My Taylor Wimpey share price forecast includes a 360-degree examination to determine whether investors should consider this housebuilder and build the stock into their portfolios.

This stock analysis report goes into detail on Taylor Wimpey’s financial position, competitive strengths, industry outlook, valuation metrics, and analysts’ predictions to uncover whether Taylor Wimpey shares actually present a golden long-term opportunity.

Read On: To find the Taylor Wimpey share price forecast and my price target.

- Taylor Wimpey Share Price (LON:TW)

- Taylor Wimpey Background

- Taylor Wimpey Business Model

- Taylor Wimpey Earnings Breakdown

- Taylor Wimpey Financials

- Taylor Wimpey Competitive Advantage

- Taylor Wimpey Shortcomings

- What is the Dividend Forecast for Taylor Wimpey Shares?

- Are Taylor Wimpey Shares Cheap?

- What is the Profit Forecast for Taylor Wimpey Shares?

- What is the Taylor Wimpey Share Price Forecast?

- What is the Price Target for Taylor Wimpey Shares?

- Are Taylor Wimpey Shares a Buy, Sell, or Hold?

Taylor Wimpey Background

Persimmon is one of the largest housebuilders in the UK by houses built with a sizeable market share. It’s known to be one of the big five developers in the country. As a whole, Taylor Wimpey builds properties across the UK but also has operations in Spain.

Altogether, it builds approximately 10,000 properties per year on average. It builds a wide variety of homes, ranging from flats to six-bedroom houses.

Taylor Wimpey shares trade on the London Stock Exchange and are constituents of the FTSE 100.

Find Out: How easy it is to buy Taylor Wimpey shares in 6 simple steps.

Taylor Wimpey Business Model

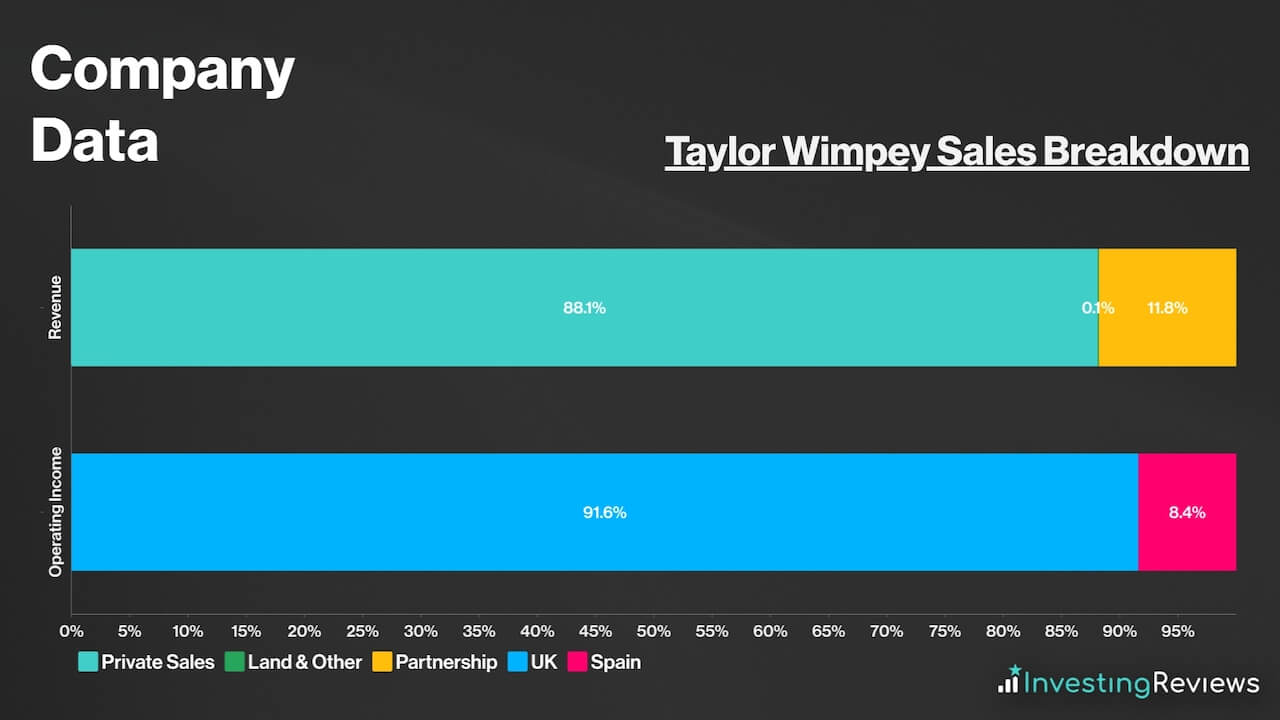

As a conglomerate, Taylor Wimpey essentially makes most, if not all of its money from selling new homes and land. The bulk of its sales stems from new homes where it acquires land, develops it through building properties, and then sells those properties at a premium. On top of that, Taylor Wimpey also generates a tiny portion of revenue from land sales.

On the geographical front, the company predominantly operates in the UK. However, Taylor Wimpey also generates a tiny portion of revenue from developing high-quality homes for a niche, upper-class market in Spain. These tend to be located in popular locations such as Costa Blanca, Costa del Sol, the Mallorca Islands, and Ibiza.

Still, the firm predominantly earns most of its money from building houses in the UK, with a rather even exposure throughout the country:

- North (East Scotland, West Scotland, North East, North West, North Yorkshire, Yorkshire, Manchester) – 30%;

- South (Bristol, Oxfordshire, Exeter, East Anglia, Southern Counties, South Midlands) – 30%;

- Midlands (Midlands, North Midlands, West Midlands, East Midlands, South Wales) – 20%;

- London (North Thames, South Thames, West London, South East, London) – 20%.

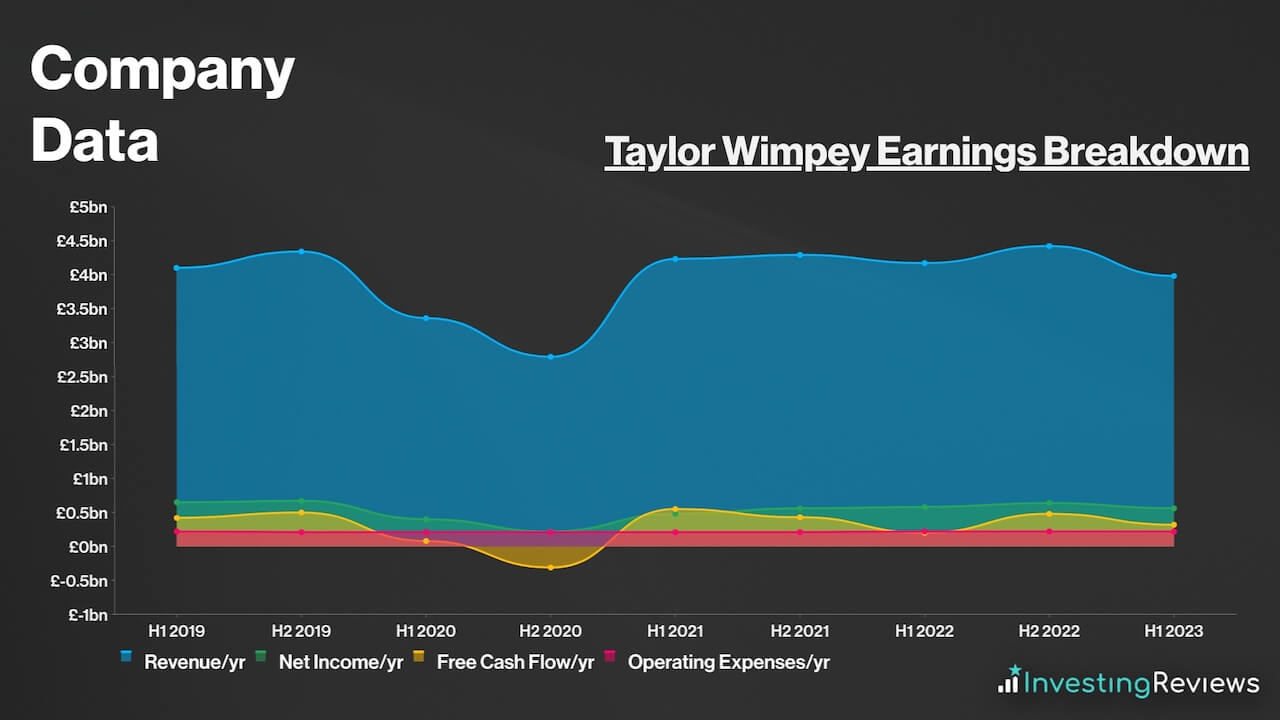

Taylor Wimpey Earnings Breakdown

Taylor Wimpey operates a housebuilding business for the most part, and earns its profits from buying land, developing properties, and then selling them to buyers to turn a profit.

Due to the large complexities and paperwork surrounding land acquisition and house building, Taylor Wimpey’s economic moat is rather deep. This allows it to operate with reasonably high margins, as homes have rather inelastic demand — hence why Taylor Wimpey has healthy profit margins (>10%).

Taylor Wimpey Financials

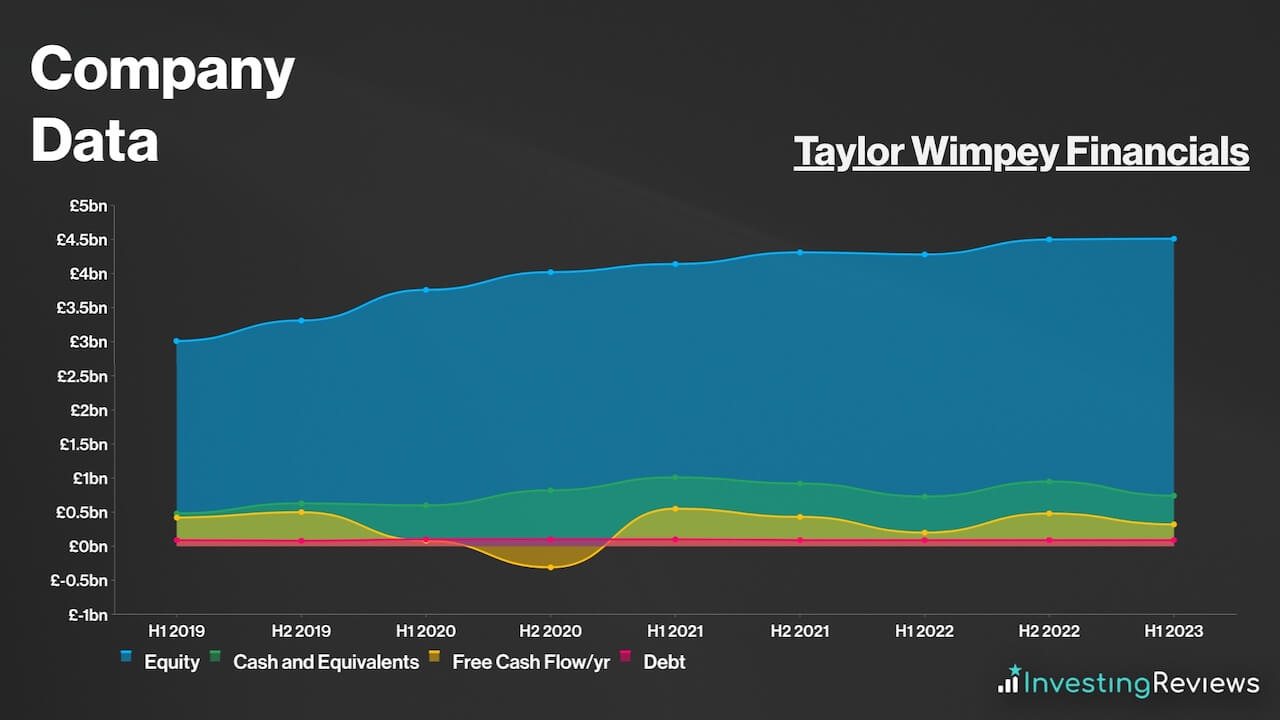

On the face of it, Taylor Wimpey’s balance sheet is as good as it comes, as its current assets trump its current liabilities by £4.96bn. This is considered to be a norm in the housebuilding industry, especially for giant builders as they require significant cushions to absorb the impact of a potential crash in house prices.

With only £86m worth of debt that’s due in 2023, the FTSE 100 stalwart should have sufficient liquidity to pay off its debt in the coming years, as long as it continues to generate cash at these levels. It’s also worth noting that Taylor Wimpey has £636m worth of undrawn committed facilities. This means that it has the option to inject more liquidity into the business if it needs to.

Taylor Wimpey Competitive Advantage

Having an economic moat (competitive advantage) over competitors is crucial in saturated industries such as housebuilding, where profit margins are competitive, with medium barriers to entry.

Nonetheless, Taylor Wimpey’s main competitive advantage is its price-to-quality proposition. Aside from having a five-star builder status, Taylor Wimpey is the highest-scoring builder in terms of build quality, according to the NHBC Construction Quality Review, scoring 4.9/5. Plus, 90% of its customers state that they’d “recommend their builder to a friend”.

These accolades allow Taylor Wimpey to stand out as the best housebuilder for its excellent price-to-quality proposition, given that its average house price sits in the middle of its big five competitors:

| Housebuilder | Average Selling Price |

|---|---|

| Taylor Wimpey | £320,200 |

| Barratt | £319,600 |

| Persimmon | £276,700 |

| Berkeley | £608,000 |

| Bellway | £310,300 |

Data source: FactSet

Aside from that, it’s also got a massive land bank. Its short-term land bank (ready for development in the near future) currently stands c.83k plots, while its strategic land pipeline (Permission to build in future) stands at c.140k potential plots.

Assuming an average output of c.12k houses a year, this gives the housebuilder the capacity to build more houses on ready-to-build land for the next seven years or so, with the potential of another 11 years or so thereafter.

To top it off, Taylor Wimpey has got a pristine set of financials, and is one of the better-run FTSE 100 companies. This allows it to pay lucrative dividend yields, which is why it’s one of the FTSE’s most favourable dividend stocks amongst passive income investors.

But perhaps most lucratively, the UK housing market is notorious for its growing property values due to the huge discrepancy between supply and demand. As such, this presents an opportunity for housebuilders like Taylor Wimpey to capitalise on. In fact, the developer plans to scale its builds over time, with the goal of eventually building c.17k homes per year. This should grow revenue and profits meaningfully in the long term.

Taylor Wimpey Shortcomings

Despite being such a giant in the housebuilding space, Taylor Wimpey also has its fair share of weaknesses. This could put investors off when buying Taylor Wimpey shares.

Most prominently, because Taylor Wimpey lacks diversification in its revenue stream, its top and bottom lines are susceptible to shocks in the housing market, as has been the case over the past year.

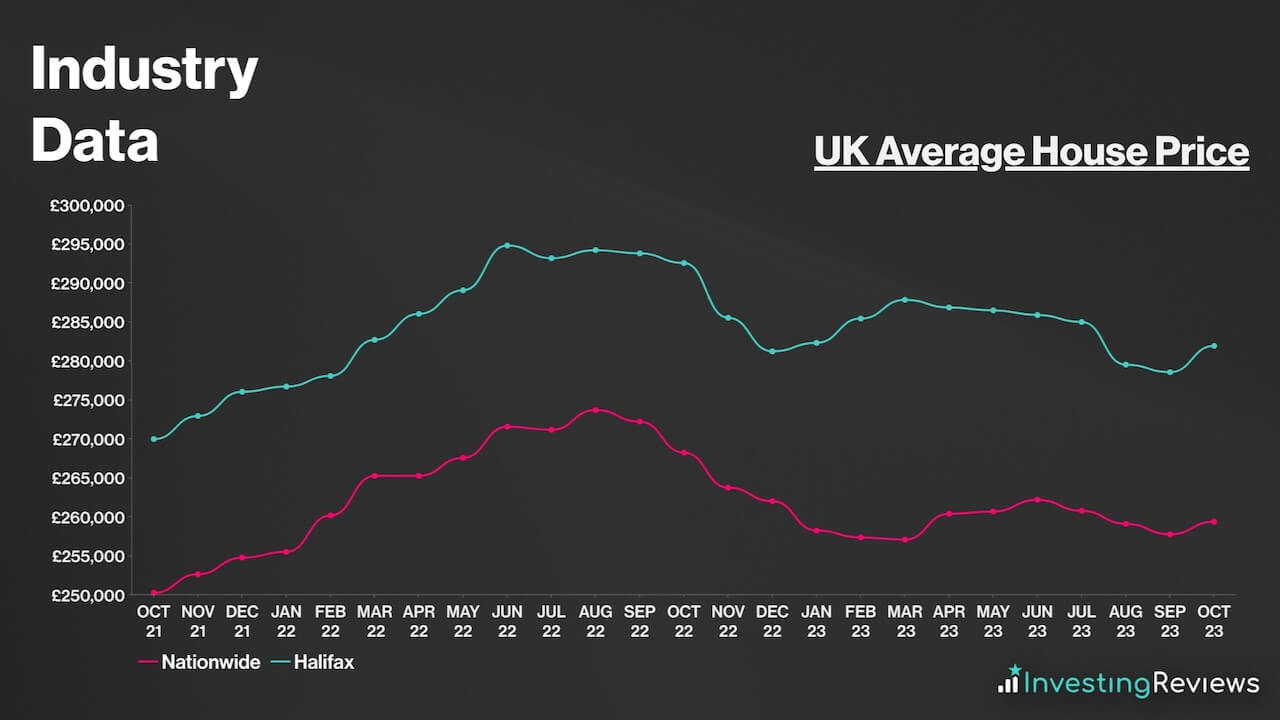

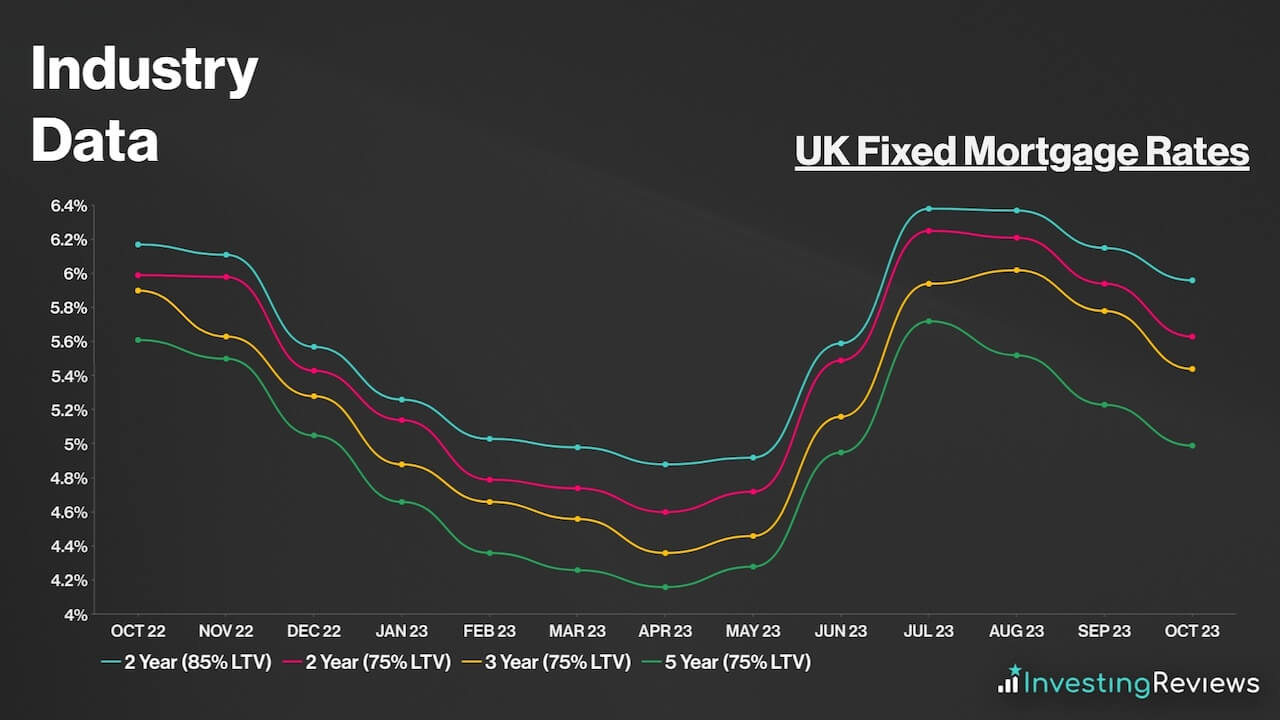

Although average house prices have held up relatively better than what many analysts were forecasting, mortgage rates have still seen a substantial rise over the past year. Consequently, this has seen metrics such as sales rates, cancellations, and forward bookings decline on an annualised basis.

Additionally, Taylor Wimpey’s relatively diversified portfolio throughout the UK is a double-edged sword and makes it extremely vulnerable to a market crash. Some would argue that diversification is key, but it also prevents the FTSE 100 constituent from hedging against the risks of a steeper fall in house prices in a specific region.

Moreover, it’s worth noting that the corporation is vulnerable to supply chain shocks, and this was evident in 2022. Russia’s invasion of Ukraine drove up the prices of several building materials, such as cement and wood. As a consequence, its heavy reliance on outsourcing supplies ramped up build cost inflation last year, and was only offset by strong house prices.

Adding to that, the builder has to contend with higher costs from increasing environmental regulations from the government. For instance, developers are now strongly encouraged to abide by new building regulations that set minimum standards for newer, energy-efficient homes. This means that builders will have to install more efficient heating systems such as heat pumps which cost more.

Furthermore, the end of the government-led Help to Buy scheme has seen short-term completions dissipate, as Taylor Wimpey no longer enjoys the tailwinds from the programme. Either way, Help to Buy completions only made up 17% of Taylor Wimpey’s total completions in 2022, down from 30% the year before.

Then there’s cladding remuneration. This was caused by the Grenfell controversy which sparked a debate surrounding the replacement of unsafe cladding on older buildings, with housebuilders footing the bill. Even though Taylor Wimpey has responsibly pledged its full support for this initiative, it’s also taken on impairment charges as a result, thus impacting profits.

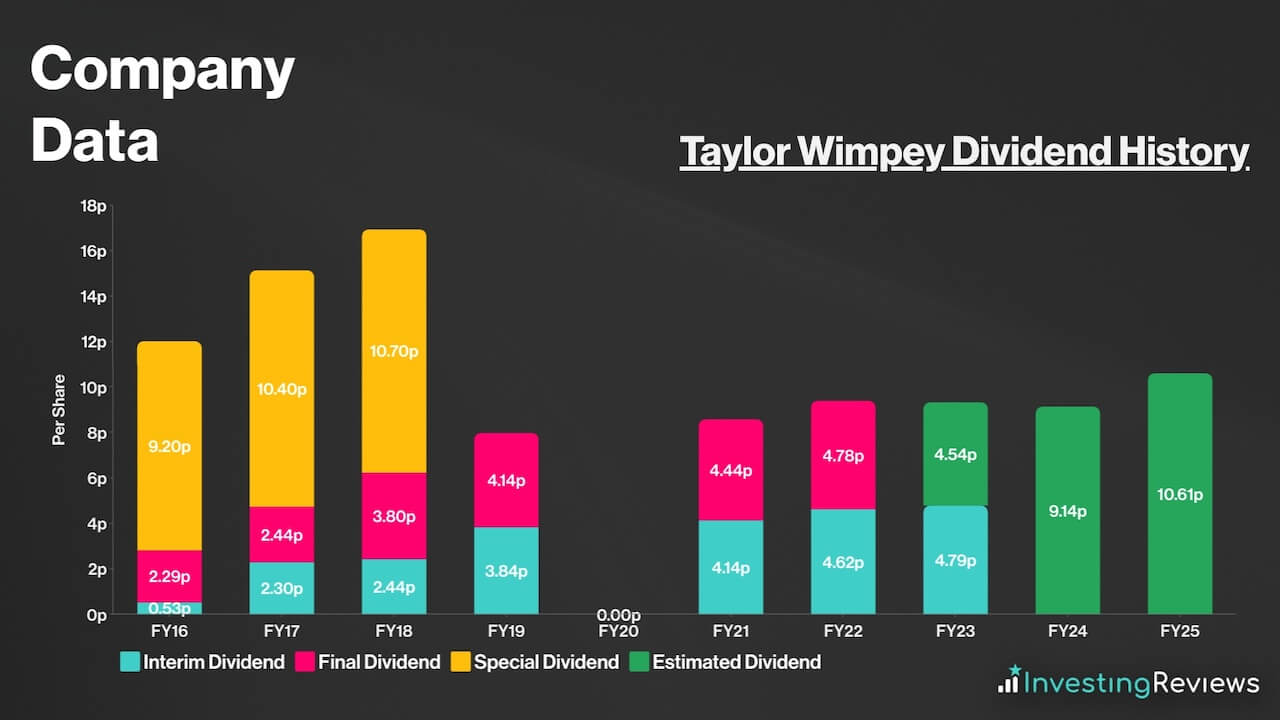

Taylor Wimpey pays a dividend and has been paying dividends since 2012. It opted to halt payments for a short period of time during the pandemic as there was huge uncertainty surrounding future cash flows. Nevertheless, the business has since resumed dividend payments with attractive yields averaging c.7%+.

More importantly, the organisation has reiterated its lucrative dividend policy despite the current weakness in the market. They’ve stress-tested their dividend policy to withstand a potential decline of up to 25% in house prices, making Taylor Wimpey’s dividends one of the most secure in the industry.

That’s because the conglomerate’s dividend policy is asset-based, rather than earnings-based as it plans to return at least c.7.5% of its net assets or £250m to shareholders annually. This gives many dividend investors the safety and incentive to continue holding Taylor Wimpey shares, as it would give them a minimum yield in both good times and bad. Further, its current dividend yield is well covered at 2.0x.

Taylor Wimpey is expecting to continue paying a dividend for the foreseeable future. Currently, analysts are forecasting dividends to stay stagnant in FY23 and FY24 before ramping up again in FY25.

Persimmon shares are currently trading at a premium when compared to their industry competitors. Their P/E and forward P/E ratios are in line with the FTSE 100‘s average too. But considering that their P/S ratio sit around 1, this could indicate tremendous growth potential from its sales.

Among the 18 qualified analysts covering Taylor Wimpey shares, the consensus is for Taylor Wimpey to see a drop in its top and bottom lines this year as demand for housing takes a backseat due to high mortgage rates, before growing again in FY24.

| Metrics | FY22 (Reported) | FY23 | FY24 | FY25 |

|---|---|---|---|---|

| Revenue | £4.42bn | £3.39bn | £3.43bn | £3.75bn |

| Adjusted Basic EPS | 19.70p | 9.54p | 9.10p | 10.83p |

Data source: FactSet

Taylor Wimpey shares currently have an average Buy rating from several brokers. With an average price target of 128p, analysts seem to agree that there’s limited upside potential for Taylor Wimpey shares in the next 12 months.

| Date | Brokerage | Rating | Price Target |

|---|---|---|---|

| 14/11/2023 | Davy | Buy | 153p |

| 10/11/2023 | Peel Hunt | Buy | 125p |

| 10/11/2023 | Jefferies | Buy | 143p |

| 9/11/2023 | JPMorgan | Hold | 96p |

| 9/11/2023 | Investec | Buy | 128p |

| 9/11/2023 | Berenberg | Hold | 122p |

| 9/11/2023 | RBC | Hold | 145p |

| 9/11/2023 | Morningstar | Buy | 190p |

| 31/10/2023 | Numis | Buy | 150p |

| 27/10/2023 | Liberum | Hold | 115p |

| 25/9/2023 | Goodbody | Buy | 150p |

| 26/9/2023 | RBC | Hold | 145p |

| 16/8/2023 | Morgan Stanley | Hold | 115p |

Data source: FactSet

My price target for Taylor Wimpey shares was last updated on 10th November 2023.

| Metrics | FY23 Simplified Assumptions (Underlying) | Comments | |

|---|---|---|---|

| Total Completions |

10,500 Homes | Upper end of guidance given stronger momentum post-H1. | |

| Average Selling Price | £329,000 | c.5% rise — Mix shift towards stronger demand for bigger houses and second-time buyers to offset decline in first-time buyers. | |

| Completions Revenue | £3.45bn | ||

| Land Revenue | £0.03bn | c.£30m from land sales — in line with long-term average due to land prices being unmoved despite current macroeconomic environment. | |

| Revenue | £3.48bn | ||

| Cost of Sales | £2.73bn | c.78.5% of revenue — slight increase from last year due to elevated cost pressures, but lower build costs in H2 to offset increases in H1. | |

| Gross Profit | £750m | ||

| Net Operating Expenses | £278m | c.8% of revenue — higher than long-term average due to elevated wage costs, but slightly offset by restructuring and lower costs in H2. | |

| Operating Profit | £472m | ||

| Finance Income | £30m | Higher interest receivables from higher interest rates. | |

| Finance Costs | £25m | Higher interest payables from loans and lease liabilities. | |

| JV Income | £0m | ||

| Profit Before Tax | £477m | ||

| Taxation | £134m | Underlying Tax Rate of c.28%. | |

| Profit for FY24 | £343m | ||

| Shares in Issue | 3.55bn |

|

|

| Adjusted Basic EPS | 9.67p | ||

| Target Price | 138p (BUY) | ||

Predictions of an outright housing market crash didn’t and haven’t come to fruition. As such, the current pessimism surrounding housebuilders has been overdone.

I still believe there’s more upside potential for the shares in the medium term, especially if house prices continue to stay resilient, but this will be heavily dependent on FY24’s outlook as well as the inflation and rate picture moving forward. A bottom for the housing market could very well be in, with data and surveys from third-party providers showing gradual signs of life.

Pair that with the business’ commitment to improving shareholder value through stock buybacks and a progressive dividend, and the buy case for the constructor is pretty solid. Given the uncertain outlook for FY24, there’s room to be cautious. But considering the improving macroeconomic outlook, a trough in sentiment and activity may have been reached, allowing Taylor Wimpey to begin turning things around.

John Choong, Senior Equity Research Analyst

Please note: John Choong has positions in Taylor Wimpey. These stock analysis reports are not personal recommendations or advice and should never be treated as such.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.