What is forex spread betting? In this guide, you can read about everything you need to know about it and how it could work for you.

Whether you’re a novice investor looking to start investing in financial markets, or you’re a veteran with plenty of experience already under your belt, it’s likely that you’ll have come across the concept of forex spread betting.

In fact, you may have heard of spread betting and forex trading separately, perhaps having made a few trades in them in the past. This may have piqued your interest, leading you to consider whether forex spread betting could be a useful strategy for you.

IG Investments

- Best for forex spread betting & CFD trading

- Free withdrawals and deposits

- Execution on more than 17,000 markets

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

What is forex trading?

First of all, you need to understand how forex trading works.

Forex trading is short for “foreign exchange trading”, and involves buying and selling multiple currencies from different countries to turn a profit.

Forex trading revolves around currency pairs. This allows you to trade on the exchange rate between two currencies.

A forex trade example

Let’s use the currency pair of British pounds to US dollars (GBP/USD) as an example.

The left-hand currency, in this case GBP, is what’s called the “base currency”. The one on the right is known as the “quote”, which is USD in this instance.

If the price of GBP/USD is 1.3715, that means 1 GBP is worth 1.3715 USD. When looking at currency pairs, you’ll also see a “buy” or “bid price” and a “sell price”, because you are essentially always selling one currency to buy another. The difference between these two figures is known as the “spread”.

So, if you thought that GBP would become stronger against USD, you would “buy”, as that means you think that you’ll need more dollars to buy a single pound in the near future.

On the other hand, if you thought that GBP would weaken against USD, you would choose to “sell”, as you think that you’ll need fewer dollars to buy one pound.

Foreign currency trading can earn forex traders a healthy return. However, there’s always the risk that you’ll lose money if one currency doesn’t behave as you expect.

What is spread betting?

As you may have read in my guide to spread betting and how spread bets work, a spread bet involves speculating on the price movement of a particular asset. This could be predicting either a gain in value (buying long) or a loss (selling short), depending on what you think will happen.

You’ll then make or lose money depending on how many points that asset moves in the direction you said, and how much you spread bet on it.

Consider this example. You open a long position on a share worth £100, betting £10 per point of upward movement as you believe the share will rise in value.

If the share then rises to £105, you’ll make a £50 profit, as that’s £10 per point times the five points it increased by.

But, if the share were to fall to £95 instead, you’d make a £50 loss, as your spread bet was incorrect, falling the other direction by five points.

Betting on the price movements of forex

Forex spread betting is essentially where spread betting and forex trading meet: rather than buying and selling currency pairs, you instead can place spread bets on the future direction of foreign currencies and the exchange rate.

Rather than clicking the buy or sell button, you place a bet with a spread betting firm or broker, saying that you think the value of GBP/USD will rise or fall.

So, for example, let’s say the value of GBP/USD is 1.3715, and you spread bet that the value will rise. You bet £10 per “pip”, the fourth decimal place of a currency pair, that it will rise.

If GBP/USD then rose to 1.3719, that means you would make £40 profit, as it rose by four pips.

Of course, if GBP/USD fell to 1.3711, you would make a £40 loss, as that’s a fall of four pips.

Alternatively, you can also choose to spread bet on a decrease in value if you think that’s what will happen.

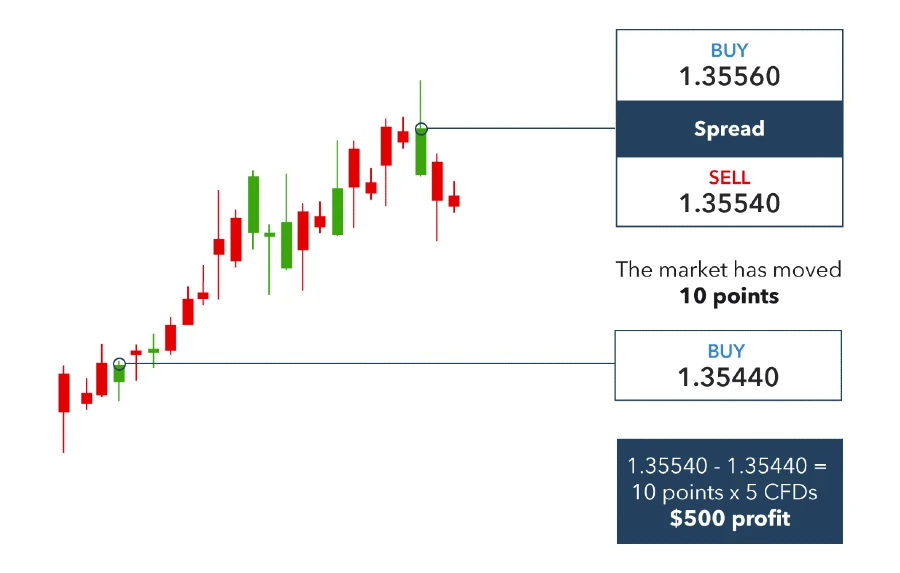

Forex spread betting vs contracts for difference (CFDs)

When researching spread betting, you may also have come across another trading option called contracts for difference, or CFDs.

While there are similarities between the two, there are important differences between spread betting and CFDs. Most notably, CFDs are a form of leveraged trading and are more closely aligned with an investment than a gamble.

That means, while your trades are still based on predicting future price movements, a CFD is essentially the equivalent of buying the asset you invest in.

Meanwhile, spread betting only involves predicting the future movement of an asset without owning it at all.

The other key difference between the two is their tax treatment. CFDs are treated as investments and so profits are taxed as such. Meanwhile, spread bets are considered to be gambling, and so are not taxed in the same way.

If you’re interested in CFD trading, check out my guide to the Best CFD Trading Platforms in the UK.

CFDs and risk

Crucially, you should note that CFDs are complex instruments, so much so that brokers are required to clearly state on their website how many retail investor accounts lose money when trading CFDs on their platform.

This figure is nearly always upwards of 50% and can climb as high as 70%, depending on who you trade with.

Make sure you’re aware that there’s a high risk of losing money with these financial instruments before you put your money in the market.

4 steps to start forex spread betting

1. Open a spread betting account

Firstly, you’ll need to open an account with a CFD forex spread betting platform or broker.

2. Deposit funds

Next, you’ll need to deposit your funds on your trading platform or with your spread betting provider.

3. Research the currency markets

Once you have money available, you need to do your research and technical analysis into different currencies and financial markets. It can be worth using trading tools, risk management tools, or even seeking investment advice to help you make informed decisions.

4. Start trading

Finally, you’ll need to place your trades – or open a spread betting position, as it’s known with spread bets.

Pros and cons of forex spread betting

Pros

Access to the market

The main benefit that spread betting offers is access to financial markets without having to actually own the underlying asset you want to invest in.

So, by spread betting on currency pairs, you can access the forex market without actually having to own the currencies you want to trade.

Low costs and commission

Typically, spread betting platforms charge no commission on spread bets and have lower account fees than other trading platforms, as they make their money from the spread they offer to their investors.

That means it can be a cheaper way for you to trade forex than by actually buying and selling it – provided that your bets are successful.

Tax-efficient

In the UK, spread betting is considered to be more akin to gambling than investing. As a result, the profits you generate are free from Capital Gains Tax.

Capital Gains Tax is payable on the gains you make when you sell or dispose of assets such as investments. But, as spread betting isn’t considered to be an investment, you won’t have to worry about paying it.

Similarly, as you’re trading in forex rather than anything else, you’ll also be free from Stamp Duty.

Typically, you have to pay Stamp Duty when you buy property, either physically or as part of an investment trust. But, as forex trading doesn’t involve property, there will be no Stamp Duty to pay.

All in all, this makes forex spread betting a tax-efficient strategy.

Cons

The forex market can be volatile

The main risk to consider when trading forex is that prices can be influenced by a huge range of factors. This could include:

- Inflation in a country that uses the currency

- Interest rates

- Government policy

- Employment rates

- Demand for imports and exports

So, unless you have a risk management strategy in place, you’re in danger of losing money rapidly in response to events that are entirely out of your control.

This can be particularly damaging when spread betting, as these events can quickly change the spread of your currency pairs.

Wide spreads

During periods of such volatility, a risk to investors is that your spread betting platform widens their spread in response.

This can magnify your losses, especially if you haven’t put a “stop-loss position” in place before you start.

The fact that it’s so easy to lose money like this has led to spread betting providers having to put a risk warning on their sites telling you how many accounts have lost money spread betting with them.

Make sure you fully understand these risks before you begin spread betting, as it may not be appropriate for your individual circumstances.

You don’t own your asset

While spread betting can give you access to the forex market without having to own an asset, this can also be a downside. Not owning the asset means you can’t hold on and wait for the price to rise, as your spread betting provider may close your position before this happens.

This means you have a high risk of losing your bet without being able to hold on and wait like you can with a traditional investment.

Also consider: Best Spread Betting Platforms

Forex spread betting FAQs

Is forex spread betting illegal?

Is spread the same as forex?

A note on forex spread betting

Spread betting, CFDs, and forex trading carry risk and are complex instruments that may not be suitable for all investors.

This article is for informational purposes only and does not constitute financial advice. All contents are based on my understanding of HMRC legislation, which is subject to change.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.