Tickmill is an online CFD and forex trading platform, offering a low-cost model on the MetaTrader online trading platforms and mobile apps in addition to the CQG mobile apps.

With several account types and various pricing structures, Tickmill is a worthy consideration for both beginners and experienced traders.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd. You should consider whether you understand how CFDs or our other products work and whether you can afford to take the high risk of losing your money..

- Tickmill Ratings

- Who is Tickmill?

- Tickmill product range overview

- Tickmill research review

- Tickmill platform review

- Tickmill customer service review

- Tickmill opening an account

- Tickmill safety

- Tickmill fees

- Tickmill deposit and withdrawal

- Tickmill education

- Who is Tickmill suitable for?

- Useful Information about Tickmill

- FAQs about Tickmill

- Tickmill Customer reviews

Tickmill Ratings

Overall

Pros

- Low fees for trading forex

- Excellent account opening process

- Negative balance protection

Cons

- Only 3 base currencies

- Limited news feed

Tickmill UK Ltd, part of the Tickmill Group, provides an extensive range of platform and account options depending on what you are looking to trade. There is also an excellent range of financial instruments available for forex and CFD traders of all levels of skill and experience.

Tickmill received the accolade of Best Forex Spreads 2022 at the Ultimate Fintech Awards which adds to an impressive array of awards received since its launch in 2014. Certainly, for MetaTrader users, Tickmill offers extremely competitive trading conditions that allow users to select an account with a package to suit their trading style.

It is also worth mentioning the impressive educational resources that would certainly benefit beginners in addition to market analysis tools and an extensive range of currency pairs.

However, with a relatively low score of 3.4 out of 5 on Trustpilot, it is worth a close look at the broker to establish if they are a trustworthy broker, as well as how they stack up against their competitors.

In my Tickmill review, I have taken a close look at the financial instruments on offer, the fees, resources and customer service so you can establish whether this online broker is worthy of your consideration.

Who is Tickmill?

Tickmill UK Ltd is a global forex and CFD broker that is regulated by the UK Financial Conduct Authority (FCA). They offer access to a wide range of financial markets across a variety of platforms catering to both novice and professional traders.

Who owns Tickmill?

Tickmill is part of the Tickmill Group and was co-founded by Ingmar Mattus, Executive Director and COO, Illimar Mattus, Executive Director, and Nikolai Nikolajenko, Executive Director.

Tickmill product range overview

Tickmill offers a wide range of trading account types, developed for specific financial markets, with varying pricing structures, suited to the requirements of different trading styles. From here you can trade CFDs on forex, stock indices and oil, precious metals, bonds, cryptocurrencies, and stocks in addition to futures and options.

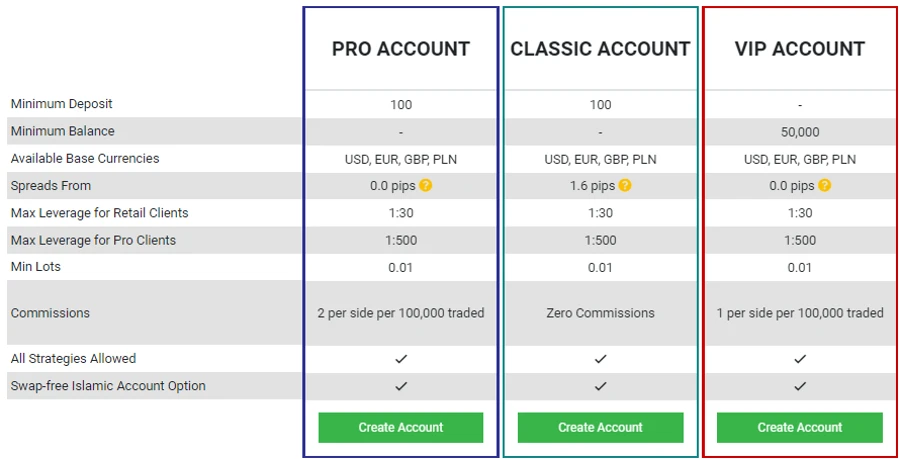

For forex and CFD traders, Tickmill provides the following live trading accounts:

Tickmill Pro Account

This account option is for experienced or professional traders who would benefit from some pretty advanced features, one of the lowest commissions available, and spreads from 0.0 pips. Execution speeds average at around 0.20 seconds and there is a minimum deposit of just $100.

The Pro account also allows placing stop and limit orders close to market prices which you won’t see at other brokers.

Tickmill’s Classic Account

Sadly the trading costs on the Classic Account are higher than average with spreads that start at 1.6 pips on the EUR/USD. There are three base currencies to choose from including USD, GBP and EUR and leverage that goes up to 1:500. The minimum deposit is still $100 which makes this an accessible entry-level account.

Tickmill VIP Account

In order to use this account, you must maintain a minimum account balance of $50,000. However, with this comes lower trading costs, in fact, these are some of the lowest trading costs I’ve come across to date and are therefore definitely worth considering if you have built up that kind of balance.

This account is intended for high-volume professional traders or more experienced traders looking for low trading fees and a host of useful trading features.

Tickmill Islamic Account

Compliant with Sharia Law, the Forex Swap Free Islamic accounts carry no rollover interest on overnight positions. This account can be accessed from the Classic, Pro, or VIP account via a simple conversion.

Tickmill Futures Account

Providing access to 7 Futures exchanges, the futures account includes competitive commissions and a minimum deposit of £1,000 on the CQG Platform.

Tickmill Demo Account

The free demo account at Tickmill allows prospective traders to practice trading strategies and get to grips with the features of the platform in real time. This includes the full suite of tools and features, however, should there be zero activity for seven consecutive days, the demo account will expire.

Tickmill markets

The range of markets at Tickmill includes CFDs on forex, stocks, stock indices, commodities, and German Government Bonds. There are 62 currency pairs including majors, minors, and exotic currency pairs which is more than most other brokers.

Whilst cryptocurrencies are available, they are restricted to professional traders.

Tickmill research review

Tickmill really shines when it comes to research, with some comprehensive tools and analysis for all levels of experience.

There are a few trading tools that really make Tickmill stand out including:

- Autochartist

- Myfxbook

- VPS service

- Advanced trading toolkit

AutoChartist

This is a third-party chart analysis tool that still comes free of charge to all live account holders. However, this tool can have a significant impact on trading activity by scanning the markets in order to send notifications about trading opportunities. It integrates seamlessly with the MT4 platform with training videos available online outlining the technical analysis. This tool can also be accessed from the demo account for practice.

Myfxbook

This is how to access copy trading facilities without the need for additional software. It is provided by a third party and will therefore come at an additional cost to the user; however, given this is generally considered one of the best social trading platforms available, this could be worth the cost for some users.

VPS Service

This allows users to trade without interruptions by providing a stable and secure connection. Tickmill has partnered with BeeksFX to provide this at a 20% discounted rate.

Advanced Trader Toolkit

This comes completely free to all users and provides access to advanced trading tools, news, and further information and analysis. There are live sentiments and alerts that are designed with experienced and professional clients in mind.

Tickmill platform review

There are several platforms available at Tickmill including MetaTrader4, MetaTrader5, MetaTrader Web, and MetaTrader for Mac. However, there is a lack of a proprietary platform which may have been more suitable for beginners.

Tickmill Mobile trading platform

As this is provided by MetaTrader, retail clients can expect a loss of functionality when compared to the web trading version, however, connection to the desktop version will allow for a seamless trading experience.

The mobile app allows traders to change or close existing orders, trade on charts (albeit with fewer charting options) and calculate their profit and loss.

Missing from the mobile application is the ability for Tickmill clients to log in using biometric identification and I would have liked to have seen a two-step login for better security.

MetaTrader 4

MetaTrader 4 remains the most popular trading platform for forex and CFDs. It offers a level of familiarity that traders can take with them when swapping brokers.

In terms of tools and resources, all the basics are available, alongside some impressive charting tools, fully customised charting and interface, and algorithmic trading.

Order types include market order, limit order, stop order, and trailing stop. There are also order time limits including good ‘til cancelled (GTC), and good ‘til time (GTT).

This isn’t my first time reviewing MetaTrader 4 and sadly the platform has still failed to take any action regarding the dated look and feel of the platform. In addition, there is a lack of alerts and notifications which could put some traders off completely.

MetaTrader 5

This is the more recent launch from MetaTrader, and whilst many traders will argue that MetaTrader 4 is a better platform, this may be due to the fact that MetaTrader 5 was designed with professional traders in mind.

This is a powerhouse of a platform, with super fast execution times and automated trading algorithms. Most of the functionality you would find at MetaTrader 4 is present, in addition to some tools that would definitely appeal to experienced traders.

Tickmill customer service review

I had a great experience when testing the Tickmill customer service, with fast response times across several channels and relevant, concise information. This is available during normal working hours.

Customer service is available across the following channels:

- Live chat

- Telephone

I found all channels to respond within a reasonable time frame, with emails getting a response within a day and phone calls being answered straight away.

I tested the live chat several times and each time was met with an immediate response to my query from a very helpful member of the customer support team. There is the option to choose your language from an extensive list which was a great touch.

Tickmill opening an account

The account opening process was fully digital with fast verification. There is a low minimum deposit of just $100.

The main consideration before opening an account with Tickmill is to establish which of the accounts on offer would suit you best. A deposit of less than $50,000 will rule out the VIP Account.

The entire opening process took in the region of 10 minutes to complete, assuming you have the relevant information to hand. This can be done in a few easy steps:

- Click ‘Create Account’ on the Tickmill website

- Complete the required personal information including name, telephone number, email address, and date of birth

- Answer some basic questions to establish your trading skills and knowledge

- Create a password

- Upload a photo ID (driving licence or passport) and a utility statement or bank statement as proof of address

- Select the account you wish to proceed with

- Select your preferred base currency (take currency conversion fees into consideration)

- Select your level of leverage

- Download your preferred platform

Once this is complete, you should be ready to start trading in a matter of hours.

Tickmill safety

Tickmill is a trading name of Tickmill UK Ltd, a company registered in England and Wales under number 09592225 (Principal and Registered Office: 3rd Floor, 27 – 32 Old Jewry, London, England, EC2R 8DQ. Authorised and Regulated by the Financial Conduct Authority, FCA Register Number: 717270) and the Dubai Financial Services Authority as a Representative Office (Reference No. F007663, Registered Address: Office S704A, 7th floor Emirates Financial Towers, South Tower, Dubai International Financial Centre, 506946, United Arab Emirates)

Clients must be at least 18 years old to use the services of Tickmill UK Ltd.

Tickmill also offer cover for all retail investor accounts from the Financial Services Compensation Scheme up to the value of £85,000 should Tickmill become insolvent for any reason.

Tickmill fees

Tickmill has competitive trading fees and low non-trading fees.

The fee structure at Tickmill will vary depending on the account option you choose so it’s important to understand how you are charged, in order to select the account that will best suit your trading style.

In the image above*, you can see that the fees on the commission-free Classic Account are actually pretty high with spreads from 1.6 pips. However, unless you have the bankroll to qualify for VIP status or the expertise to qualify for the Pro Account, this may be your only option.

Non-trading fees are very low, with free deposits and withdrawals and no inactivity fee.

*Fees are subject to change. Please check Tickmill’s website for the latest information.

Tickmill deposit and withdrawal

There are a number of options for depositing and withdrawing at Tickmill, and I found execution times to be very quick.

You can deposit funds into your Tickmill UK account using the following methods:

- Bank transfer – funds are moved from client bank accounts into their Tickmill account within one working day

- Credit/debit card – instant deposits

- Neteller/Skrill – instant deposits

- Sofort – Instant deposits

- Rapid by Skrill – Instant deposits

- Paypal – instant

Withdrawals are paid back to the deposit method and take approximately one working day.

Tickmill education

Beginners are furnished with excellent educational resources at Tickmill including videos, articles, webinars, and a demo account. There is also some content that would be relevant to more experienced traders

There is a plethora of quality educational materials at Tickmill including

- Ebooks covering the basics of forex trading, major currency pairs, trading strategies, Fibonacci analysis and other trading instruments.

- Video tutorials outlining forex trading, trading strategies, market analysis, how to use technical indicators, social trading, and trading psychology.

- Webinars in several languages covering various topics including chart theories and technical analysis.

- Infographics with information on how the markets are impacted by events.

- Seminars with handy introductions to trading concepts and strategies.

Who is Tickmill suitable for?

With the various account options on offer, I found Tickmill to be a suitable platform for both complete novice traders all the way to professional traders.

Beginners can also access excellent educational resources, whilst professionals can take advantage of the competitive fee structure offered to them via the Pro Account.

Useful Information about Tickmill

This section contains useful information to make your experience at Tickmill as seamless as possible.

How do I contact Tickmill?

Tickmill can be contacted via the following methods:

- Live Chat

- Phone: +44 203 608 6100

- Email: [email protected]

How do I withdraw money from my Tickmill account?

To withdraw funds from your Tickmill account follow these steps:

- Log in to your account

- Click ‘withdrawal’ from the main menu

- Select your preferred withdrawal method

- Enter the amount you wish to withdraw

- Click ‘Submit’

Tickmill industry awards

Some of the awards that Tickmill have received include but are not limited to:

- Best Commodities Broker from the Rankia Markets Experience Expo

- Best CFD Provider from the Online Personal Wealth Awards

- Best Trading Experience from the Forex Brokers Award 2020

- Best CFD Broker Asia from International Business Magazine

- Best Forex Education Provider from the Global Brands Magazine

FAQs about Tickmill

Can Tickmill be trusted?

Is Tickmill good for scalping?

Tickmill Customer reviews

There are no reviews yet. Be the first one to write one.