New research reveals minimum wage isn’t fit for purpose in 16 UK cities

Workers in the UK are protected by a number of laws and legislations to ensure that they are treated and paid fairly. One of these protections comes in the form of a minimum wage – an hourly rate that must be paid to employees. But is the current minimum wage fit for purpose?

As of April 2021, employees are offered five different rates according to their age:

So how far could these rates stretch if you were working full-time on minimum wage? After income tax deductions and pension contributions, is the minimum wage enough to live on?

We took a look at the living costs for cities around the UK to discover whether life on minimum wage is realistic in each city.

The Most Affordable UK Cities to Live on Minimum Wage

When working out how much workers on minimum wage get to take home every month, we needed to account for income tax and national insurance, as well as calculate the number of hours worked in a month. We based this on a 40-hour workweek and compared the take-home amount to the monthly cost of living for a single person alongside the average rental prices for a one-bedroom flat or house in each city. This information was then used to identify how much disposable income is left over after these costs are accounted for.

Key findings

For those aged 23 and over, full-time minimum wage earnings equate to £1,356 take-home pay. This results in disposable income in 32 of the 45 cities.

For those aged 21 to 22, full-time minimum wage earnings equate to £1,291 take-home pay. This results in disposable income in 29 of the 45 cities.

For those aged 18 to 20, full-time minimum wage earnings equate to £1,079 take-home pay. This results in disposable income in 4 of the 45 cities.

For those aged under 18, full-time minimum wage earnings equate to £800 take-home pay. This results in disposable income in 0 of the 45 cities.

For apprentices aged under 19, or aged 19 or over and in the first year of their apprenticeship, full-time minimum wage earnings equate to £745.32 take-home pay. This results in disposable income in 0 of the 45 cities.

The Most Affordable UK Cities to Live on Minimum Wage While Contributing to a Pension

Saving for retirement isn’t something that should be left for later on in life. It’s something that anyone in employment should be thinking about, but is it even possible for those earning minimum wage to afford to make pension contributions? We used the same calculations as above, taking into account a 5% monthly pension contribution.

The Least Affordable UK Cities to Live on Minimum Wage

On the opposite end of the spectrum are the most affluent cities in the UK, where the cost of living is much higher. We’ve looked at whether it is affordable for employees on minimum wage to reside within these cities.

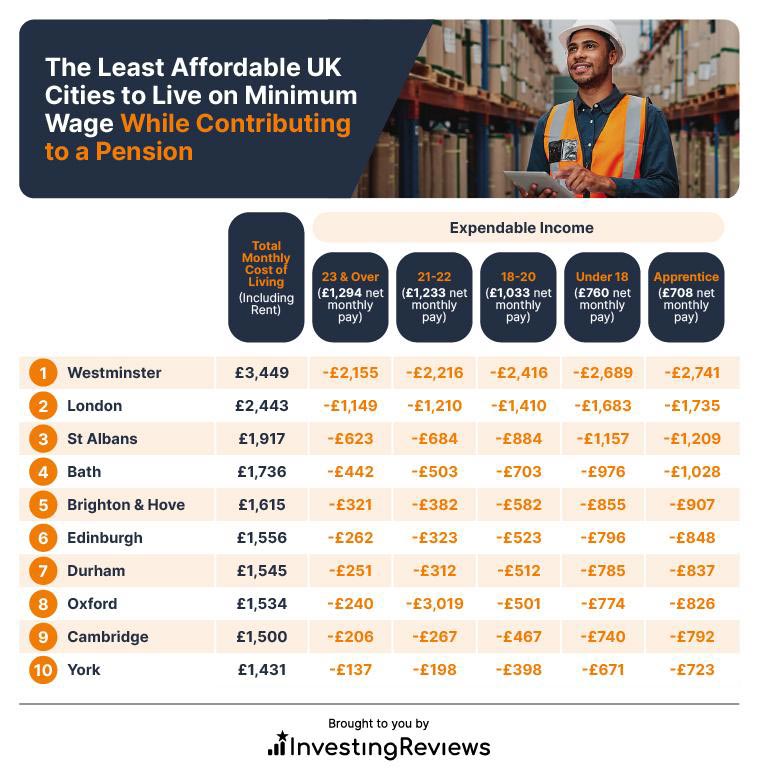

The Least Affordable UK Cities to Live on Minimum Wage While Contributing to a Pension

It goes without saying that everyone should be contributing to their pension in order to give themselves a fighting chance at being able to retire. This is how the minimum wage stretches in the least affordable cities when alongside pension contributions.

Key findings

For those aged 23 and over, full-time minimum wage earnings equate to £1,294 take-home pay after accounting for a 5% pension contribution. This results in disposable income in 29 of the 45 cities.

For those aged 21 to 22, full-time minimum wage earnings equate to £1,233 take-home pay after accounting for a 5% pension contribution. This results in disposable income in 23 of the 45 cities.

For those aged 18 to 20, full-time minimum wage earnings equate to £1,033 take-home pay after accounting for a 5% pension contribution. This results in disposable income in 2 of the 45 cities.

For those aged under 18, full-time minimum wage earnings equate to £760 take-home pay after accounting for a 5% pension contribution. This results in disposable income in 0 of the 45 cities.

For apprentices aged under 19, or aged 19 or over and in the first year of their apprenticeship, full-time minimum wage earnings equate to £708 take-home pay after accounting for a 5% pension contribution. This results in disposable income in 0 of the 45 cities.

Methodology

Looking at 45 UK cities, we took the monthly cost of living for a single person (excluding rent) according to Numbeo. Average rental prices were taken for a one-bedroom flat or house according to Zoopla.

National minimum wage rates are taken from the current government figures.

Taking 40 hours as an average workweek, we then multiplied this by 52 to get the average working hours in a year, dividing this by 12 to get the average monthly working hours of 173.33.

The working hours for a month were then multiplied by the hourly rate for each age range to give a gross monthly pay figure. We then put this figure through Money Saving Expert’s tax calculator to account for income tax and national insurance, giving us a net monthly pay figure. In the case of accounting for pension contributions, we added a 5% pension contribution to the calculations.