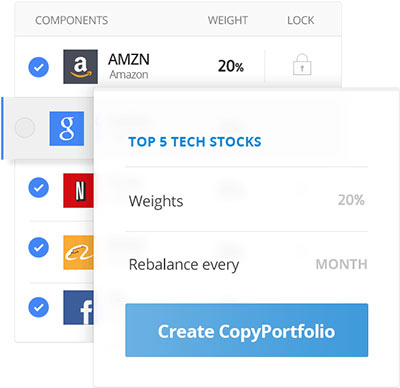

CopyPortfolio allows you to invest in two main types of investment portfolio: Top Trader Portfolios, which, simply put, allow you to invest in a portfolio consisting of the eToro users who are achieving the best returns, and Market Portfolios, which allow you to pick a market or theme of CFD stocks, commodities, or EFTs.

Bearing in mind that trading on CFDs comes with a high risk of losing your money, it’s good news that eToro makes it easy to spot the proportion of CFDs in any specific portfolio. In addition to this, asset distribution, performance, and investment strategies are all readily available to help you make the best possible decisions, and I particularly like that eToro makes sure you understand the complexity and high risk of CFDs at the outset.

Bearing in mind that trading on CFDs comes with a high risk of losing your money, it’s good news that eToro makes it easy to spot the proportion of CFDs in any specific portfolio. In addition to this, asset distribution, performance, and investment strategies are all readily available to help you make the best possible decisions, and I particularly like that eToro makes sure you understand the complexity and high risk of CFDs at the outset.

eToro Accounts vs Interactive Investor and Hargreaves Lansdown

| Account Type | eToro | Interactive Investor | Hargreaves Lansdown |

|---|---|---|---|

| Trading Account | Yes | Yes | Yes |

| SIPP | No | Yes | Yes |

| Stocks and Shares ISA | No | Yes | Yes |

| Cash ISA | No | No | No |

| Lifetime ISA | No | No | Yes |

| Junior SIPP | No | No | Yes |

| Junior Stocks and Shares ISA | No | Yes | Yes |

| Demo Account | Yes | No | Yes |

eToro Platform Review

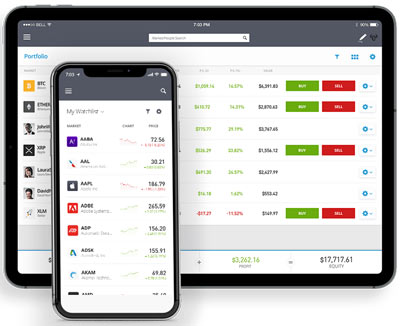

eToro has designed a really clean, modern-looking innovative trading platform that is easy to navigate and highly functional. This is available both on the web and on mobile, although they have yet to offer a desktop version to the market.

The eToro mobile app is most certainly an impressive offering to the market. Clean, easy to use, modern, and with a wealth of functionality, I enjoyed using it, and it makes for a seamless trading experience while on the move. That being said, eToro only scores 3.8 out of 5 on the app store, with a lot of the negative reviews complaining about mobile app crashes, some issues with the formatting of the charts, and the spreads, which users report they are often unaware of prior to trading.

In terms of security, eToro has installed optional two-factor authentication (2FA). This means that they verify your identity not only via your password, but also via a second authentication method. Two-factor authentication (2FA) is available on the eToro app, the eToro Money app, and the Delta investment app.

Searching, placing orders, and alerts and notifications features are all straightforward and easy to use at eToro and provide investors with a great level of functionality. On the eToro mobile version, you can even set up a push notification when an asset reaches a certain price point or when your order has been fulfilled.

eToro offers decent charting options on the eToro trading platform, giving investors the option to change chart types, chart intervals, and overlays and the ability to compare six different charts at once with their eToro ProCharts functionality. You also have easy access to your eToro account balance.

eToro Research Service and Tools Review

For investors looking for a decent level of technical analysis, eToro won’t disappoint. Unfortunately, they only offer recommendations on a limited number of stocks; however, for the ones that do have recommendations, there is a wealth of information available, such as average price targets and analyst reports.

While the research offered at eToro was good, it didn’t quite match up to providers like Interactive Investor or Hargreaves Lansdown, mostly due to the limited fundamental data on offer and insufficient research reports. In addition, eToro has failed to provide investors with financial market news or stock screeners, unlike most of their competition, which feels like a bit of an oversight.

However, eToro makes up for a lot of this with its social trading network. This works like a social feed, where other investors will offer their thoughts on stocks, often with supporting data to help you with your decisions. This social aspect of trading is not widely available and is a great little feature – earning 5 stars from me.

In terms of education, eToro has missed the mark. Their only offering is some hour-long videos in their trading academy, and while these do provide useful information regarding trading, financial markets, placing trades, and managing goals, they make it difficult for investors to find answers to specific questions without sitting through hours of webinars.

eToro Fees and Charges Review

While eToro is quick to promote their zero commission stock trading fees, there are currency conversion fees, withdrawal fees, CFD fees, and inactivity fees that investors need to be aware of.

When I compared eToro to similar trading and investing platforms, I found their CFD fees to be roughly in the same range, so nothing out of the ordinary there. However, it is worth noting that when trading eToro forex, the fees are high compared to their main competitors, which is worth taking into consideration if you plan to trade on forex.

As eToro only trades in USD, conversion fees will be applied when you deposit or withdraw money in any other currency. These vary according to the currency and how your money is deposited, but range between 50 pips and 250 pips per conversion.

For withdrawals, eToro charges a flat fee of $5 with a minimum withdrawal amount of $30. There is also an inactivity fee of $10 per month once your account has been dormant for 12 months. As a comparison, Plus500 doesn’t charge for withdrawals, and while they do have an inactivity fee, this is not on a monthly basis.

Fees

| Minimum DepositThe minimum amount required to open an account | $50 |

|---|---|

| Minimum TradeThe minimum amount to trade or buy shares | $1 |

| ETFs FeeFee per ETF trade | 0% |

| Investment Trusts FeeFee per investment trust trade | NA |

| Junior S&S ISA FeeSubscription fee per month and the platform fee | NA |

| Non Trading FeeFee for not trading in a period | $10 pcm after 1 year inactivity |

| Stocks & Shares ISA FeeSubscription fee per month and the platform fee | NA |

| Telephone Dealing FeeFee for trading over the telephone | NA |

| Withdrawal FeeFee for withdrawing funds from your account | $5 |

eToro Deposit and Withdrawal Review

eToro has certainly supplied customers with masses of options when it comes to depositing money, including:

- Visa Credit Card

- MasterCard

- PayPal

- Skrill

- Neteller

- Wire transfer

It is important that UK investors understand that eToro only operates in USD, which means any deposits will be converted and charged the relevant conversion fee. This fee will also be applicable upon withdrawal back to GBP.

Bank transfers tend to take 4–7 business days to appear in your eToro account.

When it comes to withdrawals, eToro does levy a $5 withdrawal fee, which is fairly substantial when compared to other brokers. However, by bank transfer, the whole process only takes around 2 business days and is very easy to complete on the website.

eToro FAQs

Is eToro any good?

Can I use eToro in the UK?

Does eToro have an ISA?

Please note:

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

eToro Customer reviews

Account opening straight forward but clunky. Better alternatives available for general investment accounts like Trading 212 and Invest Engine

- Deposit and withdrawal

- Customer service

etoro is an excellent platform for beginners or for people like me who cannot trade for themselves, etoro’s copytrading is second to none and I cannot recommend it enough, this is a no brainer.

- Fees

- Account opening

- Deposit and withdrawal

- Customer service

Great stuff but I could hardly get a hold of the customer service, but I was surprised how quickly I saw my money on the account and could start trading, that really helped me!

- Fees

- Account opening

- Deposit and withdrawal

- Customer service

Click here to learn how we review.