Forex scalping involves taking advantage of small price swings on currency pairs in the forex market to make small, gradual profits. Even though the profits from scalping are initially low, a large volume of trades can be conducted throughout the day, potentially adding up to significant gains.

There are several different forex scalping strategies you can use to try and maximise your potential gains. I’ll take you through my picks for the best forex scalping strategies, and show you how to start forex scalping today.

Also consider: Discover the top forex brokers

Trusted partner

![]()

76% of retail investors lose money when trading CFDs with forex.com.

Commission-free trading

- Low-cost

- 80+ FX Pairs

- Proprietary platform

5 of the best forex scalping strategies

There are several different forex scalping strategies you can use.

While they all have similarities, some strategies might appeal more to beginners or professional traders, while others could be most effective at specific times of the day. Read on to find out how these strategies work.

The one-minute scalping strategy

The one-minute scalping strategy involves identifying potentially winning trades in the market through the use of signals, then buying a position with the aim of closing it when the currency pair has earned just a few pips of movement.

This position will likely only be held for minutes at a time, and as such, it’s not unusual for forex scalpers to conduct hundreds of these trades every day, and then exit trades quickly.

The one-minute forex scalping strategy can be done with any currency pair, though it’s typically easier to conduct this forex trading strategy with major pairs.

This is because they tend to have the tightest spreads, and since this strategy targets tiny price movements, wider spreads could eat into your potential profits.

Also, the time you attempt the one-minute forex scalping strategy could make a difference to your potential profits. The best time to attempt this strategy is reportedly during times of high volatility.

Price action scalping strategy

The price action scalping strategy involves the study of a currency pair’s price movements. To conduct this strategy, traders typically use historical data to identify any potential future trends.

Candle bars are a good technical indicator to use for this, as they give you details about an FX pair’s closing price, its opening price, and its high and low prices during specific times.

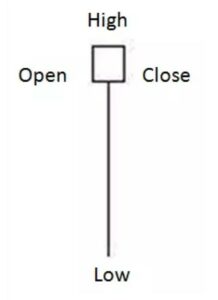

There are several different signals you can keep an eye out for on candle bar charts that could signify market trends. For instance, the “hammer” is a signal that markets are bullish and often shows a higher probability of markets moving upwards. This signal looks as follows:

Source: Admiral Markets

In this example, you would ideally buy a stake in a currency pair on the up-trend, then sell it again in short succession to turn a small profit as the price increases.

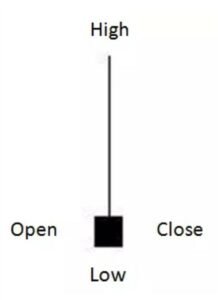

Another signal to keep an eye out for is the “shooting star”. This signal indicates bearish market conditions and a higher probability of the market moving downward. This signal looks as follows:

Source: Admiral Markets

When you see this signal, you could think about investing in a currency pair when the market finally manages to break the low. Then, when the closing price is in slight profit, you can sell your position for small gains.

There are several different signals and indicators worth keeping an eye out for when you conduct the price action trading strategy, which could make it less suitable for beginner traders.

Trend trading scalping strategy

Trend trading involves spotting and predicting trends before you make a trade. This is another form of day trading, as many separate trades are made over the course of a day.

When you conduct the trend trading strategy, traders often use scalping indicators, such as Bollinger Band charts, to predict trends ahead of time.

Since you’re required to spot trends in order to trend trade, scalp traders typically need experience timing the market, and as such, there tends to be a lower success rate when compared to other scalping methods.

Equally, when a trade does go your way, the profits tend to be greater. This is because you have analysed the market and predicted a trend before trading, so you have an idea of the price at which you’ll close your position.

This differs from more short-term scalping strategies, such as the one-minute method, as they rely on constant market monitoring to sell when the price increases slightly.

Range trading scalping strategy

When a forex currency pair’s price moves, it typically has thresholds that it normally trades between.

Traders who use the range trading scalping forex strategy will typically aim to buy a currency pair near its average low price, and then take a profit when it approaches its average high price. These thresholds are commonly referred to as “support” and “resistance” levels respectively.

The “support” is the level at which falling prices change direction and begin to rise, seen as a “floor” that holds up, or “supports”, prices. Meanwhile, the “resistance” threshold is the level at which prices stop rising and start to fall, often seen as a “ceiling” stopping prices from rising higher.

The range trading forex scalping system can be conducted at any time of the day, though you may find that it is most effective when the forex market lacks any obvious long-term trends.

To find periods with no discernable trend, you could try and identify overbought and oversold currencies.

To do so, you would aim to spot a currency pair moving between its lower support level and its upper resistance. For example, if a currency pair is exhibiting a “rectangular range”, it will typically look like this:

Source: Valutrades

As you can see, the price of this currency pair is moving between a higher resistance level and a lower support level. This is known as the “range”.

There are several other forex scalping indicators that would signify that range trading can be conducted, such as a “diagonal range”, which shows a sloped range, or a continuation range, which shows a trend in a triangle pattern.

Momentum trading scalping strategy

A momentum trading scalping strategy involves buying a particular currency pair when it is already on the rise, and then selling it when the price rise has peaked.

This is potentially one of the trickiest ways to scalp, as the strategy involves trading on very precise signals so you can figure out when a currency pair will peak. Momentum trades are commonly referred to as “swing trades”.

This strategy typically requires swing traders to have an in-depth knowledge of signals and indicators, as there are often plenty of false signals that can throw off your predictions.

It may also be wise to keep on top of any news that could move the price of a currency pair. When you know what’s happening in a country, you can more accurately predict how long a currency pair will rise for, and when it will peak.

What is the most successful forex scalping strategy?

While there technically is no “best” forex scalping strategy, some scalping methods may suit you more than others.

For example, a popular forex scalping strategy for beginners could be the one-minute method. This is because it typically requires less in-depth knowledge of indicators and signals, and is conducted over the short term, based on small price movements.

Meanwhile, strategies such as momentum trading tend to be better suited to experienced traders, as it requires more knowledge of technical indicators in order to spot price trends and peaks.

Similarly, the time you plan on trading can also have an effect on your potential profits. For example, the one-minute trading strategy tends to be most effective during times of high volatility, while the range trading strategy works best when the market is exhibiting no discernable trends.

What is forex scalping?

Forex scalping is a method of trading foreign currencies that involves targeting small profit margins over a large number of trades.

Instead of opening a forex position and holding it for a long period of time, forex scalping is conducted over minutes, or even seconds.

This can be done because the forex market is one of the largest, most liquid, and most volatile financial markets. As such, forex scalpers can take advantage of small fluctuations by opening and closing a position in short succession.

Scalp traders can benefit from both increases or decreases in a forex pair’s price, going “long” when they think it will rise or “short” if they think it will fall.

Thanks to the market volatility of currency markets, scalping has become a popular trading style for beginners and institutional traders alike, as there are plenty of opportunities to turn a profit throughout a trading session.

When scalping, forex traders can typically expect to only gain between 7 to 10 points, or “pips”, on their scalping trade. For such a small margin of gains, it stands to reason that high volumes of currency pairs must be traded in order for small profits to be turned into substantial ones.

While my guide will exclusively discuss forex scalping, it can also be done with stocks and shares, or with derivatives, such as spread bets or CFDs.

Is forex scalping profitable?

Forex scalping can often be profitable if done correctly, though it’s important to take note of the risks involved.

Since traders aim to gain small increases, usually by just a few pips, many use leverage to increase the size of their position.

Leverage is essentially a loan from a broker to help you meet the costs of larger trades. This can magnify your gains significantly if the trade goes your way.

However, leverage is a double-edged sword, and you could end up losing more money than you initially invested if a trade goes wrong.

Also, to even attempt forex scalping, you need to ensure that your broker offers tight spreads or low commissions. This is because if you’re paying too much to make trades, or the spreads are too tight, this will likely eat into your already small profits.

Despite these risks, scalping has become a viable trading strategy for retail traders. In fact, you may find that forex scalping is a popular strategy with beginner traders, as it typically requires less knowledge of the market. You should remember that when you scalp forex, you typically need to remain focused, as trades occur very quickly.

Manual scalping vs automatic scalping

Forex scalping can be conducted manually or automatically. Manual scalping involves personally analysing charts and indicators to spot signals and trends.

Meanwhile, automated FX trading involves using scalping software to identify signals and make trades for you.

Automated forex scalping tends to be slightly more complicated than manual trading because you need to program the software yourself. That means it requires in-depth knowledge of signals and indicators.

How to scalp on forex markets

Now that you’ve discovered and picked a forex scalping trading strategy, you’re likely eager to start scalping. Continue reading for a simple step-by-step guide to starting scalping, as well as some handy forex scalping tips.

1. Pick an investment product

First, you need to figure out which investment product you wish to invest in. For instance, you can trade currency pairs directly, or trade derivatives, such as spread bets or CFDs.

If you’re still new to forex scalping, it may be worth sticking with direct investments, as derivative trading tends to be slightly more complex. In fact, more than half of all retail investor accounts lose money when trading CFDs.

2. Figure out which forex pair you want to invest in

Next, you should decide which currency pair you wish to scalp. Typically, major currency pairs tend to be more liquid in return for less volatility, while minor currency pairs are usually more volatile but are less liquid.

The currency pair you decide to scalp should reflect your investment goals and your overall tolerance to risk. If you are more risk averse, it may be worth scalping major currency pairs, as they tend to have the highest trading volumes and price movements are easier to predict.

Conversely, if you’re happy taking on slightly more risk, and wish to take advantage of more volatile price action, you may want to consider scalping minor currency pairs.

3. Buy the position and monitor it, using any risk-management tools available

You’re finally ready to become a forex scalper. Simply input the number of securities you wish to purchase, then make the trade.

Since forex scalping tends to be very short-term, you should continue monitoring your position closely for any price movements. Then, when you see a slight fluctuation in the price of your currency pair, you should close the position when you feel the time is right.

It may be worth using any risk management tools your broker provides to limit potential losses. For instance, stop-loss orders allow you to set an automatic sell point on your position.

If you can’t monitor your position closely, a stop-loss order will automatically execute a trade when your currency pair reaches a certain price. This means that, if you end up losing trades, your potential profits won’t be reduced as much.

Best Forex Scalping Strategies FAQs

What is the best currency pair to scalp?

USD/EUR

USD/JPY

USD/GBP

Do all brokers allow forex scalping?

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

CFDs are complex financial instruments and more than half of retail CFD accounts lose money when trading CFDs. Please make sure that you know these risks before you start trading and that you’re aware there’s a high chance of losing money rapidly on your investment.