Deliveroo shares were unmoved after reporting a subpar set of Q3 numbers, but the stock has popped since, as the board instigated a share buyback programme. But is this rally a smokescreen for a stagnating business, or is the best yet to come?

Key Takeaways

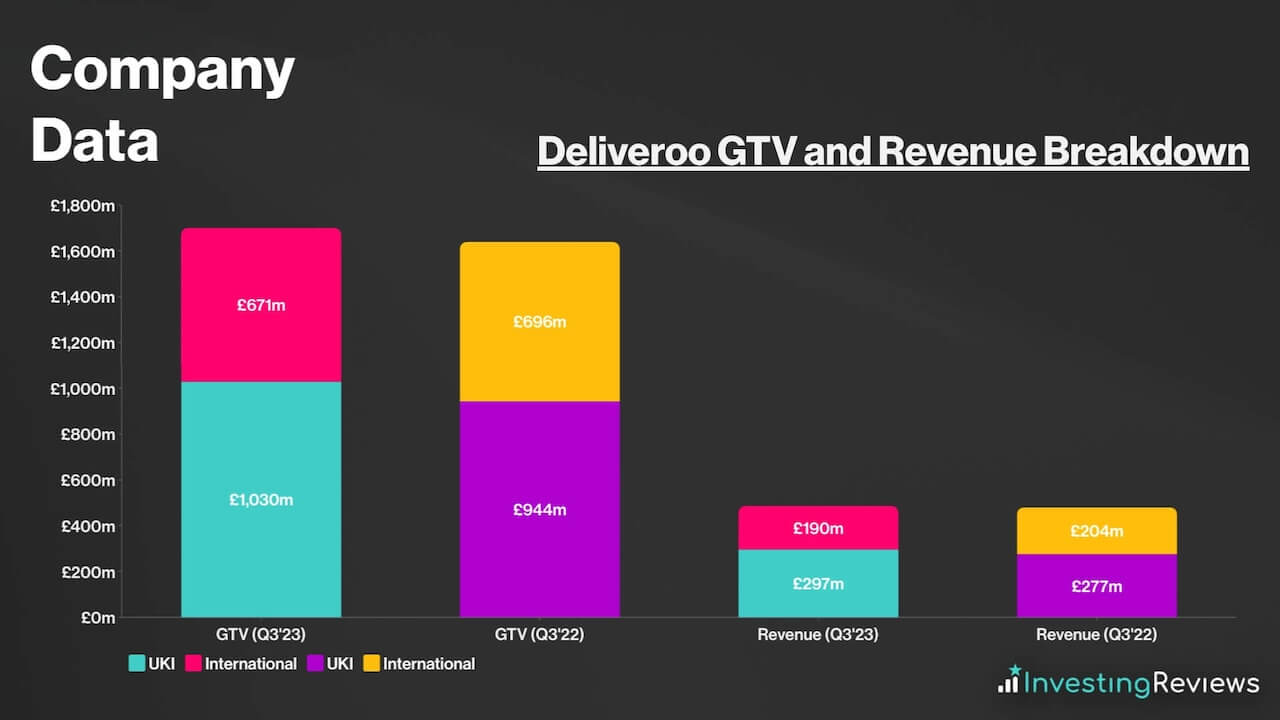

Deliveroo’s latest Q3 figures weren’t anything special. Although most of its top line figures met analysts’ consensus, growth was rather mediocre across the board. A strong performance in UK & Ireland (UKI) managed to offset a weaker showing from its International operations, but revenue (the percentage Deliveroo earns from orders) was relatively flat as compared to last year, only growing 1%.

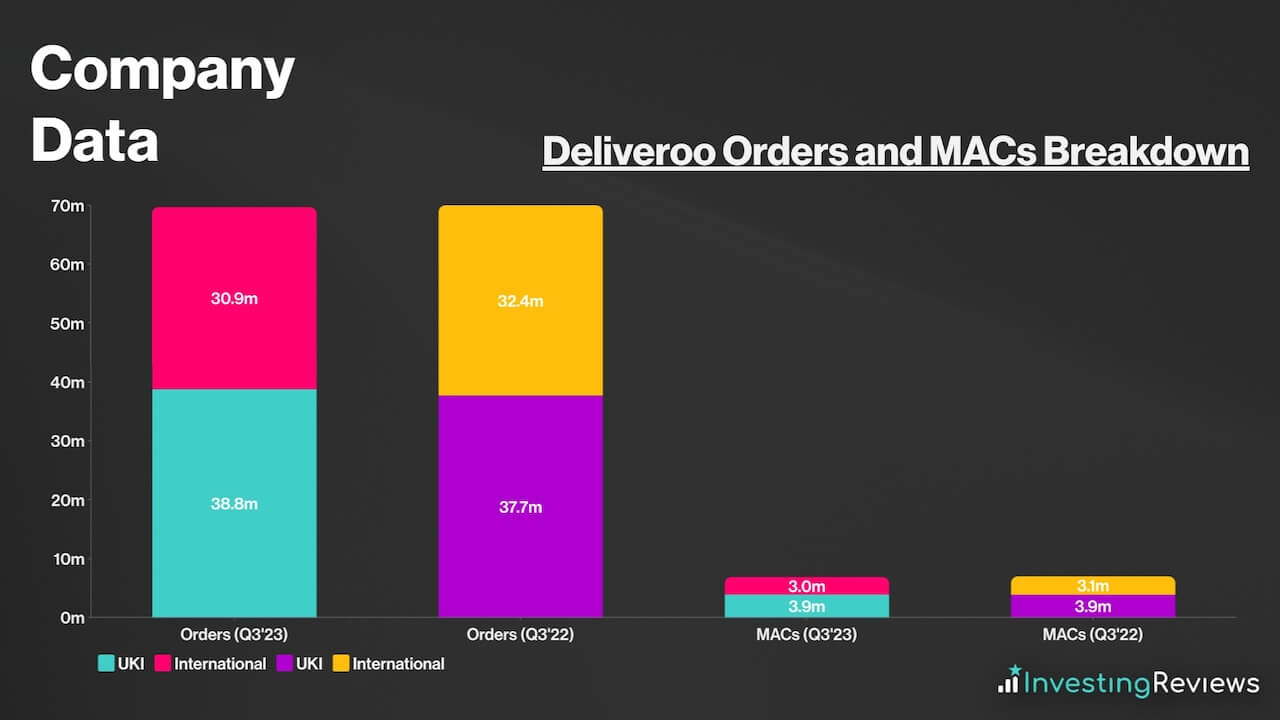

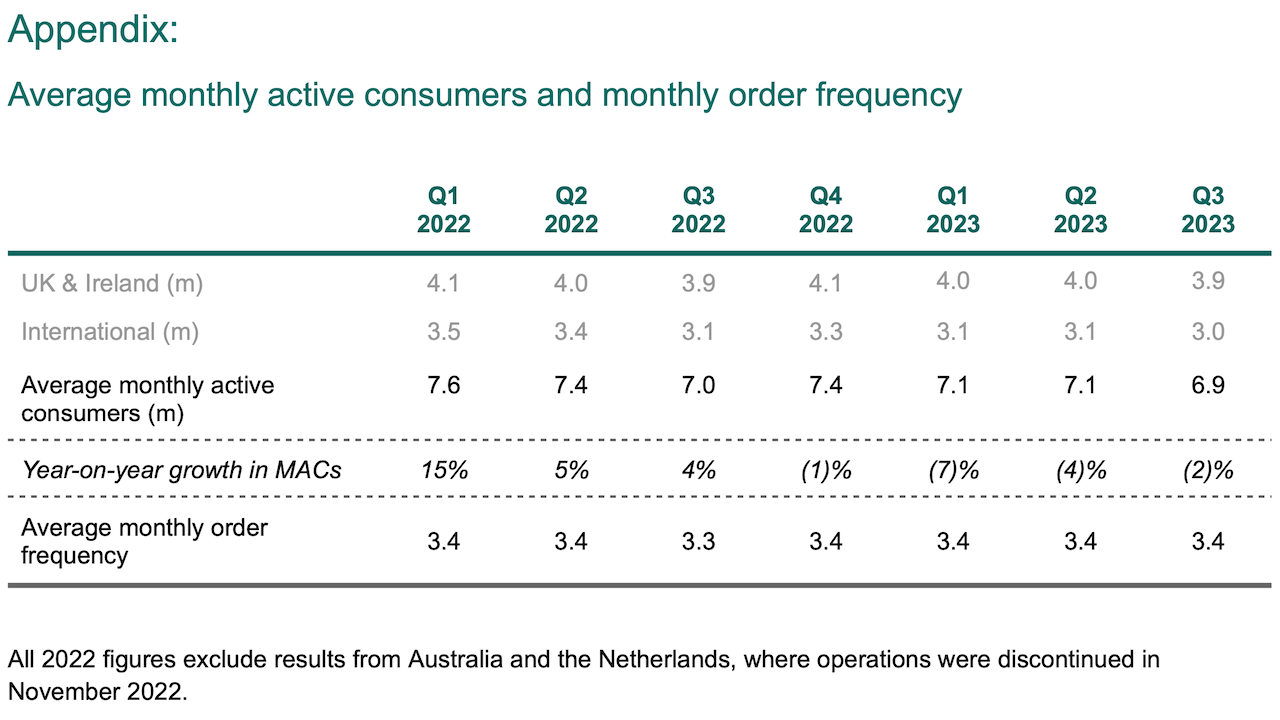

As has been the case throughout 2023, International revenue continued to underperform as stay-at-home orders have now been lifted. Hence, it’s no surprise to see a 4.6% decline in International monthly active customers (MACs). That said, gross transaction value (GTV — the amount customers order) did increase by a mere 0.3% from last year, as the figure was artificially propped up by higher inflation.

A similar trend was also seen in UKI, as healthy GTV growth of 9.1% was supported by higher food inflation. This in turn, helped to push revenue up by a robust 7.2%. Even so, the 3% increase in UKI total orders should still be regarded as a positive development given the cost-of-living crisis.

It was because of the increase in orders that the group’s monthly order frequency (MOF) remained stagnant, rather than shrink. Notwithstanding, MACs did decrease to its lowest levels since Q4’20. This was due a combination of the malaise in international markets, as well as the platform seeing a drop-off in less profitable, one-time users.

This wasn’t helped by the fact that Deliveroo’s take rate (the amount of revenue Deliveroo takes from orders) also shrunk to 28.7% from 29.3%. While this would normally hint at a reduction in pricing power against its competitors, this was due to investments made to enrich the customer value proposition (CVP). Either way, it’s worth noting that the take rate was still broadly flat from Q2.

Want more stock market news and analysis for FREE?

Riding to Profitability?

The good news, however, is that the board reiterated their guidance for the year. They continue to expect EBITDA in the range of £60-80m with low-single digit GTV growth. Despite that, the market’s initial response to this, as anyone would’ve expected, was muted. After all, Deliveroo shares had already been up by a generous c.38% in the year to date.

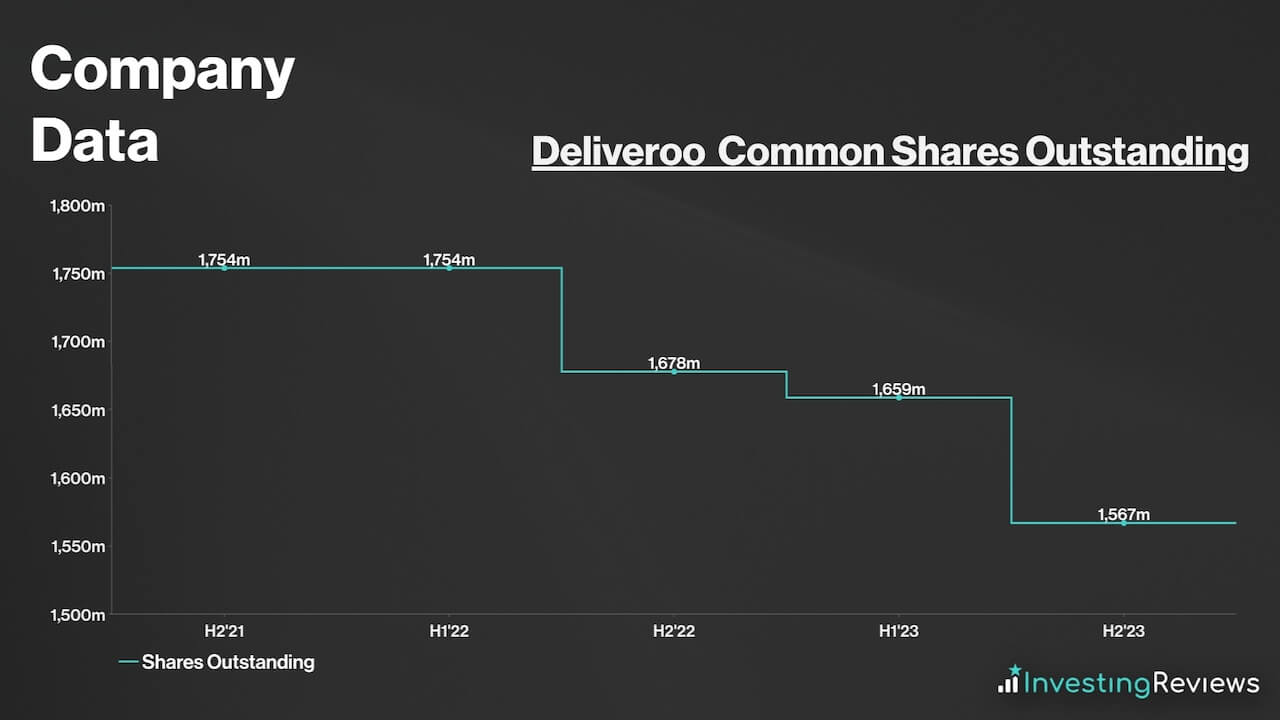

All that changed this week when management confirmed that the most recent share buyback programme was approved. Nonetheless, this was nothing new for shareholders as they’ve seen prior buybacks amounting to c.£125m to offset the share dilution from compensation to executives — a standard practice for many growing tech companies.

However, this buyback is significantly chunkier from the firm’s previous ones. Deliveroo spent a total of £250m, on top of the £50m announced in March to buy back 11.2% of its issued shares. This could be seen as a special/stealthy dividend, because unlike nominal dividends, shareholders can realise the full potential of these capital returns as there are no tax obligations from share buybacks.

Consequently, with fewer shares now in circulation, this should help to bring Deliveroo’s earnings per share (EPS) up. Analysts’ estimates are now pricing in EPS as high as 4.07p next year. This means that Deliveroo is set to become the first fully food delivery company to achieve profitability on a net income basis.

This has undoubtedly improved investor sentiment, as CEO Will Shu is putting his money where his mouths is. Not only is he showing how strong Deliveroo’s balance sheet is, he also believes that the unicorn can and will continue to achieve profitability in the medium term.

Can Deliveroo Deliver?

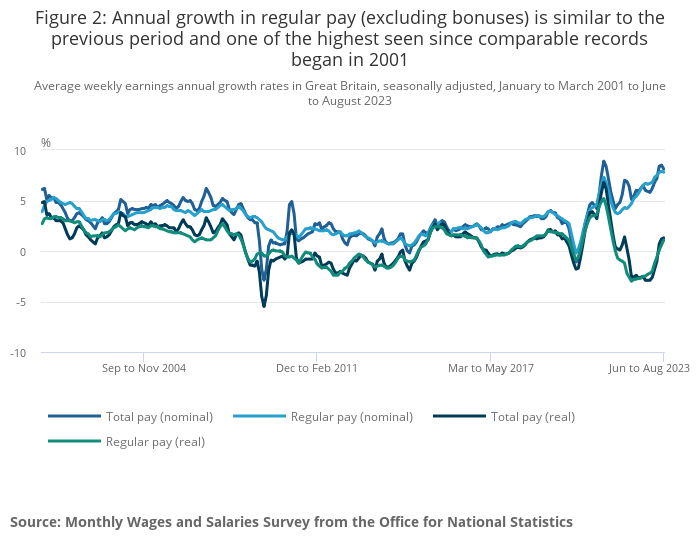

Having said that, projections are one thing; execution is another. Whether Deliveroo can end up delivering on these estimates is a whole other challenge, although I have reason to believe that it can as macroeconomic headwinds begin to dissipate and tailwinds build, with real wages now trending positive.

Deliveroo has also made strategic moves by exiting the Australian and Dutch markets due to their unprofitability. Meanwhile, expansions into affluent countries like Qatar — where disposable income is high — was a smart move. And when combined with improved CVPs through Hop (groceries) and getting more merchants on board via Editions (ghost kitchens), MACs could tick back up.

Still, the FTSE stalwart isn’t without its issues. Competition is hot and customer acquisition and stickiness remains difficult. In fact, Deliveroo Plus has found little success as compared to Uber One. This has seen Uber anecdotally take market share in UKI. So, if the Blue Kangaroo expects to see meaningful, double-digit growth, it’ll have to find a way to offer a more unique proposition.

Moreover, there are complications surrounding the employment status of its riders. The current structure of hiring independent contractors serves to benefit the corporation as it allows for a leaner cost structure. But ongoing legal disputes could force Deliveroo to label its riders as employees, which could see profitability pedal back, with costs such as sick pay having to be accounted for.

Nevertheless, investors seem to have shrugged these worries off for now. There’s certainly potential for Deliveroo to become a sustainable and profitable business, but customer growth and retention remains a risk at this rate. Thus, it’s for those reasons that I retain a Hold rating on Deliveroo as I believe the risk-reward proposition at its current share price isn’t enticing enough to instigate a Buy.

You can read my full stock analysis and find out my price target for Deliveroo here.

Please note: John Choong has no positions in Deliveroo. These news articles are not personal recommendations or advice and should never be treated as such.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.